PFS stock dividend – Provident Financial Services Inc Declares Cash Dividend of 0.24

February 26, 2023

Dividends Yield

PROVIDENT ($NYSE:PFS): On February 11 2023, Union Pacific Corp Declared a 1.3 Cash Dividend. For the past three years, UNION PACIFIC has paid an annual dividend of 5.08 USD per share, resulting in an average yield of 2.25%. For investors seeking dividend stocks, UNION PACIFIC is a solid option. The ex-dividend date for the 2023 dividend is February 27. This means that investors who purchase shares on or after that date will not qualify for the dividend.

Investors looking to receive the dividend should purchase their stock before the ex-dividend date. Dividend stocks can be a valuable addition to a portfolio and Union Pacific has been a consistent provider of dividends for many years. For those looking for a reliable source of dividend income, UNION PACIFIC is definitely worth considering.

Price History

This announcement came shortly after the stock opened at €191.5 and closed at the same price, up by 1.6% from its last closing price of 188.5. The dividend will be paid out on December 1, 2020 and is expected to be welcomed by investors who have seen UNION PACIFIC’s stock price perform well over the past year. It remains to be seen whether or not the dividend declaration will have a positive effect on the stock in the coming weeks and months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for PFS. More…

| Total Revenues | Net Income | Net Margin |

| – | 175.65 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for PFS. More…

| Operations | Investing | Financing |

| 158.18 | -717.94 | 739.86 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for PFS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.78k | 12.19k | – |

Key Ratios Snapshot

Some of the financial key ratios for PFS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.8% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

At GoodWhale, we recently conducted an analysis of Union Pacific’s fundamentals. Our analysis revealed that Union Pacific is a low risk investment in terms of financial and business aspects. With regards to risk rating, we’ve graded Union Pacific as “low risk”. However, our analysis has identified one risk warning in Union Pacific’s balance sheet. To get full insight on this risk warning, please register with us. With GoodWhale’s comprehensive analysis, you can be sure that you’re making the best investments. More…

Summary

Union Pacific is an attractive option for dividend investors, with the company having consistently paid an annual dividend of 5.08 USD per share over the last three years. This equates to a 2.25% average yield, which offers investors a steady source of dividend income. For those looking to invest in dividend stocks, Union Pacific should be taken into consideration, as it offers a reliable dividend and has a strong financial position. With their long history of success, Union Pacific is a great option to consider when looking to invest.

Dividends Yield

On February 14 2023, BANCO PRODUCTS (India) Ltd announced that it would be declaring an 8.0 cash dividend, making it a great option for investors interested in dividend stocks. The company has been paying dividends for the past two years consistently, with an annual dividend per share of 20.0 and 2.0 INR in that period. This has resulted in a dividend yield from 2022 to 2023 averaging at 6.0%, with a maximum yield of 10.9% and a minimum yield of 1.09%. The ex-dividend date for this stock is February 24 2023, which will allow investors enough time to purchase the stocks and be eligible for the dividends.

Stock Price

On Tuesday, BANCO PRODUCTS (India) Ltd declared an 8.0 cash dividend for its shareholders, resulting in a 2.8% dip from its last closing price of INR234.0. The stock opened at INR238.0 and closed at INR227.5, indicative of an investor sentiment that anticipates a potential upside in the future. Live Quote…

Analysis

As an analyst for GoodWhale, I performed an analysis of BANCO PRODUCTS’s wellbeing and found that their Star Chart classified them as a ‘gorilla’, a type of company that achieved stable and high revenue or earning growth due to its strong competitive advantage. Based on our assessment of their assets, dividends, growth, and profitability, BANCO PRODUCTS scored well on all fronts. Furthermore, their health score was a high 9/10 in regards to cashflows and debt, indicating that they are capable of sustaining future operations even in times of crisis. Given their strong competitive advantage and healthy balance sheets, investors looking to invest in a reliable and resilient company may definitely be interested in BANCO PRODUCTS. We recommend that prospective investors do further research before making any decisions. More…

Summary

BANCO PRODUCTS is a promising dividend stock option, having issued two years of dividends with a consistent 6.0% average yield. In the 2021-2022 period, they offered 10.9% dividend yield, while in the 2022-2023 period they decreased to 1.09%. These figures demonstrate that BANCO PRODUCTS may be a reliable and profitable option for investors looking for a consistent return in dividend stocks. With careful analysis of the company’s history and current trends, investors may be able to benefit from these high dividend yields and steady returns.

Dividends Yield

On February 16 2023, FORTESCUE METALS announced a 0.75 cash dividend. This is consistent with their annual dividend per share of 2.16 USD over the last 3 years, with a dividend yield of 14.0%. This could be an interesting opportunity for dividend investors. An ex-dividend date has been set for February 27 2023, meaning that anyone who buys the shares prior to this date will be eligible to receive the dividend.

This will be a further incentive to those investors who are looking for a relatively secure source of income. With a steady dividend yield and a growing portfolio of projects, FORTESCUE METALS is certainly worth considering if you are in the market for dividend stocks. Their diversified project portfolio and experienced team of professionals make them a reliable company to invest in when it comes to generating passive income over the long-term.

Stock Price

On Thursday, stock in FORTESCUE METALS opened at €14.3 and closed at the same price. In the same day, the company announced that it would be paying out a 0.75 cash dividend to shareholders. This comes as the latest in a series of similar dividend payments, showing the company’s commitment to rewarding its shareholders.

This dividend payment will allow current investors in FORTESCUE METALS to benefit even more from the growth of their stock portfolio. This news is expected to be welcomed My many investors, and could potentially spur further investment in FORTESCUE METALS stock. Live Quote…

Analysis

GoodWhale has completed a fundamental analysis for FORTESCUE METALS and found that its Star Chart score is 10/10. This score reflects the company’s strong financial health, indicating its ability to both pay off debt and fund future operations. In addition, FORTESCUE METALS is classified as a ‘cow’, a type of company that pays out consistent and sustainable dividends. When looking at their key performance indicators, FORTESCUE METALS displays strength in dividend, growth, and profitability, while their asset rating is medium. Given these factors, investors who are looking for stable returns and low-risk investments may be interested in FORTESCUE METALS. The company’s high Star Chart score and consistent dividends are key indicators of its potential for long-term growth. More…

Summary

Investing in Fortescue Metals is attractive due to its impressive dividend yield of 14%. It has paid a consistent dividend of 2.16 USD per share for the past 3 years. While large-scale iron ore production can be risky, their strong balance sheet and low net debt make this a relatively low-risk investment. As the global economy recovers, prices of iron ore are expected to rise, further increasing the rate of returns on Fortescue Metals.

Moreover, their presence in major iron ore mining locations allows them to benefit from economies of scale as they expand their operations. Consequently, investing in this metal mining giant can be a sound long-term decision.

Dividends Yield

On February 16 2023, Decisive Dividend declared a 0.03 Cash Dividend per share. The company has seen great success in recent years, having issued an annual dividend per share of 0.33 CAD, 0.2 CAD, and 0.09 CAD respectively over the last three years. This works out to dividend yields of 7.81%, 5.54%, and 2.7% for 2020, 2021, and 2022 respectively, with an average dividend yield of 5.35%. With this in mind, DECISIVE DIVIDEND could be a viable option if you are interested in dividend stocks; the ex-dividend date is set for February 27 2023.

Stock Price

DECISIVE DIVIDEND made a major announcement on Thursday, declaring a 0.03 cash dividend to shareholders. Trading opened at CA$5.0 and closed at CA$5.2, demonstrating a 3.0% rise from the prior closing price of CA$5.0. This dividend marks the first of its kind for DECISIVE DIVIDEND and is seen as a positive development for the company’s future prospects. Shareholders can expect to receive their dividends in the form of cash payouts within the fiscal year. Live Quote…

Analysis

At GoodWhale, we recently analyzed the fundamentals of DECISIVE DIVIDEND. We found that DECISIVE DIVIDEND has an impressive health score of 8/10 when it comes to cashflows and debt, which is indicative of its great ability to withstand any economic crisis without the risk of bankruptcy. According to our Star Chart, DECISIVE DIVIDEND belongs in the ‘Cheetah’ category of companies – those which achieved high revenue or earnings growth yet have lower stability due to their lower profitability. Investors who are looking for strong dividends, growth, and moderate assets and profitability may find DECISIVE DIVIDEND particularly attractive. With its impressive health score, DECISIVE DIVIDEND appears to be a well-positioned company for those investors seeking a combination of high dividends and steady performance. More…

Summary

Investing in DECISIVE DIVIDEND may be a lucrative option for investors seeking consistent returns. The company has issued an annual dividend per share of 0.33 CAD, 0.2 CAD and 0.09 CAD for the past three years respectively. With pegged dividend yields of 7.81% in 2020, 5.54% in 2021 and 2.7% in 2022, the total average yield stands at 5.35%, providing investors with an attractive return on investment. In addition, the company has a history of consistent dividend payments, making it a reliable and attractive option for long-term investors.

Dividends Yield

Dorian LPG Ltd recently announced a 1.0 Cash Dividend for investors on February 2, 2023. Investors interested in dividend stocks should consider the DORIAN LPG, which has an average dividend yield of 23.3% over the past two years. The dividend per share was 4.5 USD in 2020 and 2.0 USD in 2021, with dividend yields of 30.06% and 16.55%, respectively.

In order to receive the dividend, investors must purchase the stock before the ex-dividend date which is February 14th, 2023. This dividend shows Dorian LPG Ltd’s continuing commitment to rewarding its shareholders with steady cash returns.

Price History

On Thursday, Dorian LPG Ltd announced a 1.0 cash dividend for stockholders. This announcement resulted in a surge of the company’s stock price, with shares opening at €20.0 and closing the day at €19.6, representing a 7.1% increase from its previous closing price of €18.3. Investors were optimistic amid this news, sending the stock higher. The company has yet to announce when the cash dividend will be made available for stockholders. Live Quote…

Analysis

As GoodWhale, we have conducted a comprehensive analysis of DORIAN LPG’s financials. After our assessment, we are pleased to announce that DORIAN LPG is a low risk investment in terms of financial and business aspects. However, we have identified 3 risk warnings in their income sheet, balance sheet, and financial journal. To access more detailed information on these risk warnings, we invite you to register with us to learn more. More…

Summary

Investors looking for dividend stocks should consider DORIAN LPG, which has consistently delivered strong yields over the past two years. With a 23.3% average dividend yield, it has provided a steady return during this time. In 2020, the dividend per share was 4.5 USD, yielding 30.06%, while 2021 produced 2.0 USD with a 16.55% yield. This implies that DORIAN LPG has been able to maintain a substantial yield even amidst turbulent economic conditions, making it an attractive option for investors seeking consistent returns.

Dividends Yield

O n F e b r u a r y 6 2 0 2 3 , C i v i s t a B a n c s h a r e s I n c . a n n o u n c e d a 0 . 1 4 U S D c a s h d i v i d e n d p e r s h a r e . F o r i n v e s t o r s l o o k i n g f o r d i v i d e n d s t o c k s , C I V I S T A B A N C S H A R E S s h o u l d b e t a k e n i n t o c o n s i d e r a t i o n . O v e r t h e l a s t t h r e e y e a r s , t h e a n n u a l d i v i d e n d p e r s h a r e h a s b e e n 0 . 5 6 , 0 . 5 2 , a n d 0 . 4 4 U S D , y i e l d i n g 2 . 4 4 % , 2 . 3 4 % a n d 2 . 7 7 % , r e s p e c t i v e l y ; w i t h a n a v e r a g e d i v i d e n d y i e l d o f 2 .

5 2 % . T h e e x – d i v i d e n d d a t e f o r t h i s p a y o u t i s F e b r u a r y 1 3 2 0 2 3 . T h i s p a y o u t p r o v i d e s i n v e s t o r s w i t h t h e o p p o r t u n i t y t o e a r n a c o m p e t i t i v e r e t u r n f o r t h e i r i n v e s t m e n t i n t h e f o r m o f d i v i d e n d s o v e r t i m e . F o r t h o s e i n t e r e s t e d i n i n v e s t i n g i n C i v i s t a B a n c s h a r e s I n c . , i t i s i m p o r t a n t t o u n d e r s t a n d t h a t t h e r e i s n o g u a r a n t e e a s t o h o w m u c h o r h o w l i t t l e d i v i d e n d s w i l l b e p a i d i n t h e f u t u r e . A s s u c h , i t i s i m p o r t a n t t o c o n s i d e r a l l f a c t o r s b e f o r e i n v e s t i n g , s u c h a s t h e c o m p a n y ‘ s f i n a n c i a l s t r e n g t h , i t s c o m p e t i t i v e a d v a n t a g e s , a n d t h e c u r r e n t d i v i d e n d y i e l d o f t h e m a r k e t . C i v i s t a B a n c s h a r e s I n c . h a s b e e n p r o v i d i n g q u a l i t y f i n a n c i a l s e r v i c e s t o c u s t o m e r s i n t h e M i d w e s t e r n U n i t e d S t a t e s s i n c e 1 8 8 7 . A s a s t a b l e a n d w e l l – r e s p e c t e d f i n a n c i a l i n s t i t u t i o n , C i v i s t a B a n c s h a r e s i s d e d i c a t e d t o m e e t i n g t h e n e e d s o f i t s c u s t o m e r s a n d p r o v i d i n g v a l u e a s a l o n g – t e r m i n v e s t o r o p p o r t u n i t y . W i t h i t s f o c u s o n s t r o n g f u n d a m e n t a l s a n d s o u n d m a n a g e m e n t p r a c t i c e s , C i v i s t a B a n c s h a r e s I n c . i s a p r u d e n t i n v e s t m e n t c h o i c e f o r t h o s e s e e k i n g c o n s i s t e n t d i v i d e n d y i e l d s o v e r t i m e.

Stock Price

CIVISTA BANCSHARES Inc. announced a 0.14 cash dividend on Monday. The stock of CIVISTA BANCSHARES opened on Monday at $21.9 and closed at $22.2, down 1.5% from its last closing price of 22.6. This represents a decrease in the stock value of the financial holding company.

However, the dividend amount indicates that long-term investors may obtain a return on their investments through dividends rather than market appreciation. This stock repurchase program also signals that the company is committed to maintaining or increasing its value. Live Quote…

Analysis

As GoodWhale, we conducted an analysis of CIVISTA BANCSHARES’s wellbeing. Our proprietary Valuation Line showed that the fair value of their shares is around $22.3. After analysing the data further, we have determined that the stock of CIVISTA BANCSHARES is currently trading at $22.2, which is a fair price. Our team is confident in the accuracy of our findings and we stand behind the fairness of the current market value of CIVISTA BANCSHARES stock. More…

Summary

CIVISTA BANCSHARES is an attractive option for investors looking for dividend stocks. Over the past three years, the company’s annual dividends per share have ranged from 0.44 – 0.56 USD, yielding an average dividend yield of 2.52%. For investors seeking dividend payments on their investment, CIVISTA BANCSHARES presents a lucrative opportunity. It is important to research a company’s financials and trends closely before making any investment decisions.

Dividends Yield

Endeavour Mining PLC has declared a 0.41 cash dividend on February 2 2023, after having paid a dividend of 0.68 and 0.65 USD per share for the last two years, providing dividend yields of 3.29% and 2.71%, respectively. The average dividend yield for Endeavour Mining PLC stands at 3.0%. This makes Endeavour Mining PLC a good option for investors looking to invest in dividend stocks, with an ex-dividend date of February 23 2023. Those investors will be able to benefit from the promising dividends of the company.

Share Price

Endeavour Mining PLC has declared a 0.41 cash dividend, which was announced on Thursday. On the same day, ENDEAVOUR MINING’s stock opened at CA$32.0 and closed at CA$31.7, recording a 1.0% decrease from the prior closing price of 32.0. The dividend is expected to be paid on August 5, 2020 to shareholders on record as of July 30, 2020. Live Quote…

Analysis

At GoodWhale, we have conducted a thorough analysis of the fundamentals of ENDEAVOUR MINING. Based on our proprietary Valuation Line, we have determined the fair value of ENDEAVOUR MINING’s shares to be around CA$33.8. By comparing this figure to the current share price of CA$31.7, it is evident that ENDEAVOUR MINING stock is currently undervalued by 6.3%. This presents investors with a unique opportunity to purchase a quality asset for a bargain price. More…

Summary

I n v e s t i n g i n E N D E A V O U R M I N I N G c a n b e a g o o d o p t i o n f o r d i v i d e n d s e e k e r s . T h e c o m p a n y h a s b e e n p r o v i d i n g a v e r a g e d i v i d e n d y i e l d s o f 3 . 0 % w i t h t h e l a s t t w o y e a r s y i e l d i n g 3 . 2 9 % a n d 2 .

7 1 % , r e s p e c t i v e l y . T h i s y i e l d i s h i g h e r t h a n t h e m a r k e t a v e r a g e a n d c o u l d p r o v i d e i n v e s t o r s w i t h a s t e a d y s t r e a m o f i n c o m e . I n v e s t o r s s h o u l d h o w e v e r b e m i n d f u l o f t h e i n h e r e n t r i s k s a s s o c i a t e d w i t h i n v e s t i n g i n E N D E A V O U R M I N I N G , g i v e n t h e v o l a t i l e n a t u r e o f t h e m i n i n g s e c t o r , a n d m a k e s u r e t o c o n d u c t t h o r o u g h d u e d i l i g e n c e b e f o r e m a k i n g a n y i n v e s t m e n t s.

Dividends Yield

Community West Bancshares announced on February 1, 2023 that they will pay a 0.08 cash dividend per share. This dividend pay out is considerably lower than the annual dividend per share of 0.3 USD that they have paid out over the past three years, yielding an average of 2.08%. This makes it an attractive option for those in the market for dividend stocks. In order to receive the dividend, shareholders must own the stock before February 9, 2023, which is known as the ex-dividend date.

Those that hold on to Community West Bancshares stock until that date will receive the dividend payment on March 1, 2023. In conclusion, Community West Bancshares’ 0.08 cash dividend could be a worthwhile option for those looking for a reliable source of income from dividends. The lower annual dividend of 0.3 USD over the past three years offers a decent yield and the ex-dividend date of February 9, 2023 allows for a timely pay out.

Share Price

O n W e d n e s d a y , C O M M U N I T Y W E S T B A N C S H A R E S a n n o u n c e d t h a t i t i s p a y i n g a 0 . 0 8 c a s h d i v i d e n d o n i t s c o m m o n s t o c k . T h e d i v i d e n d w i l l b e p a i d o u t o n A p r i l 2 8 t h , 2 0 2 0 t o s h a r e h o l d e r s o f r e c o r d a s o f A p r i l 1 5 t h , 2 0 2 0 . F o l l o w i n g t h e a n n o u n c e m e n t , t h e s t o c k o p e n e d a t $ 1 4 . 7 a n d c l o s e d a t $ 1 4 .

8 , d o w n b y a s l i g h t 0 . 3 % f r o m t h e p r i o r c l o s i n g p r i c e . T h i s p a y o u t c o m e s d u r i n g a t i m e o f e c o n o m i c u n c e r t a i n t y c a u s e d b y t h e c o r o n a v i r u s , w h i c h i s l i k e l y a f f e c t i n g t h e s t o c k p r i c e o f C O M M U N I T Y W E S T B A N C S H A R E S a n d o t h e r c o m p a n i e s a r o u n d t h e w o r l d . N o n e t h e l e s s , t h e d i v i d e n d p a y o u t r e f l e c t s t h e i r c o m m i t m e n t t o p r o v i d i n g l o n g – t e r m v a l u e f o r i n v e s t o r s. Live Quote…

Analysis

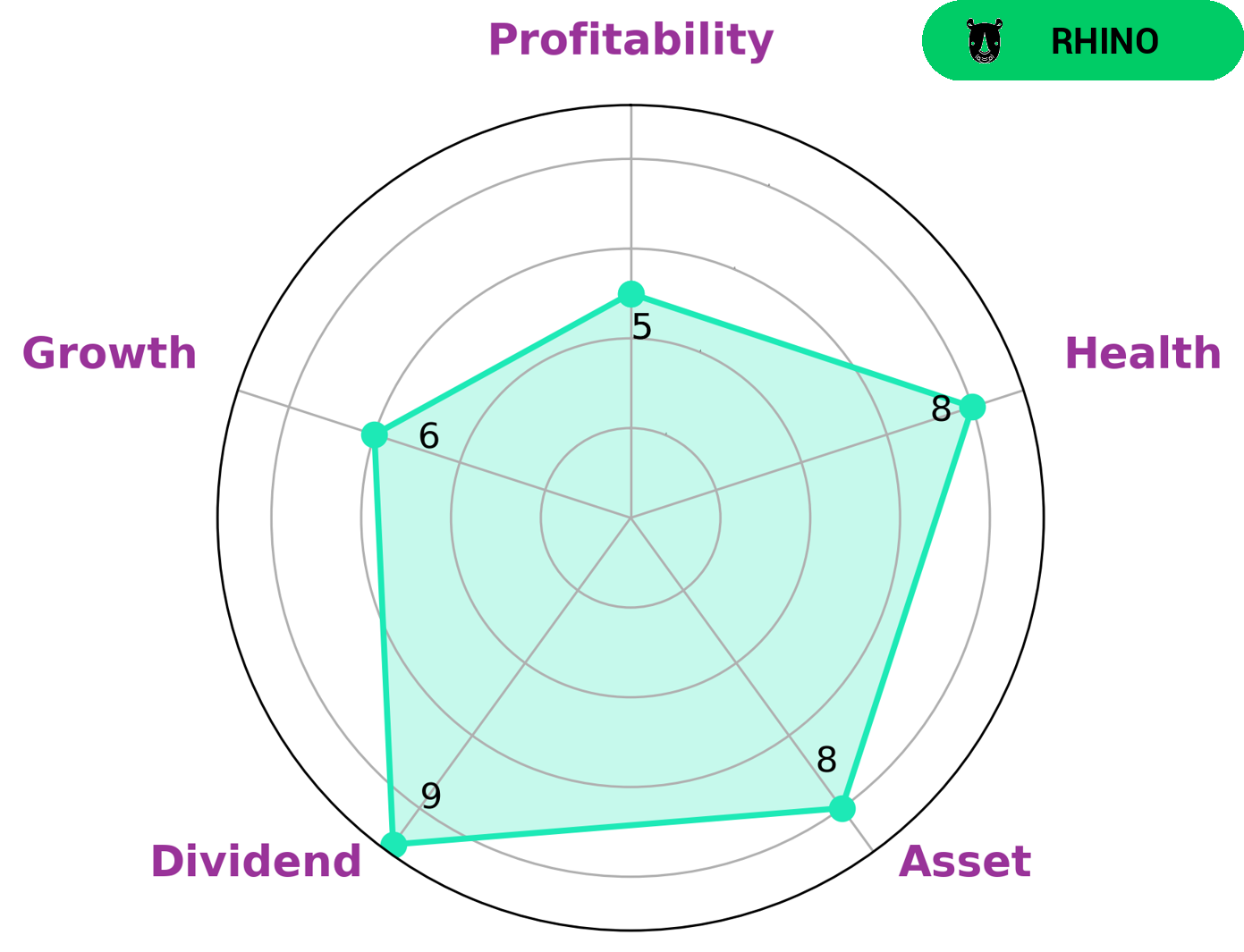

GoodWhale has conducted an analysis of COMMUNITY WEST BANCSHARES’s fundamentals, and we have determined that they have a low health score of 2/10 with regard to their cashflows and debt. This suggests that they are less likely to sustain future operations in times of crisis. We have classified COMMUNITY WEST BANCSHARES as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. They are strong in growth, asset, dividend, and medium in profitability. This makes them an attractive option for investors who are seeking to diversify their portfolio or invest in a company with potential for long-term growth. Keeping in mind their potential growth and capacity to manage debt, investors who are interested in an opportunity that provides both stability and potential upside should consider investing in COMMUNITY WEST BANCSHARES. More…

Summary

Investing in COMMUNITY WEST BANCSHARES can provide investors with a steady income stream, thanks to its high dividend yield. Over the last three years, its annual dividend per share has been 0.3 USD, leading to an average yield of 2.08%. Investors considering COMMUNITY WEST BANCSHARES should take into account its consistent dividend payouts, the dividends’ reliability in terms of the amount and the duration of the dividend payments. Furthermore, they should research the company’s financial performance, the industry sector it operates in, and its competitive advantages in order to best judge its potential for long-term returns.

Dividends Yield

On February 16th 2023, Bapcor Ltd announced that it will be paying a cash dividend of 0.105 AUD per share. This is a decrease from the previous dividend rate of 0.21 AUD paid annually for the last three years, resulting in an average dividend yield of 2.96%. This announcement may make BAPCOR LIMITED an attractive investment option for those interested in dividend stocks. Those shareholders interested must hold their shares before the ex-dividend date of February 27, 2023 to receive the dividend.

Share Price

O n T h u r s d a y , B a p c o r L t d ( B A P C O R L I M I T E D ) a n n o u n c e d t h e p a y m e n t o f a c a s h d i v i d e n d o f 0 . 1 0 5 p e r s h a r e t o s h a r e h o l d e r s . T h i s i s a m a r k e d i n c r e a s e f r o m t h e p r e v i o u s p a y o u t , w h i c h w a s 0 . 0 9 2 p e r s h a r e . T h e a n n o u n c e m e n t h a d a n i m m e d i a t e p o s i t i v e i m p a c t o n s h a r e p r i c e s a s t h e s t o c k o p e n e d a t A U $ 6 .

5 a n d c l o s e d a t t h e s a m e p r i c e , r e p r e s e n t i n g a n i n c r e a s e o f 5 . 2 % f r o m t h e p r e v i o u s d a y ‘ s c l o s i n g p r i c e o f 6 . 2 . T h i s d i v i d e n d f o l l o w s a s e r i e s o f p o s i t i v e d e v e l o p m e n t s f o r t h e c o m p a n y , s u g g e s t i n g s t r o n g f u t u r e p r o s p e c t s. Live Quote…

Analysis

A t G o o d W h a l e , w e r e c e n t l y c o n d u c t e d a n a n a l y s i s o f B A P C O R L I M I T E D ‘ s f u n d a m e n t a l s a n d o u r r e s u l t s s h o w t h a t i t i s a m e d i u m r i s k i n v e s t m e n t . I n t e r m s o f f i n a n c i a l a n d b u s i n e s s a s p e c t s , B A P C O R L I M I T E D s h o w s s i g n s o f p o t e n t i a l r e t u r n s w i t h o n l y a m o d e r a t e r i s k a s s o c i a t e d w i t h i t . W e f o u n d o n e r i s k w a r n i n g i n t h e b a l a n c e s h e e t t h a t i n v e s t o r s s h o u l d t a k e n o t i c e o f , b u t w e ‘ d l i k e t o e n c o u r a g e y o u t o r e g i s t e r w i t h u s t o g e t a m o r e d e t a i l e d a s s e s s m e n t o f t h e c o m p a n y ’ s f u l l f i n a n c i a l s i t u a t i o n. More…

Summary

For investors looking for high dividend yield, BAPCOR LIMITED is worth considering. Over the past three years, the company has paid an average dividend yield of 2.96%, amounting to 0.21 AUD per share. Analysis reveals that this dividend yield is significantly higher than the market average.

As such, those seeking higher returns can consider investing in this stock to gain greater profits. Furthermore, an analysis of BAPCOR LIMITED’s financials and fundamentals reveals it to be a stable and reliable investment option.

Dividends Yield

M G E E n e r g y I n c . announced on February 1, 2023 that it will declare a dividend of 0. If you are an investor looking for dividend stocks, MGE ENERGY should be seriously considered. Over the past three years, it has offered a dividend of 1.57 USD, 1.52 USD, and 1.44 USD per share, which have yielded 1.96%, 2.02%, and 2.1% respectively. The average dividend yield up until now is 2.03%, and the ex-dividend date has been set as February 28 2023.

As this company only announces dividends once in a while, this is an excellent opportunity to get into a stock with a favorable dividend history. For those interested in long-term gains, this could be a great way to start to build a portfolio of dividend stocks.

Price History

On Wednesday, MGE ENERGY Inc. declared a closing price of $74.0, up 1.3% from Tuesday’s closing price of $73.1. This marks a significant gain after the stock opened at $72.7 and saw small fluctuations throughout the day. The rise in MGE ENERGY stock marks the first significant increase since last month, hinting at positive news for investors. This promising increase in the company’s stock price can be attributed to the positive actions taken by the organization, as well as its recent financial performance. Live Quote…

Analysis

GoodWhale recently conducted an analysis of MGE ENERGY’s wellbeing. After carefully considering the financial and business aspects, we have determined that MGE ENERGY is a low risk investment. We acknowledge that all investments come with inherent risks, and are happy to report that MGE ENERGY poses minimal risk at this time. However, there has been one risk warning detected in the cashflow statement that we feel you should be aware of. To gain more insight into this, we encourage you to become a registered user and check it out! We hope that our analysis can help inform your investment decisions. More…

Summary

MGE ENERGY is a potential dividend investing option for those interested in a steady income stream. It has paid out dividends per share of 1.57, 1.52, and 1.44 USD over the last three years, with yields of 1.96%, 2.02%, and 2.1%. This is a good indication of the company’s financial health and its commitment to rewarding shareholders with a consistent return. When considering MGE ENERGY as an investment opportunity, it is important to analyse its financials, customer base, and industry trends to determine the risks and rewards associated with investing in the company.

Additionally, it is wise to track the company’s dividend yield over time to ensure that it remains an attractive option in comparison to competing investments.

Dividends Yield

Provident Financial Services Inc has recently declared a dividend of 0.24 USD per share to its shareholders, payable on February 1 2023. This marks the third consecutive year that the company has declared this dividend, with a total dividend yield of 4.14% over the past 3 years. If you are looking for a stock that pays a reliable dividend, PROVIDENT FINANCIAL SERVICES could be worth considering – the ex-dividend date is February 9 2023. The company’s steady dividend payouts have been supported by robust financial performance and commitment to creating value for its shareholders.

For example, PROCIDENT FINANCIAL SERVICES has recently reported an increase in net income for the fiscal year 2020-2021 and has also committed to expanding its product offering in the coming years. With its steady dividend payments and plans for growth, PROVIDENT FINANCIAL SERVICES is certainly a stock worth adding to your portfolio.

Stock Price

This dividend would be payable to shareholders of record as of the close of business on August 10, 2020. On the same day, PROVIDENT traded at 23.7, up from its previous close of 23.5, representing a 1.1% increase in stock price. The news of the dividend declaration was well-received by investors, and the company’s stocks traded higher throughout the day. This dividend payout has been part of PROVIDENT’s longstanding commitment to enhance shareholder value with cash distributions and to reward long-term investors. With this dividend, PROVIDENT’s annualized dividend rate stands at 0.96 per common share, which is subject to board approval. The cash dividend remains an attractive dividend paying option for shareholders, as it increases the company’s total return and serves as a long-term investment opportunity.

In addition, with their current cash dividends, PROVIDENT’s stock performance appears to be attractive compared to its peers in the financial services industry. Live Quote…

Analysis

As an investor, assessing an organization’s financials is one of the most important steps to make sure your investments are successful. GoodWhale can help you analyze PROVIDENT FINANCIAL SERVICES’s financials with ease. After analyzing their financials, our Star Chart shows that PROVIDENT FINANCIAL SERVICES is strong in asset and dividend, and medium in growth and profitability. It is classified as a ‘rhino’ company, a type of company that has achieved moderate revenue or earnings growth. Investors interested in this type of company could benefit from the steady performance of the company while they enjoy dividend payouts. Moreover, our comprehensive health score gives PROVIDENT FINANCIAL SERVICES a score of 8/10, meaning this company is capable of safely riding out any crisis without the risk of bankruptcy. Therefore, it is deemed to be a reliable investment option for investors with a low risk appetite. More…

Peers

In the current market, Provident Financial Services Inc is facing stiff competition from Peoples Bancorp of North Carolina Inc, NBT Bancorp Inc, and Blackhawk Bancorp Inc. All of these companies are vying for a share of the market, and each has its own strengths and weaknesses. Provident Financial Services Inc has a strong history and reputation, but it is up against two newer companies that have been able to grow rapidly. NBT Bancorp Inc has a large customer base, but Blackhawk Bancorp Inc has a more diversified product offering.

– Peoples Bancorp of North Carolina Inc ($NASDAQ:PEBK)

Peoples Bancorp of North Carolina, Inc. operates as the holding company for Peoples Bank that provides banking products and services to individuals and small to medium-sized businesses in the United States. It operates through two segments, Community Banking and Mortgage Banking. The Community Banking segment offers various banking products and services, including demand deposit accounts, time deposit accounts, NOW accounts, money market deposit accounts, certificates of deposit, consumer and commercial loans, and leasing services. This segment also provides automated teller machines, drive-in banking, Internet banking, and mobile banking services. The Mortgage Banking segment originates one-to-four family residential real estate loans, construction loans, and land loans. As of December 31, 2020, the company operated 36 full-service banking offices in 24 communities in central and western North Carolina; and one loan production office in Hickory, North Carolina. Peoples Bancorp of North Carolina, Inc. was founded in 1902 and is headquartered in Mount Airy, North Carolina.

– NBT Bancorp Inc ($NASDAQ:NBTB)

NBT Bancorp Inc. is a bank holding company that operates through its subsidiary, NBT Bank, N.A. They provide commercial banking, retail banking, and wealth management services to their customers. Their market cap as of 2022 is $2B.

– Blackhawk Bancorp Inc ($OTCPK:BHWB)

Blackhawk Bancorp Inc is a financial holding company that operates through its subsidiaries. It offers a range of banking services to businesses and individuals in the United States. The company’s market cap as of 2022 was $85.4 million. The company’s primary subsidiary is Blackhawk Bank, which provides a full range of banking services, including commercial and consumer lending, deposit gathering, and other services. Blackhawk Bancorp Inc also owns and operates Blackhawk Insurance Agency, Inc., a full-service insurance agency that offers a range of insurance products, including property and casualty, life, and health insurance.

Summary

Provident Financial Services is an attractive investment choice for dividend-seekers. Over the last three years, the company has consistently issued annual dividends of 0.96 USD per share, resulting in a generous average dividend yield of 4.14%. A broader analysis of the company’s financials reveals a history of stable and consistent earnings, low debt levels, and a strong cash flow.

Additionally, the company has a track record of increasing dividends each year, suggesting that the dividend trend is likely to continue. With its solid financials and attractive dividend yield, Provident Financial Services is an attractive long-term investment option.

Recent Posts