First Bancorp dividend – First Bancorp To Issue 0.22 Cash Dividend.

March 25, 2023

Dividends Yield

On March 17 2023, First Bancorp ($NASDAQ:FBNC) announced its intention to issue a 0.22 USD cash dividend per share to its investors. For the last three years, FIRST BANCORP has issued an annual dividend per share of 0.88 USD, giving a yield of 2.21% over 2022 to 2023. This upcoming dividend will increase the average dividend yield to 2.21%. This dividend is an attractive proposition for investors who are interested in dividend stocks.

The ex-dividend date for the dividend is March 30 2023, which means that investors must purchase the stock prior to this date in order to receive the dividend. After this date, the stock will trade without the dividend, and investors will have to wait until the next dividend payment to receive another cash dividend from FIRST BANCORP. Overall, FIRST BANCORP’s upcoming 0.22 USD cash dividend is a great opportunity for investors who are looking for a reliable dividend stock with a high yield.

Price History

On Friday, FIRST BANCORP, a banking services company, announced a 0.22 cash dividend for its shareholders. This announcement sent the stock price tumbling, as it opened at $36.6 and closed at $35.6, a 4.2% decrease from its previous closing price of 37.2. This is the sixth consecutive quarter in which FIRST BANCORP has issued a cash dividend to its shareholders. Investors have generally responded positively to the announcement, as FIRST BANCORP has consistently provided strong returns to its shareholders.

FIRST BANCORP has a strong focus on its customers, offering competitive rates on loans and other services, as well as providing excellent customer service. Despite the drop in stock price, FIRST BANCORP has been a reliable source of returns for its shareholders over the years and looks set to continue providing dividends in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for First Bancorp. More…

| Total Revenues | Net Income | Net Margin |

| – | 146.16 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for First Bancorp. More…

| Operations | Investing | Financing |

| 230.65 | -713.36 | 291.86 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for First Bancorp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.63k | 9.59k | – |

Key Ratios Snapshot

Some of the financial key ratios for First Bancorp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.7% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

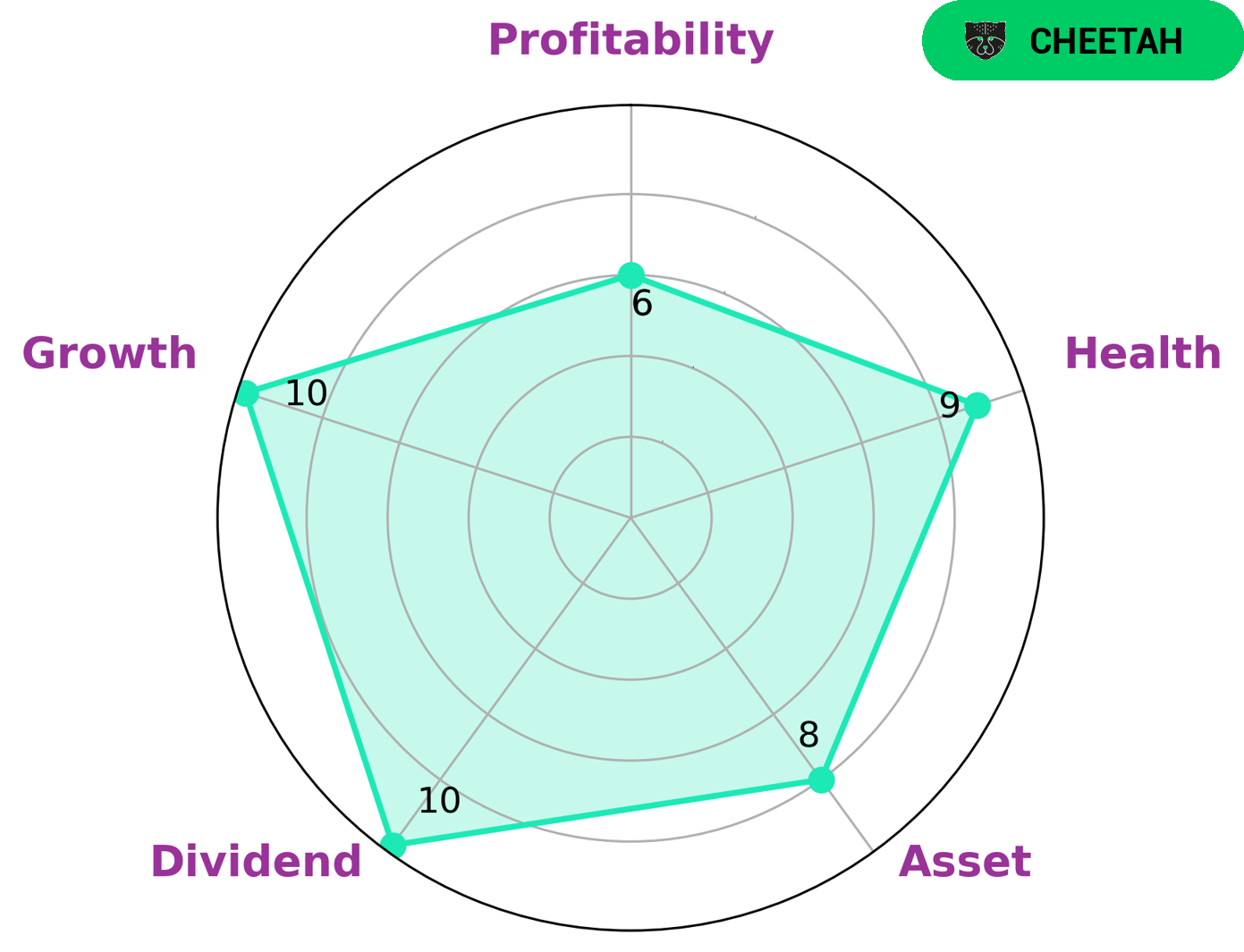

GoodWhale has conducted an analysis of FIRST BANCORP‘s fundamentals and found the company to have a high health score of 9/10 considering its cashflows and debt, making it capable to sustain future operations in times of crisis. FIRST BANCORP is strong in growth, asset, dividend, and medium in profitability. Based on this assessment, we have classified FIRST BANCORP as ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are looking for a high-risk, high-reward option may be interested in this type of company. This is because, although the company may have high growth potential, there is also a higher risk of potential returns being lower than expected. Investors should, however, be aware of the risks associated with investing in a ‘cheetah’ company and should consider their own circumstances before making any investments. More…

Peers

The company operates more than 2,000 branch offices and 4,700 ATMs across the country. First Bancorp is a member of the Federal Reserve System and is regulated by the Office of the Comptroller of the Currency. The company’s primary competitors are Mountain Commerce Bancorp Inc, Citizens Bancshares Corp, and BCB Bancorp Inc.

– Mountain Commerce Bancorp Inc ($OTCPK:MCBI)

Mountain Commerce Bancorp Inc is a bank holding company that operates through its subsidiary, Mountain Commerce Bank. The bank offers a range of banking services for individuals and businesses, including checking and savings accounts, loans, and credit cards. The company has a market cap of 170.53M as of 2022.

– Citizens Bancshares Corp ($OTCPK:CZBS)

Citizens Bancshares Corp is a bank holding company. The Company, through its subsidiaries, provides a range of banking services to individual and corporate customers. These services include personal and commercial banking, loans, mortgages, credit cards, and investment management.

– BCB Bancorp Inc ($NASDAQ:BCBP)

BCB Bancorp Inc., a bank holding company, provides banking products and services to retail, commercial, and industrial customers in the United States. The company operates in two segments, Banking and Mortgage Banking. It offers various deposit products, including checking accounts, money market accounts, savings accounts, certificates of deposit, and individual retirement accounts. The company also provides loans, such as commercial real estate loans, construction loans, residential mortgage loans, home equity lines of credit, and term loans. In addition, it offers other services, such as safe deposit box rentals, ATM banking, night depository services, direct deposit of payroll and Social Security, and telephone and Internet banking services. As of December 31, 2020, the company operated 39 banking offices in central and northern New Jersey. BCB Bancorp Inc. was founded in 1868 and is headquartered in Bayonne, New Jersey.

Summary

FIRST BANCORP is a potential investment opportunity for dividend-seekers, offering an annual dividend of 0.88 USD per share over the last three years. This represents a yield of 2.21%, making it an attractive choice for investors looking for reliable income. First Bancorp has a long-term track record of steady dividend payments, and its average dividend yield may make it an attractive addition to a portfolio. It is always important to do your own research and analysis to make sure any investment is right for you.

Recent Posts