Patrick Joseph Ward Cashes Out 1,305 Shares of WSFS Financial Stock

December 25, 2022

Trending News ☀️

WSFS ($NASDAQ:WSFS) Financial is a financial services company based in Wilmington, Delaware. WSFS Financial provides a variety of financial services, including retail banking, commercial banking, trust services, asset management, and mortgage lending. Recently, WSFS Financial’s Executive Vice President, Patrick Joseph Ward, sold 1,305 shares of the company’s stock. The sale of these shares is likely to have a positive impact on the stock price of WSFS Financial. Patrick Joseph Ward’s decision to divest his shares of the company suggests that he believes that the stock is undervalued and that further growth is likely. This is not the first time that Patrick Joseph Ward has sold off a large portion of his WSFS Financial holdings.

In addition to this sale, Ward has also been actively involved in the company’s operations. He has held executive positions in WSFS Financial’s wealth management and trust divisions and has been instrumental in helping the company to expand its market share. This could be a positive sign for investors and could potentially lead to an increase in the stock price of WSFS Financial in the future.

Stock Price

At the time of writing, WSFS Financial stock opened at $45.0 and closed at $44.7, up by 0.2% from its last closing price of 44.6. Patrick Joseph Ward has been an investor in WSFS Financial for many years, and this move marks a significant exit from his portfolio. This news is being received well by the market, as investors see it as a strong sign of confidence in the company’s future. The stock price has remained relatively steady despite the news, indicating that investors are not overly concerned about the move.

Overall, this news is being seen as a positive sign for WSFS Financial. The company has been consistently performing well in recent years and is expected to continue to do so in the near future. Investors remain optimistic about the company’s prospects and are excited to see what the future holds. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Wsfs Financial. More…

| Total Revenues | Net Income | Net Margin |

| – | 194.21 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Wsfs Financial. More…

| Operations | Investing | Financing |

| 125.65 | -1.49k | 1.24k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Wsfs Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 19.99k | 17.88k | – |

Key Ratios Snapshot

Some of the financial key ratios for Wsfs Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.8% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

VI Analysis

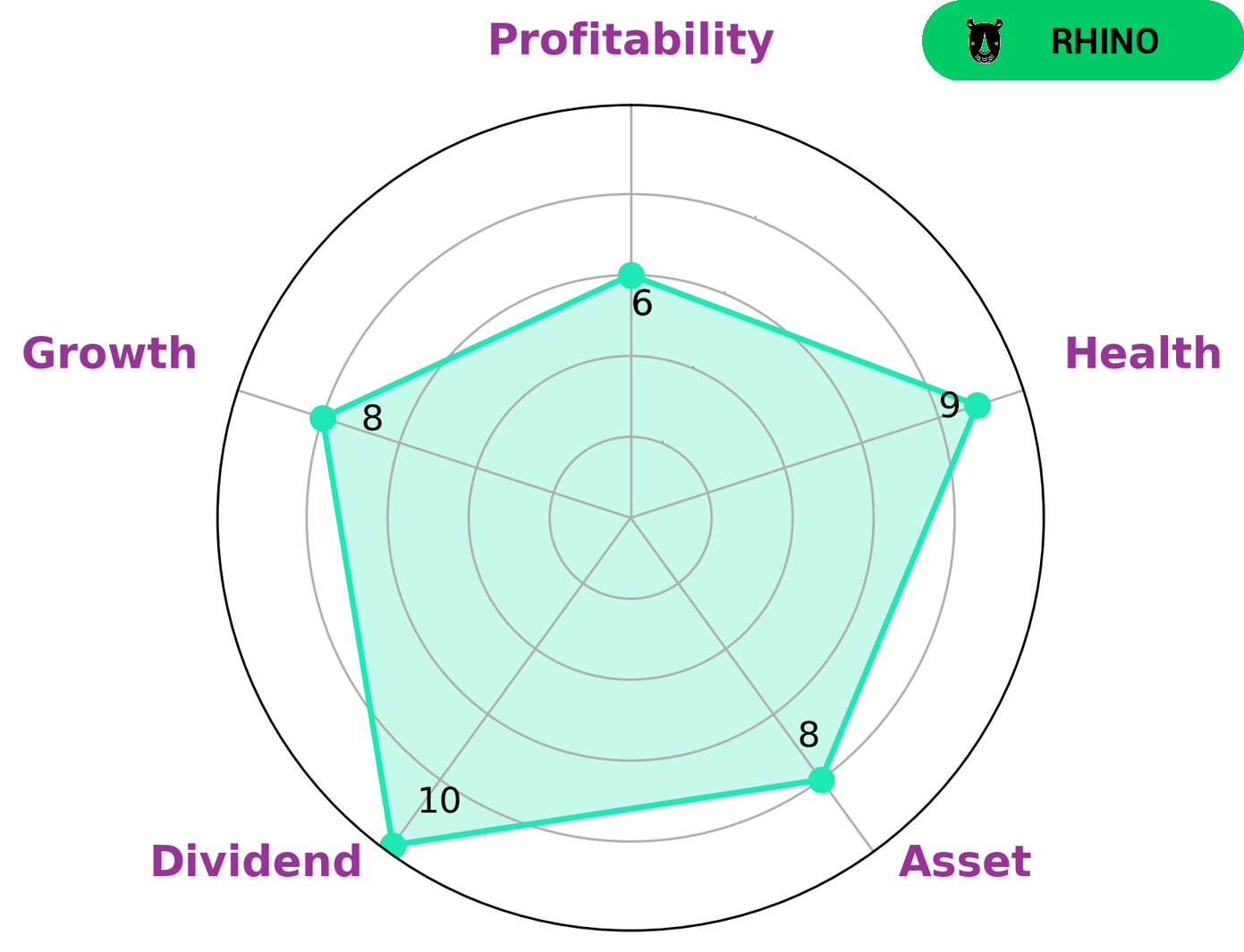

WSFS FINANCIAL is a company with strong fundamentals, easily discernible through the VI app. The VI Star Chart gives it a high health score of 9/10 for its cashflows and debt, indicating that it is capable of paying off its debt and funding future operations. It is classified as a ‘rhino’, which is a rating that acknowledges companies with moderate revenue or earnings growth. Investors seeking to benefit from such a company may be those looking for strong growth, asset, and dividend potential, as well as medium profitability. WSFS FINANCIAL has a strong average return on equity, indicating that its management is adept at making the most of its resources. It also has an impressive debt-to-equity ratio, meaning that it is able to fund operations without needing to borrow too much money. WSFS FINANCIAL has a healthy dividend yield, meaning that investors can look forward to regular returns if they choose to invest in the company. Additionally, its balance sheet is secure, with high liquidity and a low number of long-term liabilities. This means that if there are unforeseen events in the future, the company can easily adjust and survive. Overall, WSFS FINANCIAL has strong fundamentals that make it an attractive investment option for investors who are looking for moderate growth and medium profitability. It is well-equipped to meet its financial obligations, and offers good returns through its dividends. More…

VI Peers

WSFS Financial Corp is competing in a highly competitive landscape against a number of other financial institutions, such as Regions Financial Corp, HarborOne Bancorp Inc, and Enterprise Bancorp Inc. All of these companies are striving to provide the best possible products and services to their customers, making it essential for WSFS Financial Corp to continue to innovate and stay ahead of the competition.

– Regions Financial Corp ($NYSE:RF)

Regions Financial Corporation is a financial services company headquartered in Birmingham, Alabama. As of 2022, it has a market cap of 19.83B, making it one of the largest regional banks in the United States. The company provides banking, investment, mortgage, and insurance products and services throughout the United States. Regions has 1,500 banking offices located in 16 states throughout the Southern, Midwestern and Southeastern United States. It is a publicly traded company listed on the New York Stock Exchange under the ticker symbol RF. The company has been providing financial services to customers since 1971 and is a member of the S&P 500 Index.

– HarborOne Bancorp Inc ($NASDAQ:HONE)

HarborOne Bancorp Inc is a financial holding company based in Brockton, Massachusetts. It operates HarborOne Bank, a federally chartered savings bank with over twenty branches in Massachusetts and Rhode Island. As of 2022, HarborOne Bancorp Inc has a market cap of 691.1M. This market cap is a reflection of the company’s profitability, as well as its ability to create value for its shareholders through its banking services. HarborOne Bank offers a wide range of banking services, including personal and commercial lending and deposit products, as well as wealth management, trust services, and financial planning services.

– Enterprise Bancorp Inc ($NASDAQ:EBTC)

Enterprise Bancorp Inc is a publicly traded company that operates as a financial holding company. The company provides commercial banking services to small and medium-sized businesses, individuals, and families. As of 2022, Enterprise Bancorp Inc has a market cap of 427.37M. This market cap is determined by multiplying the current market price of the company’s shares by the total number of shares outstanding. The market cap is an important metric for investors to consider when evaluating a company’s potential investment opportunities. With its strong balance sheet and impressive earnings, Enterprise Bancorp Inc is a strong contender in the banking industry.

Summary

Investing in WSFS Financial can be a great opportunity for those looking to diversify their portfolios. The company is a diversified financial services company that provides a range of services, including banking, mortgage lending, insurance and wealth management. WSFS Financial has a strong presence in the Delaware Valley and the Mid-Atlantic region and is committed to growing its business and expanding its services. The company has been able to generate consistent returns for its shareholders over the years and is well-positioned to benefit from the current macroeconomic environment. WSFS Financial has a solid balance sheet and is able to generate healthy returns on equity. The company has a strong management team and is well-positioned to take advantage of potential opportunities in the market. WSFS Financial has a wide range of products and services that are tailored to meet the needs of both individual and institutional investors. The company offers a variety of banking products such as checking, savings, loans, and credit cards. It also offers a variety of investment products such as stocks, bonds, mutual funds, and ETFs.

The company’s insurance products are designed to provide customers with protection against financial risk. WSFS Financial also offers wealth management services, which include planning, investing, and managing assets. In addition to its traditional banking and investment services, WSFS Financial also provides online banking, mobile banking, and other digital services. This makes it easier for customers to access their accounts, manage their finances, and make transactions from anywhere in the world. Overall, investing in WSFS Financial can be a great choice for investors looking for solid returns and a diversified portfolio. The company has a strong balance sheet and a strong management team that can take advantage of potential opportunities in the market. The wide range of products and services it offers makes it easy for customers to access their accounts and manage their finances.

Recent Posts