Denali Therapeutics Reports Missed EPS, but Beats Revenue Estimates

May 9, 2023

Trending News 🌧️

The company’s GAAP earnings per share (EPS) was -$0.80, missing the estimated $0.10 and its revenues of $35.14M surpassed the estimated $5.26M. Despite the miss in EPS, the company’s performance beat analysts’ expectations in terms of revenue. Denali Therapeutics ($NASDAQ:DNLI) is focused on developing treatments for neurodegenerative diseases such as Alzheimer’s and Parkinson’s. It has exclusive rights to a wide range of programs, including antibodies and small molecules targeting the pathophysiology of neurodegenerative diseases. The company has also partnered with several leading academic and research institutions on a number of drug development programs.

Earnings

In the latest earnings report of FY2022 Q4 ending on December 31 2022, DENALI THERAPEUTICS reported a total revenue of 10.28M USD, but a net loss of 98.68M USD. This marked a 17.8% decrease in revenue compared to the previous year. Further, DENALI THERAPEUTICS has seen a significant decrease in revenue from 316.82M USD to 10.28M USD in the last three years. Despite beating revenue estimates, the company missed EPS estimates.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Denali Therapeutics. More…

| Total Revenues | Net Income | Net Margin |

| 108.46 | -325.99 | -300.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Denali Therapeutics. More…

| Operations | Investing | Financing |

| -244.72 | -141.39 | 310.67 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Denali Therapeutics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.46k | 417.81 | 7.67 |

Key Ratios Snapshot

Some of the financial key ratios for Denali Therapeutics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 59.6% | – | -314.2% |

| FCF Margin | ROE | ROA |

| -242.1% | -23.0% | -14.6% |

Price History

On Monday, DENALI THERAPEUTICS reported its earnings for the second quarter of the year, revealing that it had missed analysts’ estimates for earnings-per-share (EPS) but beat revenue estimates. The stock opened at $26.5 and closed at $26.6, up by 0.2% from the prior closing price of 26.5, indicating that investors were slightly encouraged by the results. Overall, although DENALI THERAPEUTICS did not meet analysts’ expectations for EPS, investors were buoyed by the fact that it exceeded estimates for revenue. Live Quote…

Analysis

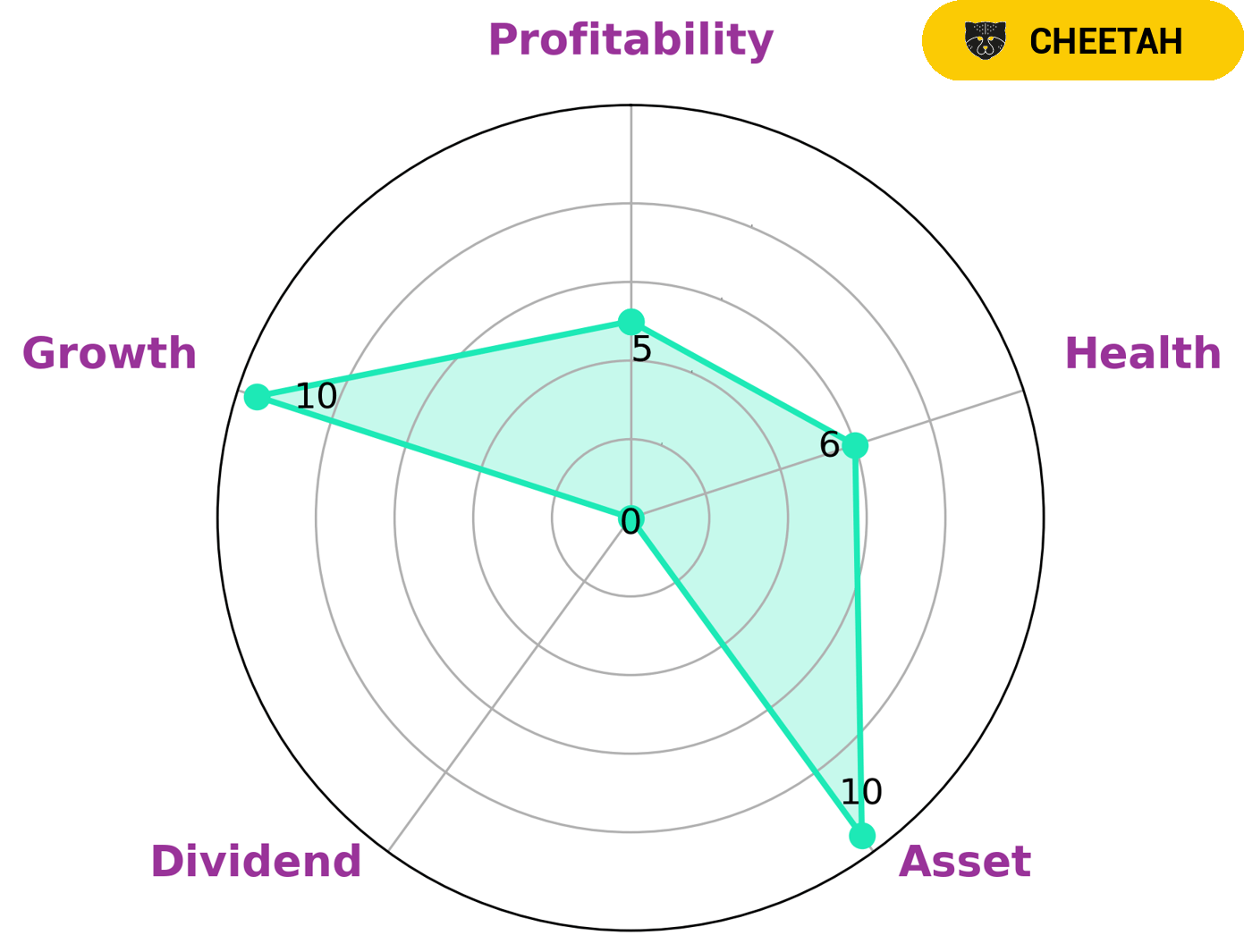

After analyzing DENALI THERAPEUTICS‘s fundamentals, GoodWhale has concluded that it is classified as ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Based on our Star Chart classification, investors who are interested in such companies may be those who are comfortable with taking on more risk in order to generate potentially higher returns. In terms of financial strength, DENALI THERAPEUTICS has an intermediate health score of 6/10 with regard to its cashflows and debt. This indicates that they might be able to pay off their debt and fund future operations. With regard to this company’s financial metrics, GoodWhale has found that DENALI THERAPEUTICS is strong in asset, growth, medium in profitability and weak in dividend. More…

Peers

The biotech sector is full of companies vying for market share andDenali Therapeutics Inc is no different. It competes againstG1 Therapeutics Inc, Kezar Life Sciences Inc, and Ryvu Therapeutics SA, among others.

– G1 Therapeutics Inc ($NASDAQ:GTHX)

G1 Therapeutics Inc is a clinical-stage biopharmaceutical company focused on the discovery and development of small molecule therapeutics for the treatment of cancer. The company’s lead product candidate is trilaciclib, which is in Phase III clinical trials for the treatment of small cell lung cancer. G1 Therapeutics Inc has a market cap of 486.46M as of 2022 and a Return on Equity of -117.43%.

– Kezar Life Sciences Inc ($NASDAQ:KZR)

Kezar Life Sciences Inc is a clinical-stage biotechnology company that focuses on the discovery, development, and commercialization of novel small molecule therapeutics to treat autoimmune and other inflammatory diseases. The company has a market cap of 506.62M as of 2022 and a Return on Equity of -14.21%. Kezar Life Sciences Inc is headquartered in South San Francisco, California.

– Ryvu Therapeutics SA ($LTS:0RKT)

Ryu Therapeutics is a clinical-stage biopharmaceutical company focused on the development and commercialization of innovative therapies for the treatment of serious and life-threatening diseases. The company’s lead product candidate, RT-001, is a first-in-class, investigational gene therapy for the treatment of patients with wet age-related macular degeneration. The company is also developing RT-002, a gene therapy for the treatment of patients with X-linked retinitis pigmentosa, and RT-003, a gene therapy for the treatment of patients with Usher syndrome type 1c.

Summary

Denali Therapeutics recently released their GAAP EPS results, which were $0.80 lower than expectations. This indicates that while Denali’s profits are below expectations, they are making positive strides in terms of their top line growth. Investors would likely be encouraged by these results and may be bullish on the company’s potential. However, it is important to do further research and analysis to evaluate the company’s short and long-term prospects before investing.

Recent Posts