Investors Undecided on Citizens Financial Group, Despite Diverging Market Opinions.

May 17, 2023

Trending News 🌧️

Citizens Financial ($NYSE:CFG) Group, Inc., a banking and financial services company headquartered in Rhode Island, is gaining attention from investors in spite of diverging opinions from the market. Through its subsidiaries, CFG provides a variety of services, including consumer banking, commercial banking, leasing and asset management. Despite a fluctuating stock price, investors remain interested in CFG’s long-term potential. Furthermore, CFG has posted strong earnings in recent quarters, which have kept investor optimism high. Even as the market remains uncertain about the future of CFG, some investors believe that the company will continue to perform well over the long-term.

Ultimately, the short-term performance of Citizens Financial Group, Inc. will largely depend on how its various business segments perform. With its broad range of products and services, CFG has a wide variety of opportunities to move forward and improve its financial position. Investors remain undecided on CFG despite the diverging opinions of the market, though most agree that the company’s long-term potential is promising.

Share Price

Investors remain indecisive in their outlook on Citizens Financial Group, Inc. (CITIZENS FINANCIAL) despite the market’s diverging opinions. On Monday, the stock opened at $24.8 and closed at $25.8, a 3.9% increase over the previous closing price of $24.8. This rise in share value can be attributed to the positive sentiment around the company’s recent performance. Despite strong market indicators, investors are still waiting for more concrete evidence of CITIZENS FINANCIAL’s long-term potential before making a decision on whether to invest or not. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Citizens Financial. More…

| Total Revenues | Net Income | Net Margin |

| – | 2.05k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Citizens Financial. More…

| Operations | Investing | Financing |

| 4.12k | -12.64k | 9.91k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Citizens Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 222.26k | 198.06k | – |

Key Ratios Snapshot

Some of the financial key ratios for Citizens Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.5% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

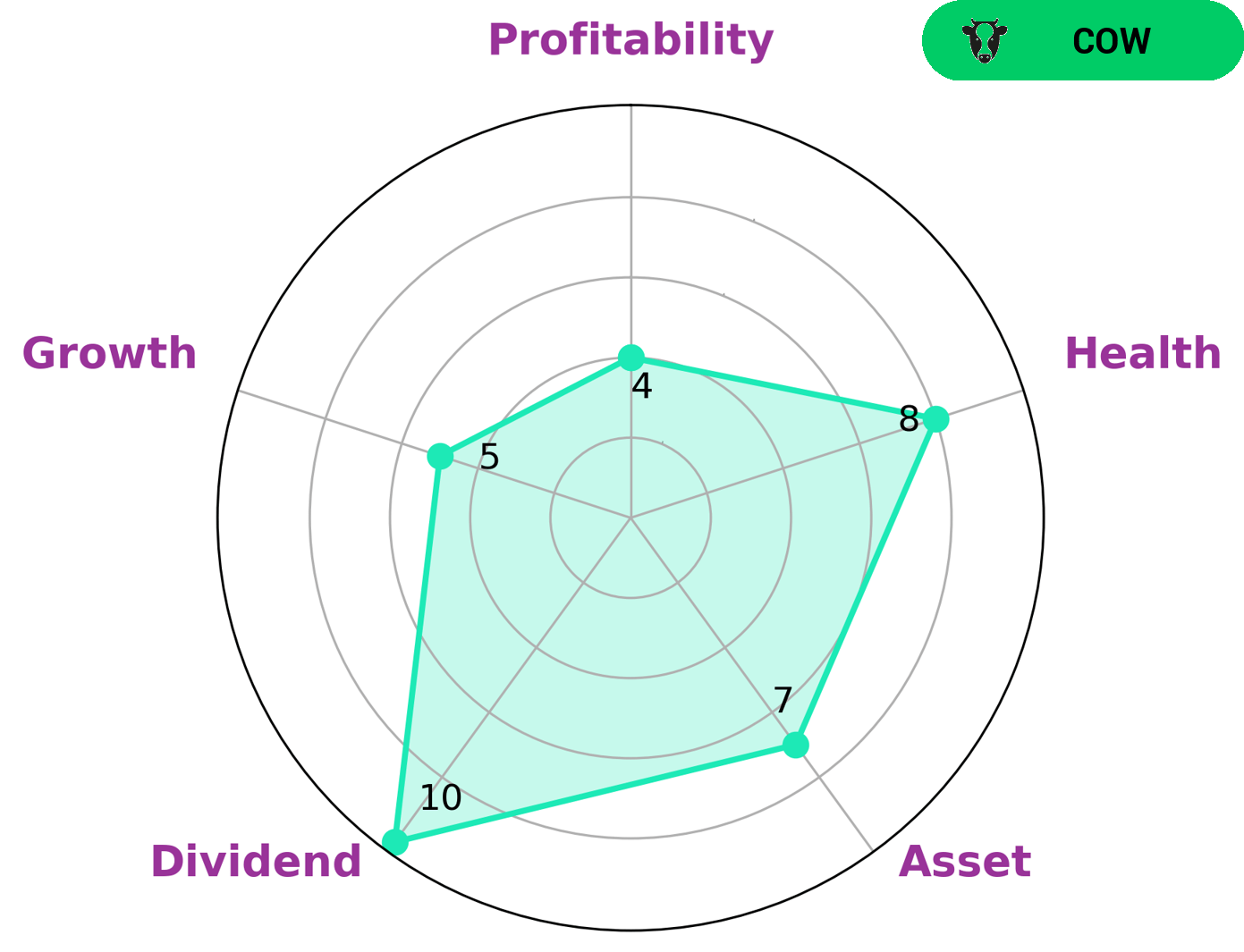

GoodWhale recently conducted an analysis of CITIZENS FINANCIAL‘s financials. According to our Star Chart, CITIZENS FINANCIAL is strong in assets and dividend, and medium in growth and profitability. Based on this analysis, we classified CITIZENS FINANCIAL as a ‘cow’. This type of company is characterized by its track record of paying out consistent and sustainable dividends. Given CITIZENS FINANCIAL’s track record and high health score of 8/10 with regard to its cashflows and debt, this company is likely to be attractive to investors looking for a low-risk, steady income stream. Furthermore, with a strong financial background and solid asset base, CITIZENS FINANCIAL is capable of paying off debt and funding future operations. More…

Peers

In recent years, the banking industry has become increasingly competitive. This is especially true for regional banks, which are facing increased competition from larger banks as well as online-only banks. Citizens Financial Group is one of the largest regional banks in the United States, with over $150 billion in assets. The company operates in more than 20 states and has over 1,200 branches. Its main competitors are NBT Bancorp, Keiyo Bank, and Southern Missouri Bancorp. All three of these banks are smaller than Citizens, but they have been growing rapidly in recent years.

– NBT Bancorp Inc ($NASDAQ:NBTB)

NBT Bancorp Inc. is a financial holding company that operates through its subsidiaries, which include NBT Bank, NBT Insurance Agency, and Penn Square Partners. The company has a market capitalization of $1.84 billion as of 2022. NBT Bancorp is headquartered in Norwich, New York and has more than 160 branches across upstate New York, northwestern Vermont, western Massachusetts, and northeastern Pennsylvania. The company’s primary business activities include commercial banking, retail banking, and asset management.

– Keiyo Bank Ltd ($TSE:8544)

Keiyo Bank Ltd is a Japanese bank with a market cap of 62.52B as of 2022. The company has over 2,000 branches and provides banking services to individuals and businesses. Services include savings and checking accounts, loans, credit cards, and investment products.

– Southern Missouri Bancorp Inc ($NASDAQ:SMBC)

Southern Missouri Bancorp Inc is a bank holding company that operates through its subsidiary, Southern Bank. The company offers a range of banking services to clients in Missouri, Arkansas, and Tennessee. As of 2022, the company had a market cap of 499 million dollars.

Summary

Citizens Financial Group, Inc. is a banking and financial services provider with a large presence in Rhode Island. Recent market opinion regarding Citizens Financial has been divergent, but investor interest in the company has been increasing. This has been evident in a recent positive movement in the stock price of the company, suggesting a potential for increased investment and long-term growth.

Analysts suggest that investors look closely at the fundamentals of the company, such as its balance sheet, earnings potential, and other factors, before making an investment decision. Ultimately, this is a company to watch in the near future.

Recent Posts