OCEANFIRST FINANCIAL Earnings Fall Short of Street Estimate in Q1

May 6, 2023

Trending News 🌥️

OCEANFIRST FINANCIAL ($NASDAQ:OCFC), a financial services holding company based in New Jersey, recently announced their earnings for Q1 of this year. The company reported earnings of $0.55 per share, which fell short of the analyst consensus estimate of $0.64. OCEANFIRST FINANCIAL is a leading provider of banking services in the Mid-Atlantic region. The company has been providing a wide range of banking and financial services for over a century, and is known for its commitment to providing customers with quality service and value.

The stock price of the company dropped by nearly 5% in after-hours trading. Despite this, analysts remain cautiously optimistic about the future of the company and its potential to outperform expectations in the coming quarters.

Earnings

In its earning report of FY2023 Q1 as of March 31 2023, OCEANFIRST FINANCIAL reported total revenue of 5.24M USD, which fell short of the street estimate. This is a 8.7% decrease in total revenue compared to the same quarter last year. Over the past three years, OCEANFIRST FINANCIAL’s total revenue has increased from 5.06M USD to 5.24M USD. Despite this increase, the company’s earnings have not been able to meet the expectations of investors.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Oceanfirst Financial. More…

| Total Revenues | Net Income | Net Margin |

| – | 144.71 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Oceanfirst Financial. More…

| Operations | Investing | Financing |

| 250.45 | -1.32k | 1.01k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Oceanfirst Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.56k | 11.94k | – |

Key Ratios Snapshot

Some of the financial key ratios for Oceanfirst Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.9% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Share Price

The stock opened at $13.8 and closed at $13.5, a reduction of 6.0% from the last closing price of $14.3. This was a major dip for the company, and caused investors to worry about how it will fare in the future. Analysts had predicted that the bank would do well in the first quarter, but it appears to have underperformed. The CEO of OCEANFIRST FINANCIAL stated that he is confident that the bank will be able to recover and meet their goals in the quarters to come. He went on to explain that they are focusing on expanding their customer base and expanding into other markets to increase their revenue.

Going forward, OCEANFIRST FINANCIAL will need to focus on long-term strategies in order to recover from this setback. They need to improve customer satisfaction and create innovative products in order to gain more customers and increase their profits. They will also have to keep an eye on their competitors and work to stay ahead of the game. Live Quote…

Analysis

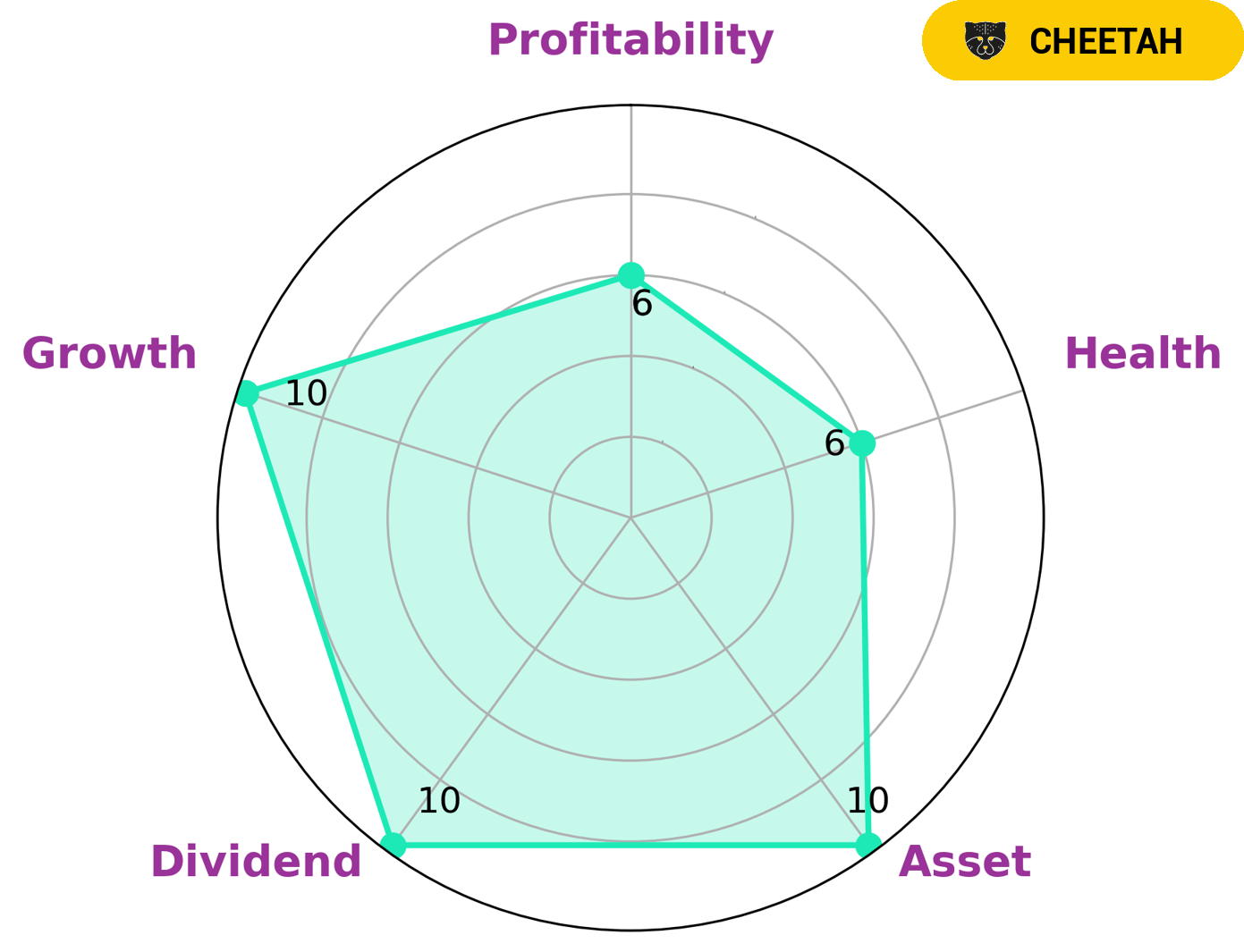

At GoodWhale, we recently conducted an analysis of the fundamentals of OCEANFIRST FINANCIAL, a publicly traded company. Our Star Chart showed that OCEANFIRST FINANCIAL scored highly in growth, asset, and dividend levels and was classified as ‘cheetah’, meaning it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given its high growth potential yet relatively lower stability score, this type of company may be of interest to certain types of investors, such as growth investors looking for higher returns, or those with a higher risk appetite. Additionally, the company’s intermediate health score of 6/10 with regard to its cashflows and debt indicates that it may be able to sustain future operations in times of crisis, suggesting that it could be a good investment for some investors. More…

Peers

OceanFirst Financial Corp faces competition from a range of financial organizations, including QNB Corp, SmartFinancial Inc, and First Bancshares Inc/MO/. As the banking industry continues to evolve and adjust to the changing economic landscape, OceanFirst Financial Corp must strive to remain competitive in order to stay ahead of its rivals.

– QNB Corp ($OTCPK:QNBC)

QNB Corp is a financial services company that provides banking, investment, and insurance services to individuals, businesses, and communities. As of 2022, the company has a market cap of 94.24M. This market cap indicates the total value of the company’s outstanding shares. QNB Corp’s market capitalization is an important indicator of the company’s financial health, as it reflects the value of the company as perceived by investors. The larger the market cap, the more valuable the company is perceived to be by investors.

– SmartFinancial Inc ($NASDAQ:SMBK)

SmartFinancial Inc is a financial services company based in the United States. It provides banking services, insurance services, and wealth management services to individuals, businesses, and institutions. As of 2022, SmartFinancial Inc has a market cap of 469.66M. This market cap reflects the company’s estimated worth, which is determined by multiplying the company’s current share price by the total number of shares outstanding. Market capitalization is an important metric used to measure the overall size and value of a company. It is one of the most reliable indicators of a company’s financial performance and health.

– First Bancshares Inc /MO/ ($OTCPK:FBSI)

First Bancshares Inc /MO/ is a holding company that provides banking services in the Midwest United States. As of 2022, the company has a market cap of 44.99M and is traded on the NASDAQ exchange. With a market cap of 44.99M, First Bancshares Inc /MO/ is considered to be a mid-cap company and is a relatively small but profitable financial institution. The company’s main focus is on providing banking services such as consumer banking, corporate banking, investment banking, and wealth management services. In addition to this, First Bancshares Inc also offers trust services, mortgage services, and merchant services to its customers.

Summary

OCEANFIRST FINANCIAL reported first quarter earnings of $0.55 per share, significantly lower than the expected $0.64 per share. As a result, the stock price of OCEANFIRST FINANCIAL immediately dropped upon release of the earnings report, and investors should proceed with caution when considering an investment in the company. Analysts must review the company’s income statement, balance sheet and cash flow statements to determine if the poor performance was an isolated incident, or a sign of deeper issues. Those who are already invested should closely monitor performance going forward, as this quarterly miss could be a sign of future declines in earnings.

Recent Posts