Bayer and Regeneron Pharmaceuticals File Application for Aflibercept 8 mg to Treat Neovascular AMD and Diabetic Macular Edema.

February 8, 2023

Trending News ☀️

Regeneron Pharmaceuticals ($NASDAQ:REGN) is a biopharmaceutical company based in the United States. Bayer and Regeneron announced on Monday that they had submitted an application to the European Medicines Agency for aflibercept 8 mg as a treatment for neovascular age-related macular degeneration (nAMD) and diabetic macular edema (DME). This application was supported by data from the PULSAR study in nAMD and the PHOTON study in DME. The results of these studies indicated that aflibercept 8 mg is as effective as Eylea, which is dosed every 8 weeks after initial monthly doses. Aflibercept 8 mg is a recombinant fusion protein designed to interfere with the action of vascular endothelial growth factor (VEGF). VEGF is a protein involved in the growth and development of new blood vessels and is involved in the progression of nAMD and DME.

By blocking the action of VEGF, aflibercept 8 mg is thought to prevent the growth of new blood vessels and thus slow the progression of the diseases. If approved, aflibercept 8 mg could offer a convenient treatment option for patients with nAMD and DME, as the drug would only need to be dosed every 8 weeks. Bayer and Regeneron are hopeful that their application will be accepted by the European Medicines Agency. If approved, aflibercept 8 mg could provide a much-needed treatment option for patients with nAMD and DME, allowing them to manage their condition more easily.

Share Price

The application was made to the United States Food and Drug Administration (FDA) and the response from the media has so far been positive. Despite this, Regeneron Pharmaceuticals stock opened at $765.7 and closed at $769.9, down by 1.4% from prior closing price of 780.9. If approved, it could provide a more cost-effective and convenient option for patients. The application follows a successful Phase III trial, which found that aflibercept 8 mg delivered similar visual acuity outcomes compared to aflibercept 2 mg, while also providing better safety and tolerability profiles.

These results have been encouraging and the application is an important step in the development of this new treatment. This application is another example of the company’s commitment to providing innovative treatments for these conditions. If approved, it could significantly improve patient outcomes and provide a more cost-effective option for treatment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Regeneron Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 12.17k | 4.34k | 37.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Regeneron Pharmaceuticals. More…

| Operations | Investing | Financing |

| 5.67k | -5.38k | -1.01k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Regeneron Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 29.21k | 6.55k | 197.05 |

Key Ratios Snapshot

Some of the financial key ratios for Regeneron Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.7% | 31.2% | 40.4% |

| FCF Margin | ROE | ROA |

| 34.1% | 14.3% | 10.5% |

Analysis

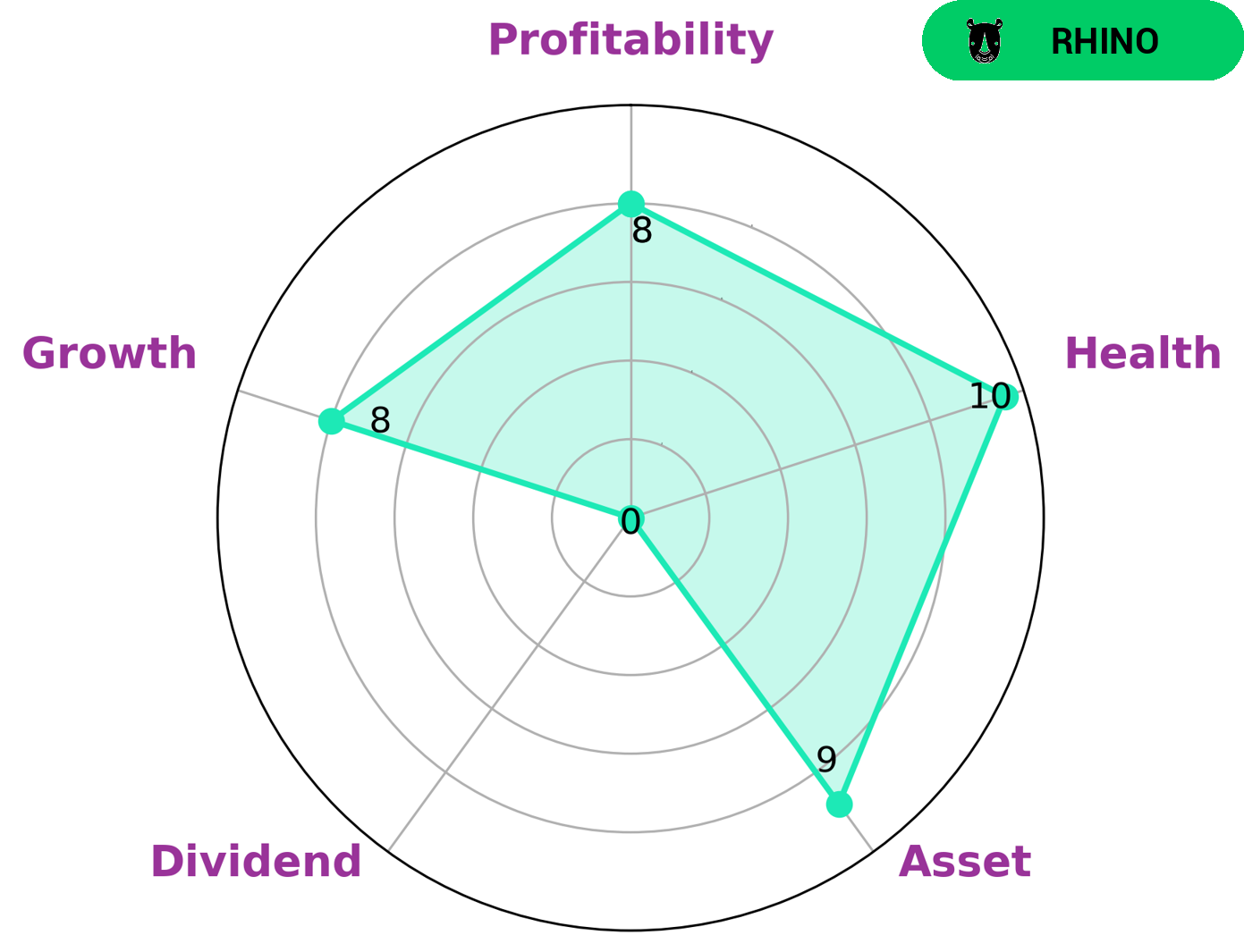

REGENERON PHARMACEUTICALS is an ideal candidate for analyzing fundamentals, as GoodWhale provides a comprehensive view of the company’s financials. On the Star Chart, it is classified as ‘rhino’, meaning that it has achieved moderate growth in either revenue or earnings. This type of company may be attractive to value investors who are looking for a company that is stable and has potential for growth. The company’s health score is 10/10 with regards to cashflows and debt – indicating that REGENERON PHARMACEUTICALS is able to withstand any economic crisis without risk of bankruptcy. The company is strong in assets, growth, and profitability, but relatively weaker in dividend. This may indicate that the company is more focused on reinvesting in itself rather than rewarding shareholders. Investors should also consider other factors such as the current market conditions, the company’s management, and its competitive position before investing. Additionally, the company’s performance in the past should be taken into consideration as well. Taking all of these into account, REGENERON PHARMACEUTICALS may be an attractive option for value investors who are looking for a stable company with potential for growth. More…

Peers

The company’s competitors include Cue Biopharma Inc, CytoDyn Inc, and Belite Bio Inc.

– Cue Biopharma Inc ($NASDAQ:CUE)

The company’s market cap is $94.12M and its ROE is -48.38%. Cue Biopharma is a clinical-stage biopharmaceutical company that uses its proprietary technology to develop immuno-oncology and immuno-inflammation therapeutics. The company’s immuno-oncology product candidates are designed to target cancer cells and tumor-associated antigens. The company’s immuno-inflammation product candidates are designed to target pro-inflammatory cytokines.

– CytoDyn Inc ($OTCPK:CYDY)

CytoDyn Inc is a clinical stage biotechnology company. The company is focused on the development and commercialization of novel therapies for treating autoimmune diseases, cancer, and human immunodeficiency virus. CytoDyn’s lead product candidate is leronlimab, a monoclonal antibody that inhibits the CCR5 receptor.

Summary

Regeneron Pharmaceuticals is a biotechnology company that develops and manufactures innovative medicines to treat serious medical conditions. The company’s portfolio includes treatments for rare and common diseases, such as eye diseases, inflammatory and autoimmune diseases, cancer, and infectious diseases. Recently, Bayer and Regeneron Pharmaceuticals filed an application with the U.S. Food and Drug Administration (FDA) for aflibercept 8 mg to treat neovascular AMD and diabetic macular edema. The news has been well-received by the market, resulting in an increase in the company’s stock price.

Investors should consider Regeneron’s long-term growth potential and its diverse product portfolio when assessing the stock. The company’s strong research and development capabilities, extensive pipeline of products, and strong financial position should also be taken into account.

Recent Posts