Clarius Group LLC Reduces Stake in Adaptive Biotechnologies Co. by 22.5% in Fourth Quarter

April 11, 2023

Trending News 🌥️

Adaptive Biotechnologies ($NASDAQ:ADPT) is a biotechnology company that focuses on creating transformative solutions to revolutionize the understanding, diagnosis, and treatment of disease. Clarius Group LLC reported its significant reduction of stake in Adaptive Biotechnologies Co. in a filing with the US Securities and Exchange Commission (SEC). As the biotechnology industry continues to expand, investors are becoming more selective with their investments, looking for companies that can offer the most growth potential and returns.

Market Price

On Monday, ADAPTIVE BIOTECHNOLOGIES stock opened at $8.5 and closed at $8.6, down by 0.2% from previous closing price of 8.6. This stake reduction follows a trend of declining interest in the company that has been observed over the past few quarters. This could lead to a decrease in the company’s value, as well as a drop in investor confidence in the company. It remains to be seen how Adaptive Biotechnologies will respond in the coming months and how their stock prices will be affected. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Adaptive Biotechnologies. More…

| Total Revenues | Net Income | Net Margin |

| 185.31 | -200.19 | -108.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Adaptive Biotechnologies. More…

| Operations | Investing | Financing |

| -183.94 | 2.9 | 132.26 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Adaptive Biotechnologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 856.62 | 392.52 | 3.24 |

Key Ratios Snapshot

Some of the financial key ratios for Adaptive Biotechnologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.6% | – | -105.8% |

| FCF Margin | ROE | ROA |

| -108.1% | -25.8% | -14.3% |

Analysis

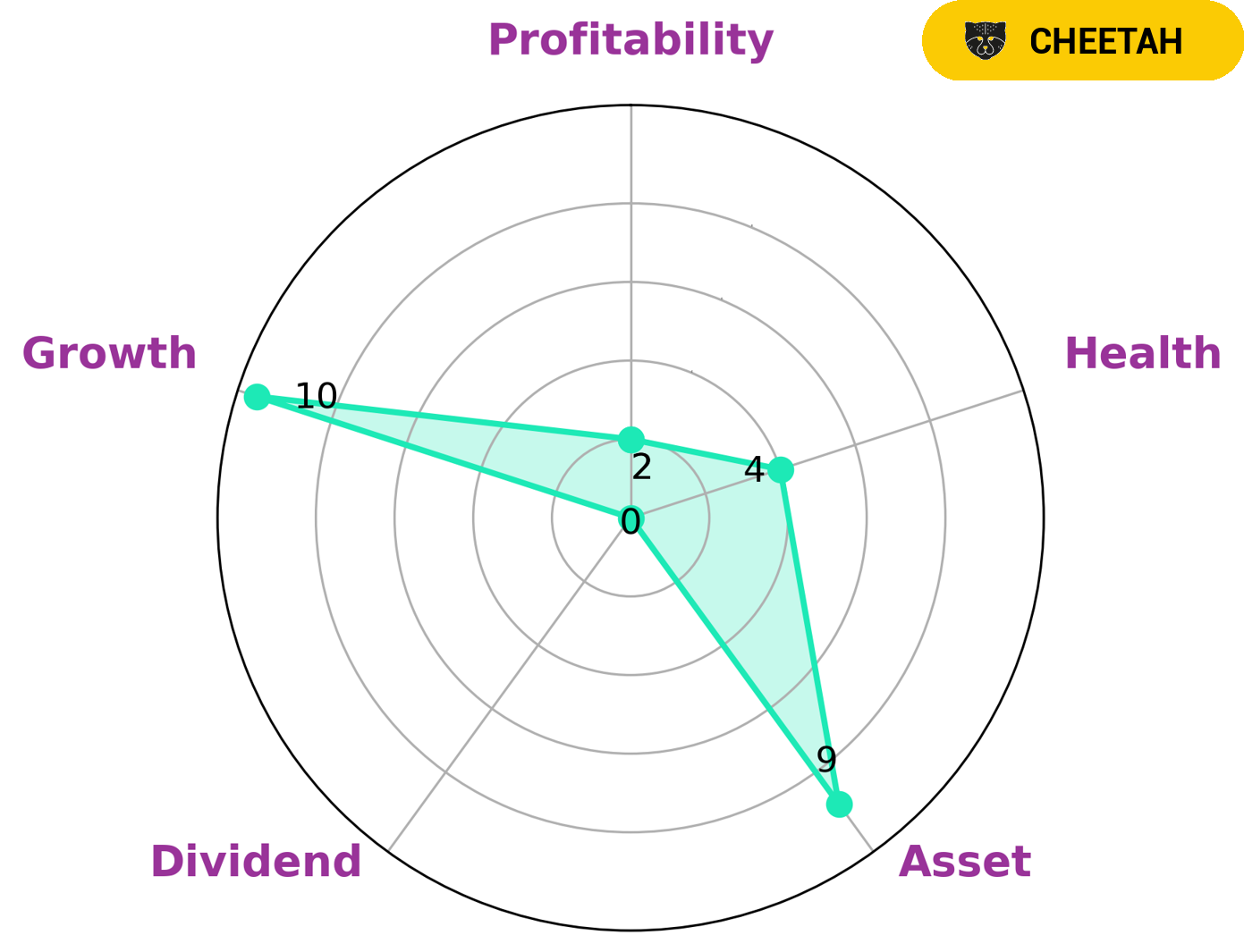

As GoodWhale, we have analyzed ADAPTIVE BIOTECHNOLOGIES‘s financials and our assessment with Star Chart shows that the company is strong in asset, growth, and weak in dividend and profitability. We have classified ADAPTIVE BIOTECHNOLOGIES as a ‘cheetah’, which is a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company may interest investors who are looking for high potential and long-term growth potential. Furthermore, ADAPTIVE BIOTECHNOLOGIES has an intermediate health score of 4/10 with regard to its cashflows and debt, which indicates that the company is likely to sustain future operations in times of crisis. More…

Peers

Adaptive Biotechnologies Corp is a biotechnology company that develops products to diagnose and treat cancer and other diseases. The company’s products are based on its proprietary technology platforms, which enable the company to identify and target cancer cells and other diseased cells. The company’s products include diagnostic tests and treatments for cancer, autoimmune diseases, and infectious diseases.

The company’s main competitors are Forte Biosciences Inc, Synaptogenix Inc, and Resverlogix Corp.

– Forte Biosciences Inc ($NASDAQ:FBRX)

Forte Biosciences Inc is a clinical-stage biopharmaceutical company that focuses on the development of therapeutics to improve patient outcomes in dermatology and immunology. The company’s lead product candidate is Vixari, a topical formulation of an anti-TNF-alpha biologic, which is in Phase 2 clinical trials for the treatment of plaque psoriasis. Forte Biosciences has a market cap of 20.95M as of 2022 and a Return on Equity of -42.75%. The company’s focus on developing therapeutics to improve patient outcomes in dermatology and immunology makes it a promising investment opportunity in the healthcare sector.

– Synaptogenix Inc ($NASDAQ:SNPX)

Synaptogenix is a clinical-stage biotechnology company developing drugs to treat neurodegenerative diseases. The company’s lead product candidate, SYN-115, is in development for the treatment of Alzheimer’s disease. Synaptogenix has a market cap of $43.23 million as of 2022 and a return on equity (ROE) of -38.9%. The company’s clinical-stage drugs are not yet approved for commercial use, which makes it a high-risk investment. However, the potential rewards for investors are significant if Synaptogenix is successful in developing an effective treatment for Alzheimer’s disease.

– Resverlogix Corp ($TSX:RVX)

Resverlogix Corp. is a biopharmaceutical company, which engages in the development of small molecule therapeutics for the treatment of atherosclerosis and associated diseases. Its products include RVX-208, RVX-210, and BETonMACE. The company was founded by Norman W. Wong on February 3, 2004 and is headquartered in Calgary, Canada.

Summary

Adaptive Biotechnologies is a biotechnology company that specializes in developing immune-driven diagnostic and therapeutic products. This move signals a potential change in sentiment among major investors in the company, highlighting the need for further analysis into this development.

Recent Posts