South State Corporation Beats Revenue Expectations Despite Missing Non-GAAP EPS Forecast

April 28, 2023

Trending News ☀️

SOUTHSTATE ($NASDAQ:SSB): The South State Corporation recently reported their earnings results, and while they exceeded expectations in terms of revenue, they fell short on Non-GAAP earnings per share (EPS). Despite an impressive $452.62M in revenue, which beat estimates by $10.5M, South State Corporation reported a Non-GAAP EPS of $1.93, missing their forecast by $0.03. It is the nation’s largest publically traded real estate investment trust and the fifth largest owner-operator of shopping centers in the United States.

The company has a diverse portfolio of properties including shopping centers, office buildings, industrial properties, and apartment complexes across the country. The company also has a strong focus on customer service and strives to provide exceptional experiences for its customers at each of its properties. SouthState Corporation is also heavily invested in the communities it serves and works to create positive change through its various community partnerships.

Stock Price

On Thursday, SOUTHSTATE CORPORATION reported their fourth quarter earnings that beat revenue expectations, despite missing the non-GAAP earnings per share (EPS) forecast. The stock opened at $66.5 and closed at $67.5, up by 2.7% from its previous closing price of $65.7. This can be attributed to higher employee costs, taxes, and depreciation expenses. Despite this, SOUTHSTATE CORPORATION’s stock still rose steadily throughout the day due to its better-than-expected revenue performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Southstate Corporation. More…

| Total Revenues | Net Income | Net Margin |

| – | 496.05 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Southstate Corporation. More…

| Operations | Investing | Financing |

| 1.73k | -4.86k | -2.28k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Southstate Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 43.92k | 38.84k | – |

Key Ratios Snapshot

Some of the financial key ratios for Southstate Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 35.9% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

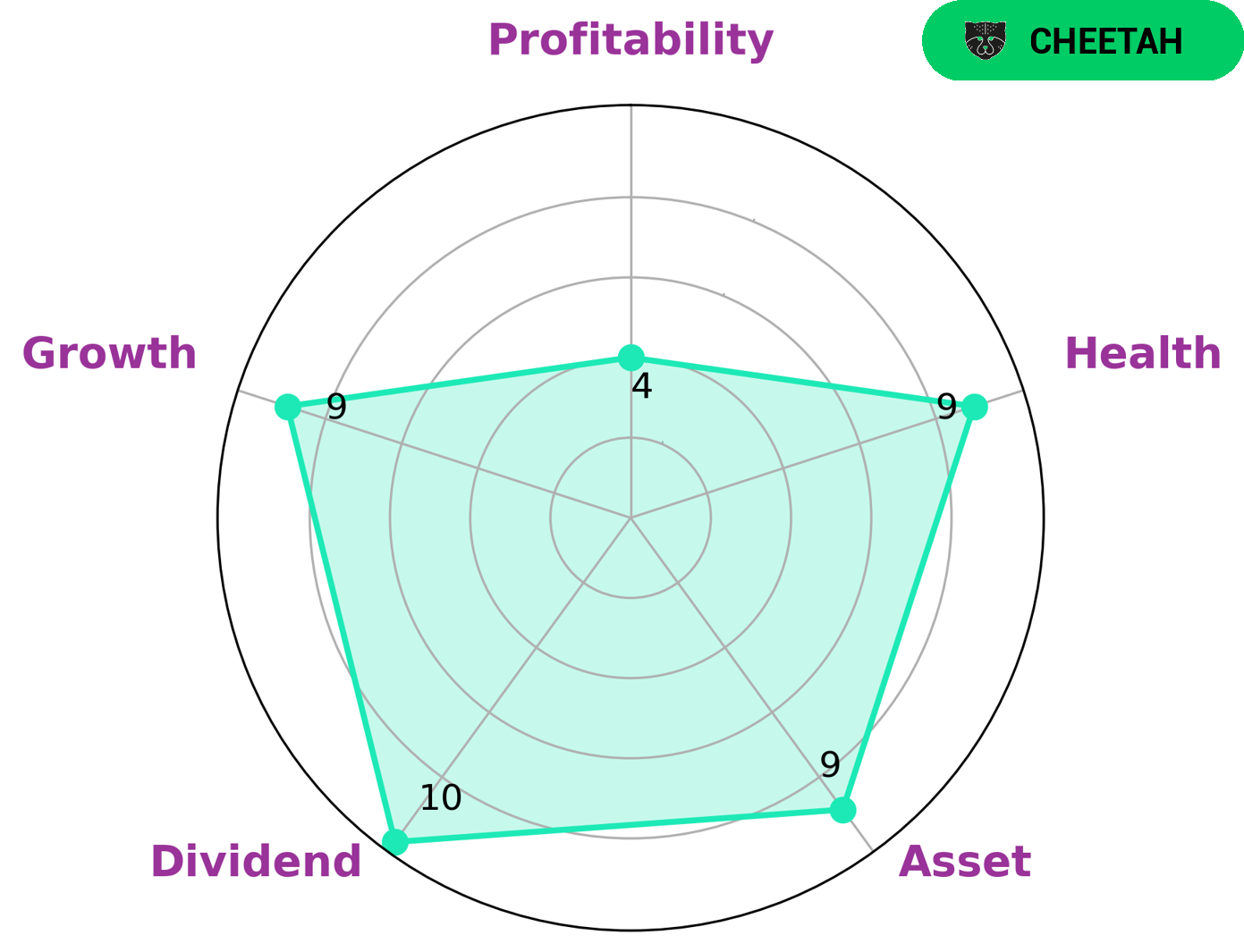

We at GoodWhale recently conducted an analysis of SOUTHSTATE CORPORATION‘s wellbeing. According to our Star Chart evaluation, the company has a high health score of 9/10 when considering its cash flows and debt. This indicates that SOUTHSTATE CORPORATION is capable of sustaining future operations in times of crisis. We classified SOUTHSTATE CORPORATION as a ‘cheetah’ type of company. This means that the company has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors may be interested in this type of company for its potential for growth, asset and dividend values, though the lack of financial stability may be a deterrent. Overall, SOUTHSTATE CORPORATION is strong in growth, asset, dividend and medium in profitability. More…

Peers

In the current market, SouthState Corp is facing stiff competition from banks such as Andover Bancorp Inc, United Community Banks Inc, and Citba Financial Corp. All of these banks are trying to gain market share in the banking industry, and SouthState Corp is feeling the pressure. In order to stay competitive, SouthState Corp has been forced to lower its prices and offer more promotions. Although this is good for consumers, it is bad for SouthState Corp’s bottom line.

– Andover Bancorp Inc ($OTCPK:ANDC)

United Community Banks Inc is a regional bank holding company with over $40 billion in assets. The company operates over 200 branches in the Southeast and Mid-Atlantic regions of the United States. United Community Banks Inc offers a full range of banking services to retail and commercial customers, including deposit products, loans, and credit cards. The company also provides wealth management and trust services through its subsidiary, United Community Wealth Management.

– United Community Banks Inc ($NASDAQ:UCBI)

Citba Financial Corp is a bank holding company. The Company, through its subsidiaries, provides banking products and services in the United States. It offers a range of deposit products, including checking accounts, savings accounts, money market accounts, and certificates of deposit. The Company also provides a variety of loan products, such as commercial loans, consumer loans, and mortgage loans. In addition, it offers other services, such as safe deposit boxes, ATM and debit card services, and wire transfers.

Summary

SouthState Corporation, a major financial services provider, recently reported its quarterly earnings. The company cited strength in commercial banking and increases in mortgage production as the primary drivers of the better-than-expected performance. Analysts have been encouraged by the results and are optimistic about SouthState’s prospects. Investors should keep an eye on the company’s future performance and monitor any new developments closely.

Recent Posts