Great West Life Assurance Co. Invests in Banner Corporation with 40,800 Shares Purchased.

February 3, 2023

Trending News ☀️

Banner Corporation ($NASDAQ:BANR) is an American financial services holding company headquartered in Spokane, Washington. The company also provides financial services such as trust and investment management, retail brokerage, insurance, and mortgage services. The company recently made headlines as Great West Life Assurance Co. has purchased 40,800 shares of Banner Corporation. This purchase is an endorsement of the company’s stability and soundness, which is a vote of confidence from a major institutional investor.

This dividend yield is currently supported by healthy cash flows and solid balance sheet metrics, which have allowed the company to remain profitable despite the ongoing economic uncertainty. Overall, Banner Corporation is well-positioned for continued growth and success in the future. With a strong balance sheet and impressive financial metrics, it is no surprise that Great West Life Assurance Co. has chosen to invest in the company with its purchase of 40,800 shares.

Price History

So far, the media exposure has been mostly positive. On Monday, the stock opened at $62.7 and closed at $62.9, up by 0.3% from the last closing price of 62.7. This increased investment shows that Banner Corporation is a company investors are interested in, and its stock could potentially benefit from further increases in the future. Banner Corporation is an established company with a long history of success, and the recent investment from Great West Life Assurance Co. is a testament to its potential financial growth.

It appears that investors are recognizing the value of Banner Corporation, and the stock price increase is an indication of this. The increase in stock price is an indication that investors are confident in Banner Corporation’s ability to succeed, and the purchase of 40,800 shares is a major sign of confidence in the company’s future success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Banner Corporation. More…

| Total Revenues | Net Income | Net Margin |

| – | 195.38 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Banner Corporation. More…

| Operations | Investing | Financing |

| 301.58 | -1.02k | 1.61k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Banner Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.83k | 14.38k | – |

Key Ratios Snapshot

Some of the financial key ratios for Banner Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.5% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

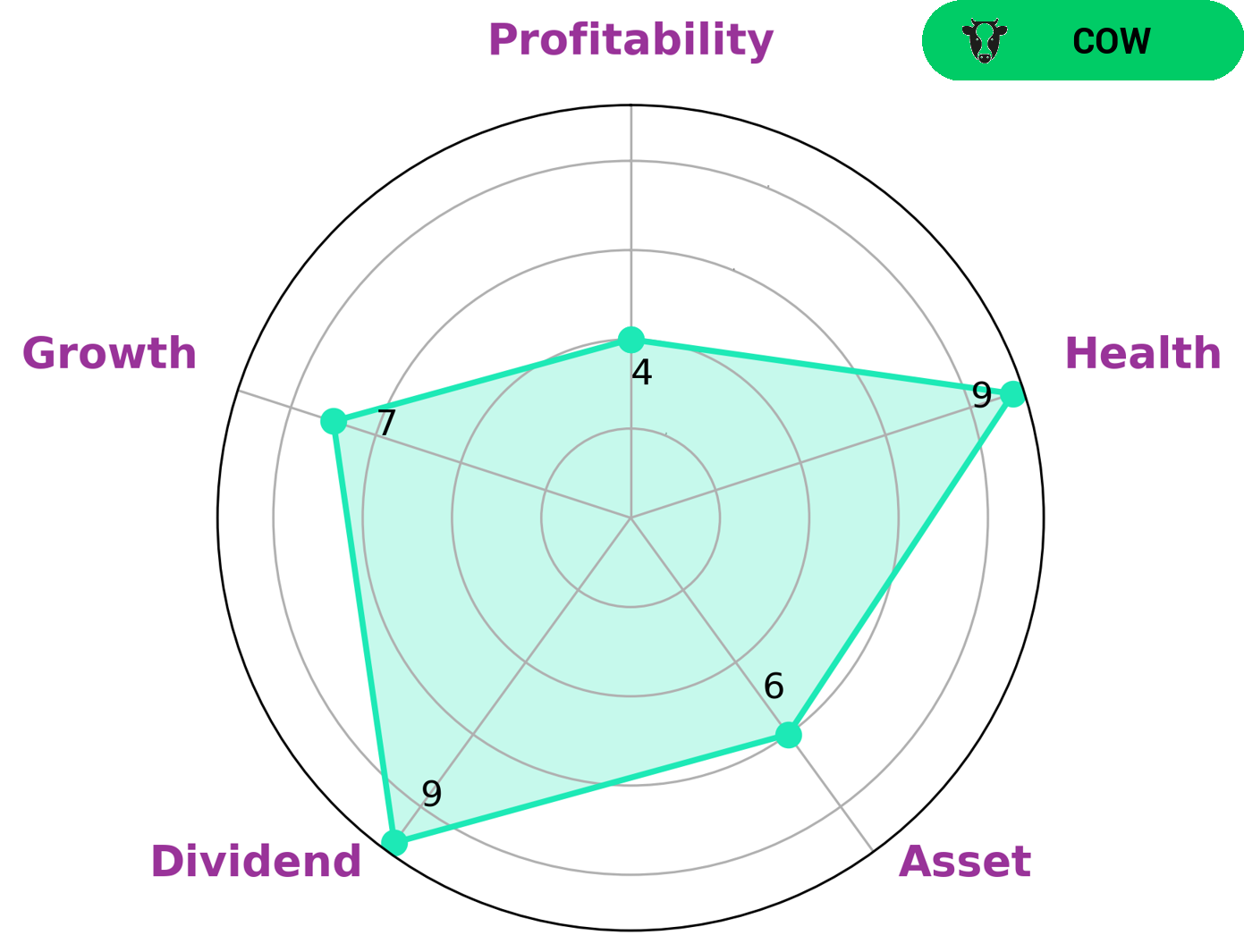

GoodWhale has conducted an analysis of BANNER CORPORATION‘s wellbeing, shown through its Star Chart. The chart shows that BANNER CORPORATION is strong in growth and dividend, and medium in profitability and asset. On top of that, BANNER CORPORATION has a high health score of 9/10 with regard to its cashflows and debt, which shows that it is capable to sustain future operations in times of crisis. Based on these facts, BANNER CORPORATION is classified as ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. Such companies are attractive to investors who are looking for steady returns with low risk. Investors who are looking for capital appreciation or aggressive growth may not be suitable for such type of company. In addition, BANNER CORPORATION may also be attractive to income-seeking investors looking for steady dividend income as well as capital gains over the long run. Such investors may include retirees and those who are looking for a steady source of income. Furthermore, investors who are looking for a safe investment in times of economic downturn may be interested in investing in BANNER CORPORATION due to its strong cashflows and debt position. Overall, BANNER CORPORATION is an attractive ‘cow’ type of company that may appeal to many types of investors. Its strong growth and dividend, as well as its ability to sustain operations in times of crisis, make it an attractive option for investors looking for steady returns with low risk. More…

Peers

The company’s primary competitors are Golden VY Bancshares Inc, Red River Bancshares Inc, and CB Financial Services Inc. All three companies are similar in size and offer similar banking products and services. Banner Corp has a slight advantage in terms of geography, as it operates in a larger geographic area than its competitors.

However, all three companies are well-positioned to compete for market share in the northwest United States.

– Golden VY Bancshares Inc ($OTCPK:GVYB)

Golden VY Bancshares Inc is a bank holding company that operates through its subsidiary, Golden Valley Bank. The Bank offers a range of personal and business banking services. Its personal banking services include checking and savings accounts, loans, and credit cards. The Bank’s business banking services include loans, lines of credit, and treasury management. As of December 31, 2020, Golden VY Bancshares Inc operated through 11 full-service branches located in California’s Central Valley.

– Red River Bancshares Inc ($NASDAQ:RRBI)

Red River Bancshares Inc is a bank holding company. The Company’s primary business is the ownership and operation of its bank subsidiary, Red River Bank (the Bank). The Bank provides a range of banking services to individual and corporate customers in central Louisiana.

– CB Financial Services Inc ($NASDAQ:CBFV)

CB Financial Services Inc is a bank holding company. The Company’s principal business is the ownership and operation of its subsidiaries, Citizens Bank and Citizens Bank of Pennsylvania. These subsidiaries are engaged in the business of banking and related activities, including accepting deposits, making loans and providing other services for personal, business and institutional customers.

Summary

Recently, Great West Life Assurance Co. has invested in the Banner Corporation with a purchase of 40,800 shares. This investment has been met with mostly positive media exposure. As a result, investors have been taking a closer look at the Banner Corporation and its potential. Analysts have suggested that Banner Corporation is a strong investment choice due to its well-established infrastructure and its ability to generate consistent returns.

Additionally, Banner Corporation has a high degree of financial flexibility and good corporate governance practices, making it an attractive option for long-term investments. Investors should also be aware of the potential for higher returns due to the company’s active management of its portfolio and focus on high-value investments. With all these factors taken into consideration, the Banner Corporation appears to be a sound and secure choice for investors.

Recent Posts