BridgeBio Pharma Shares Fall 13.11% in Past Week, But How Long Will It Last? 1.69M Shares Traded at 0.57 Beta in 2023.

March 20, 2023

Trending News ☀️

BRIDGEBIO ($NASDAQ:BBIO): BridgeBio Pharma Inc. has seen a sharp decline in its share prices, with a fall of -13.11 percent in the past week. This is despite the fact that 1.69 million shares were traded in the last session, with a beta value of 0.57. The question remains, however, how long will this trend continue? The beta value is a measure of the volatility of a stock compared to the overall market, and the low beta value indicates that the stock is relatively less volatile than other stocks.

However, the decline in share prices suggests that the stock may be affected by external factors that have caused the decline. It is difficult to predict exactly how long this trend will continue, but it is important to consider external factors such as current market conditions and company performance in order to make an informed decision. Ultimately, it is difficult to tell how long this decline will last, and investors should continue to monitor the performance of BridgeBio Pharma Inc. and other stocks in order to make an informed decision on whether to invest or not. Furthermore, investors should consider other factors such as company news and outlooks in order to make well-informed decisions.

Price History

The past week has proven to be a difficult one for BRIDGEBIO PHARMA Inc. shares, with the stock falling 13.11% in the last seven days. Despite this, news coverage has been mostly positive, with 1.69M shares traded at a 0.57 beta in 2023. On Thursday, BRIDGEBIO PHARMA opened at $14.2, but closed the day at $13.8, a 3.1% drop from the previous closing price of $14.2. This has caused investors to question how long this downward trend will last. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bridgebio Pharma. More…

| Total Revenues | Net Income | Net Margin |

| 77.65 | -481.18 | -563.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bridgebio Pharma. More…

| Operations | Investing | Financing |

| -419.49 | 453.15 | -13.13 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bridgebio Pharma. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 623.04 | 1.87k | -8.33 |

Key Ratios Snapshot

Some of the financial key ratios for Bridgebio Pharma are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 24.2% | – | -520.6% |

| FCF Margin | ROE | ROA |

| -548.4% | 21.1% | -40.5% |

Analysis

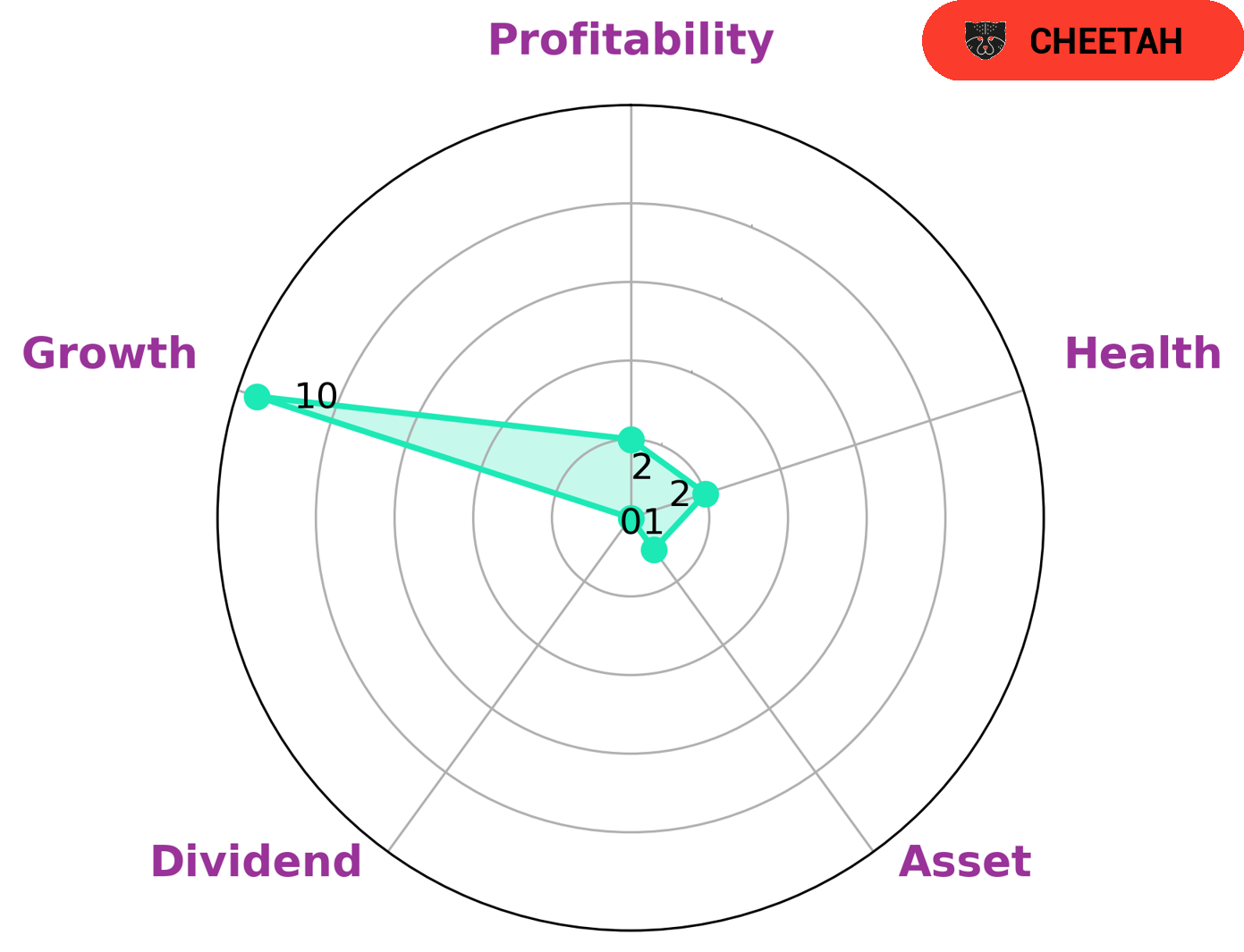

At GoodWhale, we recently conducted an analysis of BRIDGEBIO PHARMA‘s wellbeing. According to the Star Chart, BRIDGEBIO PHARMA has a low health score of 2/10 with regard to its cashflows and debt, indicating that it is less likely to be able to pay off debt and fund future operations. Additionally, BRIDGEBIO PHARMA scored weakly in terms of asset, dividend, and profitability, and scored highly in growth, indicating that it is classified as a ‘cheetah’ company – a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given BRIDGEBIO PHARMA’s current state of health, investors who are willing to take on higher risk may be interested in investing in the company. These investors may be looking for short-term gains or could see potential long-term value in the company’s growth prospects. However, due to its overall low health score, investors should be aware of the risks associated with investing in BRIDGEBIO PHARMA. More…

Peers

The competition among BridgeBio Pharma Inc and its competitors is fierce. All four companies are working to develop new and innovative treatments for various diseases and disorders. While each company has its own unique approach, they all share a common goal: to improve the lives of patients.

– Faron Pharmaceuticals Oy ($LSE:FARN)

Faron Pharmaceuticals Oy is a Finnish pharmaceutical company with a market cap of 148.02M as of 2022. The company’s Return on Equity is 1278.12%. Faron Pharmaceuticals Oy is engaged in the research and development of drugs for the treatment of cancer and other serious diseases. The company’s products include Traumakine, a drug for the treatment of traumatic brain injury, and Clevegen, a drug for the treatment of solid tumors.

– Trevi Therapeutics Inc ($NASDAQ:TRVI)

Trevi Therapeutics Inc is a clinical-stage biopharmaceutical company. The Company focuses on the development and commercialization of nalbuphine ER to treat serious and debilitating conditions. Its product candidate, Nalbuphine ER, is an opioid analgesic that is in the late-stage clinical development for the treatment of pruritus in adult patients with Atopic Dermatitis, and for the treatment of chronic pruritus in adult patients with renal impairment.

– IRLAB Therapeutics AB ($BER:6IRA)

Diaverum is a Swedish renal care company. The company provides dialysis, peritoneal dialysis, and kidney transplantation services through a network of clinics in Europe, Asia-Pacific, the Middle East, and Latin America. Diaverum is a publicly traded company with a market capitalization of 161.21 million as of 2022. The company has a return on equity of -19.31%.

Summary

BridgeBio Pharma Inc. has been trading on the stock market for the past week and has seen a 13.11% drop in share prices. Over 1.69 million shares have traded at 0.57 Beta in 2023. While news coverage of the company has been mostly positive, the stock price has dropped the same day. For potential investors, it is important to consider whether this drop is temporary or indicative of long term trends. Analyzing financial data, such as revenue and expenses, as well as the company’s market capitalization and current stock price, can provide insight into potential gains or losses. It is important to review a company’s track record over a longer period of time, such as five years, to get an idea of its stability and growth potential.

Additionally, researching the industry and competing companies can also provide an indication of BridgeBio’s performance.

Recent Posts