ARROWHEAD PHARMACEUTICALS Reports Record Earnings and Revenue, Beating Expectations by Over $100M

May 3, 2023

Trending News 🌧️

Arrowhead Pharmaceuticals ($NASDAQ:ARWR) Inc. is a biopharmaceutical company that focuses on the development of medicines that treat intractable diseases by silencing the genes that cause them. According to the report, Arrowhead Pharmaceuticals reported a GAAP earning per share (EPS) of $0.45, surpassing the expectations of $1.06, and revenue of $146.26M, exceeding the forecast of $100.78M. This was a record performance for the company and showcased a notable increase in its year-over-year earnings and revenue. The company attributed the positive results to its diversified portfolio of therapeutic programs that focus on treating diseases involving liver, kidney, and cardiovascular dysfunction, as well as certain genetic disorders.

The company also reported positive progress in its clinical trials and research efforts, which drove its revenue growth in the quarter. Overall, Arrowhead Pharmaceuticals reported strong financial performance that beat expectations and demonstrated its ability to drive value for its shareholders.

Market Price

The stock opened at $35.5 and closed at $35.4, down by 1.0% from last closing price of 35.7. This is a positive sign for investors, as ARROWHEAD PHARMACEUTICALS continues to perform well in the market. The company’s strong financial performance indicates that it has been able to maintain its competitive edge and capitalize on the growing demand for its products and services. This is good news for shareholders, as the company’s success should lead to increased dividends and other benefits in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Arrowhead Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 278.34 | -154.52 | -55.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Arrowhead Pharmaceuticals. More…

| Operations | Investing | Financing |

| -150.34 | -52.73 | 313.88 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Arrowhead Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 891.49 | 495.12 | 3.53 |

Key Ratios Snapshot

Some of the financial key ratios for Arrowhead Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.4% | – | -56.5% |

| FCF Margin | ROE | ROA |

| -84.9% | -25.4% | -11.0% |

Analysis

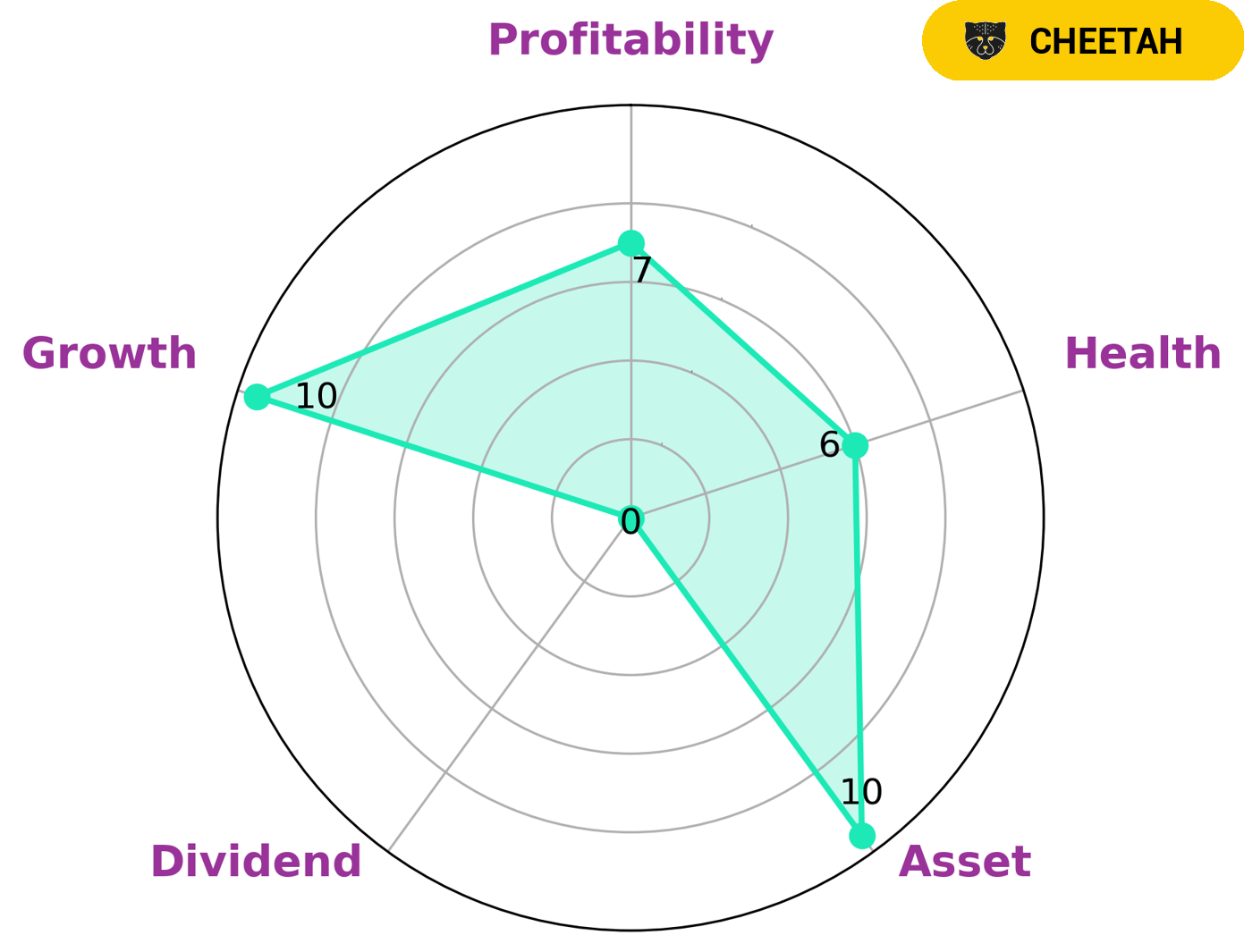

At GoodWhale, we have conducted an analysis of ARROWHEAD PHARMACEUTICALS‘s financials. According to our Star Chart, ARROWHEAD PHARMACEUTICALS has an intermediate health score of 6/10, which suggests that the company is likely to pay off its debt and fund future operations. Furthermore, ARROWHEAD PHARMACEUTICALS is classified as a ‘cheetah’, indicating that the company has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Given this information, we believe that investors who are looking for high growth potential in a company with higher risk would be interested in ARROWHEAD PHARMACEUTICALS. While ARROWHEAD PHARMACEUTICALS is strong in terms of asset and growth, it is weak in terms of profitability and dividend. As such, investors should keep the company’s risk profile in mind when considering investing in ARROWHEAD PHARMACEUTICALS. More…

Peers

It also has a large marketing and sales force that helps it to sell its products to customers.

– Lin BioScience Inc ($TPEX:6696)

Sangamo Therapeutics is a clinical-stage biopharmaceutical company focused on developing and commercializing novel genomic therapies. The Company’s technology platform is based on zinc finger DNA-binding proteins (ZFPs). The Company’s product candidates are designed to target and modulate the activity of specific genes associated with disease. The Company’s lead product candidates include SB-525, which is in Phase III clinical trials for the treatment of hemophilia A, and SB-913, which is in Phase I/II clinical trials for the treatment of Mucopolysaccharidosis Type I (MPS I).

– Acer Therapeutics Inc ($NASDAQ:ACER)

Acer Therapeutics Inc is a pharmaceutical company that focuses on the development and commercialization of therapies for serious rare and life-threatening diseases. The company’s lead product candidate, Etrasimod, is in clinical development for the treatment of ulcerative colitis, Crohn’s disease, and relapsing multiple sclerosis. Acer also has a portfolio of product candidates in various stages of development for the treatment of rare genetic disorders, including Duchenne muscular dystrophy, Friedreich’s ataxia, alpha-1 antitrypsin deficiency, and Gaucher disease.

– Innovation1 Biotech Inc ($OTCPK:IVBT)

Innovation1 Biotech Inc is a company that focuses on developing innovative treatments for diseases. The company has a market cap of 1.6M as of 2022 and a Return on Equity of -5.58%. The company’s market cap is the value of its outstanding shares of stock. The company’s ROE is a measure of how much profit it generates for shareholders.

Summary

Arrowhead Pharmaceuticals posted strong results in their latest quarterly report. The company reported a GAAP EPS of $0.45, which beat estimates by $1.06. On the revenue side, Arrowhead reported a figure of $146.26M, beating estimates by $100.78M. Investors have been encouraged to take a closer look at the company’s performance, as the strong results could be a sign of future growth and potential investment opportunity.

The stock has been performing well since the release of the report, with the share price continuing to rise. In conclusion, investors may find Arrowhead Pharmaceuticals to be a promising stock to consider for their portfolio.

Recent Posts