BCV Decreases Investment in Aurinia Pharmaceuticals

July 8, 2023

🌥️Trending News

Recently, Defense World reported that Banque Cantonale Vaudoise has decreased its ownership in Aurinia Pharmaceuticals ($NASDAQ:AUPH) Inc. (AUP). Aurinia Pharmaceuticals Inc. is a clinical-stage biopharmaceutical company focused on the development of a therapeutic drug to treat autoimmune diseases. The company’s lead drug candidate, Voclosporin, is a calcineurin inhibitor intended for the treatment of Lupus Nephritis (LN). The drug is currently being tested in a global Phase III clinical trial (AURION) for the treatment of LN.

The decrease in Banque Cantonale Vaudoise’s investment in AUP is a significant development in the company’s stock, as it signals a lack of faith in the efficacy of its lead drug candidate. As such, investors should remain cautious when considering an investment in Aurinia Pharmaceuticals Inc., and should carefully consider the risks associated with investing in a clinical-stage biopharmaceutical company.

Share Price

On Thursday, AURINIA PHARMACEUTICALS Inc. saw a slight increase in their stock prices despite BCV Investment’s decision to reduce their stake in the company. AURINIA PHARMACEUTICALS opened the day at $9.8 before closing at $10.1, representing an increase of 1.7% from the prior closing price of $10.0. This slight increase in the opening and closing prices of the stock led to the assumption that the market does not view BCV’s decision as having a significantly negative impact on the future of AURINIA PHARMACEUTICALS. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Aurinia Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 146.81 | -96.76 | -65.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Aurinia Pharmaceuticals. More…

| Operations | Investing | Financing |

| -64.45 | 17.25 | 3.67 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Aurinia Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 451.76 | 61.35 | 2.73 |

Key Ratios Snapshot

Some of the financial key ratios for Aurinia Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 672.9% | – | -70.3% |

| FCF Margin | ROE | ROA |

| -44.4% | -16.2% | -14.3% |

Analysis

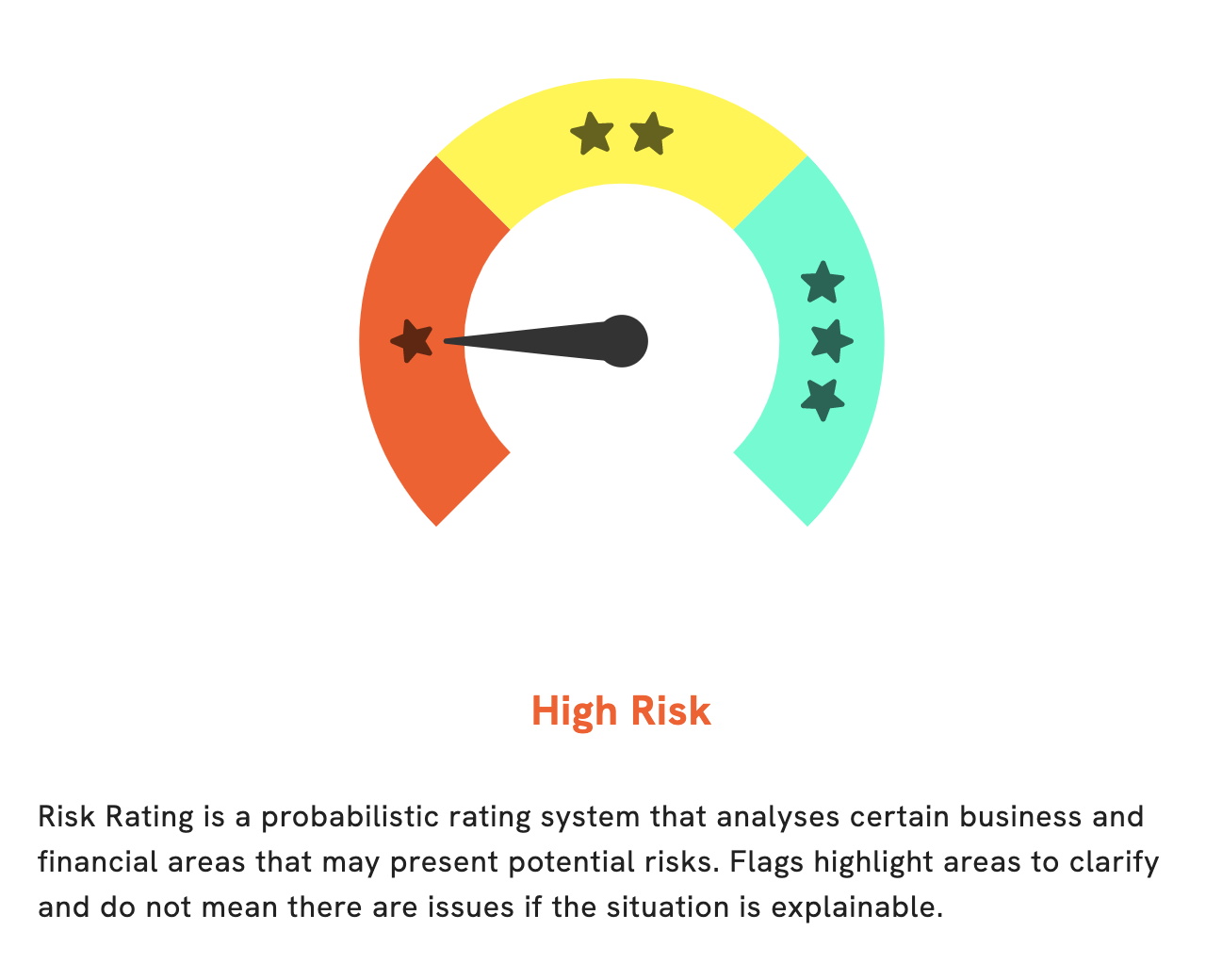

As a GoodWhale user, you can analyze AURINIA PHARMACEUTICALS‘s fundamentals and assess its financial health. Our Risk Rating indicates that AURINIA PHARMACEUTICALS is a high risk investment in terms of the company’s financial and business aspects. Through our analysis, we have detected three risk warnings in AURINIA PHARMACEUTICALS’s income sheet, balance sheet, and cashflow statement. If you would like to find out more, become a registered GoodWhale user to access our detailed analysis. More…

Peers

The company’s lead candidate, voclosporin, is a novel, potentially first-in-class immunomodulatory drug that is being investigated for the treatment of lupus nephritis and other autoimmune diseases. Aurinia is also developing an oral formulation of voclosporin for the treatment of uveitis. Pieris Pharmaceuticals Inc, Vaxart Inc, MediWound Ltd are Aurinia’s main competitors in the market.

– Pieris Pharmaceuticals Inc ($NASDAQ:PIRS)

Pieris Pharmaceuticals Inc is a publicly traded company with a market capitalization of $74.41M as of March 2022. The company has a Return on Equity of -89.14%. Pieris Pharmaceuticals Inc is a biopharmaceutical company that focuses on the development of Anticalin proteins to treat a variety of respiratory diseases, including asthma, COPD, and cystic fibrosis.

– Vaxart Inc ($NASDAQ:VXRT)

Vaxart Inc is a clinical-stage biotechnology company focused on the development and commercialization of oral recombinant vaccines. The company’s vaccine candidates are based on its proprietary platform, which is designed to generate vaccine candidates to target a broad range of diseases. Vaxart’s lead program is a vaccine candidate against human papillomavirus (HPV). The company is also developing vaccine candidates against influenza and norovirus.

– MediWound Ltd ($NASDAQ:MDWD)

MediWound Ltd is a global biopharmaceutical company that develops, manufactures, and markets innovative therapeutics to address unmet needs in the fields of severe burns, chronic and other hard-to-heal wounds. The company has a market capitalization of 56.19 million as of 2022 and a return on equity of 193.32%. MediWound was founded in 2000 and is headquartered in Yavne, Israel.

Summary

Investors in Aurinia Pharmaceuticals Inc. have reason to be optimistic, as Banque Cantonale Vaudoise recently reduced its stake in the company. This indicates that the bank had confidence in Aurinia’s long-term potential and its ability to grow its business. The stock has seen some volatility recently, but analysts remain bullish on the company’s prospects.

AURINIA has a strong pipeline of products, promising research and development efforts and a strategic alliance with Merck & Co. that could help drive growth. Despite recent challenges, analysts believe that the company is well-positioned to capitalize on the opportunities in the market and produce strong returns in the coming years.

Recent Posts