Arrowhead Pharmaceuticals Intrinsic Stock Value – ARROWHEAD PHARMACEUTICALS Announces Up to 48% Decline in Bad Cholesterol with Anti-Lipid Agent

May 24, 2023

Trending News 🌧️

ARROWHEAD PHARMACEUTICALS ($NASDAQ:ARWR) is a biopharmaceutical company focused on the development of innovative medicines to treat cardiovascular, metabolic, and renal diseases. The company recently announced the results of their anti-lipid agent, which showed a reduction of up to 48% in bad cholesterol. This is an impressive result as bad cholesterol, or low-density lipoprotein (LDL) cholesterol, is a major risk factor for cardiovascular disease. The anti-lipid agent was administered alongside a statin, which is a drug used to lower levels of cholesterol in the blood. The results of the study showed that the combined use of the two drugs was more effective than the statin alone in reducing levels of LDL cholesterol.

Additionally, the agent was found to be safe and well-tolerated by the patients. The promising results of the anti-lipid agent could have significant implications for the treatment of high cholesterol. If the agent can be developed into a marketable product, it would provide an additional option for physicians to treat their patients with high cholesterol. This could potentially help to reduce rates of cardiovascular disease and other related health issues.

Analysis – Arrowhead Pharmaceuticals Intrinsic Stock Value

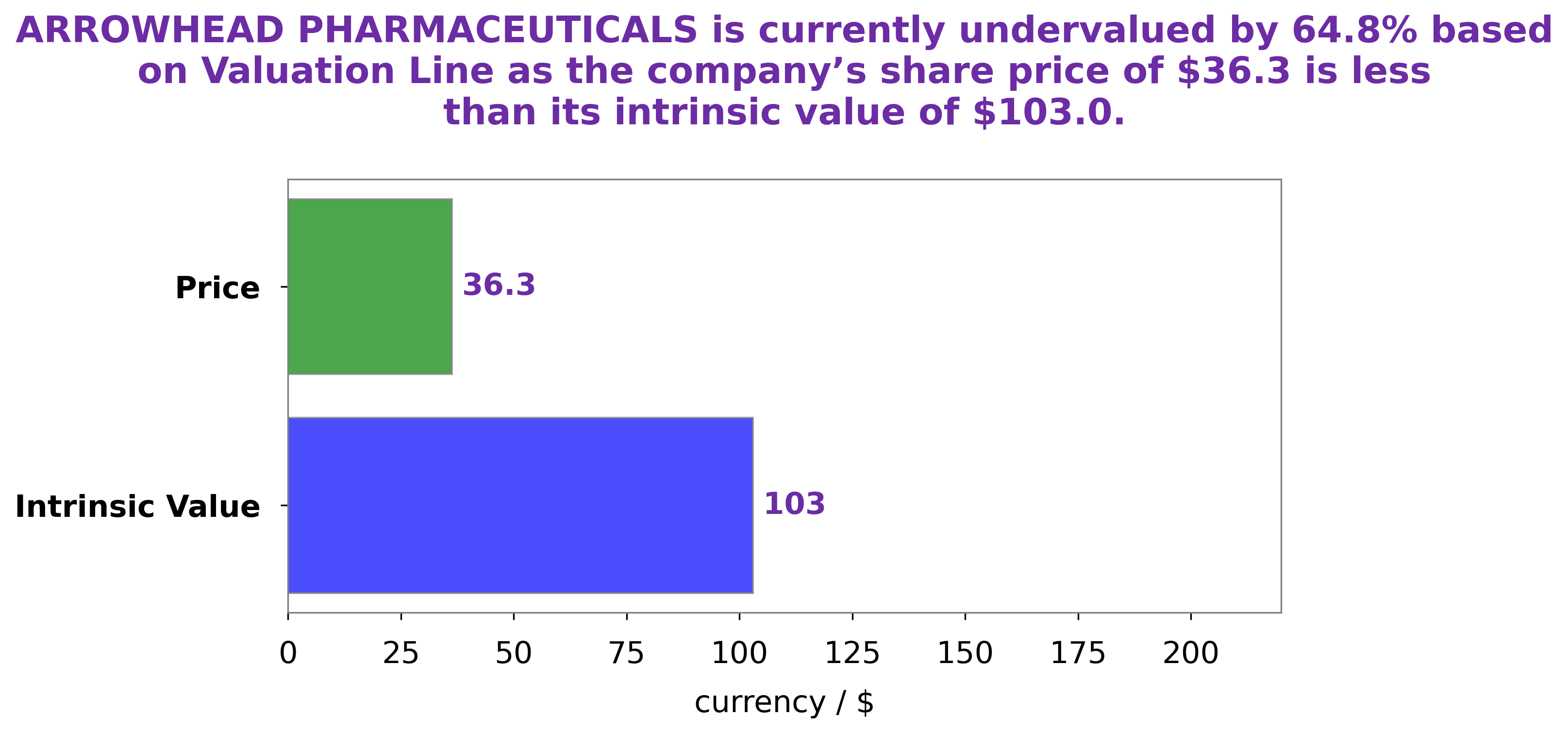

At GoodWhale, our goal is to provide our customers with valuable insights into the financials of companies like ARROWHEAD PHARMACEUTICALS. Our proprietary Valuation Line analyzes the company’s financials and shows that the intrinsic value of ARROWHEAD PHARMACEUTICALS share is around $103.0. Currently, the company’s share is traded at $36.3, which means it is undervalued by 64.8%. Our analysis reveals a great opportunity for investors to buy the stock at a discounted price and benefit from the potential upside when the market catches up with its true value. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Arrowhead Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 272.8 | -150.21 | -55.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Arrowhead Pharmaceuticals. More…

| Operations | Investing | Financing |

| -244.74 | -19.04 | 312.55 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Arrowhead Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 891.31 | 426.2 | 3.53 |

Key Ratios Snapshot

Some of the financial key ratios for Arrowhead Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 25.2% | – | -53.6% |

| FCF Margin | ROE | ROA |

| -129.5% | -22.2% | -10.3% |

Peers

It also has a large marketing and sales force that helps it to sell its products to customers.

– Lin BioScience Inc ($TPEX:6696)

Sangamo Therapeutics is a clinical-stage biopharmaceutical company focused on developing and commercializing novel genomic therapies. The Company’s technology platform is based on zinc finger DNA-binding proteins (ZFPs). The Company’s product candidates are designed to target and modulate the activity of specific genes associated with disease. The Company’s lead product candidates include SB-525, which is in Phase III clinical trials for the treatment of hemophilia A, and SB-913, which is in Phase I/II clinical trials for the treatment of Mucopolysaccharidosis Type I (MPS I).

– Acer Therapeutics Inc ($NASDAQ:ACER)

Acer Therapeutics Inc is a pharmaceutical company that focuses on the development and commercialization of therapies for serious rare and life-threatening diseases. The company’s lead product candidate, Etrasimod, is in clinical development for the treatment of ulcerative colitis, Crohn’s disease, and relapsing multiple sclerosis. Acer also has a portfolio of product candidates in various stages of development for the treatment of rare genetic disorders, including Duchenne muscular dystrophy, Friedreich’s ataxia, alpha-1 antitrypsin deficiency, and Gaucher disease.

– Innovation1 Biotech Inc ($OTCPK:IVBT)

Innovation1 Biotech Inc is a company that focuses on developing innovative treatments for diseases. The company has a market cap of 1.6M as of 2022 and a Return on Equity of -5.58%. The company’s market cap is the value of its outstanding shares of stock. The company’s ROE is a measure of how much profit it generates for shareholders.

Summary

ARROWHEAD PHARMACEUTICALS is a biopharmaceutical company focused on developing innovative therapies that treat serious diseases. Its most recent investment analysis has shown positive results, with its anti-lipid agent causing a decline of up to 48% in bad cholesterol levels. There have also been improvements in other lipid markers like ApoB and non-HDL cholesterol. Its stock price has risen significantly in the past year and there are strong indications that continued investments in new therapies will result in further gains.

Recent Posts