European Commission Concludes Preliminary Antitrust Investigation of Coca-Cola Company and Bottlers, Finding No Grounds to Pursue Further Action.

March 1, 2023

Trending News 🌧️

COCA-COLA ($NYSE:KO): The European Commission recently concluded a preliminary antitrust investigation into Coca-Cola Company, Coca-Cola Europacific Partners PLC, and Coca-Cola HBC. This investigation was initially opened due to worries that the three companies had attempted to use conditional rebates to discourage the influx of new drinks into the marketplace in certain EU countries. To make this decision, the European antitrust regulators obtained a significant amount of data from Coca-Cola, its bottlers, and retailers. After performing a thorough review of all available information, the regulators concluded that there were not enough grounds to initiate a full antitrust investigation, and would thus discontinue the preliminary inquiry.

Coca-Cola Company was relieved of the potential antitrust scrutiny, but will continue to face close regulatory scrutiny and should remain aware of the potential implications such matters can bring. The company has committed to further engage with authorities both in Europe, and around the world, to ensure all of its practices comply with all applicable laws.

Market Price

This news has been generally well-received in the market, as reflected in the stock’s response. On Tuesday, the stock opened at $59.7 and closed at $59.5, down by 0.5% from its previous closing price at $59.8. Despite the small drop, this indicates that investors are mostly positive about the news from the European Commission and do not see any long-term repercussions from the investigation. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Coca-cola Company. More…

| Total Revenues | Net Income | Net Margin |

| 43k | 9.54k | 22.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Coca-cola Company. More…

| Operations | Investing | Financing |

| 11.02k | -763 | -10.25k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Coca-cola Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 92.76k | 66.94k | 5.27 |

Key Ratios Snapshot

Some of the financial key ratios for Coca-cola Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.9% | 2.0% | 29.2% |

| FCF Margin | ROE | ROA |

| 22.2% | 33.5% | 8.5% |

Analysis

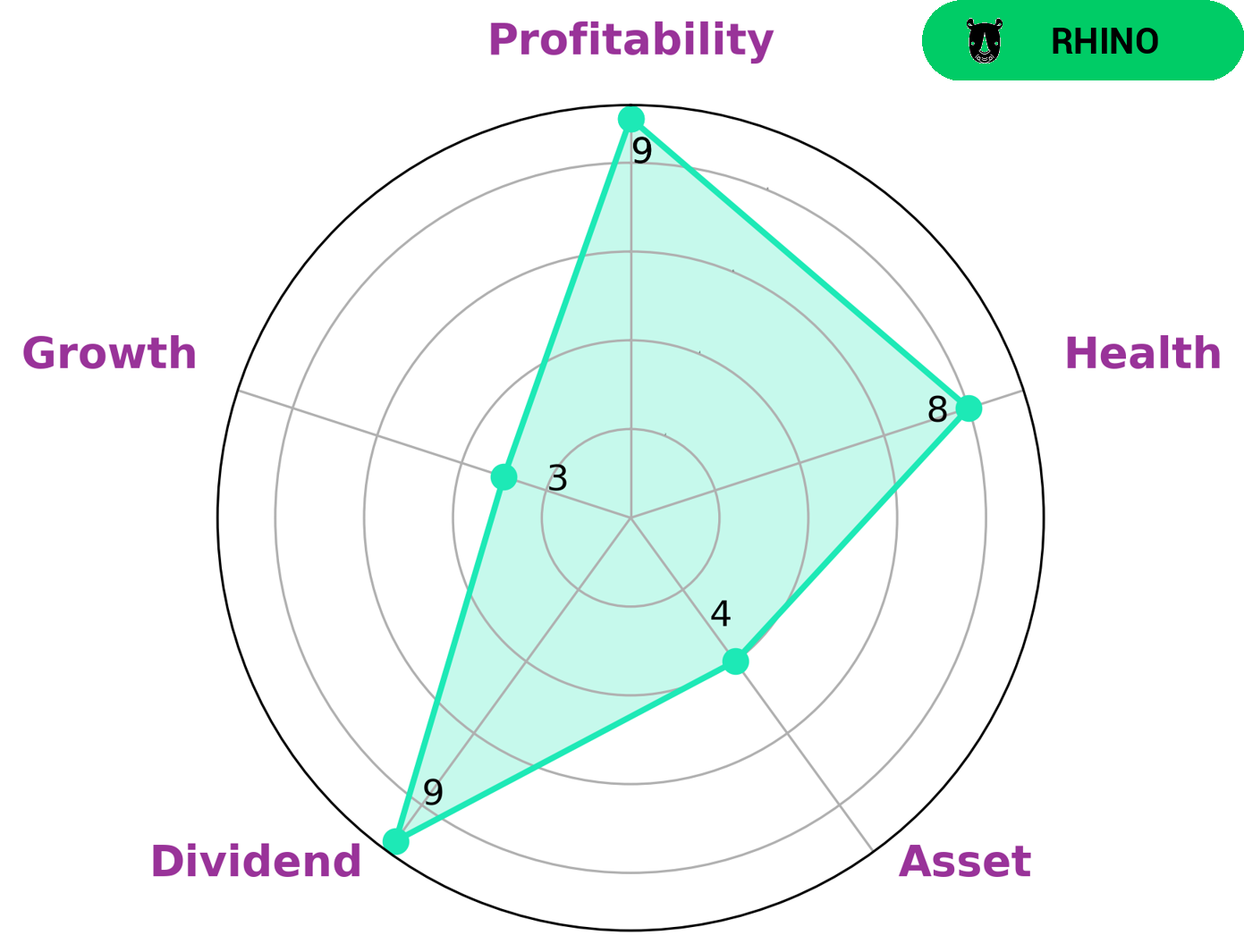

O u r S t a r C h a r t s h o w s t h a t C O C A – C O L A C O M P A N Y i s c a p a b l e t o p a y o f f d e b t a n d f u n d f u t u r e o p e r a t i o n s t h a n k s t o i t s c a s h f l o w s a n d d e b t . T h e c o m p a n y ‘ s p e r f o r m a n c e i s s t r o n g i n t e r m s o f d i v i d e n d a n d p r o f i t a b i l i t y , h o w e v e r , i t i s o n l y m e d i u m w i t h i t s a s s e t s a n d w e a k i n t e r m s o f g r o w t h . I n t e r m s o f t y p e o f c o m p a n i e s , i t i s c l a s s i f i e d a s a ‘ r h i n o ‘ , a t y p e o f c o m p a n y t h a t h a s a c h i e v e d m o d e r a t e r e v e n u e o r e a r n i n g s g r o w t h . A s s u c h , C O C A – C O L A C O M P A N Y m a k e s a g o o d i n v e s t m e n t f o r i n v e s t o r s l o o k i n g i n t o d i v i d e n d a n d p r o f i t a b i l i t y . O n t h e o t h e r h a n d , t h o s e i n v e s t o r s w h o a r e l o o k i n g f o r r a p i d g r o w t h o r q u i c k r e t u r n s m a y n o t f i n d t h i s c o m p a n y a t t r a c t i v e. More…

Peers

The Coca-Cola Company has been in competition with PepsiCo, Inc. since the late 1800s. The two companies have been fighting for market share ever since. More recently, Keurig Dr Pepper Inc. and Monster Beverage Corp have become major competitors in the beverage industry.

– PepsiCo Inc ($NASDAQ:PEP)

PepsiCo is a food and beverage company with a market cap of $238.84 billion as of 2022. The company has a return on equity of 45.25%. PepsiCo operates in more than 200 countries and employs more than 300,000 people. The company’s products include Pepsi-Cola, Lay’s potato chips, Tropicana orange juice, and Quaker oats. PepsiCo was founded in 1898 and is headquartered in Purchase, New York.

– Keurig Dr Pepper Inc ($NASDAQ:KDP)

Keurig Dr Pepper Inc is a publicly traded company with a market capitalization of $53.5 billion as of May 2022. The company has a return on equity of 10.39%. Keurig Dr Pepper Inc is a leading beverage company that manufactures and markets coffee, tea, and other beverage products. The company operates in North America, Europe, and Asia Pacific. Keurig Dr Pepper Inc is headquartered in Burlington, Massachusetts.

– Monster Beverage Corp ($NASDAQ:MNST)

As of 2022, Monster Beverage Corporation had a market cap of $46.49 billion and a return on equity of 18.04%. The company produces and sells energy drinks, soda, and juice products under the Monster, NOS, and Full Throttle brands. It also has a minority stake in Reign Beverage Company. The company was founded in 1987 and is headquartered in Corona, California.

Summary

Investing in Coca-Cola Company recently received a major boost after The European Commission concluded its preliminary antitrust investigation into the company and its bottlers. This news is seen as mostly positive, as it means that Coca-Cola has not been found to be in violation of any anti-competition legislation. Investing in Coca-Cola Company may be a good bet for investors, as the stock price has seen a steady rise over the past year and its consumer base remains strong.

The firm’s long-term outlook is promising, with its diversified product range and strong brand recognition across many countries. Coca-Cola has made large investments in innovation, sustainability and digital technology, which should continue helping it to remain a profitable and attractive investment opportunity.

Recent Posts