Arcus Biosciences Reports Strong Q1 Earnings, Revenues Exceed Expectations

May 10, 2023

Trending News ☀️

Arcus Biosciences ($NYSE:RCUS) had a strong first quarter, exceeding analysts’ expectations. On the revenue side, Arcus Biosciences reported a total of $25M, $2.53M higher than what was forecast. Arcus Biosciences is a clinical-stage biopharmaceutical company focused on developing small molecule and antibody therapeutics to treat cancer. It focuses on discovering and developing novel treatments through its deep understanding of the biology and the genetics of cancer.

Its pipeline includes immuno-oncology drugs that are designed to stimulate the immune system to fight cancer and targeted therapies that are designed to inhibit key proteins in cancer cells that are involved in promoting cancer growth. Arcus Biosciences is based in Hayward, California and is listed on the NASDAQ stock exchange.

Earnings

In the latest earnings report for the fiscal year ending December 31, 2022, ARCUS BIOSCIENCES reported total revenue of 34.0M USD and a net loss of 67.0M USD. This is a 90.4% decrease in total revenue and a 124.0% decrease in net income from the previous year. Despite this decrease, ARCUS BIOSCIENCES has seen a steady growth in total revenue over the last three years, beginning with 9.49M USD and ending with 34.0M USD.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Arcus Biosciences. More…

| Total Revenues | Net Income | Net Margin |

| 112 | -267 | -238.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Arcus Biosciences. More…

| Operations | Investing | Financing |

| 438 | -413 | 33 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Arcus Biosciences. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.34k | 688 | 9.01 |

Key Ratios Snapshot

Some of the financial key ratios for Arcus Biosciences are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 95.5% | – | -235.7% |

| FCF Margin | ROE | ROA |

| 380.4% | -24.3% | -12.3% |

Market Price

The stock opened at $19.7 and closed at $19.4, a decrease of 2.3% from the previous closing price of 19.8. Despite this dip in the stock price, the company reported a positive quarter overall and showed potential for future growth.

Additionally, Arcus Biosciences reported strong results from its clinical trials and strong partnerships with leading healthcare providers. The company is optimistic about the future and believes it will continue to grow in the coming quarters. The stock price may have seen a slight decrease on Tuesday, but investors remain confident in the company’s prospects for success. Live Quote…

Analysis

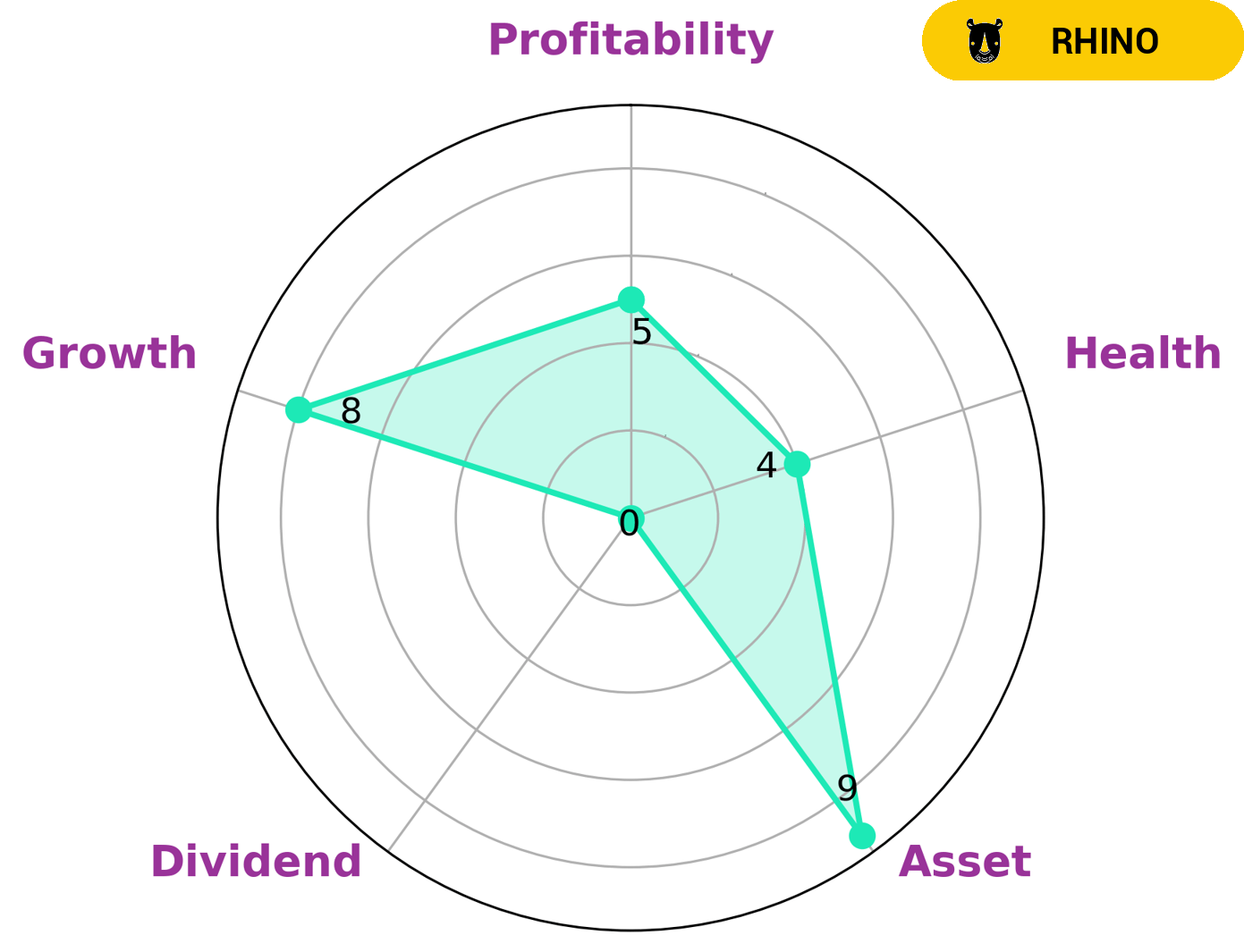

GoodWhale has conducted an analysis of ARCUS BIOSCIENCES‘s wellbeing and found that it is classified as a ‘rhino’ – a type of company that has achieved moderate revenue or earnings growth. Our Star Chart analysis shows that ARCUS BIOSCIENCES is strong in asset, growth, and medium in profitability, but weak in dividend. We believe this company will be of great interest to investors who are looking for slightly higher returns for their investments. We further assessed the company’s health score with regard to its cashflows and debt, and found that it had an intermediate score of 4/10. This suggests that ARCUS BIOSCIENCES is likely to pay off debt and fund future operations. More…

Peers

The company’s product candidates include AB928, AB154 and AB122, which are in various clinical trials for the treatment of solid tumors and hematologic malignancies. Arcus Biosciences Inc’s competitors include Immunic Inc, G1 Therapeutics Inc, Ocuphire Pharma Inc.

– Immunic Inc ($NASDAQ:IMUX)

The company’s market cap is $56.93M as of 2022 and its ROE is -44.31%. The company is engaged in the development of immunotherapies for the treatment of cancer.

– G1 Therapeutics Inc ($NASDAQ:GTHX)

G1 Therapeutics Inc is a clinical-stage biopharmaceutical company focused on the discovery and development of small molecule therapies for the treatment of cancer. The company’s lead product candidate is trilaciclib, which is in clinical development for the treatment of small cell lung cancer (SCLC) and triple-negative breast cancer (TNBC). Trilaciclib is a first-in-class cyclin-dependent kinase 4/6 (CDK4/6) inhibitor that selectively targets proliferating cancer cells and spares normal cells. CDK4/6 inhibitors are a new class of anti-cancer drugs that block the activity of two proteins that are involved in cell division.

G1 Therapeutics has a market cap of $366.9 million and a return on equity of -159.15%. The company’s lead product candidate is trilaciclib, which is in clinical development for the treatment of small cell lung cancer (SCLC) and triple-negative breast cancer (TNBC). Trilaciclib is a first-in-class cyclin-dependent kinase 4/6 (CDK4/6) inhibitor that selectively targets proliferating cancer cells and spares normal cells. CDK4/6 inhibitors are a new class of anti-cancer drugs that block the activity of two proteins that are involved in cell division.

– Ocuphire Pharma Inc ($NASDAQ:OCUP)

Ocuphire Pharma Inc. is a clinical-stage biopharmaceutical company, which focuses on developing and commercializing therapies to treat ocular disorders. Its lead product candidate is Nyxol, a once-daily eye drop for the treatment of glaucoma and ocular hypertension. The company was founded by Derek J. Rappaport and Nancy S. Lurie on March 1, 2006 and is headquartered in Boca Raton, FL.

Summary

This beat the analyst consensus estimate by $0.10. Revenue for the quarter came in at $25 million, which was $2.53 million higher than the consensus estimate. This indicates that Arcus Biosciences is performing well and investors should consider them for their portfolio. The company’s strong financial performance is a sign of a good investment opportunity in the biotech sector.

Arcus Biosciences is in a strong position to continue to generate growth in the future and has a very promising outlook. Investors should be sure to keep an eye on the company’s progress as it looks to capitalise on its position in the biotech industry.

Recent Posts