CX Institutional Boosts Stake in Monster Beverage Co. by 143.4% in Q1

August 5, 2023

☀️Trending News

Monster Beverage ($NASDAQ:MNST) Corporation is a leading provider of energy drinks and alternative beverages in the United States and around the world. According to the company’s most recent report, its shareholding rose by an impressive 143.4%. With a large shareholding, CX Institutional will be able to have a significant influence on Monster Beverage Co.’s future operations and strategy.

It also serves as a reminder of the long-term potential of the energy drink and alternative beverage market. With the backing of CX Institutional and other large investors, the company is well-equipped to capitalise on current market trends and remain a leader in the global energy drink and alternative beverage space.

Analysis

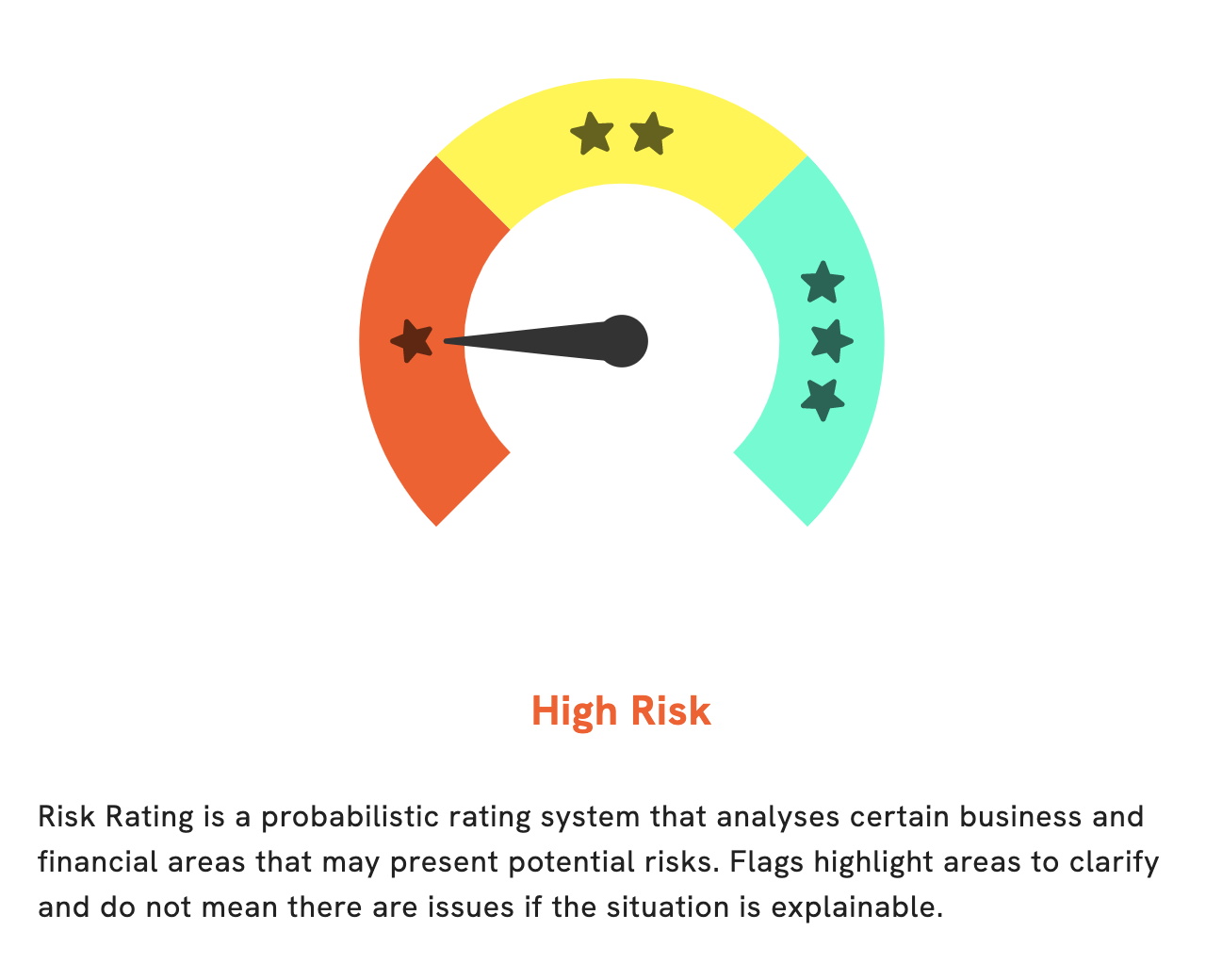

GoodWhale has analyzed MONSTER BEVERAGE‘s financials and has determined that the company is a high risk investment. We have identified 1 risk warning in the cashflow statement that registered users can view. For those looking to make an informed investment decision, it is important to understand the associated risk of the company. MONSTER BEVERAGE, in particular, is considered a high risk investment according to our risk rating. We invite you to become a registered user with GoodWhale so that you can view the risk warning and make a decision based on all information available. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Monster Beverage. More…

| Total Revenues | Net Income | Net Margin |

| 6.69k | 1.44k | 21.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Monster Beverage. More…

| Operations | Investing | Financing |

| 1.31k | -161.37 | -706.94 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Monster Beverage. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.26k | 1.42k | 7.49 |

Key Ratios Snapshot

Some of the financial key ratios for Monster Beverage are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.8% | 7.0% | 27.2% |

| FCF Margin | ROE | ROA |

| 16.2% | 14.9% | 12.3% |

Peers

The company’s primary competitors include EQ Labs Inc, GURU Organic Energy Corp and FBEC Worldwide Inc.

– EQ Labs Inc ($OTCPK:EQLB)

GURU Organic Energy Corp is a Canadian company that produces and sells organic energy products. The company has a market cap of 109.93 million as of 2022 and a return on equity of -19.55%. The company’s products include energy bars, energy drinks, and protein powders.

– GURU Organic Energy Corp ($TSX:GURU)

Founded in 1971, FBEC Worldwide Inc is a holding company that owns and operates businesses in the food and beverage industry. The company’s portfolio includes brands such as Fatburger, Buffalo’s Cafe, and Hurricane Grill & Wings. FBEC Worldwide Inc has a market cap of 358.24k as of 2022 and a Return on Equity of -4.07%. The company’s main focus is on franchising, licensing, and managing restaurant chains.

Summary

Monster Beverage Corporation is a publicly traded company in the beverage industry. Despite this confidence from institutional investors, the stock price unexpectedly dropped on the same day. This could indicate that investors are uncertain of the company’s potential going forward.

Analysts should carefully monitor Monster Beverage’s performance to identify any potential risks and opportunities. Moreover, they should look at the company’s financials and compare it to its peers in order to get a better understanding of its performance and prospects for the future.

Recent Posts