Bridgebio Pharma Stock Intrinsic Value – BridgeBio Pharma, Sees Significant Reduction in Short Interest at Defense World

June 2, 2023

☀️Trending News

BRIDGEBIO ($NASDAQ:BBIO): BridgeBio Pharma, Inc. has seen a significant reduction in short interest at Defense World. This decline has been attributed to the company’s positive performance in the pharmaceutical industry, as well as its strong pipeline of drugs in development. BridgeBio Pharma, Inc. is a biopharmaceutical company focused on developing and commercializing life-transforming therapies for genetic diseases. The company leverages its expertise in genetics and drug development to unlock the potential of novel therapeutics, with a focus on delivering treatments to patients with rare and neglected diseases.

Over the past few years, BridgeBio Pharma, Inc. has seen a rise in its stock value and has continued to build a strong portfolio of drugs and technologies. With its current projects in development, BridgeBio Pharma, Inc. is making great strides in the pharmaceutical industry, and this reduction in short interest reflects the public’s confidence in the company’s future success.

Price History

The stock opened at $13.9 and closed at $13.5, down by 1.5% from prior closing price of 13.8. Investors appear to be encouraged by this news and have responded by decreasing their short positions on BRIDGEBIO PHARMA stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bridgebio Pharma. More…

| Total Revenues | Net Income | Net Margin |

| 77.78 | -424.94 | -514.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bridgebio Pharma. More…

| Operations | Investing | Financing |

| -403.18 | 326.82 | 137.28 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bridgebio Pharma. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 625.68 | 1.84k | -7.65 |

Key Ratios Snapshot

Some of the financial key ratios for Bridgebio Pharma are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 24.2% | – | -444.6% |

| FCF Margin | ROE | ROA |

| -525.4% | 17.4% | -34.5% |

Analysis – Bridgebio Pharma Stock Intrinsic Value

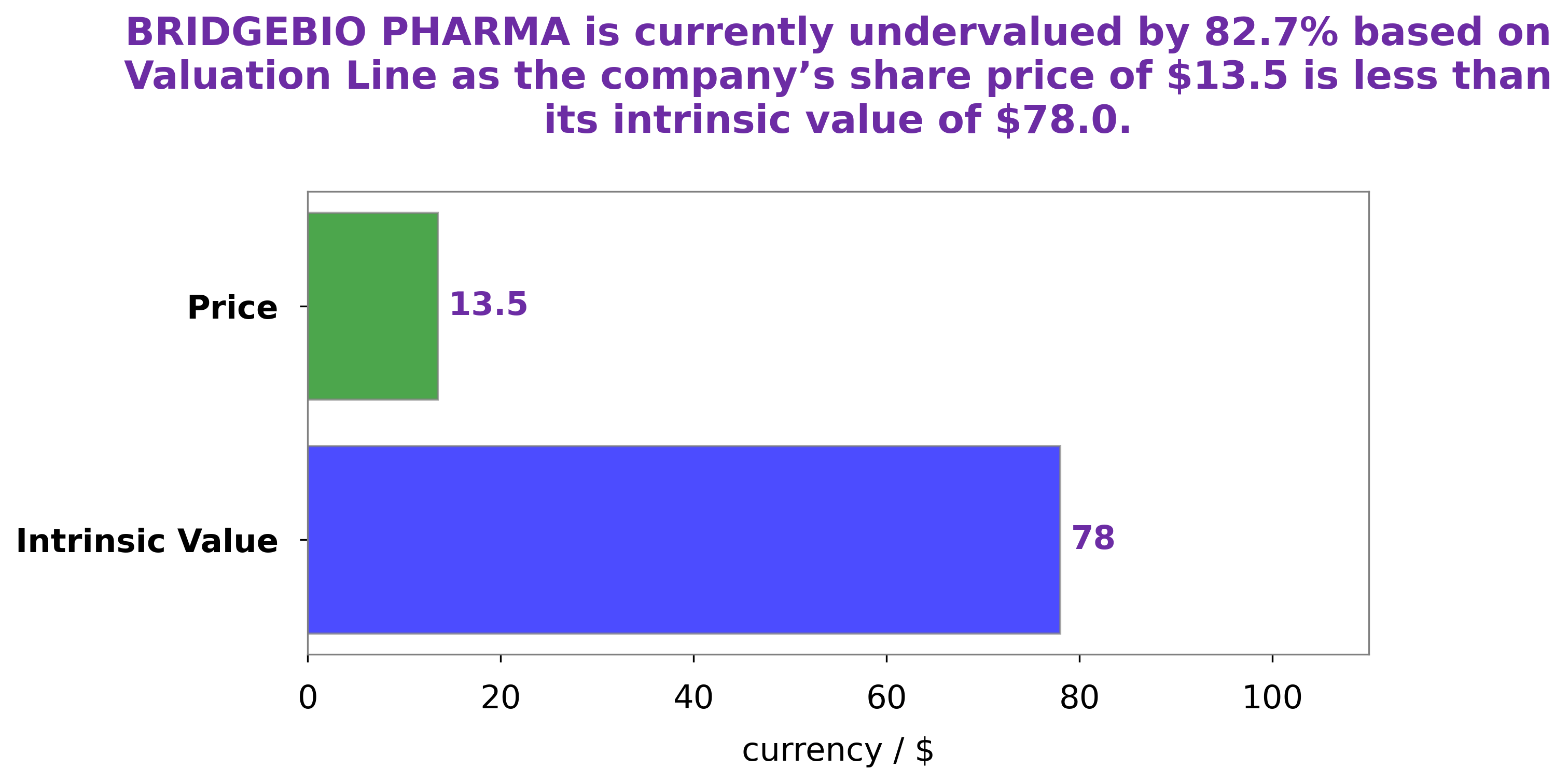

GoodWhale has conducted a thorough analysis of BRIDGEBIO PHARMA’s fundamentals and has concluded that the fair value of a BRIDGEBIO PHARMA share is around $78.0. This figure was determined using GoodWhale’s proprietary Valuation Line. At the moment, BRIDGEBIO PHARMA stock is trading at $13.5, meaning that it is undervalued by 82.7%. GoodWhale has identified BRIDGEBIO PHARMA as a strong and undervalued opportunity for investors, and we believe that now is the time to invest in the company. With our detailed analysis, investors can make an informed decision when deciding whether or not to purchase the stock. More…

Peers

The competition among BridgeBio Pharma Inc and its competitors is fierce. All four companies are working to develop new and innovative treatments for various diseases and disorders. While each company has its own unique approach, they all share a common goal: to improve the lives of patients.

– Faron Pharmaceuticals Oy ($LSE:FARN)

Faron Pharmaceuticals Oy is a Finnish pharmaceutical company with a market cap of 148.02M as of 2022. The company’s Return on Equity is 1278.12%. Faron Pharmaceuticals Oy is engaged in the research and development of drugs for the treatment of cancer and other serious diseases. The company’s products include Traumakine, a drug for the treatment of traumatic brain injury, and Clevegen, a drug for the treatment of solid tumors.

– Trevi Therapeutics Inc ($NASDAQ:TRVI)

Trevi Therapeutics Inc is a clinical-stage biopharmaceutical company. The Company focuses on the development and commercialization of nalbuphine ER to treat serious and debilitating conditions. Its product candidate, Nalbuphine ER, is an opioid analgesic that is in the late-stage clinical development for the treatment of pruritus in adult patients with Atopic Dermatitis, and for the treatment of chronic pruritus in adult patients with renal impairment.

– IRLAB Therapeutics AB ($BER:6IRA)

Diaverum is a Swedish renal care company. The company provides dialysis, peritoneal dialysis, and kidney transplantation services through a network of clinics in Europe, Asia-Pacific, the Middle East, and Latin America. Diaverum is a publicly traded company with a market capitalization of 161.21 million as of 2022. The company has a return on equity of -19.31%.

Summary

BridgeBio Pharma, Inc. has seen a significant decrease in short interest due to an increase in investors taking long-term positions in the company. This implies a decline in bearish sentiment among investors and an increased confidence in BridgeBio Pharma’s performance. Analysts suggest this trend is likely to continue due to positive developments in the company’s pipeline and financials.

Recent Posts