Boston Beer Stock Fair Value – Boston Beer Set to Celebrate 2023 Milestone with New Innovations

December 1, 2023

☀️Trending News

Boston Beer ($NYSE:SAM) is set to celebrate its 2023 milestone on November 29th with a host of innovative developments. The company is renowned for its commitment to innovation; from pioneering the craft beer revolution to introducing novel recipes such as Double Bock, Angry Orchard Hard Ciders, Twisted Tea, and Truly Hard Seltzers. Boston Beer’s 2023 milestone celebration will mark a significant achievement for the company, with plans for further expansion into new markets and the launch of new products. As part of the celebration, the company has revealed plans to release an exclusive limited-edition beer to commemorate the occasion.

The beer is said to be a combination of traditional brewing techniques fused with a modern twist. The 2023 milestone will also serve as an opportunity for Boston Beer to reflect on its past successes and accomplishments while looking forward to the future. With its innovative spirit and commitment to excellence, the company is sure to continue pushing the boundaries of beer-making and delighting beer-lovers around the world.

Price History

On Wednesday, BOSTON BEER stock opened at $345.3 and closed at $343.0, which was a 0.4% decrease from the previous closing price of 344.4. This slight downturn in their stock price is unlikely to hinder the company’s efforts to create new products for its upcoming milestone as they are committed to continuing to innovate and stay ahead of the competition. With new products being tested and released regularly, Boston Beer is sure to have a successful 2023. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Boston Beer. More…

| Total Revenues | Net Income | Net Margin |

| 2.06k | 82.96 | 4.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Boston Beer. More…

| Operations | Investing | Financing |

| 207.39 | -65.77 | -52.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Boston Beer. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.52k | 396.11 | 91.93 |

Key Ratios Snapshot

Some of the financial key ratios for Boston Beer are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.4% | -16.3% | 6.4% |

| FCF Margin | ROE | ROA |

| 6.7% | 7.4% | 5.4% |

Analysis – Boston Beer Stock Fair Value

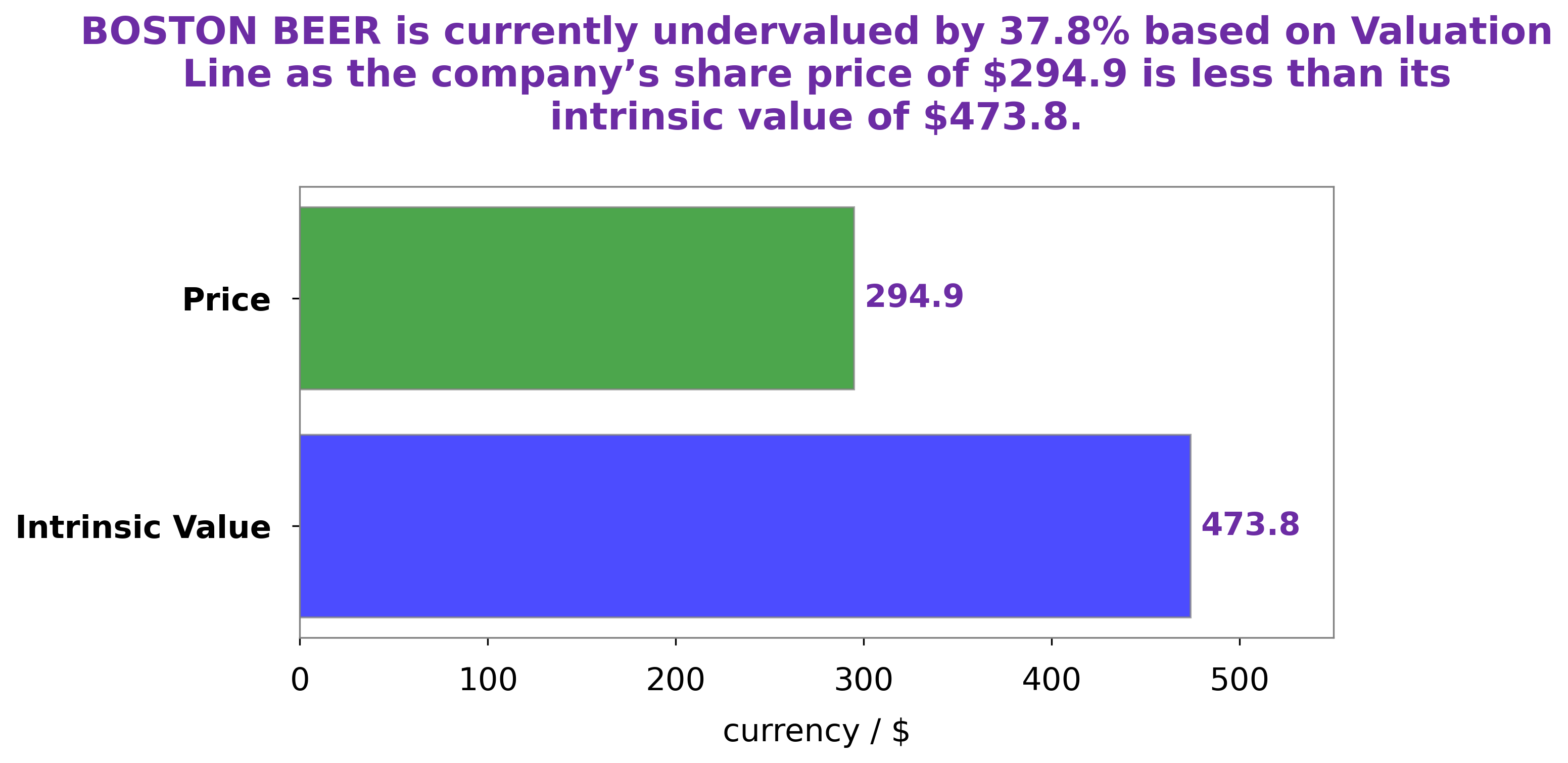

At GoodWhale, we conducted an analysis of BOSTON BEER‘s financials. After careful consideration, our proprietary Valuation Line calculated the intrinsic value of BOSTON BEER share to be around $536.1. Interestingly, the stock is currently trading at $343.0, which represents a 36.0% discount to its intrinsic value. This could be a good buying opportunity for investors looking for long-term value in the stock market. More…

Peers

Boston Beer Co Inc is a leading American brewer that manufactures and sells beer and cider under the Samuel Adams, Angry Orchard, and Twisted Tea brands. The company competes with Anheuser-Busch InBev SA/NV, Molson Coors Beverage Co, and Constellation Brands Inc.

– Anheuser-Busch InBev SA/NV ($LTS:0RJI)

Anheuser-Busch InBev SA/NV, a Belgian-Brazilian multinational beverage and brewing company, is the world’s largest brewer. The company was formed through successive mergers of three international brewing groups: Interbrew from Belgium, AmBev from Brazil and Anheuser-Busch from the United States. It has a primary listing on the Euronext Brussels stock exchange and is a component of the Euro Stoxx 50 stock market index.

As of 2019, Anheuser-Busch InBev’s net sales totaled US$52.5 billion, with a gross profit of US$24.2 billion. The company’s operating income totaled US$11.9 billion, and its net income was US$9.3 billion. Its head office is in Leuven, Belgium.

– Molson Coors Beverage Co ($NYSE:TAP)

Molson Coors Beverage Co is a publicly traded company that operates in the brewing industry. The company has a market cap of 10.5B as of 2022 and a Return on Equity of 5.05%. The company’s primary operations are in the United States, Canada, and the United Kingdom. Molson Coors Brewing Company was founded in 1873 by John Molson in Montreal, Canada. The company produces a variety of beer brands including Coors Light, Miller Lite, Molson Canadian, and Carling.

– Constellation Brands Inc ($NYSE:STZ)

Constellation Brands Inc is a leading international producer and marketer of beer, wine and spirits with operations in the U.S., Canada, Mexico, Europe and Asia. The company’s products include some of the world’s best-known brands, such as Corona, Modelo Especial, Ballast Point and SVEDKA Vodka, as well as innovative new products such as High West Whiskey. Constellation Brands is dedicated to delivering exceptional service to its customers and driving sustainable growth for its shareholders.

Summary

Boston Beer (SAM) is an iconic beer and hard cider maker with a long track record of success. A thorough analysis should consider its financial performance, including revenue, earnings, and cash flow, as well as its competitive position in the craft beer industry.

Additionally, examining trends in its free cash flow, dividends, and share price can offer insight into its potential as an investment. Investors should also consider the company’s sustainability initiatives and how they may impact the long-term outlook for Boston Beer. The company has recently embarked on a cost-saving program to streamline operations and capital investments, which may provide further opportunities for growth and value creation. Taking a comprehensive approach to investing analysis is key to making informed decisions about the potential of Boston Beer as an attractive investment.

Recent Posts