OceanFirst Financial Corp. Schedules 2023 Earnings Conference Call

March 31, 2023

Trending News 🌥️

OCEANFIRST ($NASDAQ:OCFC): OceanFirst Financial Corp. has announced plans to hold an earnings conference call on 2023. During the call, management will discuss the company’s performance over the past year and provide an outlook for the future. Investors and analysts will find this call to be an invaluable source of information, as it will provide insight into the company’s strategy for growth and development. The call will also feature questions from investors and analysts, allowing them to get more detailed answers about the company’s performance and plans for the future.

This conference call is an important event for OceanFirst Financial Corp., as it provides an opportunity for the company to communicate their performance and plans to their investors and stakeholders. The insights gained from this call will help investors make informed decisions regarding their investments in OceanFirst Financial Corp., and it will also help the company to build strong relationships with its stakeholders.

Stock Price

ET to discuss its 2023 earnings results. On Monday, OCEANFIRST FINANCIAL stock opened at $19.5 and closed at $19.0, down by 0.7% from the prior closing price of 19.1. The conference call will be broadcast live over the internet and will also be available through a replay. Interested parties are invited to access the live audio webcast of the call through OCEANFIRST FINANCIAL’s Investor Relations website.

Additionally, interested parties may access a replay of the webcast through the same website. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Oceanfirst Financial. More…

| Total Revenues | Net Income | Net Margin |

| – | 142.59 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Oceanfirst Financial. More…

| Operations | Investing | Financing |

| 250.45 | -1.32k | 1.01k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Oceanfirst Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.1k | 11.52k | – |

Key Ratios Snapshot

Some of the financial key ratios for Oceanfirst Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.9% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

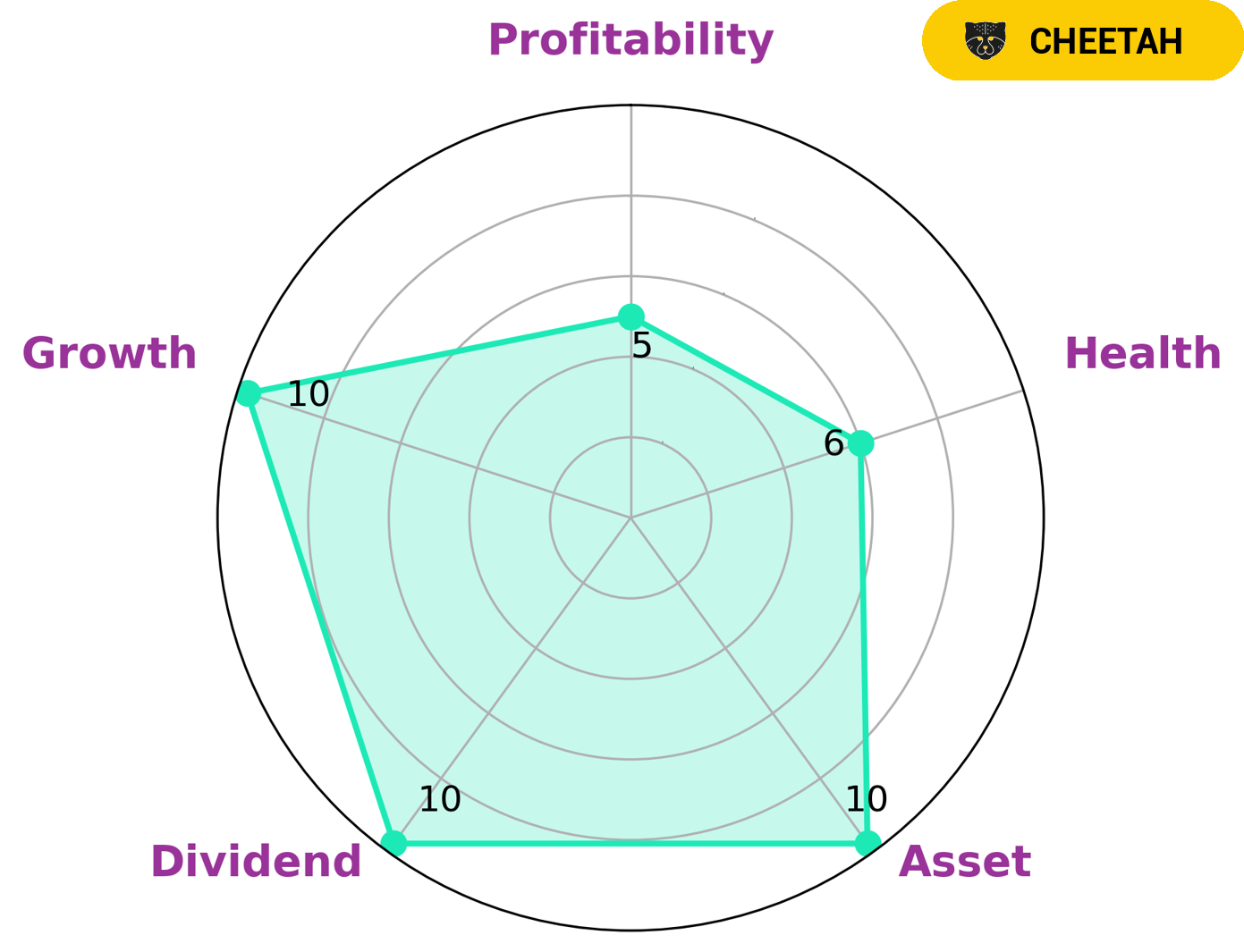

GoodWhale has conducted a thorough analysis of OCEANFIRST FINANCIAL‘s fundamentals, and based on our Star Chart assessment has concluded that their intermediate health score is 6/10 with regards to their cashflows and debt. This suggests that the company may be able to pay off its debt and fund future operations. OCEANFIRST FINANCIAL also performed strong in growth, asset and dividend, but was only medium in profitability. Based on this, we have classified the company as a ‘cheetah’ – a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are looking for companies with high growth potential but are comfortable with taking on some risk may find OCEANFIRST FINANCIAL an attractive option, as it is well positioned to take advantage of new opportunities while managing its debt load. Those investors who are looking for a more stable long-term investment may want to look elsewhere. More…

Peers

OceanFirst Financial Corp faces competition from a range of financial organizations, including QNB Corp, SmartFinancial Inc, and First Bancshares Inc/MO/. As the banking industry continues to evolve and adjust to the changing economic landscape, OceanFirst Financial Corp must strive to remain competitive in order to stay ahead of its rivals.

– QNB Corp ($OTCPK:QNBC)

QNB Corp is a financial services company that provides banking, investment, and insurance services to individuals, businesses, and communities. As of 2022, the company has a market cap of 94.24M. This market cap indicates the total value of the company’s outstanding shares. QNB Corp’s market capitalization is an important indicator of the company’s financial health, as it reflects the value of the company as perceived by investors. The larger the market cap, the more valuable the company is perceived to be by investors.

– SmartFinancial Inc ($NASDAQ:SMBK)

SmartFinancial Inc is a financial services company based in the United States. It provides banking services, insurance services, and wealth management services to individuals, businesses, and institutions. As of 2022, SmartFinancial Inc has a market cap of 469.66M. This market cap reflects the company’s estimated worth, which is determined by multiplying the company’s current share price by the total number of shares outstanding. Market capitalization is an important metric used to measure the overall size and value of a company. It is one of the most reliable indicators of a company’s financial performance and health.

– First Bancshares Inc /MO/ ($OTCPK:FBSI)

First Bancshares Inc /MO/ is a holding company that provides banking services in the Midwest United States. As of 2022, the company has a market cap of 44.99M and is traded on the NASDAQ exchange. With a market cap of 44.99M, First Bancshares Inc /MO/ is considered to be a mid-cap company and is a relatively small but profitable financial institution. The company’s main focus is on providing banking services such as consumer banking, corporate banking, investment banking, and wealth management services. In addition to this, First Bancshares Inc also offers trust services, mortgage services, and merchant services to its customers.

Summary

OceanFirst Financial Corp. has scheduled a 2023 earnings conference call for investors. This is an important step for potential investors to consider when evaluating the stock. Analysts will examine the company’s financial performance, including their profits, debts and other financial indicators.

Additionally, investors can use this opportunity to review the company’s business strategy, management team, and other factors to help determine an investment decision. OceanFirst Financial Corp. is an attractive option for investors, as it has a long-term track record of growth and profitability. Furthermore, its sound financials and experienced management team make it a safe and reliable investment.

Recent Posts