Blueprint Medicines on Track to Reach Analysts’ Expectations with 6.6% Increase in Four Weeks.

February 3, 2023

Trending News ☀️

Blueprint Medicines ($NASDAQ:BPMC) is a biopharmaceutical company that specializes in using genomics to develop precision medicines for patients with difficult-to-treat diseases. The company is focused on transforming the lives of people with diseases caused by mutations in their genomic information and works to develop treatments for cancers and rare diseases. The stock has risen 6.6% in the past four weeks, closing at $46.71 in the last trading session. This marks an increase of 61.38% since the start of the year, putting it on track to reach analysts’ expectations. Both of these projects are expected to be game-changers for Blueprint Medicines and could help it reach the level Wall Street analysts are anticipating.

The company is also investing heavily in research and development, which has been a major factor in driving its stock price up. This suggests that the company’s investments are paying off and that it is on track to reach analysts’ expectations. Overall, Blueprint Medicines is on track to reach its analysts’ expectations with a 6.6% increase in four weeks.

Price History

Despite this, the media exposure of the company has been mostly mixed. On Wednesday, the BLUEPRINT MEDICINES stock opened at $46.4 and closed at $46.0, down by 1.5% from the prior closing price of 46.7. The company has been able to demonstrate a 6.6% increase in stock prices over the four week period, overall showing a positive trend in the company’s performance. This shows that the investors have confidence in the company’s prospects, despite the mixed reviews from the media outlets. It is possible that the company’s ability to deliver on its promises and its ability to grow despite the negative press has been a factor in its success.

The company is likely to continue to deliver on its promises and show an overall positive trend in its stock price over time. It is important for investors to keep an eye on the company’s performance and news coverage to ensure that their investments are secure. This is encouraging news and a sign that the company is making good on its promises and continuing to show a positive trend despite the mixed media coverage. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Blueprint Medicines. More…

| Total Revenues | Net Income | Net Margin |

| 272.28 | -717.56 | -263.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Blueprint Medicines. More…

| Operations | Investing | Financing |

| -394.99 | -443.21 | 577.25 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Blueprint Medicines. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.46k | 818.09 | 10.71 |

Key Ratios Snapshot

Some of the financial key ratios for Blueprint Medicines are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 157.2% | – | -258.5% |

| FCF Margin | ROE | ROA |

| -243.1% | -63.4% | -30.2% |

Analysis

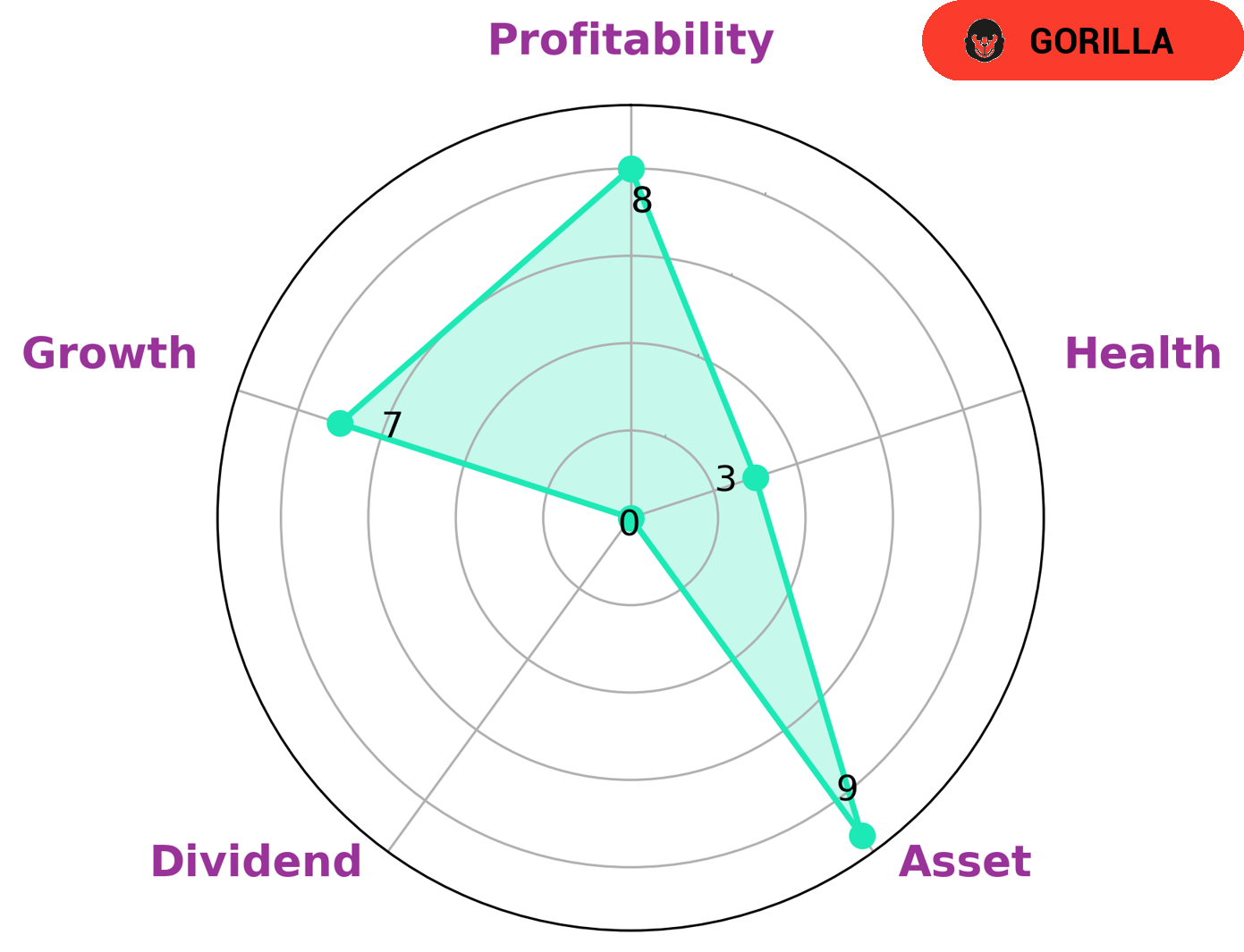

BLUEPRINT MEDICINES has been analysed by GoodWhale, and according to the Star Chart, the company has a low health score of 3 out of 10 due to its cashflows and debt. This suggests that it is less likely to sustain future operations in times of crisis. Despite this, BLUEPRINT MEDICINES is classified as a ‘gorilla’, a type of company that has achieved steady and high revenue or earning growth due to its strong competitive advantage. Investors who are looking for potential growth opportunities may be interested in BLUEPRINT MEDICINES. The company is strong in terms of assets, growth and profitability, however it is relatively weak when it comes to its dividend strategy. This suggests that investors who are looking for long-term capital gains might find BLUEPRINT MEDICINES an attractive choice. In conclusion, BLUEPRINT MEDICINES has a low health score and is not particularly strong in terms of dividend policy. Nevertheless, the company is a ‘gorilla’ and has strong competitive advantage in terms of its asset, growth and profitability which may make it an attractive option for investors who are looking for potential long-term capital gains. More…

Peers

Its main competitors are Theseus Pharmaceuticals Inc, Pardes Biosciences Inc, and Resverlogix Corp.

– Theseus Pharmaceuticals Inc ($NASDAQ:THRX)

With a market cap of 208.28M as of 2022, a return on equity of 21.98%, and a focus on developing treatments for cancer and other diseases, Theseus Pharmaceuticals Inc is a company to watch. While still relatively small, Thiseus has shown impressive growth and profitability, making it a company to keep an eye on in the coming years.

– Pardes Biosciences Inc ($NASDAQ:PRDS)

Pardes Biosciences Inc is a clinical stage biopharmaceutical company that focuses on developing drugs for the treatment of cancer and other diseases. The company’s market cap is 71.05M as of 2022. The company’s products are in various stages of development, including two Phase III clinical trials for the treatment of pancreatic cancer.

– Resverlogix Corp ($TSX:RVX)

Resverlogix Corp. operates as a clinical stage biopharmaceutical company. It focuses on the development and commercialization of therapeutics for the treatment of cardiovascular diseases. The company’s lead drug is RVX-208, a small molecule that is in Phase III clinical trials for the treatment of patients with apoA-I deficiency and high cardiovascular risk. Resverlogix Corp. was founded in 2000 and is headquartered in Calgary, Canada.

Summary

Investing in Blueprint Medicines has seen mixed media exposure recently. Despite this, the stock has seen an increase of 6.6% in the past four weeks, indicating that it is on track to meet analysts’ expectations. Investors should do their own research and determine if Blueprint Medicines is a good fit for their portfolio.

Recent Posts