Southside Bancshares dividend – Southside Bancshares Declares 0.35 Cash Dividend

March 25, 2023

Dividends Yield

On February 3 2023, Southside Bancshares ($NASDAQ:SBSI) Inc. announced that it was declaring a cash dividend of 0.35 USD per share. This follows their annual dividend rate per share of 1.36 USD for the past three years, resulting in dividend yields of 3.52% for each year. Investors looking for a dividend stock should consider SOUTHSIDE BANCSHARES as their go-to option, with the ex-dividend date set at February 15 2023. Investing in SOUTHSIDE BANCSHARES can be a great way to diversify and generate passive income. With an average dividend yield of 3.52%, investors will be able to benefit from the consistent returns they will get through the dividend payouts.

Not only that, but SOUTHSIDE BANCSHARES also has a history of reliable financial performance with great liquidity and low leverage ratio, making it a safe choice for investors. All in all, SOUTHSIDE BANCSHARES is an attractive option for those looking for passive income and consistent returns. With the upcoming dividend announcement, now might be the perfect time to invest in this stock.

Share Price

On Friday, the stock of the company opened at $39.0 and closed at $39.6, providing a 1.9% increase to its previous closing price of 38.9. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Southside Bancshares. More…

| Total Revenues | Net Income | Net Margin |

| – | 105.02 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Southside Bancshares. More…

| Operations | Investing | Financing |

| 226.52 | -634.78 | 405.76 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Southside Bancshares. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.56k | 6.81k | – |

Key Ratios Snapshot

Some of the financial key ratios for Southside Bancshares are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.0% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

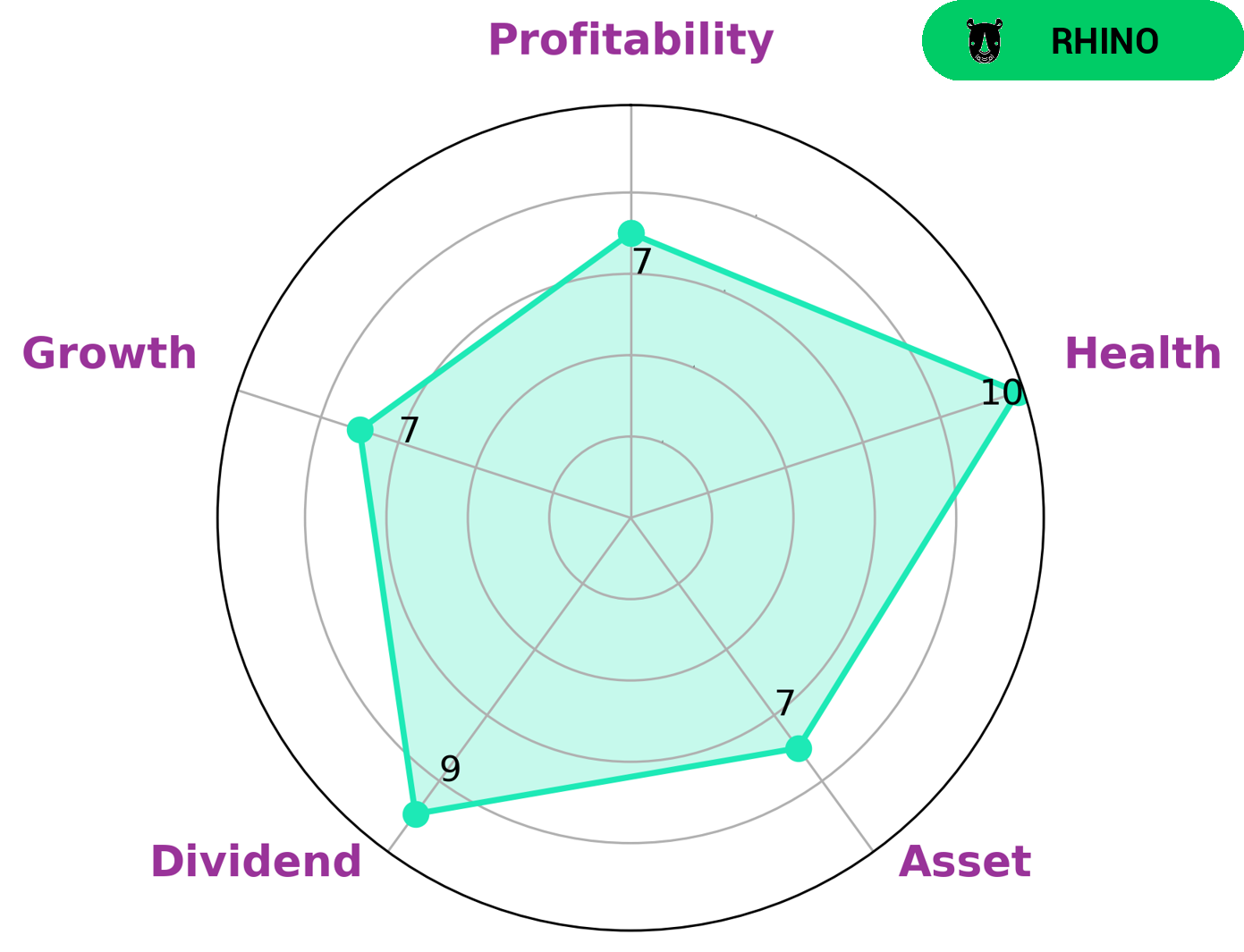

GoodWhale has conducted an analysis of SOUTHSIDE BANCSHARES‘ financials. Our star chart shows that SOUTHSIDE BANCSHARES is strong in growth, profitability, asset, and dividend. In addition, we have classified SOUTHSIDE BANCSHARES as a ‘rhino’, which we have concluded has achieved moderate revenue or earnings growth. Given these characteristics, we believe that SOUTHSIDE BANCSHARES may be of interest to investors who are looking for a company with a good record of growth and profitability, as well as a high dividend yield. Moreover, the company has a high health score of 10/10 with regard to its cashflows and debt, indicating that it is capable to pay off debt and fund future operations. As such, SOUTHSIDE BANCSHARES may be an attractive investment opportunity for long-term investors and those looking for a reliable stream of income. More…

Peers

As of December 31, 2018, Southside Bancshares Inc operated 108 branches in Virginia, North Carolina, and South Carolina. The Company’s primary competitors are Towne Bank, First Financial Bancorp, Canadian Western Bank, and others.

– Towne Bank ($NASDAQ:TOWN)

Towne Bank is a regional bank headquartered in Virginia. As of December 31, 2016, the company had $7.0 billion in assets, $5.2 billion in loans, and $5.6 billion in deposits. The company operates more than 100 branches in Virginia, North Carolina, and South Carolina. Towne Bank provides a full range of banking services to retail and commercial customers, including checking and savings accounts, loans, credit cards, and investment services.

– First Financial Bancorp ($NASDAQ:FFBC)

First Financial Bancorp has a market cap of 2.33B as of 2022. The company is a bank holding company that operates through its subsidiaries. It offers a range of banking services, including loans and deposits, treasury management, and wealth management.

– Canadian Western Bank ($TSX:CWB)

Canadian Western Bank’s market cap as of 2022 is 2.15B. The company is a leading provider of banking services in Canada. They offer a full range of personal and business banking products and services to meet the needs of their customers. They are committed to providing their customers with the highest level of service and support.

Summary

SOUTHSIDE BANCSHARES is a great option for investors looking to diversify their portfolios with a high dividend yielding stock. For the last three years, SOUTHSIDE BANCSHARES has maintained an annual dividend rate of 1.36 USD per share, resulting in an average dividend yield of 3.52%. This makes it an attractive option for those looking to maximize their returns on investment. The company has proven its ability to sustain high dividend yields even in difficult economic conditions, making it a viable option for long-term investment.

Recent Posts