Boston Beer Company Receives ‘Reduce’ Recommendation from Defense World Analysts

June 10, 2023

☀️Trending News

The company is widely known for its flagship brand, Samuel Adams, as well as a wide variety of other brands such as Twisted Tea, Angry Orchard, and Truly Hard Seltzer. Recently, analysts at Defense World have released their consensus recommendation for the company, giving it a “Reduce” rating. Analysts at Defense World cite the company’s high dependence on its flagship Sam Adams brand as a primary reason for the recommendation. The analysts note that while the brand still remains popular, it has recently seen a decline in sales due to increased competition from the craft beer industry as a whole. Furthermore, the analysts point out that while the company has attempted to diversify its product line with new offerings such as hard seltzers, these products have yet to make up for the lost ground from Sam Adams. At the same time, analysts at Defense World caution investors to be cognizant of the company’s risk factors. The company’s high level of debt has been a concern among investors for some time, and its recent struggles in terms of sales and profitability could further complicate matters in this regard.

Additionally, analysts at Defense World point out that the craft beer industry is still relatively immature and highly competitive, which could make it difficult for Boston Beer ($NYSE:SAM) Company to maintain its market share over the long term. In light of the aforementioned risk factors and recent sales struggles, analysts at Defense World have given The Boston Beer Company, Inc. a consensus recommendation of “Reduce”. Investors should proceed with caution when considering purchasing shares of the company.

Stock Price

On Thursday, shares of Boston Beer Company opened at $332.3 and closed at $333.2, up 0.3% from the prior closing price of $332.4. Unfortunately for investors, Defense World analysts issued a ‘Reduce’ recommendation on the stock, suggesting that investors should sell their shares in the company. This is a direct contrast to the optimism surrounding the stock in previous weeks, when analysts had upgraded their outlook on BOSTON BEER. A ‘Reduce’ recommendation could be a sign that investors may want to reconsider their current positions in the company and look into other opportunities. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Boston Beer. More…

| Total Revenues | Net Income | Net Margin |

| 2.07k | 60.26 | 4.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Boston Beer. More…

| Operations | Investing | Financing |

| 223.13 | -81.92 | -34.42 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Boston Beer. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.39k | 351.15 | 84.69 |

Key Ratios Snapshot

Some of the financial key ratios for Boston Beer are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.9% | -7.6% | 5.3% |

| FCF Margin | ROE | ROA |

| 6.7% | 6.5% | 4.9% |

Analysis

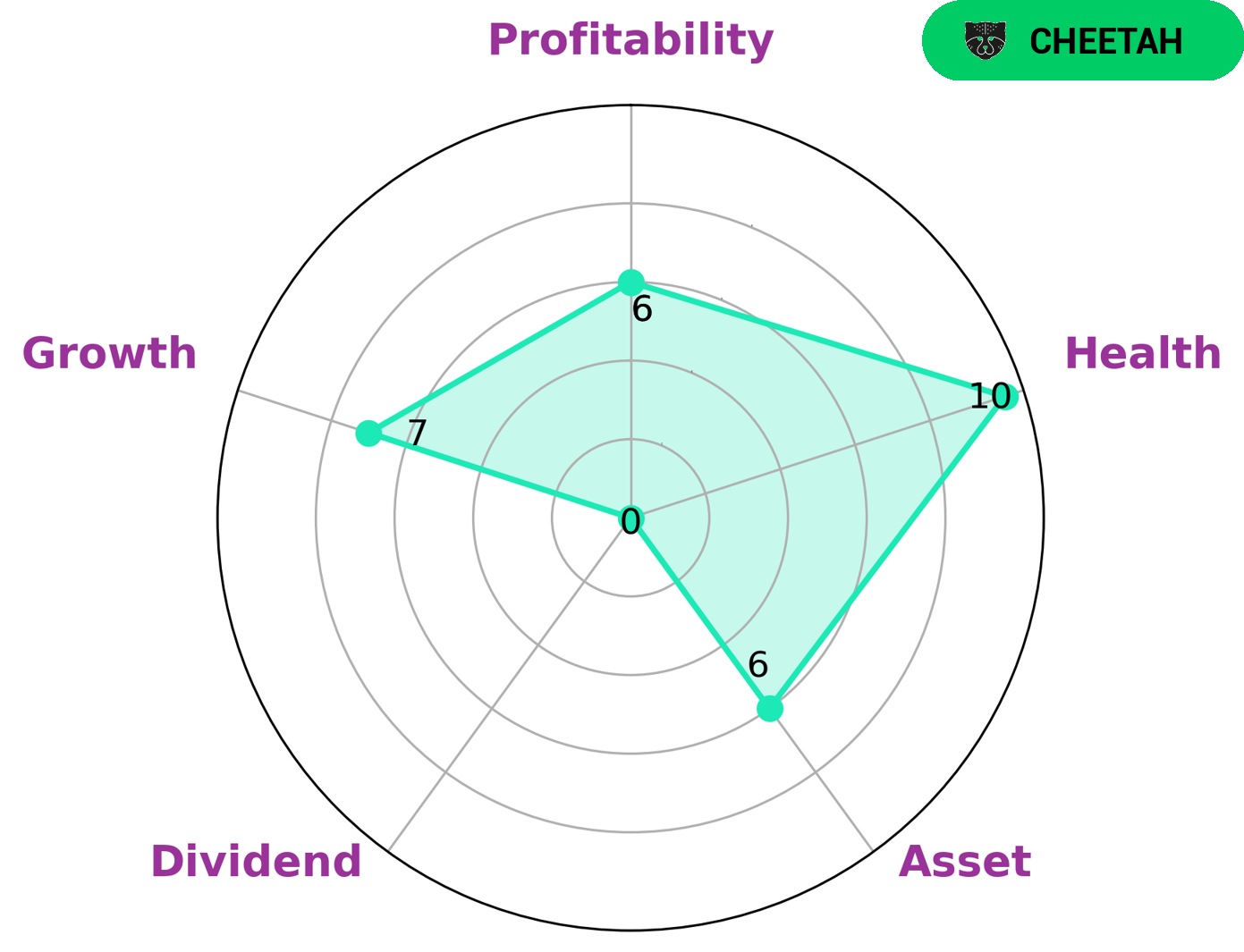

GoodWhale conducted an analysis of BOSTON BEER‘s wellbeing, and our findings are encouraging. This indicates that the company is capable of paying off its debt and funding its future operations with ease. Additionally, BOSTON BEER has a high score in growth, a medium score in asset, profitability and a weak score in dividend. Based on this data, we classified BOSTON BEER as a ‘cheetah’ – a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who understand the risks associated with such companies may be interested in BOSTON BEER as a viable investment opportunity. More…

Peers

Boston Beer Co Inc is a leading American brewer that manufactures and sells beer and cider under the Samuel Adams, Angry Orchard, and Twisted Tea brands. The company competes with Anheuser-Busch InBev SA/NV, Molson Coors Beverage Co, and Constellation Brands Inc.

– Anheuser-Busch InBev SA/NV ($LTS:0RJI)

Anheuser-Busch InBev SA/NV, a Belgian-Brazilian multinational beverage and brewing company, is the world’s largest brewer. The company was formed through successive mergers of three international brewing groups: Interbrew from Belgium, AmBev from Brazil and Anheuser-Busch from the United States. It has a primary listing on the Euronext Brussels stock exchange and is a component of the Euro Stoxx 50 stock market index.

As of 2019, Anheuser-Busch InBev’s net sales totaled US$52.5 billion, with a gross profit of US$24.2 billion. The company’s operating income totaled US$11.9 billion, and its net income was US$9.3 billion. Its head office is in Leuven, Belgium.

– Molson Coors Beverage Co ($NYSE:TAP)

Molson Coors Beverage Co is a publicly traded company that operates in the brewing industry. The company has a market cap of 10.5B as of 2022 and a Return on Equity of 5.05%. The company’s primary operations are in the United States, Canada, and the United Kingdom. Molson Coors Brewing Company was founded in 1873 by John Molson in Montreal, Canada. The company produces a variety of beer brands including Coors Light, Miller Lite, Molson Canadian, and Carling.

– Constellation Brands Inc ($NYSE:STZ)

Constellation Brands Inc is a leading international producer and marketer of beer, wine and spirits with operations in the U.S., Canada, Mexico, Europe and Asia. The company’s products include some of the world’s best-known brands, such as Corona, Modelo Especial, Ballast Point and SVEDKA Vodka, as well as innovative new products such as High West Whiskey. Constellation Brands is dedicated to delivering exceptional service to its customers and driving sustainable growth for its shareholders.

Summary

Boston Beer (SAM) is a brewing company based in the United States, and is best known for its Samuel Adams brand of beers. Analysts at Defense World have recently given Boston Beer a consensus recommendation of “Reduce” due to a variety of factors. Among these are decreased customer demand in the US, declining beer sales volumes, and increased competition from larger brewing companies. They also cited concerns over a lack of future revenue growth.

Furthermore, the company’s high debt levels are seen as a risk to the firm’s balance sheet and could reduce its ability to pay dividends and invest in new products. Investors should carefully weigh the risks associated with investing in Boston Beer before making any decisions.

Recent Posts