Bio-techne Corporation stock dividend – Bio-Techne Corporation Declares Quarterly Dividend of $0.08/Share, Maintaining Yield of 0.39%.

February 3, 2023

Trending News 🌥️

Bio-techne Corporation stock dividend – BIO-TECHNE ($NASDAQ:TECH): Bio-Techne Corporation is a leading provider of biotechnology products, reagents, instruments, and services for the life science research and clinical diagnostics markets. The company produces and distributes in vitro diagnostic products and services to the clinical laboratory market. It also offers a wide range of products and services for the research, drug discovery, and bioprocess markets. Bio-Techne Corporation has declared a quarterly dividend of $0.08 per share, consistent with the prior dividend of $0.32, resulting in a forward yield of 0.39%. This dividend is payable on February 27th to shareholders of record on February 13th, with the ex-dividend date set for February 10th. For more information, please visit the TECH Dividend Scorecard, Yield Chart, and Dividend Growth. Bio-Techne Corporation has a long history of delivering outstanding returns to investors. The company’s strong financial position and its commitment to returning value to shareholders make it an attractive investment.

Additionally, the company’s cash flow has consistently been positive over the past five years, indicating its ability to generate and sustain profits. In conclusion, Bio-Techne Corporation’s consistent dividend payments and strong financial position make it an attractive investment for dividend investors. The company’s strong returns and commitment to returning value to shareholders further enhances its appeal.

Dividends – Bio-techne Corporation stock dividend

This announcement comes after the company has issued a consistent annual dividend per share over the last three years, at $1.28 USD. The company’s dividend yields from 2021 to 2023 are estimated to be 1.37%, 1.37%, and 1.15%, respectively, with an average dividend yield of 1.3%. This steady yield provides investors with a reliable and consistent source of income, as the company continues to expand its portfolio and develop new products. The company has developed and produces a variety of products and services, ranging from antibody-based reagents to protein analysis kits and assay systems. The company also provides custom services, such as cell line development and protein expression services, as well as contract research services.

The company is committed to delivering innovative products and services to its customers, while striving to maintain the highest standards of quality and customer service. This latest dividend announcement from Bio-Techne Corporation is an indication of their long-term focus on providing reliable and consistent returns for their shareholders. Investors can rest assured that their investments in the company are secure and will continue to provide them with a steady stream of income.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bio-techne Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 1.12k | 291.88 | 25.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bio-techne Corporation. More…

| Operations | Investing | Financing |

| 332.92 | -109.42 | -234.97 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bio-techne Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.35k | 599.57 | 44.64 |

Key Ratios Snapshot

Some of the financial key ratios for Bio-techne Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.0% | 23.2% | 31.3% |

| FCF Margin | ROE | ROA |

| 25.5% | 12.6% | 9.3% |

Price History

Bio-Techne Corporation, one of the leading biotechnology companies, announced a quarterly dividend of $0.08/share on Thursday. The stock opened at $80.7 and closed at $80.8, down 0.5% from its previous closing price of $81.3. The announcement was met with mostly negative media sentiment. Analysts had expected the company to present higher dividends, and investors were disappointed by the lack of growth. Despite this, some analysts remain hopeful that Bio-Techne Corporation will remain a strong performer despite the current market volatility. Bio-Techne Corporation has a strong history of providing innovative biotechnology products and services to its customers. They have developed an impressive portfolio of products, ranging from antibodies and proteins for research and diagnostic applications to flow cytometry and cell analysis systems. The company has also made significant investments in research and development, which has enabled them to stay ahead of the competition and develop new products. Bio-Techne Corporation has also been very proactive in responding to customer needs and market trends. They have invested in a broad range of digital tools to enable their customers to better access their products and services.

In addition, they have also increased their focus on customer support in order to ensure that customers have the best possible experience when using their products and services. Overall, despite the recent negative sentiment surrounding the company, Bio-Techne Corporation remains in a strong position. Their product portfolio is well-positioned to continue to deliver value to their customers, and the company is actively investing in digital tools to improve customer experience. With a stable dividend yield, investors can remain confident that Bio-Techne Corporation will continue to deliver long-term value to its shareholders. Live Quote…

Analysis

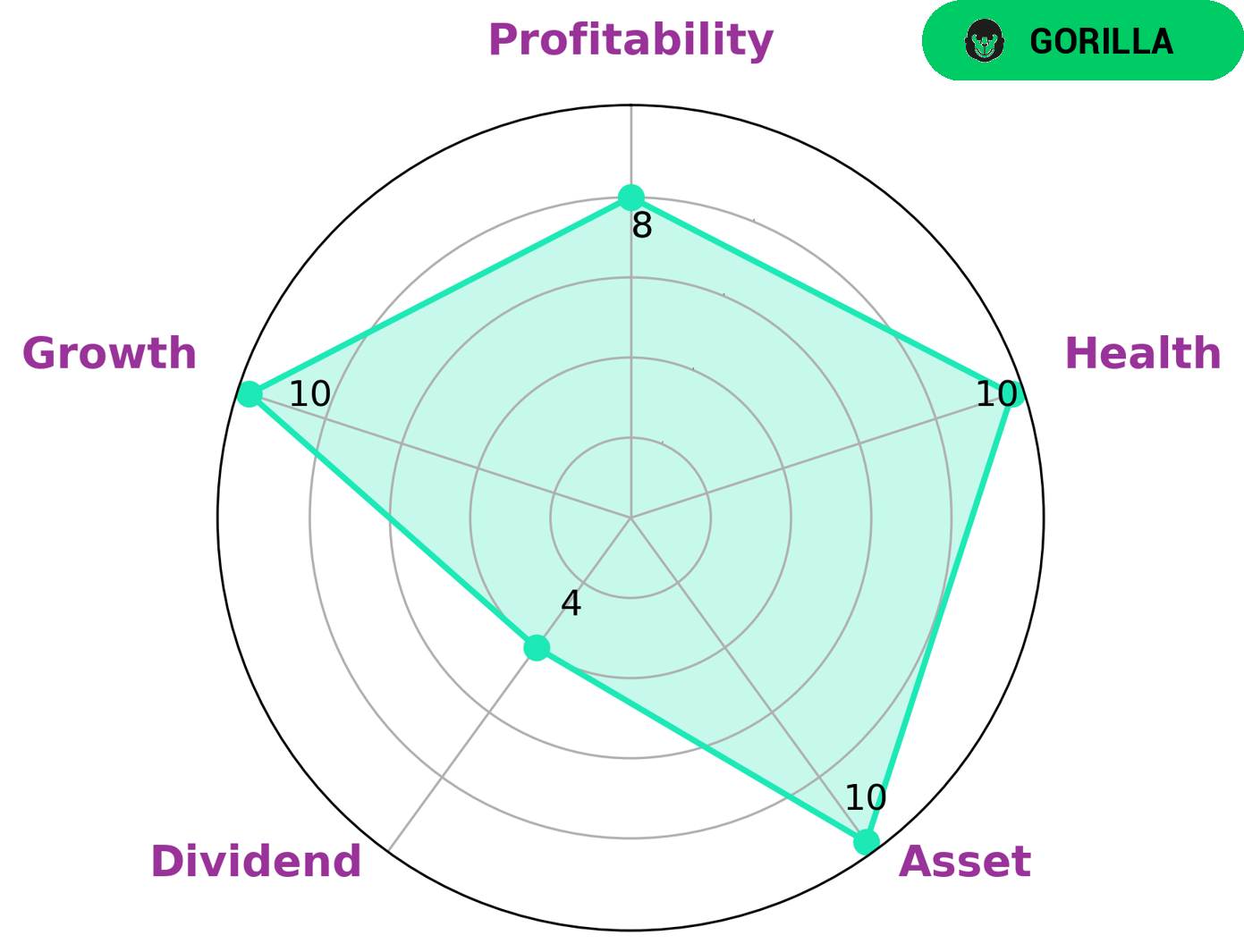

GoodWhale has analyzed the wellbeing of BIO-TECHNE CORPORATION, and the results have been positive. According to the Star Chart, BIO-TECHNE CORPORATION has a high health score of 10/10 due to its strong cashflows and debt, allowing it to safely ride out any crisis without the risk of bankruptcy. BIO-TECHNE CORPORATION is also strong in asset, growth, and profitability, and medium in dividend. As a result, BIO-TECHNE CORPORATION is classified as a “gorilla”, which is a type of company that achieved stable and high revenue or earning growth due to its strong competitive advantage. Given this analysis, investors may be interested in such a company due to its ability to generate returns and its resilience in times of financial difficulty. Furthermore, investors may be lured by the potential for long-term returns as BIO-TECHNE CORPORATION is likely to continue to grow in value over time. Finally, investors may be attracted to the stability of BIO-TECHNE CORPORATION’s capital structure and the ability to withstand economic downturns without the risk of bankruptcy. All these factors make BIO-TECHNE CORPORATION an attractive investment opportunity and may draw the attention of potential investors. More…

Peers

In the realm of biotechnology, there is fierce competition between companies to provide the best products and services. Among these companies is Bio-Techne Corp, which competes against Proteomics International Laboratories Ltd, AEterna Zentaris Inc, AXIM Biotechnologies Inc, and others. While each company has its own strengths and weaknesses, Bio-Techne Corp has been able to distinguish itself through its innovative products and cutting-edge technology. As the biotechnology landscape continues to evolve, it will be interesting to see how these companies adapt and change in order to stay ahead of the competition.

– Proteomics International Laboratories Ltd ($ASX:PIQ)

Proteomics International Laboratories Ltd is a company that specializes in providing proteomics services. Its market cap as of 2022 was 110.87M, and its ROE was -75.41%. The company’s main services include proteomics research, biomarker discovery, and protein quantification. Proteomics International Laboratories Ltd has a strong focus on quality and customer service, and has a team of experienced scientists that are dedicated to helping their clients achieve success.

– AEterna Zentaris Inc ($TSX:AEZS)

Aeterna Zentaris is a Canadian biopharmaceutical company engaged in the discovery, development, and commercialization of therapeutic drugs for the treatment of cancer and endocrine disorders. As of 2022, the company had a market capitalization of $25.01 million and a return on equity of -14.54%. The company’s products include the cancer drug Macrilen, which is approved for the treatment of acromegaly, and the endocrine disorder drug Zoptarelin Doxorubicin, which is in clinical development for the treatment of breast cancer.

– AXIM Biotechnologies Inc ($OTCPK:AXIM)

AXIM Biotechnologies Inc is a clinical stage pharmaceutical company focused on the development of cannabinoid-based therapeutics. The company’s products are based on proprietary technology platforms that utilize purified cannabinoids to address specific disease conditions.

The company’s market cap is 10.55M as of 2022. The company’s ROE is 223.83%.

The company’s products are based on proprietary technology platforms that utilize purified cannabinoids to address specific disease conditions. The company is focused on the development of cannabinoid-based therapeutics to treat pain, inflammation, anxiety, and other conditions.

Summary

Bio-Techne Corporation recently declared a quarterly dividend of $0.08 per share, which maintains its yield at 0.39%. This announcement has resulted in mostly negative sentiment from the media. From an investing perspective, Bio-Techne Corporation is a biotechnology company that develops, manufactures and sells reagents, instruments and test kits for use in research and clinical diagnostics. The company also offers custom services and products for biopharmaceutical production.

Bio-Techne Corporation has a diversified portfolio of products, a strong financial position and a good track record of delivering value to shareholders. The company has a history of dividend increases and has maintained a consistent dividend payout over the years. With its strong fundamentals and attractive dividend yield, Bio-Techne Corporation may be an attractive investment opportunity for investors looking for reliable income.

Recent Posts