Jury Awards Flo Rida $82.6M in Damages for Breach of Contract Against Celsius Holdings

January 30, 2023

Trending News 🌥️

Celsius Holdings ($NASDAQ:CELH), Inc. is an American publicly-traded company that markets and sells innovative, clinically-studied performance beverages and supplements. On Wednesday, a jury in Broward County, Florida, awarded rapper Flo Rida a whopping $82.6 million in damages for breach of contract against Celsius Holdings. The jury heard Flo Rida’s whistleblower lawsuit, which began in May 2021, and found the company guilty of breach of contract. The deal stipulated that Flo Rida would appear in Celsius advertisements, wear Celsius branded clothing and post about Celsius products on social media.

In response to the verdict, Flo Rida said, “I am grateful for the jury’s decision and I am proud to have been able to stand up for myself and the other artists and celebrities who are taken advantage of by companies like Celsius Holdings.” The jury’s decision is a reminder that companies should take their contractual obligations seriously and honor their agreements with artists, celebrities, and other contracted parties. Celsius Holdings has yet to comment on the jury’s verdict or indicate whether they plan to appeal the decision.

Share Price

Media coverage of the news has mostly been negative, as CELSIUS HOLDINGS stock opened at 99.7 and closed at 97.8, down by 3.9% from its prior closing price of 101.8. Flo Rida had filed a lawsuit against Celsius Holdings, alleging that the company had not paid him in full and had breached the promotional agreement. The news of the jury’s verdict has caused a stir in the financial markets, as investors have been quick to sell off shares of Celsius Holdings following the news. With the stock dropping by almost 4%, it is clear that the investors are not confident in the company’s future prospects. Although the news has been mostly negative, some analysts have speculated that the jury award may be reduced on appeal, which could result in a bounce back for Celsius Holdings’ stock price.

However, until the legal proceedings are resolved, it is unclear how the situation will play out for the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Celsius Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 579.89 | -158.71 | -26.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Celsius Holdings. More…

| Operations | Investing | Financing |

| 126.44 | -1.64 | 540.93 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Celsius Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.33k | 443.71 | 11.6 |

Key Ratios Snapshot

Some of the financial key ratios for Celsius Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 106.6% | – | -21.0% |

| FCF Margin | ROE | ROA |

| 21.1% | -13.6% | -5.7% |

VI Analysis

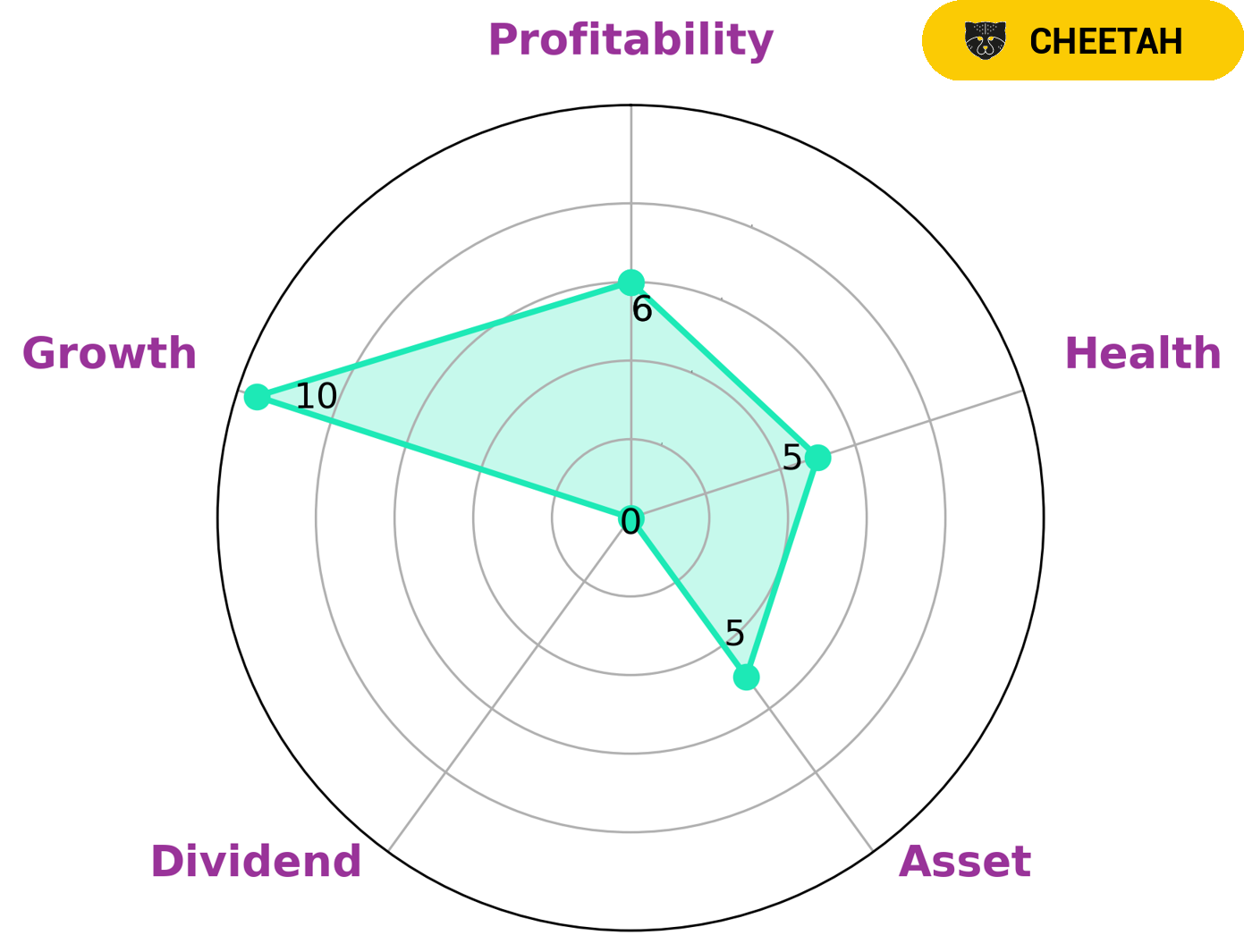

Company’s fundamentals are an important indicator of its long-term potential and can be effectively analyzed with the help of VI app. CELSIUS HOLDINGS is strongly rated in terms of growth, but is moderate in terms of asset, profitability and dividend. The company is classified as a ‘cheetah’, since it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are looking for high growth stocks and are willing to take on some risk may find CELSIUS HOLDINGS attractive. CELSIUS HOLDINGS also has an intermediate health score of 5/10, which indicates that it can safely ride out any crisis without the risk of bankruptcy, due to its cashflows and debt levels. Overall, CELSIUS HOLDINGS is a company with strong growth potential, but investors should consider the associated risks before investing. It is always advisable to do due diligence before investing in any stock, even if the fundamentals look promising. More…

VI Peers

Celsius Network is a cryptocurrency platform that enables users to earn interest on their digital assets and borrow cash without selling their crypto.

– Monster Beverage Corp ($NASDAQ:MNST)

Beverage Corporation is an American multinational corporation that manufactures, markets, and distributes energy drinks, soda, and juice. The company was founded in 1987 and currently operates in more than 30 countries. Beverage Corporation’s products are sold under the Monster Energy, Hansen’s Natural, and Lost Energy brands. In addition to its own brands, the company also distributes and markets products from other companies, such as Red Bull and Rockstar.

Beverage Corporation has a market capitalization of 53.82 billion as of 2022 and a return on equity of 14.71%. The company’s products are sold in more than 30 countries and its brands include Monster Energy, Hansen’s Natural, and Lost Energy.

– Coca-Cola Co ($NYSE:KO)

Coca-Cola Co has a market cap of 269.63B as of 2022. It is a publicly traded company with a 35.17% return on equity. The company is headquartered in Atlanta, Georgia, and is a provider of nonalcoholic beverages.

– PepsiCo Inc ($NASDAQ:PEP)

PepsiCo Inc is a food and beverage company with a market cap of 254.66B as of 2022. The company has a Return on Equity of 45.25%. PepsiCo Inc is a food and beverage company with a portfolio of brands that includes Pepsi, Gatorade, Quaker, and Tropicana. The company operates in more than 200 countries and employs more than 285,000 people.

Summary

Celsius Holdings Inc. (CELH) has recently made headlines after a jury awarded Flo Rida $82.6 million in damages for breach of contract against the company. This news has had a negative impact on CELH’s stock price, causing it to move down on the same day of the announcement. Investing in CELH could be risky due to its legal troubles, but it may be worth considering as the company has been profitable in the past and has a strong product line. It is important to do further research on CELH before investing in order to determine whether or not it is a good investment opportunity.

Recent Posts