William G. Year Acquires $14,250.00 in SB Financial Group, Stock in 2023.

March 24, 2023

Trending News 🌥️

William G. Smith, a Director at SB ($NASDAQ:SBFG) Financial Group, Inc., recently made a significant investment in the company’s stock of $14250.00. This acquisition marks an important milestone for both the company and Smith, as it showcases Smith’s faith in the potential of the company’s growth and success. Smith’s purchase is indicative of his confidence in the future of the company and its ability to deliver strong returns for its shareholders. The move is a testament to the trust that Smith has placed in the organization, and reflects the importance of his role in the company.

This purchase further highlights SB Financial Group, Inc.’s commitment to success and emphasizes its dedication to providing a secure and profitable investment opportunity to its shareholders. The acquisition of SB Financial Group, Inc. stock by William G. Smith is a testament to his confidence in the company, and reinforces the company’s commitment to providing a safe, profitable return to its shareholders. Smith’s investment is an important milestone that signals a bright future for the organization and its stakeholders.

Stock Price

This investment came shortly after the company’s stock opened at $13.3 and closed at $13.2, representing an increase of 1.4% from its prior closing price of 13.0. The purchase gave Year a large stake in the company and is expected to be a strong move for his portfolio. With this acquisition, Year has made a sizable commitment to SB Financial Group, Inc., demonstrating his confidence in the company’s stock and its future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sb Financial. More…

| Total Revenues | Net Income | Net Margin |

| – | 12.52 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sb Financial. More…

| Operations | Investing | Financing |

| 25.57 | -165.67 | 18.41 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sb Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.34k | 1.22k | – |

Key Ratios Snapshot

Some of the financial key ratios for Sb Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.9% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

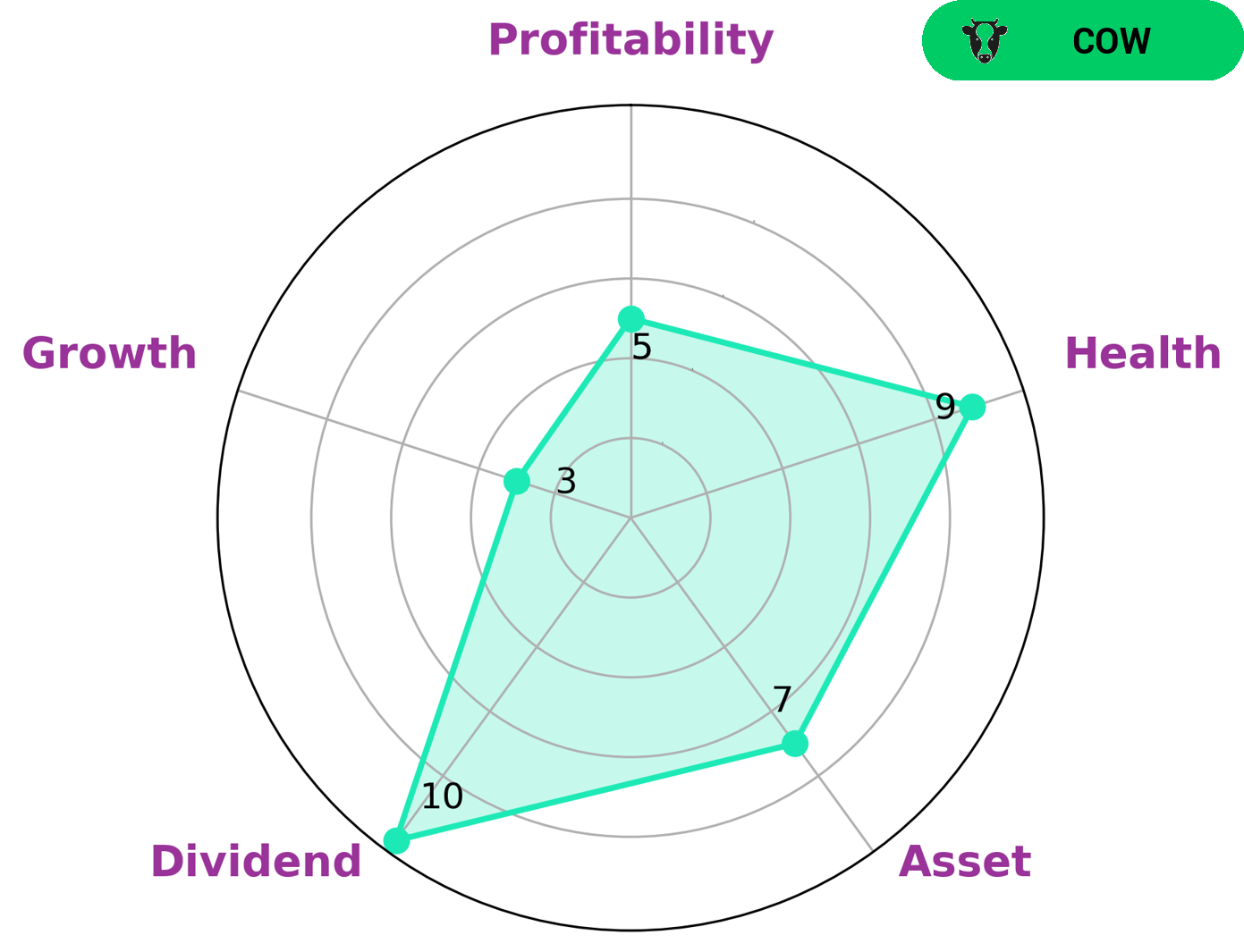

GoodWhale’s analysis of SB FINANCIAL’s financials has yielded interesting results. Based on our Star Chart, SB FINANCIAL is strong in asset, dividend, and medium in profitability, but weak in growth. This has led us to categorize this company as a ‘cow’, a type of company we conclude has the track record of paying out consistent and sustainable dividends. Given these impressive financial metrics, it is likely that investors who are looking for a safe, consistent return on their investments may be interested in this company. Furthermore, SB FINANCIAL has a high health score of 9/10 with regard to its cashflows and debt, which means that its balance sheet is strong and it is capable to sustain future operations in times of crisis. These factors make SB FINANCIAL a desirable option for many investors. More…

Peers

The company’s primary subsidiaries include The Scott County Bank, which offers personal and commercial banking services; and Ohio Valley Financial Group, Inc., which provides personal, commercial, and agricultural banking services. The company operates in three segments: Banking, Wealth Management, and Insurance. The company offers its services to individuals, families, and businesses in Indiana, Kentucky, and Ohio. The company was founded in 1855 and is headquartered in Scottsburg, Indiana.

– Peoples Financial Corp ($OTCPK:PFBX)

As of 2022, Peoples Financial Corp has a market cap of 75.79M. The company is a provider of banking and financial services to individuals and businesses in the United States. It offers a range of deposit and loan products, as well as online and mobile banking services.

– First Commonwealth Financial Corp ($NYSE:FCF)

Commonwealth Financial Corporation is a financial services company headquartered in Philadelphia, Pennsylvania. The company provides banking, insurance, and investment services to consumers and businesses in the United States through its subsidiaries. As of December 31, 2020, Commonwealth Financial Corporation had assets of $1.38 billion and deposits of $841 million.

Summary

SB Financial Group, Inc. is an attractive investment opportunity for investors. The stock is likely to yield high returns due to the company’s impressive track record of profitability and good management practices. Its long-term strategy is to focus on organic growth, while also seeking out strategic acquisitions and partnerships to diversify its business portfolio.

Additionally, SB Financial Group, Inc. has a strong balance sheet and diversified product offerings, which enable it to remain competitive in the current market environment. Investors should consider its performance and financial stability when making an investment decision.

Recent Posts