Preferred Bank Reports Stellar Earnings and Revenue Results in Q2

April 19, 2023

Trending News 🌥️

Preferred Bank ($NASDAQ:PFBC), a leading national financial services provider, has reported stellar results for the second quarter of the year. According to the financial report, the bank earned GAAP earnings per share of $2.61, a figure that exceeded analysts’ expectations by $0.05. Revenue for the quarter was also impressive, coming in at $75.65M, which was $0.81M more than what analysts had anticipated. From traditional banking services such as loans, checking and savings accounts, to more specialized services such as wealth management and trust services, Preferred Bank is committed to delivering quality financial services to its clients.

These impressive earnings and revenue figures demonstrate the strength of Preferred Bank’s business model and its commitment to delivering quality service. Investors should take note of this positive news and consider buying Preferred Bank stock as a long-term investment.

Stock Price

The company’s stock opened at $51.4 and closed at $50.2, down by 1.8% from the previous day’s closing price of 51.2. Overall, Preferred Bank reported solid earnings and revenue results for the quarter, indicating that their financial performance is very healthy. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Preferred Bank. More…

| Total Revenues | Net Income | Net Margin |

| – | 128.84 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Preferred Bank. More…

| Operations | Investing | Financing |

| 143.76 | -699.89 | 273.05 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Preferred Bank. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.43k | 5.79k | – |

Key Ratios Snapshot

Some of the financial key ratios for Preferred Bank are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.2% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

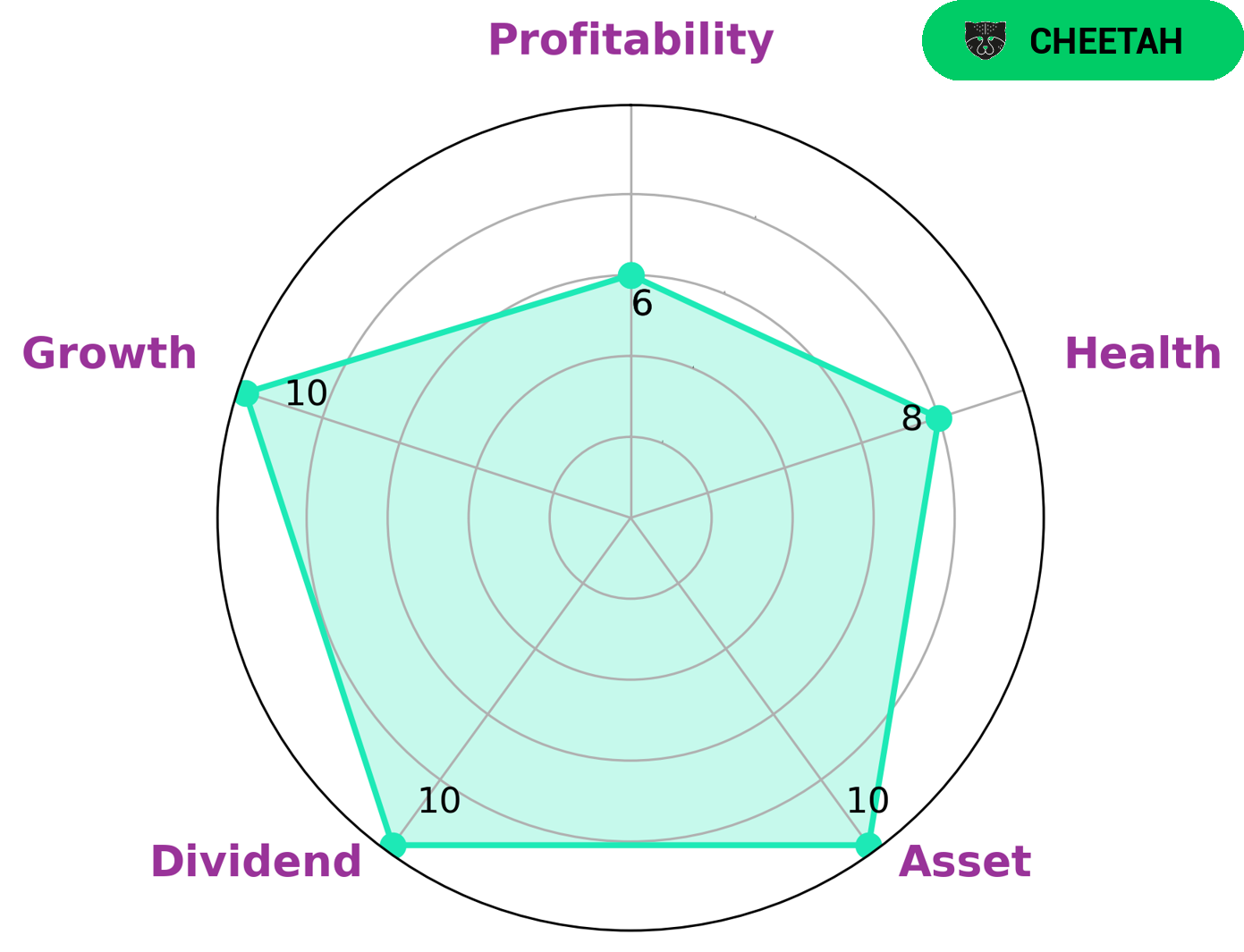

GoodWhale recently conducted an analysis of PREFERRED BANK‘s wellbeing. The results revealed that PREFERRED BANK was classified as a ‘cheetah’ on the Star Chart, indicating a high rate of revenue or earnings growth but lower profitability and stability. This type of company may be attractive to investors such as growth-oriented or momentum-oriented investors, who are looking for investments with the potential for high returns. On the other hand, PREFERRED BANK scored 8/10 on GoodWhale’s Health Score, indicating that it is capable of paying off its debt and funding future operations. More…

Peers

The bank has over $11 billion in assets and operates over 60 branches in California, Texas, New York, Illinois, and Nevada. The bank offers a full range of banking services, including deposits, loans, credit cards, and online banking. The bank’s primary competitors are Touchmark Bancshares Inc, Solvay Bank, and PCB Bancorp.

– Touchmark Bancshares Inc ($OTCPK:TMAK)

Mark cap for Touchmark Bancshares Inc has been on a steady decline since 2016. In 2016, the market cap was $16.4 million. As of 2022, the market cap has declined to $13.9 million. The company provides banking and financial services to businesses and individuals in the United States. The company has a network of branches in Arizona, Colorado, and Texas.

– Solvay Bank ($OTCPK:SOBS)

Solvay Bank is a regional bank headquartered in Solvay, New York. The Bank has 36 full-service branches serving the Central New York market, which includes the cities of Syracuse, Rochester and Albany. Solvay Bank offers a full range of personal and business banking products and services, including checking and savings accounts, loans, mortgages, credit cards and investment services. The Bank is a subsidiary of Solvay Bank Corporation, a New York corporation.

– PCB Bancorp ($NASDAQ:PCB)

The company’s market cap is $280.46M as of 2022. It is a regional bank that serves the Philadelphia metropolitan area. The bank has over $2.5B in assets and operates more than 60 branches.

Summary

Preferred Bank is a company that recently reported its GAAP EPS at $2.61, beating analysts’ estimates by $0.05. The company also reported its revenue of $75.65M, surpassing expectations by $0.81M. This could be an attractive investment opportunity as the company has managed to maintain positive financial results despite challenging market conditions. Investors should consider Preferred Bank as a potential portfolio addition for potential future gains on their portfolio.

Recent Posts