Cytokinetics Stock Fair Value – Cytokinetics Forced to Discontinue Phase 3 ALS Study After Failing to Demonstrate Clinical Benefit

April 1, 2023

Trending News 🌧️

Cytokinetics ($NASDAQ:CYTK), a biopharmaceutical company focused on developing novel therapies to treat serious diseases, has recently announced their decision to discontinue their Phase 3 study for ALS (Amyotrophic Lateral Sclerosis). After conducting the study and analyzing the results, they were unable to demonstrate a clinically meaningful benefit. This was a major blow to the company, as the ALS drug in development was their primary focus. ALS is a progressive neurodegenerative disease and the most common type of motor neuron disease. As such, it is a devastating condition with no cure. Cytokinetics had hoped that their drug would be able to provide an effective treatment for ALS, but unfortunately, it appears that this will not be the case. Despite the disappointing results from the Phase 3 study, Cytokinetics remains committed to developing innovative therapies for serious diseases. They are still currently developing drugs for cardiac and neuromuscular diseases, and believe that their research can help improve the lives of those suffering from these conditions. The news of the failed Phase 3 study has had a negative impact on the stock price of Cytokinetics, as investors were expecting a positive outcome from the study.

However, the company is not giving up on their mission of helping people with serious diseases, and they remain hopeful that their research will produce successful results in the future.

Market Price

On Friday, CYTOKINETICS announced news that it would be forced to discontinue its Phase 3 clinical trial for its amyotrophic lateral sclerosis (ALS) drug due to the failure to demonstrate any clinical benefit. As a result, the company’s stock opened at $35.0 and closed at $35.2, up 2.9% from its previous closing price of $34.2. The news was met with disappointment from investors who had hoped the drug would prove to be successful in treating the progressive, motor neuron disease.

Unfortunately, the phase 3 trial did not meet its primary objectives and the drug failed to show any meaningful clinical benefit. This news raises questions as to what options CYTOKINETICS will have going forward in order to develop a successful treatment for ALS. cytokinetics-forced-to-discontinue-phase-3-als-study-after-failing-to-demonstrate-clinical-benefit”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cytokinetics. cytokinetics-forced-to-discontinue-phase-3-als-study-after-failing-to-demonstrate-clinical-benefit”>More…

| Total Revenues | Net Income | Net Margin |

| 94.59 | -388.95 | -384.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cytokinetics. cytokinetics-forced-to-discontinue-phase-3-als-study-after-failing-to-demonstrate-clinical-benefit”>More…

| Operations | Investing | Financing |

| -299.52 | -262.13 | 516.17 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cytokinetics. cytokinetics-forced-to-discontinue-phase-3-als-study-after-failing-to-demonstrate-clinical-benefit”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.01k | 1.12k | -1.14 |

Key Ratios Snapshot

Some of the financial key ratios for Cytokinetics are shown below. cytokinetics-forced-to-discontinue-phase-3-als-study-after-failing-to-demonstrate-clinical-benefit”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 52.1% | – | -357.1% |

| FCF Margin | ROE | ROA |

| -328.6% | 340.9% | -20.8% |

Analysis – Cytokinetics Stock Fair Value

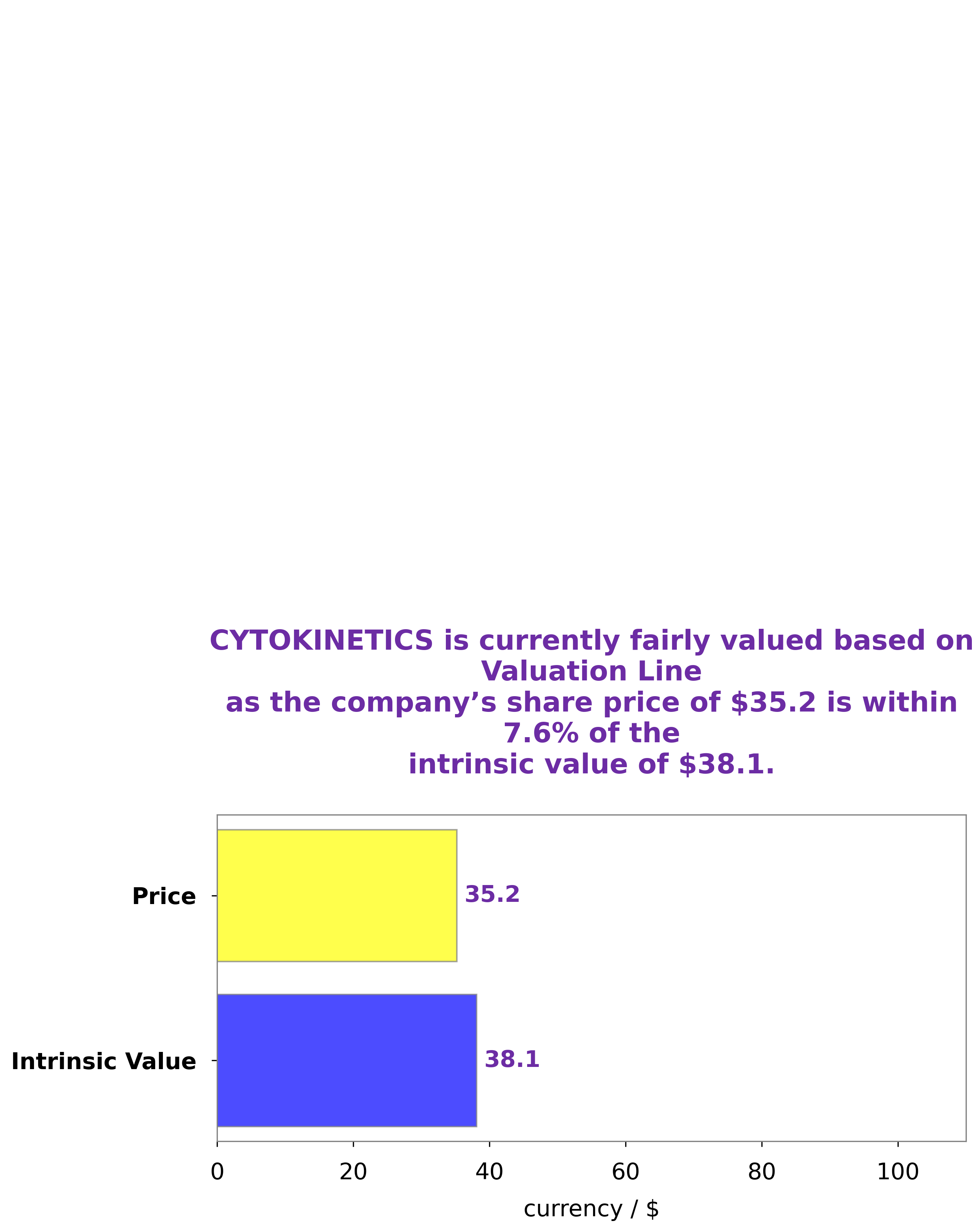

GoodWhale has conducted an analysis of the financials of CYTOKINETICS and has determined a fair value for its share of $38.1. This fair price was calculated using our proprietary Valuation Line. Currently, the stock is trading at $35.2, making it a fair price that is undervalued by 7.5%. This presents an opportunity for investors to benefit from the current discrepancy between the fair price and the market price. cytokinetics-forced-to-discontinue-phase-3-als-study-after-failing-to-demonstrate-clinical-benefit”>More…

Peers

The company’s main competitors are Rubius Therapeutics Inc, XSpray Pharma AB, and Proteo Inc.

– Rubius Therapeutics Inc ($NASDAQ:RUBY)

Rubius Therapeutics Inc is a clinical-stage biopharmaceutical company focused on the development of a new class of therapeutics called Red Cell Therapeutics (RCTs). RCTs are living medicines that are derived from red blood cells and have the potential to treat a wide range of diseases with a single administration. The company’s lead product candidate, RTX-134, is in development for the treatment of severe combined immunodeficiency (SCID), a rare and potentially fatal genetic disease. Rubius has completed a Phase 1/2 clinical trial of RTX-134 in SCID patients and is preparing for a Phase 3 clinical trial.

Rubius has a market capitalization of $31.69 million and a negative return on equity of 105.38%. The company’s lead product candidate, RTX-134, is in development for the treatment of severe combined immunodeficiency (SCID), a rare and potentially fatal genetic disease. Rubius has completed a Phase 1/2 clinical trial of RTX-134 in SCID patients and is preparing for a Phase 3 clinical trial.

– XSpray Pharma AB ($LTS:0GHZ)

Spray Pharma AB is a pharmaceutical company with a market cap of 1.28B as of 2022. The company has a Return on Equity of -12.71%. Spray Pharma AB focuses on the development and commercialization of drugs for the treatment of rare diseases.

Summary

Cytokinetics, Inc. (Nasdaq: CYTK) recently announced a halt to their Phase 3 clinical study on edaravone for the treatment of ALS, or amyotrophic lateral sclerosis. The decision was made after a review of the data revealed that the drug did not have a meaningful clinical benefit to patients. The outcomes of the study have put a significant damper on investing in the company.

Investors may be concerned over any potential future development of the drug and other programs, as well as the company’s financials and operational performance. With Phase 3 trials now halted, investors should consider other opportunities in the biopharmaceutical space.

Recent Posts