Envestnet Asset Management Reduces Holdings in Provident Financial Services, Inc

June 12, 2023

☀️Trending News

Provident Financial Services ($NYSE:PFS), Inc, (PFS) is a financial holding company providing consumer and business banking services, wealth management services, and insurance offerings. Operating primarily through its wholly-owned subsidiaries, it operates in New Jersey, Pennsylvania, Delaware, and Maryland. Recently, Envestnet Asset Management Inc. disclosed that it has reduced its stake in Provident Financial Services, Inc stocks. Although the amount of shares sold by Envestnet Asset Management Inc. may be relatively small, it could signal that future investments may be less than previously expected or that investors may be looking for new opportunities elsewhere.

Price History

The stock opened at $17.3 and closed at $16.6, making a 4.6% decline in the value of PFS from the previous closing price of 17.4. This is a significant reduction for the company, and investors are responding in kind by decreasing their own holdings of PFS. It is unclear what the effects of this move will be for Provident Financial Services, Inc in the long-term, but it certainly signals a potential shift in the market regarding the company’s future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for PFS. More…

| Total Revenues | Net Income | Net Margin |

| – | 172.22 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for PFS. More…

| Operations | Investing | Financing |

| 200.31 | -647.56 | -78.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for PFS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.78k | 12.14k | – |

Key Ratios Snapshot

Some of the financial key ratios for PFS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.8% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

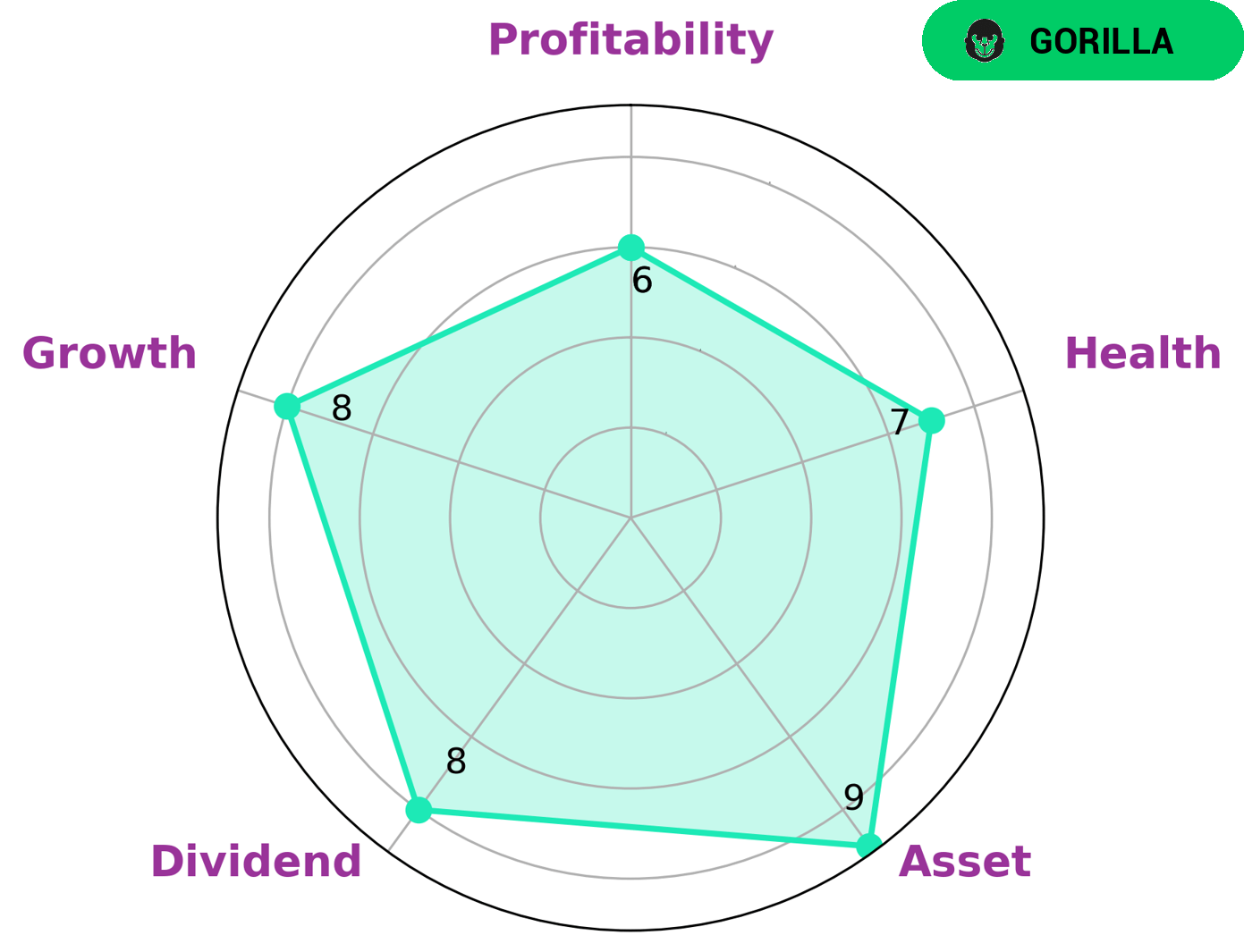

At GoodWhale, we have performed an analysis of PROVIDENT FINANCIAL SERVICES’s fundamentals. According to our Star Chart, this company is strong in growth, asset, dividend, and medium in profitability. Its health score is high, at 7/10, which bodes well for its ability to sustain future operations in times of crisis. Moreover, we have classified PROVIDENT FINANCIAL SERVICES as a ‘gorilla’, a company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given these positive metrics, we believe PROVIDENT FINANCIAL SERVICES would be of particular interest to value investors, growth investors, and dividend investors. Value investors would be drawn to the company’s strong fundamentals and competitive advantage, while growth investors would appreciate the high revenue and earnings growth that it has achieved. Likewise, dividend investors may be attracted to the company’s generous dividend payout. More…

Peers

In the current market, Provident Financial Services Inc is facing stiff competition from Peoples Bancorp of North Carolina Inc, NBT Bancorp Inc, and Blackhawk Bancorp Inc. All of these companies are vying for a share of the market, and each has its own strengths and weaknesses. Provident Financial Services Inc has a strong history and reputation, but it is up against two newer companies that have been able to grow rapidly. NBT Bancorp Inc has a large customer base, but Blackhawk Bancorp Inc has a more diversified product offering.

– Peoples Bancorp of North Carolina Inc ($NASDAQ:PEBK)

Peoples Bancorp of North Carolina, Inc. operates as the holding company for Peoples Bank that provides banking products and services to individuals and small to medium-sized businesses in the United States. It operates through two segments, Community Banking and Mortgage Banking. The Community Banking segment offers various banking products and services, including demand deposit accounts, time deposit accounts, NOW accounts, money market deposit accounts, certificates of deposit, consumer and commercial loans, and leasing services. This segment also provides automated teller machines, drive-in banking, Internet banking, and mobile banking services. The Mortgage Banking segment originates one-to-four family residential real estate loans, construction loans, and land loans. As of December 31, 2020, the company operated 36 full-service banking offices in 24 communities in central and western North Carolina; and one loan production office in Hickory, North Carolina. Peoples Bancorp of North Carolina, Inc. was founded in 1902 and is headquartered in Mount Airy, North Carolina.

– NBT Bancorp Inc ($NASDAQ:NBTB)

NBT Bancorp Inc. is a bank holding company that operates through its subsidiary, NBT Bank, N.A. They provide commercial banking, retail banking, and wealth management services to their customers. Their market cap as of 2022 is $2B.

– Blackhawk Bancorp Inc ($OTCPK:BHWB)

Blackhawk Bancorp Inc is a financial holding company that operates through its subsidiaries. It offers a range of banking services to businesses and individuals in the United States. The company’s market cap as of 2022 was $85.4 million. The company’s primary subsidiary is Blackhawk Bank, which provides a full range of banking services, including commercial and consumer lending, deposit gathering, and other services. Blackhawk Bancorp Inc also owns and operates Blackhawk Insurance Agency, Inc., a full-service insurance agency that offers a range of insurance products, including property and casualty, life, and health insurance.

Summary

Provident Financial Services, Inc. is a financial services company based in Jersey City, New Jersey. Investors should pay close attention to any signs of further activity from Envestnet Asset Management Inc. which could give insight into potential future movements in the market. Additionally, investors should consider current market trends and events related to Provident Financial Services, Inc. when making decisions about the stock. It may also be beneficial to research the company’s financial history, performance, and potential future plans in order to better understand how it may impact stock prices.

Recent Posts