CEO of Novavax Reports $50 Million Cost Reduction in Q1 of 2023

April 13, 2023

Trending News 🌥️

Novavax ($NASDAQ:NVAX) is a biotechnology company that specializes in developing vaccines and drug delivery systems. Novavax has a history of advancing its technological capabilities, and this cost reduction indicates their success in doing so. This cost reduction is expected to improve the company’s profits and create beneficial opportunities for the shareholders. The reduction is also indicative of the company’s commitment to investing in research and development in order to continue their strong track record of success.

The cost reduction is an encouraging sign that Novavax is on the right track to achieving further success in the coming years. As the company continues to refine its technology and processes, investors can expect to see more positive developments from Novavax in the near future.

Price History

This news gave investors a positive outlook for the company, as it was reflected in the stock market with NOVAVAX stock opening at $9.2 and closing at $9.0. The cost reduction represents a significant milestone for the company, indicating that it is on track for a successful year of financial performance. It also demonstrates Novavax’s commitment to responsible and sustainable practices. Investors are eager to see the continued progress of the company in the coming months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Novavax. More…

| Total Revenues | Net Income | Net Margin |

| 1.98k | -657.94 | -33.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Novavax. More…

| Operations | Investing | Financing |

| -415.94 | -92.98 | 324.99 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Novavax. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.26k | 2.89k | -7.37 |

Key Ratios Snapshot

Some of the financial key ratios for Novavax are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 373.6% | – | -32.0% |

| FCF Margin | ROE | ROA |

| -25.7% | 66.0% | -17.5% |

Analysis

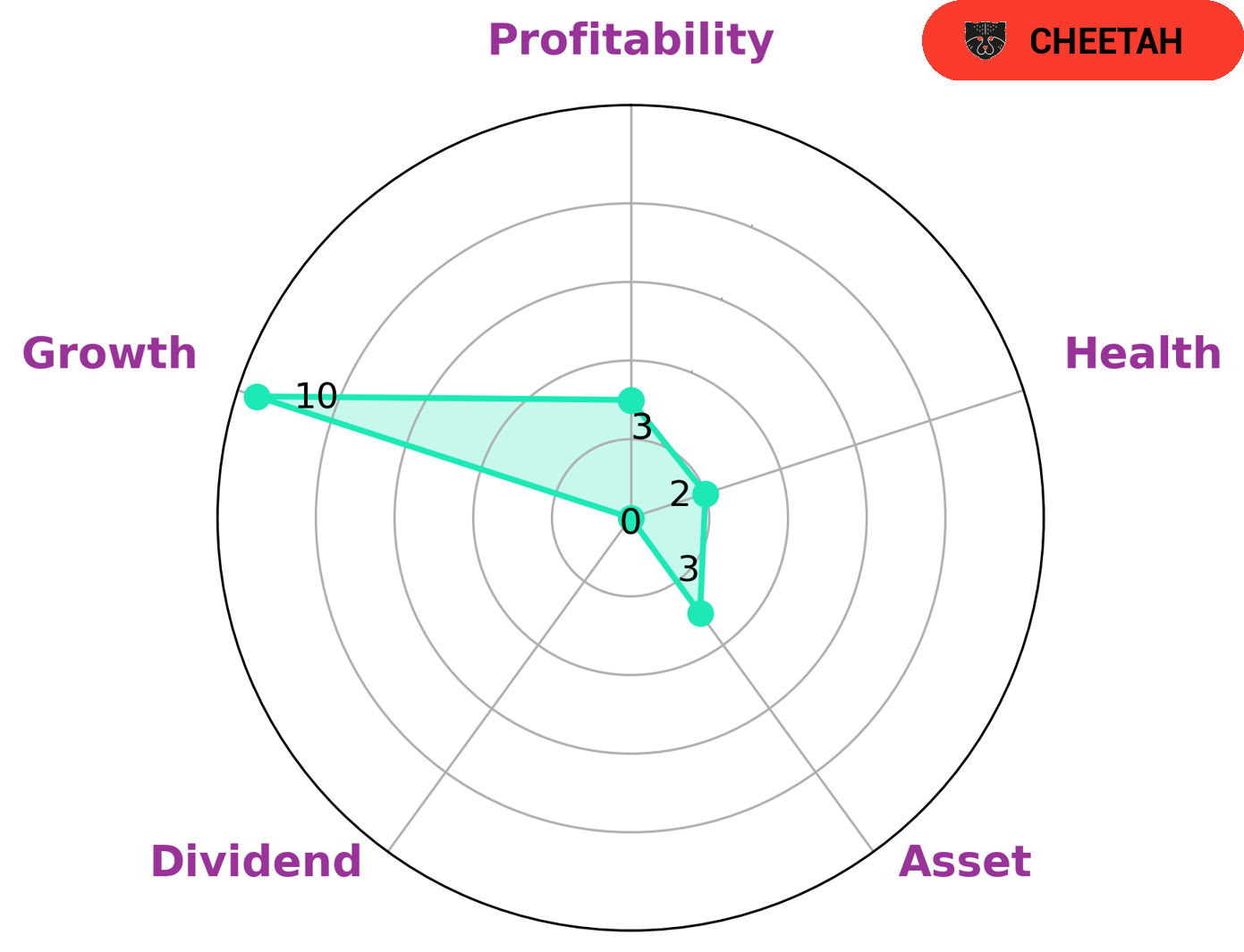

GoodWhale has conducted an analysis of NOVAVAX‘s health, which reveals that the company is classified as ‘cheetah’ on our Star Chart. This type of company has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Hence, investors who are looking for growth and are comfortable with taking on more risk might be interested in such a company. Our analysis also shows that NOVAVAX is strong in growth, but weak in asset, dividend, and profitability. Moreover, NOVAVAX has a low health score of 2/10, indicating that it is less likely to pay off debt and fund future operations. More…

Peers

The competition between Novavax Inc and its competitors is fierce. Moderna Inc, BioNTech SE, and Pfizer Inc are all major players in the vaccine industry, and each company is striving to develop the most effective vaccine possible. While Novavax Inc has made great strides in recent years, its competitors are not far behind.

– Moderna Inc ($NASDAQ:MRNA)

Moderna Inc is a clinical stage biotechnology company that discovers, develops, and commercializes therapeutics and vaccines based on RNA. As of 2022, Moderna Inc has a market cap of 48.32B and a ROE of 80.28%. Moderna Inc’s mission is to harness the power of RNA to revolutionize medicine and change the way diseases are prevented, treated, and cured.

– BioNTech SE ($NASDAQ:BNTX)

As of 2022, BioNTech SE has a market cap of 32.44B and a Return on Equity of 71.82%. The company is a German biotechnology company that develops and manufactures vaccines and antibody therapeutics. The company has developed a platform that allows it to rapidly design and produce custom-made vaccines and therapeutics.

– Pfizer Inc ($NYSE:PFE)

Pfizer Inc is a pharmaceutical company with a market cap of 247.45B as of 2022. The company has a return on equity of 24.63%. Pfizer Inc is a research-based, global pharmaceutical company that discovers, develops, manufactures, and markets safe, effective, and affordable human and veterinary medicines. The company is one of the world’s largest research-based pharmaceutical companies, with products available in more than 150 countries.

Summary

NOVAVAX is a biotechnology company focusing on the development of vaccines. In its first quarter of 2023, it achieved a significant milestone of reducing its costs by $50 million. This accomplishment was highlighted by the CEO, who expressed confidence in the company’s future prospects. Investors should note that this cost reduction demonstrates NOVAVAX’s ability to become more financially efficient and could create potential opportunities for growth and expansion.

In addition, it may also indicate that the company is in a strong position to monetize its research and investments in the coming years. All in all, NOVAVAX appears to be on the right track and investors should watch the company closely for further developments.

Recent Posts