Alnylam Pharmaceuticals Receives $43.38 Million Investment from Two Sigma Investments LP in 2023

March 15, 2023

Trending News 🌥️

Alnylam Pharmaceuticals ($NASDAQ:ALNY), Inc., a biopharmaceutical company focused on the discovery, development, and commercialization of novel therapeutics based on RNA interference (RNAi) technology, recently announced that it has received a significant investment of $43.38 million from Two Sigma Investments LP. This infusion of capital will enable Alnylam to accelerate its development of innovative treatments for a range of diseases, including those caused by the genetic mutation known as transthyretin-mediated amyloidosis (ATTR). The investment from Two Sigma is a testament to the company’s dedication to developing innovative therapies which can have an enormous impact on the health and well-being of patients. This new funding will enable the company to continue to develop new treatments and expand its product portfolio to meet the needs of patients and healthcare providers.

Alnylam is committed to providing cutting-edge treatments to help improve the lives of those living with chronic and rare diseases. This investment from Two Sigma will allow them to take their research and development efforts to the next level, so they can continue to bring innovative treatments to patients in need. The company is excited to have the support of Two Sigma and looks forward to continuing its work to develop new therapies and improve patient outcomes.

Price History

On Monday, Alnylam Pharmaceuticals received a $43.38 million investment from Two Sigma Investments LP. Media sentiment towards the news has been overwhelmingly positive and the stock opened at $183.9, closing at $184.9, up 1.2% from its prior closing price of 182.7. This investment is expected to help Alnylam Pharmaceuticals further expand its research and development capabilities, and reach its goal of becoming a leading biopharmaceutical company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Alnylam Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 1.04k | -1.13k | -97.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Alnylam Pharmaceuticals. More…

| Operations | Investing | Financing |

| -541.27 | 169.35 | 425.75 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Alnylam Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.55k | 3.7k | -1.28 |

Key Ratios Snapshot

Some of the financial key ratios for Alnylam Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 67.8% | – | -93.6% |

| FCF Margin | ROE | ROA |

| -59.1% | 537.4% | -17.1% |

Analysis

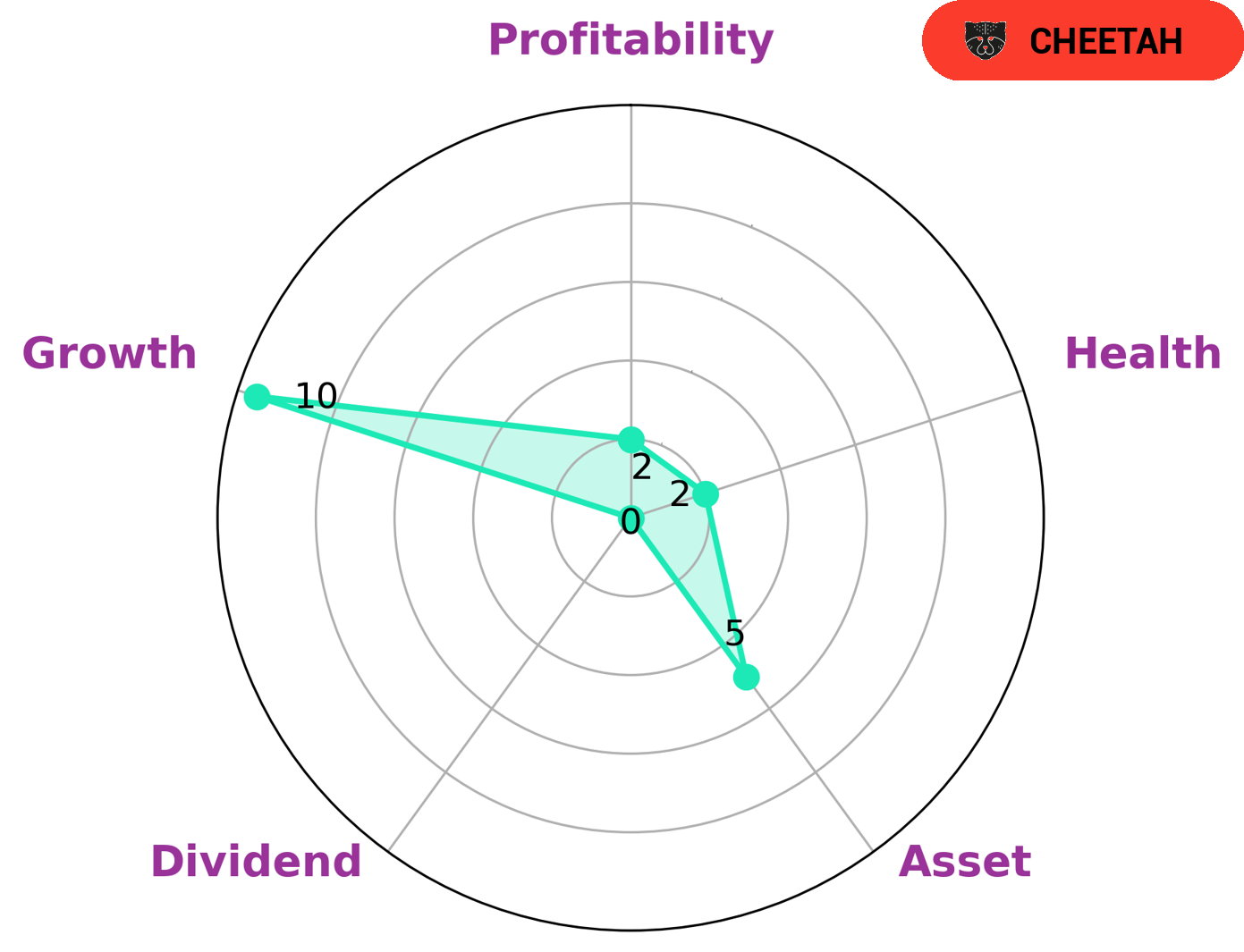

GoodWhale recently conducted an analysis of ALNYLAM PHARMACEUTICALS‘s wellbeing. As our Star Chart reveals, ALNYLAM PHARMACEUTICALS has a low health score of 2/10 with regard to its cashflows and debt. This means that it is less likely to sustain future operations in times of crisis. Moreover, ALNYLAM PHARMACEUTICALS is classified as ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. What this means is that ALNYLAM PHARMACEUTICALS is strong in growth, medium in asset, and weak in dividend and profitability. This type of company might be attractive to investors looking for higher potential returns, albeit with higher risk due to the lower stability of the company. More…

Peers

The company was founded in 2002 and is headquartered in Cambridge, Massachusetts. Alnylam’s competitors include Regeneron Pharmaceuticals Inc, Intellia Therapeutics Inc, and Novartis AG.

– Regeneron Pharmaceuticals Inc ($NASDAQ:REGN)

As of 2022, Regeneron Pharmaceuticals Inc has a market cap of 79.02B and a Return on Equity of 19.7%. The company is a biotech company that focuses on the discovery, development, and commercialization of medicines for the treatment of serious medical conditions.

– Intellia Therapeutics Inc ($NASDAQ:NTLA)

Intellia Therapeutics is a gene-editing company that focuses on developing therapeutics to treat serious diseases. The company has a market cap of $3.96 billion as of 2022 and a return on equity of -26.91%. Intellia’s gene-editing technology is based on CRISPR-Cas9, which is a naturally occurring bacterial system that can be used to target and edit specific genes. The company’s pipelines include programs for sickle cell disease, beta thalassemia, Huntington’s disease, and transthyretin amyloidosis.

– Novartis AG ($LTS:0QM7)

Novartis AG is a global pharmaceutical company with a market cap of 169.13B as of 2022. It has a Return on Equity of 24.65%. The company focuses on the discovery, development, and commercialization of healthcare products. Novartis’s products include over-the-counter and prescription drugs, vaccines, and diagnostic tools. The company has operations in over 140 countries and its products are sold in 180 countries.

Summary

Alnylam Pharmaceuticals has attracted a major $43.38 million investment from Two Sigma Investments LP in 2023, as revealed by recent market reports. Analysts are positive about the stock, which has seen positive media sentiment in the past months. Investment analysis of Alnylam Pharmaceuticals suggests that it is a promising stock, given its solid financial performance, experienced leadership, and impressive development pipeline. The company has a strong balance sheet with a reasonable price-earnings ratio, making it an attractive investment for the long-term.

Its robust revenue growth and strong gross margin indicate that the company may have the potential to grow even further in the coming years. Moreover, Alnylam Pharmaceuticals is committed to innovation, with an extensive research and development program that focuses on developing treatments for rare diseases.

Recent Posts