Hilltop Holdings Reports Impressive Earnings and Revenue Growth

April 22, 2023

Trending News ☀️

Hilltop ($NYSE:HTH)’s GAAP earnings per share of $0.40 exceeded expectations by $0.16, and its revenue of $281.87M beat estimates by $8.99M. It offers banking, mortgage, insurance, and investment services through its subsidiaries and provides customized financial solutions to businesses and individuals. Hilltop’s insurance subsidiaries offer specialized services, including casualty and property, professional liability, and employee benefits insurance.

The company attributed its strong quarter to its focus on diversifying its product offerings and expanding its customer base. Hilltop is well-positioned to capitalize on increased consumer confidence and improved economic conditions in the coming quarters.

Share Price

On Thursday, the company’s stock opened at $29.6 and closed at $29.5, down slightly by 0.8% from its prior closing price of 29.7. Hilltop Holdings‘ strong results were driven by higher loan originations and deposits, as well as gains from the sale of certain securities. The company is expected to continue to report strong results in the coming quarters and investors remain hopeful that Hilltop Holdings’ stock will soon rebound. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hilltop Holdings. More…

| Total Revenues | Net Income | Net Margin |

| – | 116.68 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hilltop Holdings. More…

| Operations | Investing | Financing |

| 1.19k | -877.3 | -1.71k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hilltop Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.03k | 14.95k | – |

Key Ratios Snapshot

Some of the financial key ratios for Hilltop Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -8.3% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

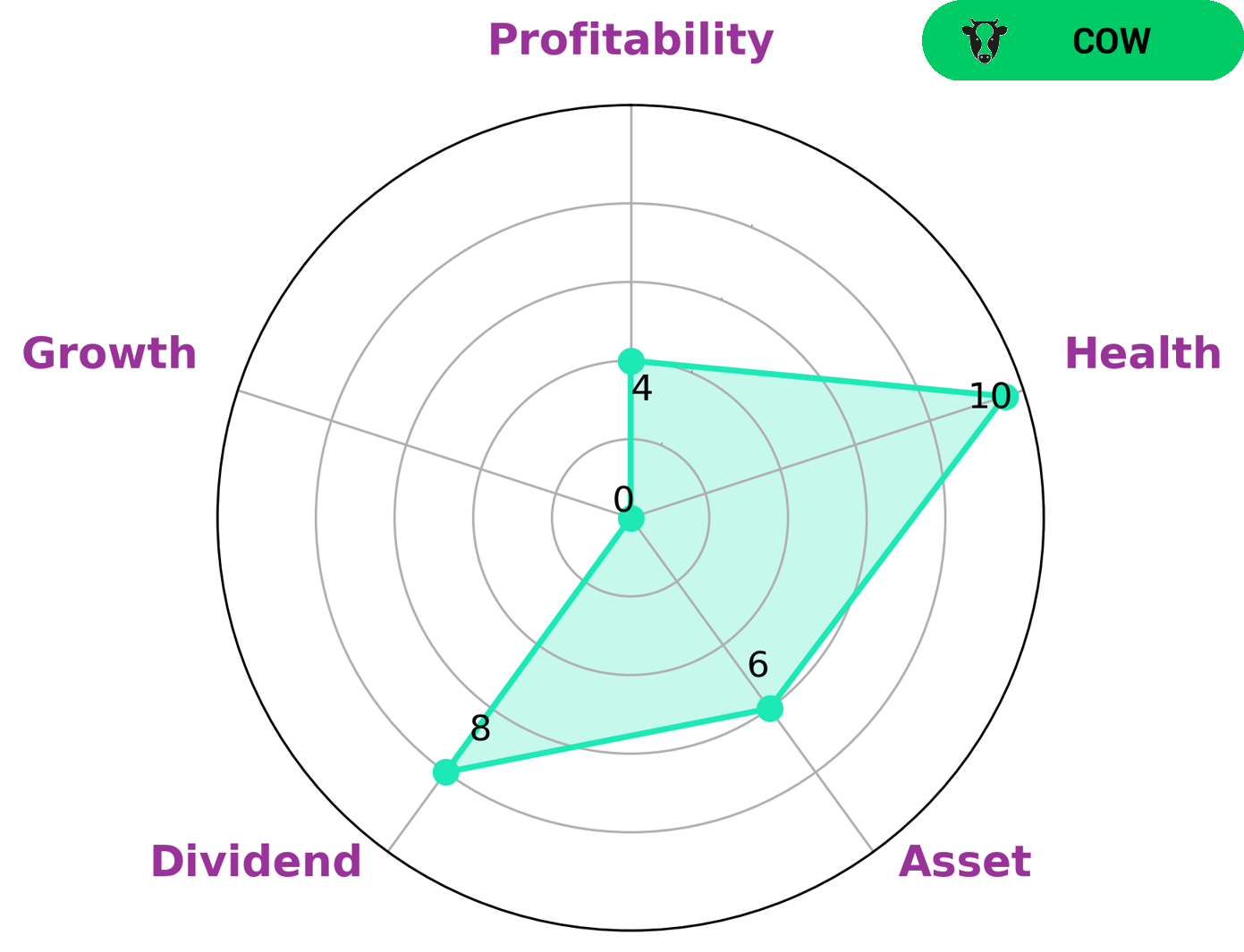

GoodWhale is delighted to analyze HILLTOP HOLDINGS‘s financial health, as assessed using our Star Chart. We score HILLTOP HOLDINGS with a high health score of 10/10, which indicates that it is capable to safely ride out any crisis without the risk of bankruptcy, thanks to its healthy cashflows and debt. Furthermore, we classify the company as ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. Investors who prefer to have steady income through dividends will be interested in this company. Looking at other aspects of the company, GoodWhale finds that HILLTOP HOLDINGS is strong in dividend, medium in profitability, asset and weak in growth. This makes it an ideal choice for investors who are seeking steady dividend returns but not so interested in capital gains. More…

Peers

The competition between Hilltop Holdings Inc and its competitors is fierce. S&T Bancorp Inc, City Holding Co, and Ledyard Financial Group Inc are all fighting for market share in the banking industry. Hilltop Holdings Inc has a strong presence in the southern United States, while its competitors are spread out across the country.

– S&T Bancorp Inc ($NASDAQ:STBA)

S&T Bancorp Inc. is a bank holding company, which engages in the provision of banking and financial services. It operates through the following segments: Banking, Wealth Management, and Insurance. The Banking segment offers personal and business banking products and services, including checking and savings accounts, loans, and deposit products. The Wealth Management segment provides investment management, fiduciary, and trust services. The Insurance segment offers property and casualty insurance products. The company was founded in 1902 and is headquartered in Indiana, PA.

– City Holding Co ($NASDAQ:CHCO)

PNC Financial Services Group, Inc., is a diversified financial services holding company and one of the largest banks in the United States. PNC Bank provides retail and commercial banking, residential mortgage banking, consumer finance, and investment management. The company operates more than 2,300 branches and 9,000 ATMs in 19 states and the District of Columbia. PNC is headquartered in Pittsburgh, Pennsylvania.

– Ledyard Financial Group Inc ($OTCPK:LFGP)

Ledyard Financial Group Inc. is a publicly traded holding company that owns and operates several businesses in the financial services industry. The company has a market capitalization of $67.01 million as of 2022. The company’s businesses include investment banking, asset management, insurance, and real estate. The company’s headquarters are in New York City.

Summary

This strong performance reflects positively on the company and will likely improve investor sentiment. Hilltop’s stock price rose in response to the news, and investors should continue to monitor the company for potential further gains.

Recent Posts