Insiders Miss Out on 15% Loss After Selling US$140k of Territorial Bancorp Stock in 2023.

March 23, 2023

Trending News 🌧️

Insiders of Territorial Bancorp ($NASDAQ:TBNK) Inc. were fortunate to have sold their US$140k worth of stock in 2023, before it experienced a 15% decrease in price. Selling at an average of US$23.34 per share, those who had held onto the stock would have seen a significant loss in value had they decided to stay invested. The 15% drop in pricing could have easily been avoided had the stock been sold sooner, however, it is encouraging to know that those who did not have the required foresight to sell did not suffer a loss that could have been easily avoided.

Given the current market conditions, it is likely that this drop in value was an expected outcome, and those who sold early were able to make a safe profit from their initial investment. It is unlikely that those who held onto their shares will recover the losses that they suffered from the price drop, and perhaps the only positive outcome from this unfortunate circumstance is that it serves as a reminder for investors to be more vigilant with their investments.

Market Price

So far, news coverage of the company has been mostly positive. On Thursday, shares of TERRITORIAL BANCORP opened at $19.0 and closed at $20.4, a 5.1% increase from the previous closing price of 19.4. This marks the second consecutive day of positive increases for the company’s stock.

Analysts attribute the success to the company’s sound financial management, as well as its commitment to investing in technology and innovation. With the current positive momentum and outlook, Territorial Bancorp Inc. is well-positioned to continue its impressive performance for years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Territorial Bancorp. More…

| Total Revenues | Net Income | Net Margin |

| – | 16.16 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Territorial Bancorp. More…

| Operations | Investing | Financing |

| 12.52 | -283.01 | 6.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Territorial Bancorp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.17k | 1.91k | – |

Key Ratios Snapshot

Some of the financial key ratios for Territorial Bancorp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.5% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

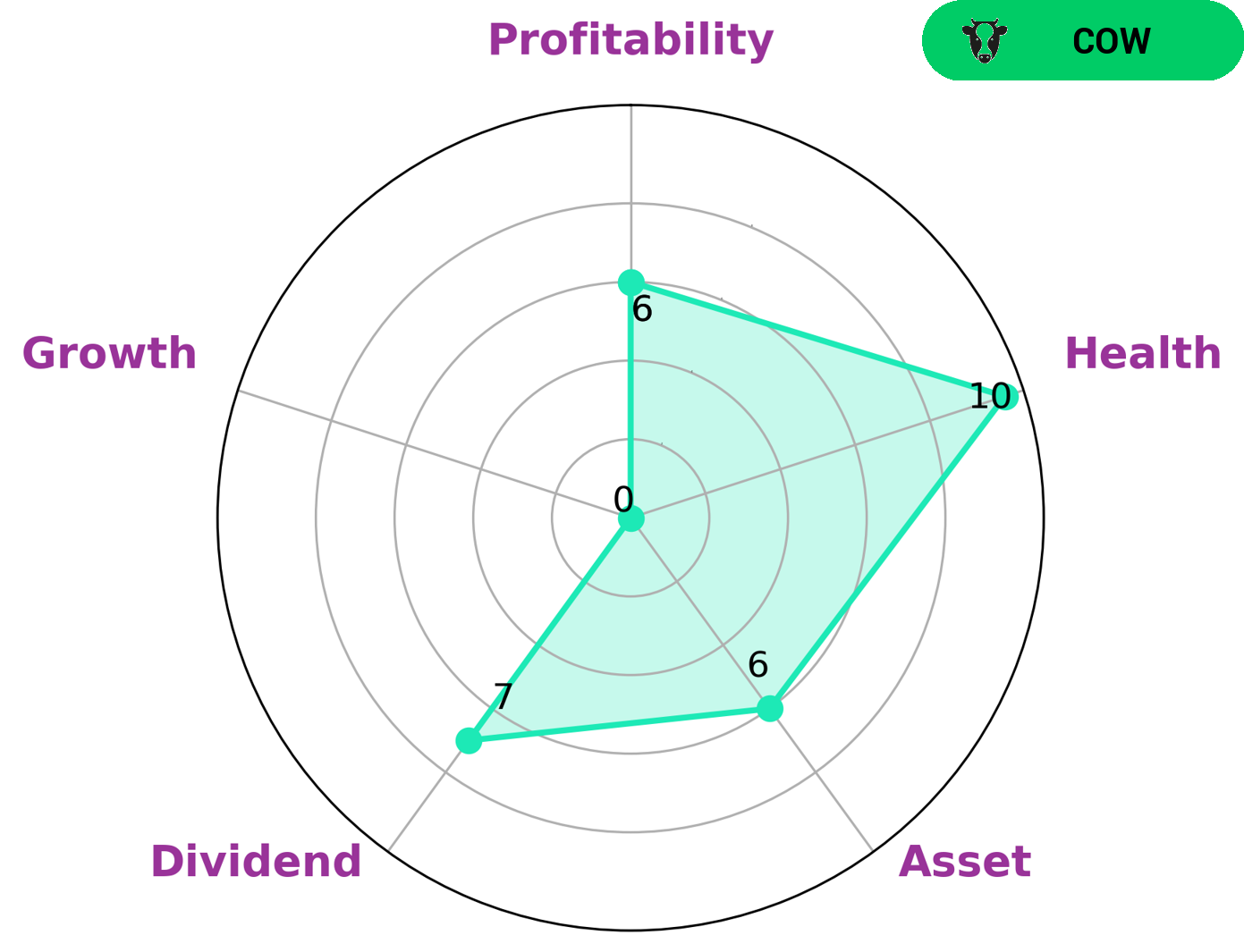

GoodWhale has conducted an analysis of TERRITORIAL BANCORP‘s financials and has classified the company as a ‘cow’, a type of company with a track record of paying out consistent and sustainable dividends. It is important to note that TERRITORIAL BANCORP’s Star Chart score is strong in dividend, medium in profitability, asset and weak in growth. However, TERRITORIAL BANCORP has a high health score of 10/10 with regard to its cashflows and debt, indicating that the company is capable to sustain future operations in times of crisis. Given its financials, TERRITORIAL BANCORP may be an interesting investment for investors looking for steady income from dividend payments and relatively low-risk ventures. Its track record of consistent dividend payments could prove attractive to investors looking for passive income and reliable growth prospects. TERRITORIAL BANCORP may also be of interest to those seeking to diversify their portfolios with holdings outside of traditional stock investments. More…

Peers

It has a wide range of competitors in the banking industry such as Lake Shore Bancorp Inc, Citizens Community Bancorp Inc, and IF Bancorp Inc. All of these companies offer competitive services with a variety of products and services for their customers.

– Lake Shore Bancorp Inc ($NASDAQ:LSBK)

Lake Shore Bancorp Inc has a market cap of 70.32M as of 2022. The company is a bank holding company that operates Lake Shore Savings Bank, a full-service community bank with branches located throughout Western New York. Lake Shore Bancorp offers a variety of deposit and loan products, as well as wealth management and digital banking services to both consumer and business customers. The company also has investments in stocks, bonds, and other securities, and provides trust services. Its primary focus is on serving the financial needs of individuals, families, and small businesses in the Western New York area.

– Citizens Community Bancorp Inc ($NASDAQ:CZWI)

Citizens Community Bancorp Inc is a full-service financial institution with assets totaling just over $1 billion. Founded in 1958, the company offers a wide range of consumer and business banking services, including lending, wealth management, and trust services. As of 2022, the company has a market capitalization of $123.29 million, making it one of the largest publicly traded financial services companies in the Midwest region. The company’s primary focus is on providing consumer and commercial banking services to small- and medium-sized businesses, but its retail banking services are also widely respected and enjoyed throughout the area.

– IF Bancorp Inc ($NASDAQ:IROQ)

IF Bancorp Inc is a financial services company that has been in existence since 1922. The company provides a range of banking and financial services to customers in the United States. As of 2022, the company has a market cap of 57.26M, making it one of the larger financial services companies in the country. The company’s market cap reflects the size and strength of their operations, as well as their ability to generate returns for shareholders over time. The company is well-positioned to continue to grow and expand its services in the future.

Summary

Investors in Territorial Bancorp Inc. have missed out on a 15% loss after selling US$140k worth of stock in 2023. Market analysis suggests that the stock price moved up on the same day, indicating a positive response from investors. It remains to be seen whether this positive sentiment will continue, or if the stock will decline in the future. For now, it seems that investing in Territorial Bancorp Inc. could be a safe bet, however, investors should always consider the risks before investing.

Recent Posts