Wall Street Analysts Issue Sell Rating for BankUnited Inc Stock After a 51.82% Decline in 12 Months

April 22, 2023

Trending News 🌥️

BANKUNITED ($NYSE:BKU): The stock of BankUnited Inc, a publicly traded bank holding company, has experienced a dramatic decline in the past year. According to Wall Street analysts, the stock has decreased by a staggering 51.82%, prompting many analysts to issue a “Sell” rating for BankUnited Inc stock. This rating is generally reserved for stocks with a very low probability of future success, making the situation dire for BankUnited Inc’s investors. BankUnited Inc is a financial holding company that provides retail and commercial banking services in the United States.

By offering an array of products and services, BankUnited Inc aims to serve its customers’ financial needs. Many investors are now concerned about the future of BankUnited Inc, as its future success is uncertain with such a low rating from analysts.

Stock Price

As of Friday, BANKUNITED stock opened at $21.2 and closed at $21.2, down by 0.5% from its prior closing price of $21.3. This downward trend is concerning to analysts, as it signals potential risks to investors who have put their faith in the company. As such, analysts have warned investors against investing in BANKUNITED’s stock, due to its current volatility and the uncertainty surrounding its future performance. It is important for investors to consider all available information before investing in any stock, especially in light of the current market environment.

Investors need to be aware of the risks associated with any stock, and make sure to do their own research before investing. Despite the current sell rating for BANKUNITED’s stock, there is still potential for growth in the future. Thus, it is important for investors to weigh their options carefully before deciding on whether to invest in BANKUNITED or not. BankUnited_Inc_Stock_After_a_51.82_Decline_in_12_Months”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bankunited. More…

| Total Revenues | Net Income | Net Margin |

| – | 279.9 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bankunited. More…

| Operations | Investing | Financing |

| 1.29k | -2.12k | 1.08k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bankunited. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 37.03k | 34.59k | – |

Key Ratios Snapshot

Some of the financial key ratios for Bankunited are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.2% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

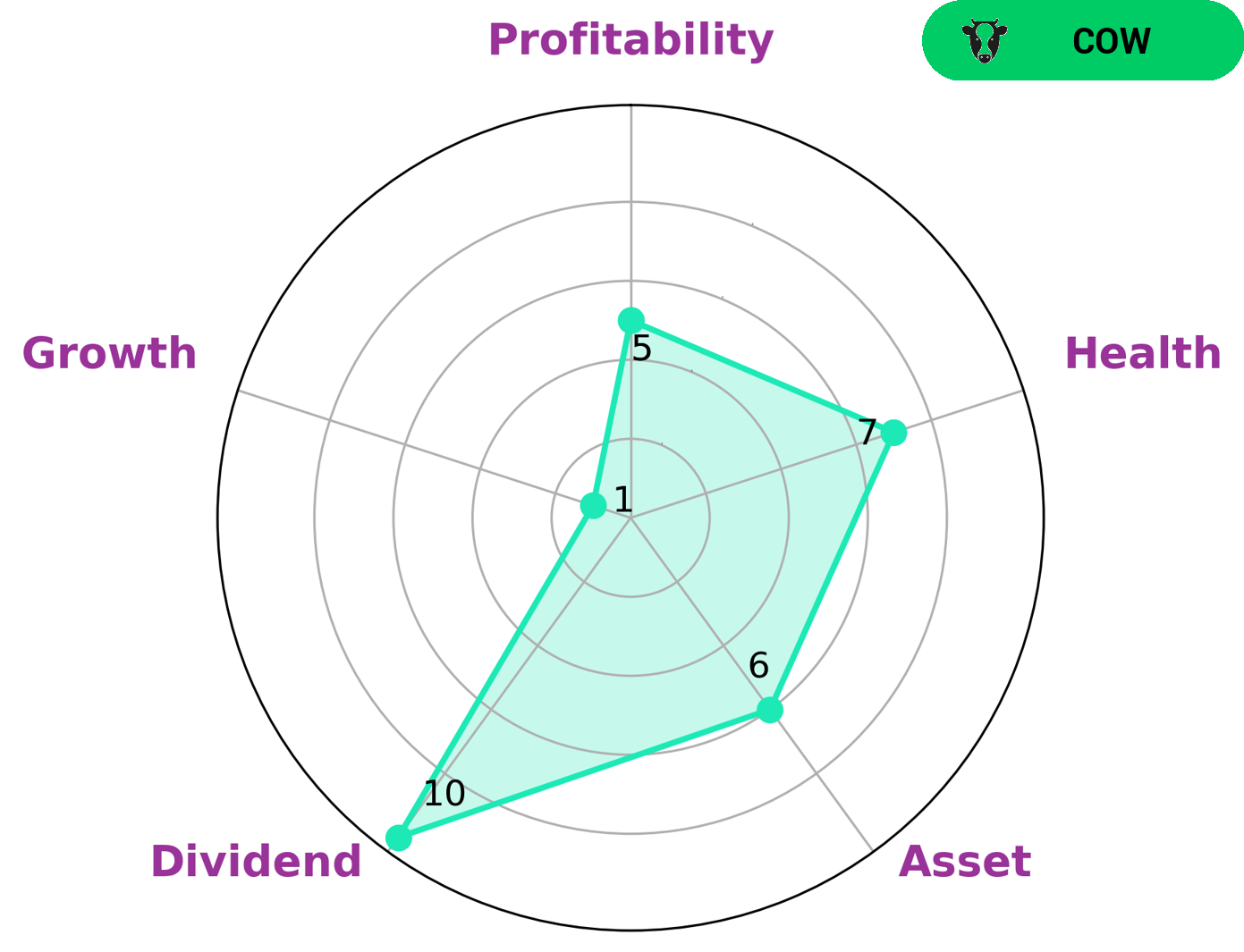

GoodWhale recently conducted an analysis of BANKUNITED’s fundamentals. According to Star Chart, BANKUNITED is strong in dividend, medium in profitability, asset and weak in growth. With a high health score of 7/10, considering its cashflows and debt, we are confident that BANKUNITED is capable to sustain future operations in times of crisis. Based on this analysis, we classify BANKUNITED as a ‘cow’, a type of company that has a track record of paying out consistent and sustainable dividends. Investors who are looking for slow and steady growth with consistent cash dividends may be interested in investing in such a company. BANKUNITED’s stable dividend gives investors the assurance of a reliable income stream, while its low growth rate may also attract those with a more conservative approach. In addition, investors interested in defensive strategies may also find BANKUNITED attractive due to its strong health score and ability to sustain future operations. BankUnited_Inc_Stock_After_a_51.82_Decline_in_12_Months”>More…

Peers

The company competes with other large banks, such as PacWest Bancorp, Columbia Banking System Inc, and Glacier Bancorp Inc. All of these companies offer similar products and services, so it can be difficult for customers to choose one over the other.

However, BankUnited Inc. has several advantages that make it a good choice for customers looking for a reliable and comprehensive financial institution.

– PacWest Bancorp ($NASDAQ:PACW)

PacWest Bancorp is a holding company for Pacific Western Bank, a regional bank with operations in California, Oregon and Washington. The company has a market cap of $2.95 billion as of 2022. PacWest Bancorp is focused on providing commercial banking services to small and medium-sized businesses. The company offers a range of deposit and loan products, as well as treasury management and foreign exchange services. PacWest Bancorp also provides residential and commercial mortgage lending services through its subsidiary, Pacific Western Mortgage Company.

– Columbia Banking System Inc ($NASDAQ:COLB)

Columbia Banking System Inc is a regional bank holding company headquartered in Tacoma, Washington. The Company operates through its wholly owned subsidiary, Columbia State Bank (the Bank). The Bank provides a range of banking services to small and medium-sized businesses, professionals, and individuals in Washington, Oregon, and Idaho. As of December 31, 2018, the Company operated through a network of 149 branches and approximately 300 ATMs.

– Glacier Bancorp Inc ($NYSE:GBCI)

Glacier Bancorp Inc is a regional bank holding company headquartered in Kalispell, Montana. The Company operates through its banking subsidiary, Glacier Bank (the Bank). The Bank offers a range of commercial and consumer banking services through over 130 banking offices located in Montana, Idaho, Colorado, Wyoming, Utah, and Washington. Glacier Bancorp Inc has a market cap of 6.39B as of 2022.

Summary

Investors should proceed with caution when considering BankUnited Inc. stock. Furthermore, Wall Street analysts have a consensus Sell rating on the stock. Before investing, investors should carefully evaluate the risks and potential rewards of investing in BankUnited Inc. stock and research the company’s financials and competitors to determine if it is a worthwhile investment.

Recent Posts