Considering Investing in Aurinia Pharmaceuticals? Read This First!

February 4, 2023

Trending News 🌥️

Aurinia Pharmaceuticals ($NASDAQ:AUPH) Inc. is a clinical stage biopharmaceutical company based in Victoria, British Columbia, Canada. The company is focused on the development and commercialization of therapeutic drugs for the treatment of autoimmune diseases such as lupus nephritis. Aurinia Pharmaceuticals is also engaged in the research and development of other therapeutic treatments for kidney diseases. Before investing in Aurinia Pharmaceuticals Inc. it is important to thoroughly research the company and its stock. One should review the company’s financials, business strategy and management team. It is also important to consider the company’s competitive landscape, potential opportunities and risks to assess whether investing in Aurinia Pharmaceuticals Inc. is right for you. Investors should consider the current market sentiment towards Aurinia Pharmaceuticals Inc., as well as its performance relative to peers in the industry.

Additionally, investors should pay attention to any news or developments related to the company, including any upcoming clinical trials or drug approvals that could impact the stock price. It is also important to look at the company’s financial history and any analyst ratings or targets for Aurinia Pharmaceuticals Inc. Finally, investors should use technical analysis to assess the current price of Aurinia Pharmaceuticals Inc. stock and its potential upside and downside. This includes looking at the stock’s relative strength index (RSI), moving average convergence divergence (MACD) and volume trend. By analyzing these metrics, investors can get a better understanding of the company’s current position and its potential for future growth. In summary, it is important to do thorough research before investing in Aurinia Pharmaceuticals Inc. stock. Understanding the company’s fundamentals, competitive landscape and technical analysis are key to making an informed decision about whether or not to invest in the stock.

Market Price

If you are considering investing in Aurinia Pharmaceuticals Inc. (AUPH) stock, it is important to first understand the current market situation. On Friday, AUPH stock opened at $9.2 and closed at $9.0, down by 2.9% from last closing price of 9.3. This means that investors are taking a cautious approach when it comes to investing in AUPH stock, which could be due to a variety of reasons. It is important to also consider the company’s financials before investing in AUPH stock. The company’s earnings per share are also positive, indicating that it has good profitability and is able to generate returns for its shareholders. In addition to financials, investors should also look at the company’s business model and recent news about it. AUPH is a biopharmaceutical company focused on developing treatments for kidney diseases, including lupus nephritis. It has recently announced positive results from a Phase 3 clinical trial evaluating its lupus nephritis drug, voclosporin, which could lead to a potential new treatment for the condition. Overall, investing in AUPH stock can be a risky proposition.

However, if investors have a good understanding of the company’s financials and business model, there could be potential for long-term returns. It is important to do your research and make an informed decision before investing in AUPH stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Aurinia Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 129 | -115.46 | -89.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Aurinia Pharmaceuticals. More…

| Operations | Investing | Financing |

| -115.9 | -63.1 | 207.47 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Aurinia Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 488.29 | 64.87 | 2.98 |

Key Ratios Snapshot

Some of the financial key ratios for Aurinia Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 640.3% | – | -90.0% |

| FCF Margin | ROE | ROA |

| -90.1% | -17.1% | -14.9% |

Analysis

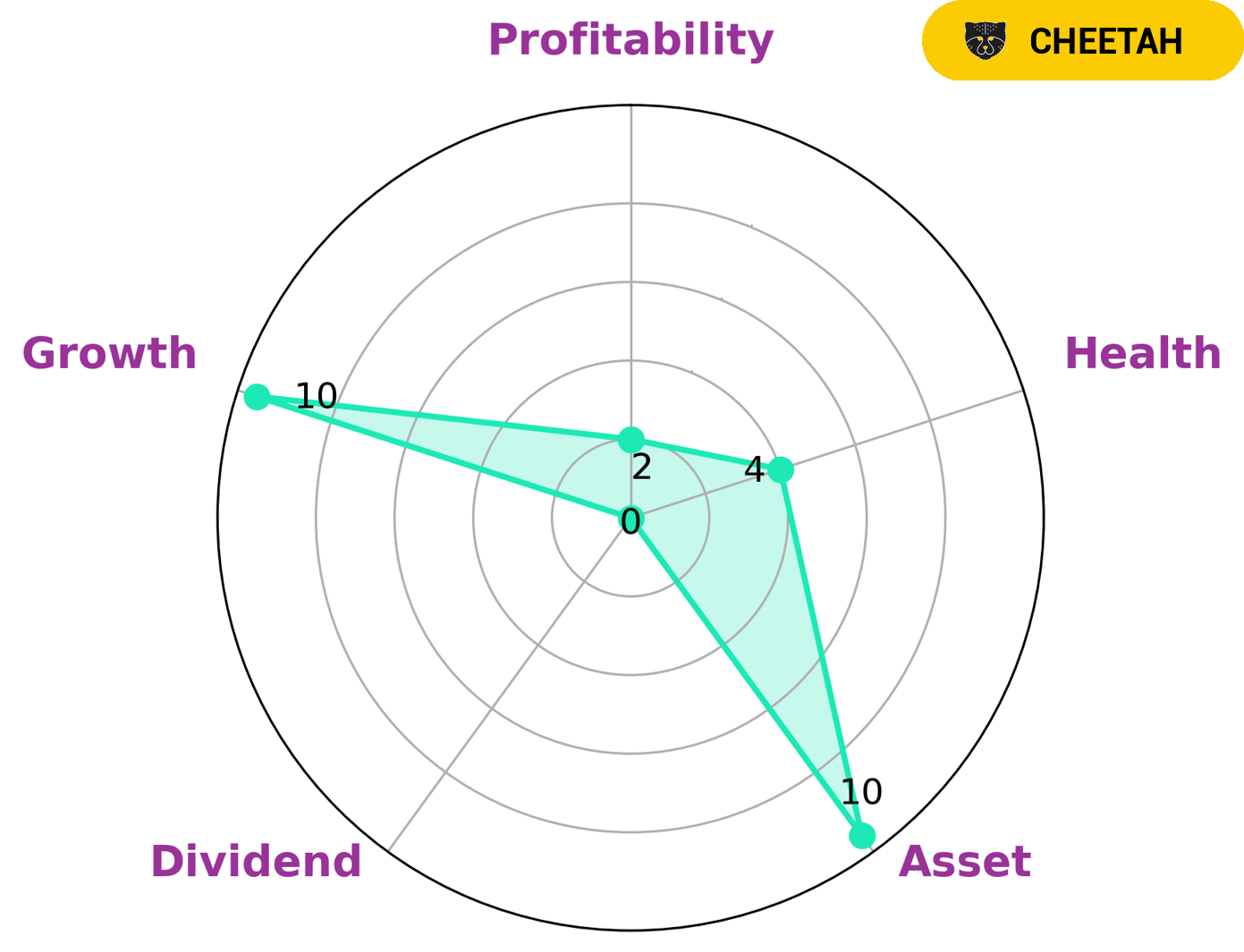

GoodWhale performed an analysis to assess the wellbeing of AURINIA PHARMACEUTICALS, which resulted in a Star Chart that illustrated the company’s strengths and weaknesses. AURINIA PHARMACEUTICALS’s assets and growth potential were strong, but dividend and profitability were weak. AURINIA PHARMACEUTICALS was given an intermediate health score of 4/10 when considering cashflows and debt, suggesting that the company is likely to pay off debt and fund future operations. In addition, AURINIA PHARMACEUTICALS was classified as a ‘cheetah’ – a company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. These types of companies may be attractive investments for investors who are looking for high returns, as these investments come with higher risk. Investors who are looking for more stability may be more hesitant to invest in such companies. Overall, AURINIA PHARMACEUTICALS has a strong asset and growth potential despite the weak dividend and profitability, making it a potentially attractive investment for investors who are willing to take on additional risks. More…

Peers

The company’s lead candidate, voclosporin, is a novel, potentially first-in-class immunomodulatory drug that is being investigated for the treatment of lupus nephritis and other autoimmune diseases. Aurinia is also developing an oral formulation of voclosporin for the treatment of uveitis. Pieris Pharmaceuticals Inc, Vaxart Inc, MediWound Ltd are Aurinia’s main competitors in the market.

– Pieris Pharmaceuticals Inc ($NASDAQ:PIRS)

Pieris Pharmaceuticals Inc is a publicly traded company with a market capitalization of $74.41M as of March 2022. The company has a Return on Equity of -89.14%. Pieris Pharmaceuticals Inc is a biopharmaceutical company that focuses on the development of Anticalin proteins to treat a variety of respiratory diseases, including asthma, COPD, and cystic fibrosis.

– Vaxart Inc ($NASDAQ:VXRT)

Vaxart Inc is a clinical-stage biotechnology company focused on the development and commercialization of oral recombinant vaccines. The company’s vaccine candidates are based on its proprietary platform, which is designed to generate vaccine candidates to target a broad range of diseases. Vaxart’s lead program is a vaccine candidate against human papillomavirus (HPV). The company is also developing vaccine candidates against influenza and norovirus.

– MediWound Ltd ($NASDAQ:MDWD)

MediWound Ltd is a global biopharmaceutical company that develops, manufactures, and markets innovative therapeutics to address unmet needs in the fields of severe burns, chronic and other hard-to-heal wounds. The company has a market capitalization of 56.19 million as of 2022 and a return on equity of 193.32%. MediWound was founded in 2000 and is headquartered in Yavne, Israel.

Summary

Aurinia Pharmaceuticals Inc. is a clinical-stage biopharmaceutical company that focuses on the development and commercialization of therapeutic drugs for the treatment of autoimmune diseases. The company’s lead product candidate, voclosporin, is an investigational drug for the treatment of lupus nephritis (LN). The company has a strong balance sheet, robust research and development capabilities, and key partnerships with large pharmaceutical companies. It also has a promising pipeline of products and clinical trials that could potentially be approved by regulators.

However, the stock has been volatile due to delays in achieving regulatory approval and uncertainty around the company’s ability to reach its commercial goals. Investors should do their own due diligence before investing in Aurinia.

Recent Posts