Aurinia Pharmaceuticals Reports Positive Quarterly Results, Beating Revenue and EPS Estimates

May 5, 2023

Trending News ☀️

Aurinia Pharmaceuticals ($NASDAQ:AUPH) recently reported highly positive quarterly results, surpassing both revenue and earnings per share (EPS) estimates. The company posted Gaap earnings per share of -$0.18, beating estimates by $0.04, and revenue of $34.41M, exceeding projections by $6.29M. Aurinia Pharmaceuticals is a biopharmaceutical company focused on the development of innovative therapies to treat various conditions. The company’s lead drug candidate is voclosporin, an immunomodulating drug for the treatment of lupus nephritis, a severe and life-threatening condition that affects the kidneys. Furthermore, the company is also researching voclosporin for other autoimmune and inflammatory diseases.

The company’s success has been largely due to its focus on developing novel treatments that offer significant improvements over existing therapies. Aurinia Pharmaceuticals has already seen a number of successes, with their voclosporin drug candidate being approved in the United States and European Union. As such, the company’s successful quarterly results are likely to further increase investor confidence and further cement Aurinia Pharmaceuticals’ position as a leader in developing innovative treatments.

Earnings

AURINIA PHARMACEUTICALS recently released its quarterly results for FY2022 Q4 as of December 31 2022, and the results have been positive. The company reported 28.44M USD in total revenue and a net income loss of 26.05M USD. This marks a 21.5% increase in revenue from the same quarter last year, and a significant improvement from the 50.03M USD it earned three years ago. The company has managed to beat its revenue and EPS estimates, making it a successful quarter for AURINIA PHARMACEUTICALS.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Aurinia Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 134.03 | -108.18 | -80.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Aurinia Pharmaceuticals. More…

| Operations | Investing | Financing |

| -79.53 | -60.63 | 2.43 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Aurinia Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 470.86 | 65.42 | 2.85 |

Key Ratios Snapshot

Some of the financial key ratios for Aurinia Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 649.8% | – | -83.2% |

| FCF Margin | ROE | ROA |

| -59.6% | -16.8% | -14.8% |

Price History

Aurinia Pharmaceuticals had an encouraging quarterly report on Thursday, with stock opening at $11.8 and closing at $11.3, down by only 3.0% from the previous closing price of $11.7. Most notably, the company beat revenue and earnings per share (EPS) estimates for the quarter. These results are an indication of the company’s strength and overall performance, prompting a positive forecast for future quarters. Live Quote…

Analysis

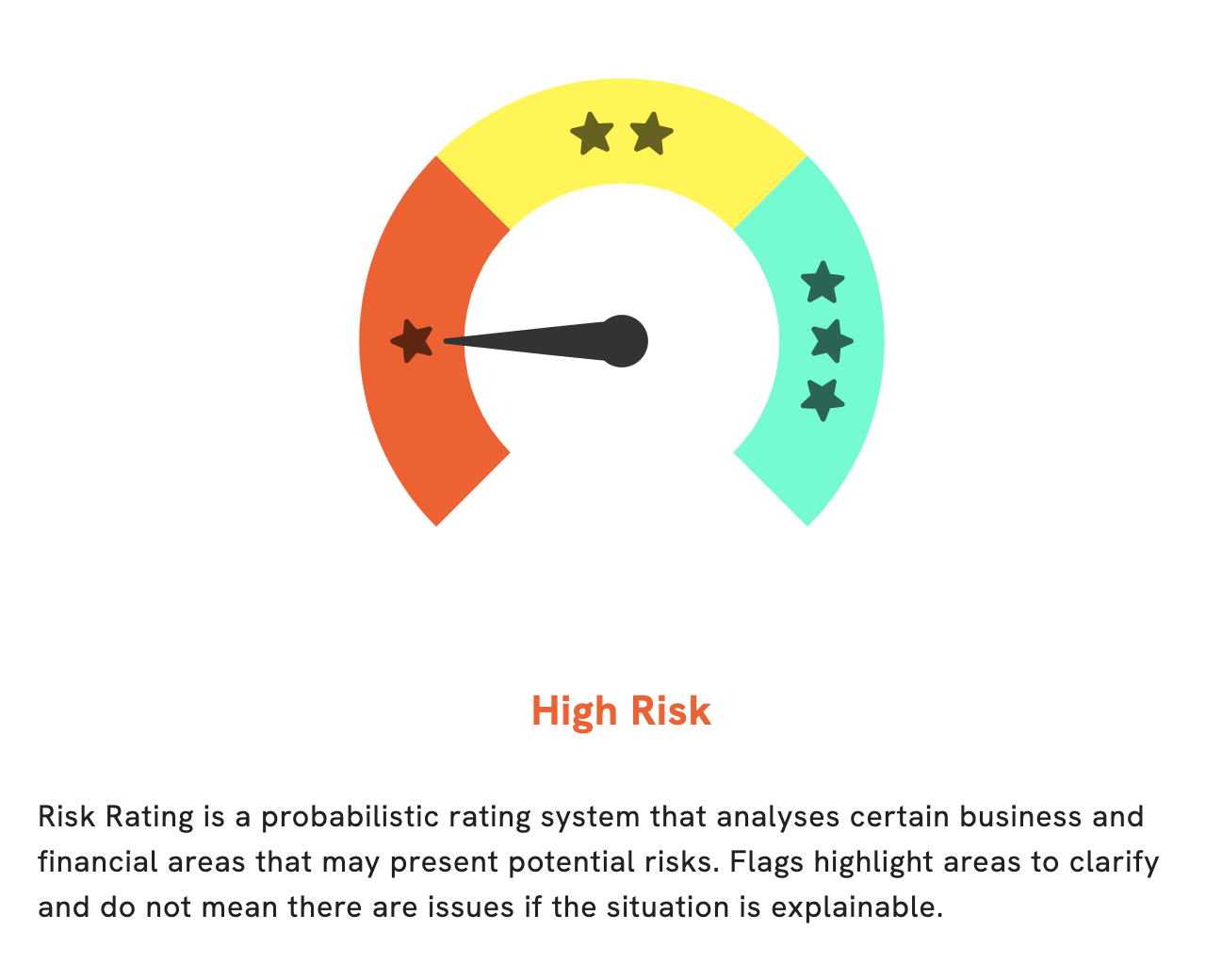

When it comes to the fundamentals of AURINIA PHARMACEUTICALS, GoodWhale can provide you with the insights you need to make a sound investment decision. According to our Risk Rating, AURINIA PHARMACEUTICALS is a high risk investment in terms of financial and business aspects. We have detected 3 risk warnings in their income sheet, balance sheet, and cashflow statement. If you are interested in learning more, register on goodwhale.com to access our in-depth analysis and make an informed decision. More…

Peers

The company’s lead candidate, voclosporin, is a novel, potentially first-in-class immunomodulatory drug that is being investigated for the treatment of lupus nephritis and other autoimmune diseases. Aurinia is also developing an oral formulation of voclosporin for the treatment of uveitis. Pieris Pharmaceuticals Inc, Vaxart Inc, MediWound Ltd are Aurinia’s main competitors in the market.

– Pieris Pharmaceuticals Inc ($NASDAQ:PIRS)

Pieris Pharmaceuticals Inc is a publicly traded company with a market capitalization of $74.41M as of March 2022. The company has a Return on Equity of -89.14%. Pieris Pharmaceuticals Inc is a biopharmaceutical company that focuses on the development of Anticalin proteins to treat a variety of respiratory diseases, including asthma, COPD, and cystic fibrosis.

– Vaxart Inc ($NASDAQ:VXRT)

Vaxart Inc is a clinical-stage biotechnology company focused on the development and commercialization of oral recombinant vaccines. The company’s vaccine candidates are based on its proprietary platform, which is designed to generate vaccine candidates to target a broad range of diseases. Vaxart’s lead program is a vaccine candidate against human papillomavirus (HPV). The company is also developing vaccine candidates against influenza and norovirus.

– MediWound Ltd ($NASDAQ:MDWD)

MediWound Ltd is a global biopharmaceutical company that develops, manufactures, and markets innovative therapeutics to address unmet needs in the fields of severe burns, chronic and other hard-to-heal wounds. The company has a market capitalization of 56.19 million as of 2022 and a return on equity of 193.32%. MediWound was founded in 2000 and is headquartered in Yavne, Israel.

Summary

Aurinia Pharmaceuticals is an up-and-coming biopharmaceutical company based in Canada that specializes in the research and development of drugs for the treatment of kidney diseases. In the most recent quarter, Aurinia Pharmaceuticals reported a GAAP earnings per share of -$0.18 that beat analysts’ estimates by $0.04, and revenue of $34.41M that beat analysts’ estimates by $6.29M.

However, despite the earnings beat, the stock price moved down the same day. Investors should take this into consideration when evaluating Aurinia Pharmaceuticals as an investment opportunity. A further analysis of the latest earnings report and performance of Aurinia’s products may help investors to make more informed decisions.

Recent Posts