JLL Secures Financing for Two Beverly Hills Trophies for Wintrust Financial

June 9, 2023

☀️Trending News

Wintrust Financial ($NASDAQ:WTFC) Corporation, a financial holding company headquartered in Rosemont, Illinois, recently secured financing for two prestigious Beverly Hills properties with the help of JLL. This is a major success for Wintrust Financial, as the company continues to grow and develop its presence in the real estate market. Wintrust Financial offers a range of financial services, including commercial banking, wealth management, specialty leasing, and mortgage banking. The company specializes in providing quality financial services to small- and medium-sized businesses, primarily located in the Midwest and Great Lakes regions. The two Beverly Hills properties that Wintrust Financial secured financing for are located in prime locations in one of the most desirable cities in the world.

JLL was able to secure the financing for Wintrust Financial through its extensive network of contacts and comprehensive market knowledge. This recent financing deal is a testament to Wintrust Financial’s commitment to providing quality financial services to its clients. With the help of JLL, Wintrust Financial was able to acquire two prestigious Beverly Hills properties, further reinforcing their presence in the real estate market. The success of this deal is only the beginning for Wintrust Financial, as they continue to expand their presence throughout the Midwest and beyond.

Price History

On Thursday, WINTRUST FINANCIAL had a difficult day on the market, with their stock opening at $71.8 and closing at $71.1, down by 1.5% from prior closing price of 72.2. This marks a major milestone for the company, which is now one step closer to completing their mission of becoming a major player in the financial services industry. The financing will help Wintrust Financial build on its already strong foothold in the market and continue to expand its services and offerings. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Wintrust Financial. More…

| Total Revenues | Net Income | Net Margin |

| – | 534.52 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Wintrust Financial. More…

| Operations | Investing | Financing |

| 1.38k | -3.49k | 2.2k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Wintrust Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 52.87k | 47.86k | – |

Key Ratios Snapshot

Some of the financial key ratios for Wintrust Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.3% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

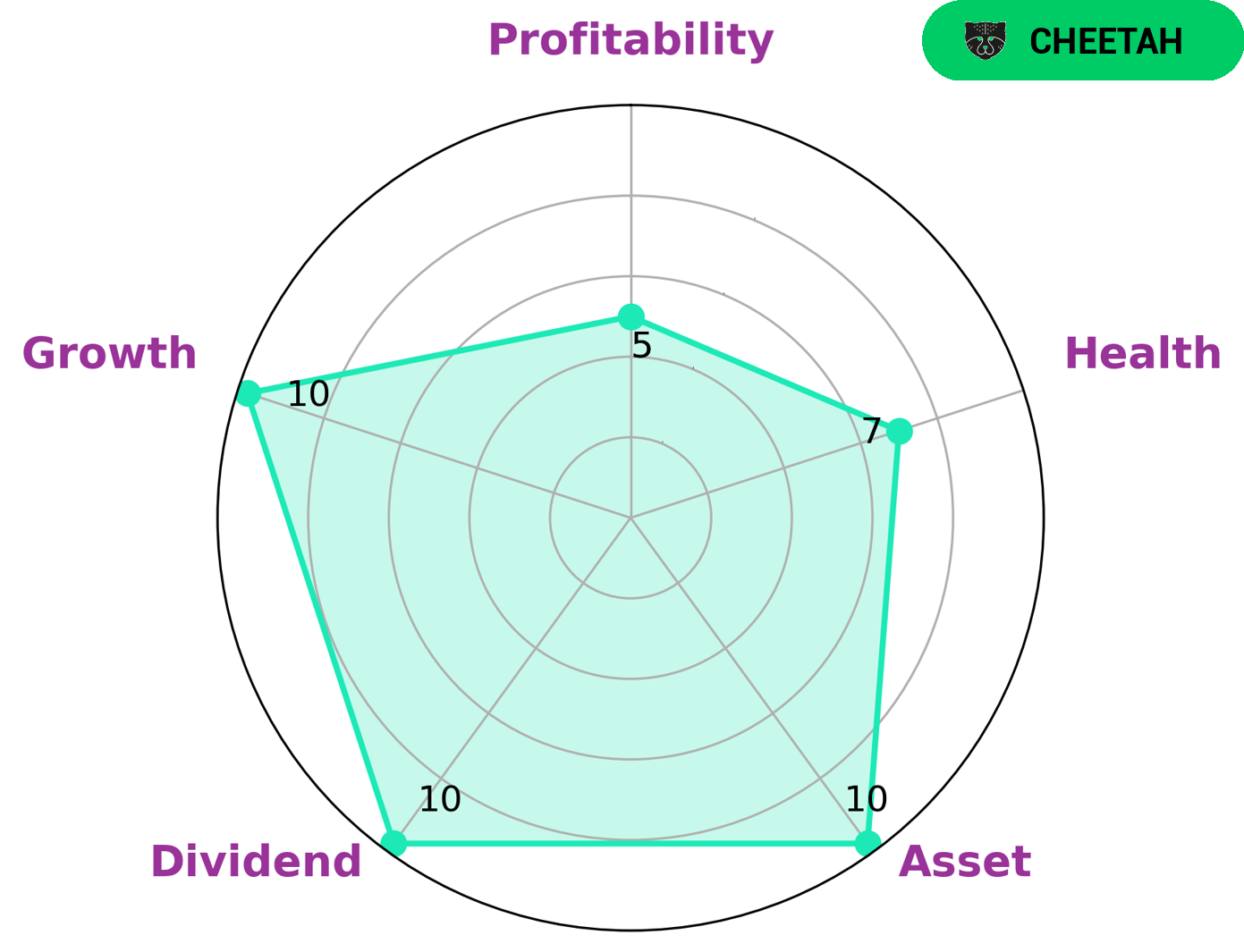

GoodWhale conducted an analysis of WINTRUST FINANCIAL‘s wellbeing and found them to be quite strong in terms of growth, asset, and dividend. Additionally, their profitability was rated as medium. Based on our research, we classified WINTRUST FINANCIAL as a ‘cheetah’, which means the company achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given this assessment, investors looking for returns while taking on a higher risk might be interested in WINTRUST FINANCIAL. Despite its lower profitability, the company has a high health score of 7/10 with regards to cashflows and debt and is likely to be able to safely ride out any crisis without the risk of bankruptcy. More…

Peers

The banking industry is highly competitive, with numerous banks vying for market share. Wintrust Financial Corp is no exception, as it competes against other banks such as First Financial Bancorp, F N B Corp, and First Busey Corp. While each bank has its own strengths and weaknesses, Wintrust Financial Corp has been able to consistently outperform its competitors and maintain a strong market position.

– First Financial Bancorp ($NASDAQ:FFBC)

First Financial Bancorp has a market cap of $2.25 billion as of 2022. The company is a holding company for First Financial Bank, which provides banking and other financial services to businesses and individuals in Ohio, Indiana, and Kentucky. First Financial Bancorp is the parent company of First Financial Bank, which is a regional bank that operates primarily in Ohio, Indiana, and Kentucky. The bank offers a range of banking and other financial services to businesses and individuals, including loans, deposit accounts, and wealth management services.

– F N B Corp ($NYSE:FNB)

The company has a market capitalization of 4.85B as of 2022. It is a provider of banking and financial services. The company operates through three segments: Consumer Banking, Commercial Banking, and Wealth Management. The company offers a range of products and services, including savings and checking accounts, loans, credit cards, and investment products.

– First Busey Corp ($NASDAQ:BUSE)

First Busey Corporation is a bank holding company headquartered in Urbana, Illinois. The Company operates through its banking subsidiary, First Busey Bank. First Busey Bank is a full-service bank offering personal and business banking products and services through 44 locations in Illinois, Indiana and Florida. The Company’s primary focus is serving the needs of individual and business customers in the communities it serves.

Summary

Wintrust Financial recently secured financing for two high-profile properties in Beverly Hills, California. The financing, which was arranged by JLL, allows Wintrust Financial to acquire a majority ownership stake in the properties. The acquisition is part of Wintrust’s strategy to invest in high-end real estate assets and expand its portfolio. Wintrust Financial has a long history of investing in commercial real estate, and this move symbolizes their continued commitment to the sector.

With this deal, Wintrust Financial now owns more than $2 billion worth of real estate assets, including high-end properties in Beverly Hills. Investors in Wintrust Financial can expect this deal to increase returns and add value to the company’s portfolio.

Recent Posts