Analysts Anticipate Rocket Pharmaceuticals,’s Q1 2023 Earnings to Soar.

March 19, 2023

Trending News 🌥️

Analysts are expecting Rocket Pharmaceuticals ($NASDAQ:RCKT), Inc.’s first quarter of 2023 to be a successful one, with earnings soaring higher than ever before. This optimism is based on research conducted by industry insiders, who believe that the company’s advancements in the development of treatments for rare genetic diseases will drive their market share and revenue growth significantly. Rocket Pharmaceuticals has already shown success in the treatment of conditions such as Leukoscelosis and Fanconi Anemia, with more potential treatments in the works. The company’s research and development teams have been hard at work to bring more treatments to the market and make sure that Rocket Pharmaceuticals continues to maintain a competitive edge. As a result, analysts anticipate a strong first quarter showing for the company in 2023, with a double-digit increase in revenues compared to the previous year.

Moreover, they predict that Rocket Pharmaceuticals will exceed industry expectations with a significant boost in market share. With the expectation that Rocket Pharmaceuticals’ Q1 2023 earnings will soar, investors should keep an eye out for the company’s upcoming news releases and financial statements. This could potentially be an excellent opportunity to capitalize on the company’s continued success in developing treatments for rare genetic diseases.

Market Price

On Friday, Rocket Pharmaceuticals opened at $18.2 and closed at $17.6, representing a 5.4% drop from the previous closing price of $18.6. This dip, however, does not seem to have shook investors confidence in the upcoming earnings report, as analysts are confident that Q1 2023 will be a strong quarter for Rocket Pharmaceuticals. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Rocket Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -221.86 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Rocket Pharmaceuticals. More…

| Operations | Investing | Financing |

| -178.14 | -69.33 | 155.29 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Rocket Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 551.81 | 62.12 | 6.19 |

Key Ratios Snapshot

Some of the financial key ratios for Rocket Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.0% | – | – |

| FCF Margin | ROE | ROA |

| – | -32.1% | -24.9% |

Analysis

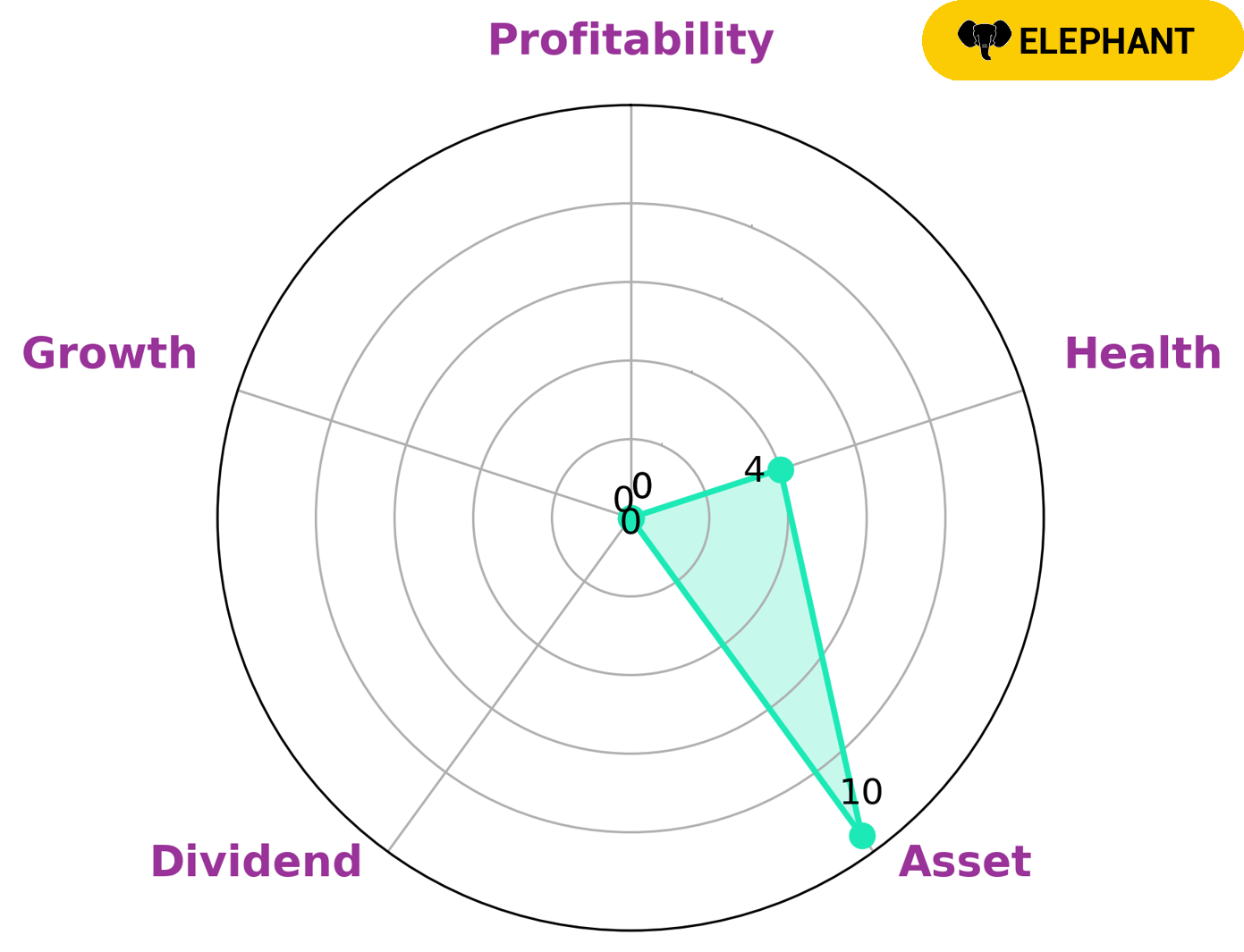

GoodWhale analyzes ROCKET PHARMACEUTICALS‘s fundamentals, and the results show that ROCKET PHARMACEUTICALS is strong in asset, and weak in dividend, growth, and profitability. According to our Star Chart, this company is classified as an ‘elephant’, a type of company we conclude that is rich in assets after deducting off liabilities. Therefore, this company is likely to be of interest to investors seeking to invest in an asset-rich and stable company. ROCKET PHARMACEUTICALS has an intermediate health score of 4/10 considering its cashflows and debt, which suggests that the company is likely to sustain future operations in times of crisis. Therefore, investors who seek a more secure and stable portfolio may be interested in such a company. More…

Peers

Rocket Pharmaceuticals Inc is an innovative biopharmaceutical company that is focused on developing and commercializing a portfolio of gene therapy treatments for rare and life-threatening diseases. It is engaged in a competitive market with other companies such as Candel Therapeutics Inc, HilleVax Inc, and Talaris Therapeutics Inc, all of which are striving to develop groundbreaking therapies to benefit people living with rare diseases.

– Candel Therapeutics Inc ($NASDAQ:CADL)

Candel Therapeutics Inc is a biotechnology company focused on developing innovative, targeted treatments for cancer, autoimmune diseases, and other complex disorders. With a market cap of 43.92M as of 2022, the company is a mid-sized player in the industry. Candel Therapeutics also has a Return on Equity of -50.84%, which suggests that the company is not meeting its financial objectives and is likely struggling to generate profits. Candel Therapeutics is actively working on new treatments and with further development, it will be able to increase its market cap and ROE.

– HilleVax Inc ($NASDAQ:HLVX)

HilleVax Inc is a biotechnology company that develops and manufactures innovative vaccines and treatments for global public health. With a market capitalization of 469.5 million dollars as of 2022, the company is well positioned to continue its growth and expansion. The Return on Equity (ROE) of -36.14% indicates a decrease in profitability from the previous year, which could be attributed to greater expenses or a decrease in revenue. HilleVax Inc is committed to providing safe and reliable treatments for global public health, and the company remains well-positioned to continue its growth and development.

– Talaris Therapeutics Inc ($NASDAQ:TALS)

Talaris Therapeutics Inc is a biopharmaceutical company focused on the development of cell-based therapies for the treatment of rare genetic disorders. The company’s market capitalization is currently at 45.63M as of 2022, making it a relatively small-cap company. Its Return on Equity (ROE) is -19.06%, indicating that it has not been profitable in recent quarters. Talaris Therapeutics Inc is currently focused on the development of cell-based therapies for the treatment of rare genetic disorders, such as sickle cell anemia, β-thalassemia, and others. The company has shown promise in its research and development efforts and continues to strive for success in its mission to find cures for these diseases.

Summary

Rocket Pharmaceuticals is currently generating positive media coverage and analysts anticipate strong Q1 2023 earnings. Despite these positive signs, the stock price dropped on the same day as the news was released. Investors are likely waiting to see if the company can deliver on these anticipated earnings and should monitor the situation closely. If Rocket Pharmaceuticals can fulfill expectations, it could be a great long-term investment opportunity.

However, further research and analysis should be conducted before deciding to invest.

Recent Posts