Unraveling the BOQ Share Price: Investigating One of Australia’s Largest Regional Banks

January 31, 2023

Trending News ☀️

BANK ($ASX:BOQ): Researching the BOQ share price can be a daunting task, given its status as one of the largest regional banks in Australia, with over 200 branches across the country. The bank provides a comprehensive range of banking services, including personal banking, business banking, and wealth management. With its extensive branch network, BOQ has become a major player in the banking sector. Investigating the BOQ share price requires an understanding of the company’s financial performance, as well as an analysis of the economic environment in which it operates. As a publicly traded company, BOQ’s share price is subject to factors such as investor sentiment, macroeconomic indicators, and industry trends. As such, researching the BOQ share price requires an in-depth analysis of its financial performance, as well as an understanding of the external environment in which it operates. The BOQ share price is largely determined by its financial performance. As such, investors should focus on the bank’s balance sheet and income statement. Key metrics to consider include earnings per share (EPS), return on equity (ROE), and dividend yield.

Analyzing these metrics will allow investors to get a better understanding of the bank’s growth prospects, as well as its ability to generate returns for shareholders. In addition to its financial performance, investors should also consider macroeconomic indicators such as inflation and interest rates when analyzing the BOQ share price. Changes in these indicators can have a significant impact on the share price, as they affect the bank’s ability to generate profits. Similarly, industry trends should also be considered when researching the BOQ share price. Understanding the competitive landscape and industry developments can help investors gain an insight into how the bank is likely to perform in the future. Therefore, researching the BOQ share price requires an in-depth analysis of both internal and external factors. By understanding the company’s financial performance and considering macroeconomic indicators and industry trends, investors can gain an insight into how the bank is likely to perform in the future.

Market Price

The Bank Of Queensland (BOQ) is one of Australia’s largest regional banks, and has recently been at the center of media attention owing to its share price. So far, the news coverage of BOQ’s share price has largely been positive, which has helped to boost investor confidence in the stock. On Thursday, BOQ’s stock opened at AU$7.0 and closed at AU$7.0, only down by 0.4% from the previous closing price of 7.0. This can be seen as a healthy sign for the company, as it reflects a relatively steady market performance over the course of the day and indicates that the investors are still interested in buying BOQ’s shares. The performance of BOQ’s share price is an interesting area to investigate, as it gives us an insight into how the company is perceived in the market and how it fares in comparison to its competitors.

It’s also important to consider other factors that may be affecting BOQ’s share price, such as macroeconomic conditions, changes in interest rates and regulatory updates. Overall, the performance of BOQ’s share price is a good sign that the company is in a strong position and is likely to continue to perform well in the future. For those interested in investing in BOQ or other regional banks, it’s important to remember to do your research and understand the fundamentals of the company before making any decisions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BOQ. More…

| Total Revenues | Net Income | Net Margin |

| – | 423 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BOQ. More…

| Operations | Investing | Financing |

| -1.24k | -192 | 1.32k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BOQ. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 99.93k | 93.25k | – |

Key Ratios Snapshot

Some of the financial key ratios for BOQ are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.5% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

VI Analysis

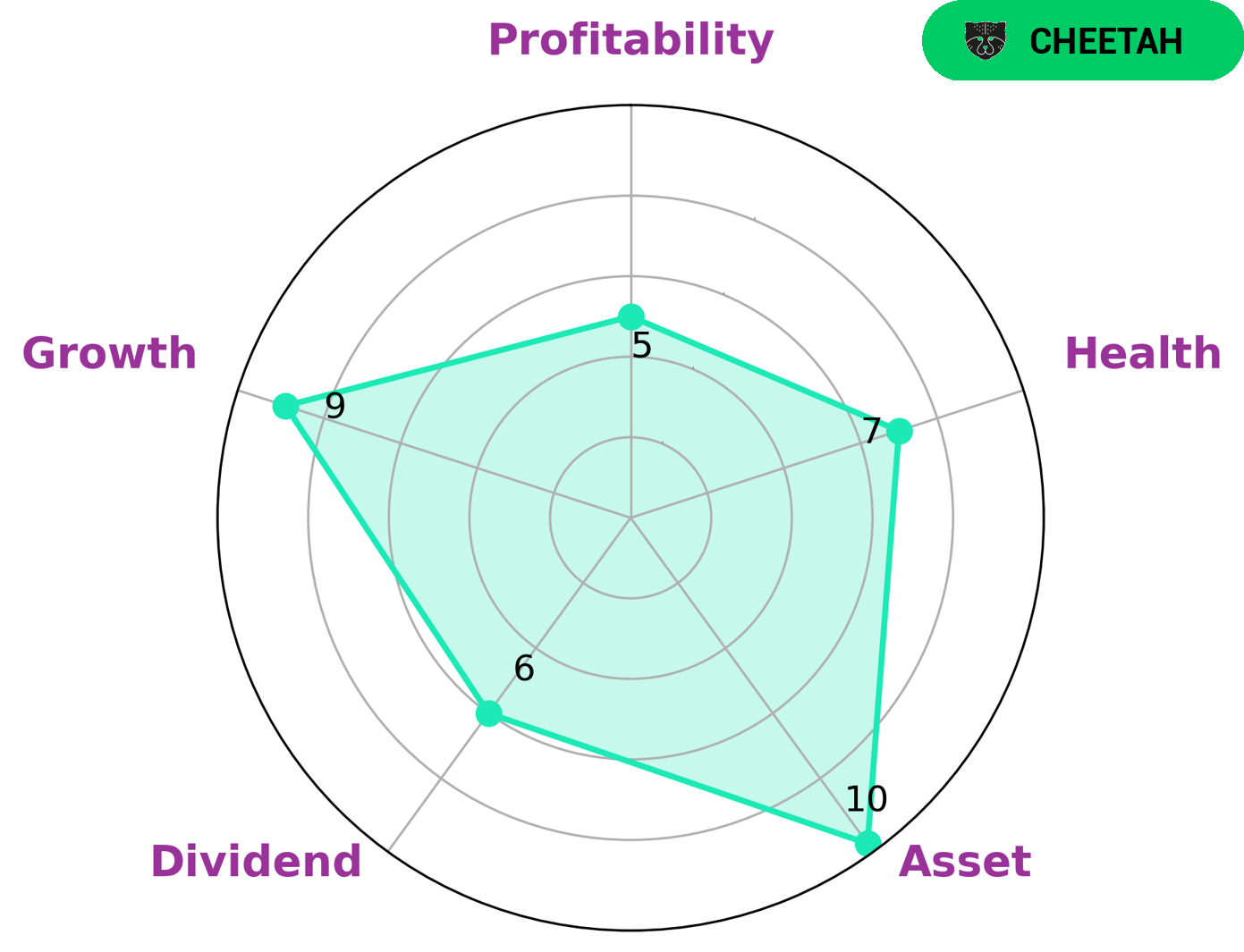

The VI app simplifies the analysis of company fundamentals, making it easier to identify potential investment opportunities. BANK OF QUEENSLAND is a ‘cheetah’ company, one that has been able to achieve high revenue or earnings growth but is considered less stable due to lower profitability. This type of company may be attractive to investors who are willing to take on higher risk for higher reward. According to the VI Star Chart, BANK OF QUEENSLAND has a health score of 7/10, indicating that it is capable of riding out any crisis without the risk of bankruptcy. Furthermore, its financials are strong in growth, asset and medium in profitability and dividend, providing investors with an attractive risk-reward trade-off. Overall, BANK OF QUEENSLAND is an attractive investment opportunity for investors who are willing to take on higher risk for higher reward. With a high health score and strong financials, BANK OF QUEENSLAND is well-positioned to ride out any crisis and provide investors with long-term returns. More…

VI Peers

The banking industry in Australia is fiercely competitive, with Bank of Queensland Ltd striving to maintain its market share against a range of competitors. These include Auswide Bank Ltd, Secure Trust Bank PLC, and Independent Bank Group Inc, all of whom are seeking to gain an advantage in the market by offering innovative products and services. As such, Bank of Queensland Ltd must remain agile and responsive to customer needs in order to remain competitive.

– Auswide Bank Ltd ($ASX:ABA)

Auswide Bank Ltd is a customer owned bank, offering banking, finance and insurance services to individuals, businesses and corporate customers. The company has a market cap of 270.02M as of 2023. Market capitalization (market cap) is the total market value of all of a company’s outstanding shares and is an important measure of a company’s size. Auswide Bank Ltd is a midsize bank with a market cap that places it in the mid-range of Australian banks in terms of size when compared to the larger four banks. It offers a range of services including home loans, personal loans, credit cards, savings accounts and transactional banking, as well as business banking, corporate banking and insurance products.

– Secure Trust Bank PLC ($LSE:STB)

Trust Bank PLC is a UK-based financial services company that provides a range of banking and financial services to customers in the UK. Its market capitalization as of 2023 is 142.43M, which indicates its size and market presence in the UK. The company’s services include retail banking, corporate banking, insurance, credit cards, mortgages, wealth management, and other services. Trust Bank PLC is committed to providing customers with secure, convenient, and reliable financial products and services. The company is well-known for its competitive interest rates and its strong customer service reputation.

– Independent Bank Group Inc ($NASDAQ:IBTX)

Independent Bank Group Inc., with a market cap of 2.4 billion as of 2023, is a financial holding company that provides community banking services in Texas, Oklahoma and Colorado. The company provides a range of banking services, including consumer and commercial loans, deposit accounts, treasury management services, and trust services. It also offers financial solutions to its customers through its subsidiaries. The company has a strong presence in the Dallas-Fort Worth metroplex and employs over 1,900 people. It has a solid customer base and a wide network of over 100 branches and offices located across the states of Texas, Oklahoma and Colorado.

Summary

Investing in Bank of Queensland (BOQ) is an attractive opportunity for investors. The bank has a long and successful history in Australia, being one of the largest regional banks, and offers a wide range of products and services. It has consistently delivered strong financial results and offers attractive dividends for shareholders. The BOQ share price has been on a steady upward trajectory in recent years, and analysts expect further growth in the coming months.

Investors should consider the bank’s solid track record, its strong balance sheet, and its commitment to providing excellent customer service when considering investing in BOQ. With an excellent outlook for the future and a solid foundation, investing in BOQ is an excellent choice for investors looking for long-term growth potential.

Recent Posts