German American Bank Receives Top Rating from BauerFinancial

April 2, 2023

Trending News ☀️

German American Bancorp ($NASDAQ:GABC), Inc. recently received a 5-Star rating from BauerFinancial, Inc., a leading independent bank rating firm. This top rating is an affirmation of the company’s quality and services. German American Bancorp is a financial holding company headquartered in Jasper, Indiana. It provides a range of retail and commercial banking services through its subsidiary banks, German American Bank and Old National Bank. Its services include deposit products, mortgage banking, credit cards, electronic banking, wealth management, investment services, and trust services. German American’s banking operations are located primarily in Indiana and Kentucky but also serve customers in Tennessee, Illinois, and Wisconsin.

Additionally, it offers insurance and securities products through its insurance underwriting subsidiary, German American Insurance Agency, and through its broker-dealer subsidiary, GNIA Securities Corporation. German American Bancorp has an impressive track record of performance and growth over the last decade. With this 5-Star rating from BauerFinancial, German American Bancorp has cemented its reputation as a reliable choice for banking services.

Share Price

On Wednesday, GERMAN AMERICAN BANCORP stock opened at $33.8 and closed at $33.4, down by 0.6% from prior closing price of 33.6. This comes after the announcement that the company has been rated a 5-Star Superior financial institution by BauerFinancial, Inc. for the tenth consecutive quarter. This rating places the company in their highest distinction and is reflective of the company’s overall financial stability and sound management practices.

These ratings are based on the capitalization, profitability, asset quality, liquidity and sensitivity to market risk of the bank’s operations. As such, German American Bank customers can rest assured that their deposits and investments are secure and managed responsibly. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for GABC. More…

| Total Revenues | Net Income | Net Margin |

| – | 81.83 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for GABC. More…

| Operations | Investing | Financing |

| 110.04 | -24.18 | -363.67 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for GABC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.16k | 5.6k | – |

Key Ratios Snapshot

Some of the financial key ratios for GABC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.8% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

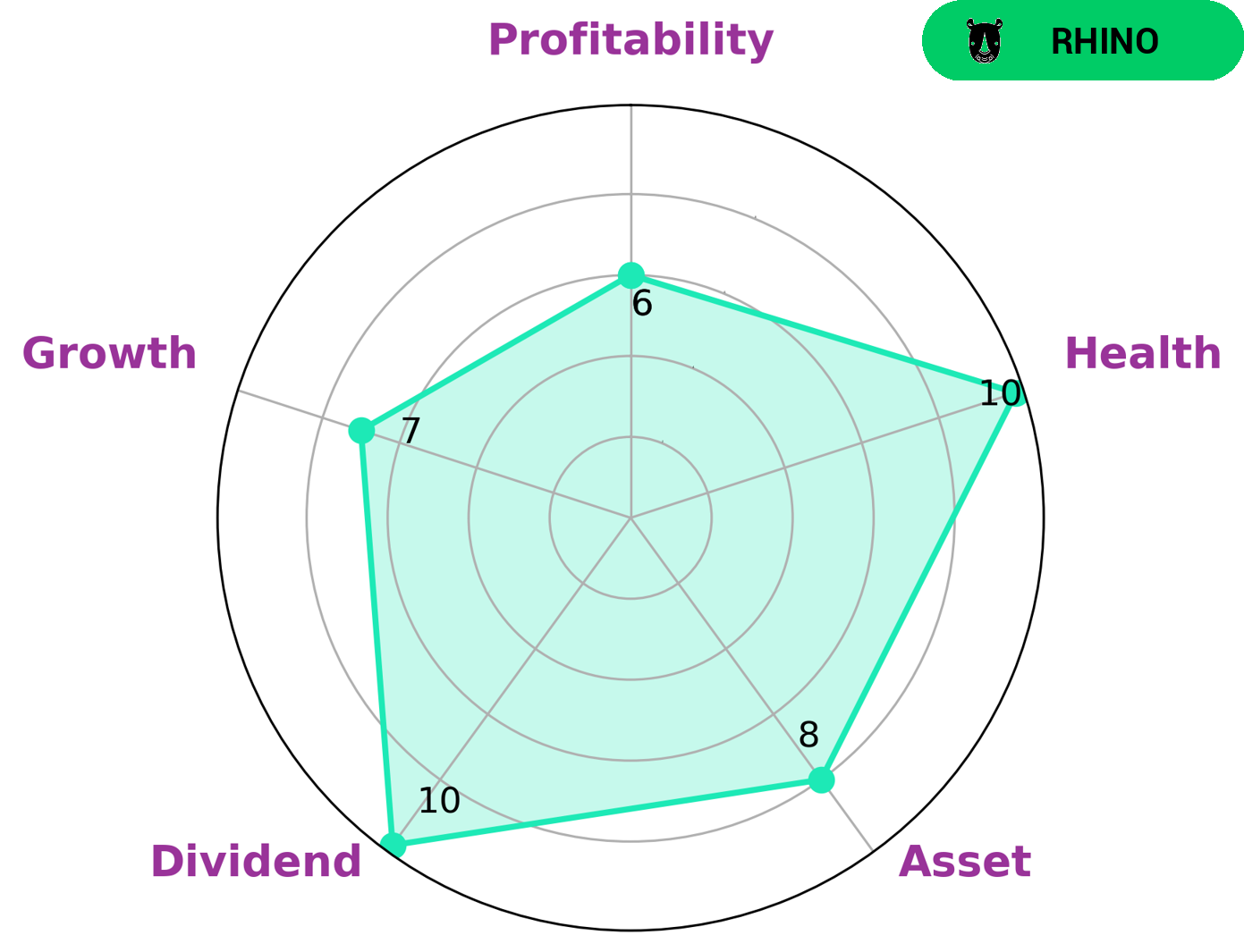

At GoodWhale, we recently conducted an analysis of GERMAN AMERICAN BANCORP’s wellbeing. After looking at their Star Chart, we found that the company is classified as ‘rhino’; this is a type of company that has achieved moderate revenue or earnings growth. As such, it is likely to be attractive to investors who prioritize steady growth over explosive returns. What is particularly impressive about GERMAN AMERICAN BANCORP is its high health score of 10/10 with regard to its cashflows and debt. This suggests that the company is capable of safely riding out any crisis without the risk of bankruptcy. In addition to this, GERMAN AMERICAN BANCORP is also strong in growth, asset, dividend, and medium in profitability. Altogether, these factors make GERMAN AMERICAN BANCORP a compelling investment option for investors who are interested in steady, reliable returns and are not scared off by financial risk. More…

Peers

The competition between German American Bancorp Inc and its competitors is fierce. Each company is vying for market share and customer base. They all offer similar products and services, so it is important for each company to differentiate itself in the market. German American Bancorp Inc has been able to do this by offering unique products and services that its competitors do not offer. This has allowed German American Bancorp Inc to gain a loyal customer base and a strong market share.

– Intercorp Financial Services Inc ($NYSE:IFS)

Intercorp Financial Services Inc is a financial services company with a market cap of 2.77B as of 2022. The company offers a range of financial services, including banking, insurance, and investment management.

– First Western Financial Inc ($NASDAQ:MYFW)

First Western Financial Inc is a holding company for First Western Bank & Trust, a regional bank with branches throughout the Western United States. First Western Bank & Trust offers a full range of banking services, including deposits, loans, and credit cards. It has a market cap of 262.07M as of 2022.

– Evans Bancorp Inc ($NYSEAM:EVBN)

Evans Bancorp Inc is a company that provides banking services. It has a market cap of 200.6M as of 2022. The company has been in operation for over 100 years and is headquartered in New York.

Summary

German American Bancorp has been awarded a 5-Star rating by BauerFinancial, an independent bank research group. This is a significant accomplishment, as the 5-Star rating indicates that the bank is a “superior” institution in terms of its financial stability, soundness, and profitability. German American Bancorp is an ideal place for those looking to make informed and secure investments. The Bank’s commitment to financial security and stability is evidenced by its consistent 5-Star rating from BauerFinancial. Its culture of frugality and attention to detail further enhances the Bank’s reputation as a safe place to invest money.

German American Bancorp’s commitment to excellence and customer service also set it apart from other financial institutions. It is well positioned to provide investors with a wide range of investment options and financial services. All of these factors make German American Bancorp an attractive option for those looking to invest their money in a secure and profitable manner.

Recent Posts