Eagle Bancorp stock dividend – Eagle Bancorp Inc Declares 0.45 Cash Dividend

April 8, 2023

Dividends Yield

Eagle Bancorp ($NASDAQ:EGBN) Inc announced on April 1 2023, that they will be issuing a cash dividend of 0.45 USD per share. This is the fourth time since their debut in the market in 2018 that they have issued a dividend – their average dividend yield is 3.22%. This makes EAGLE BANCORP an attractive option for investors looking for a dividend stock to invest in. EAGLE BANCORP has consistently issued a dividend since 2018, demonstrating its commitment to reward shareholders. The dividends have grown from 2.15 USD in 2018 to the current 0.45 USD. This has allowed it to compete with other banking stocks that usually pay higher dividends than EAGLE BANCORP.

The dividend of 0.45 USD from EAGLE BANCORP has come at a great time for investors, as the markets have been volatile during the first quarter of 2023, and this dividend has provided some stability and also a chance for investors to earn some returns. This dividend has also helped the stock price of EAGLE BANCORP to appreciate, which is a positive sign for the future of this stock. In conclusion, EAGLE BANCORP has shown its commitment to shareholders by issuing a consistent dividend since 2018 and this dividend of 0.45 US per share will help investors to earn returns in a volatile market. Therefore, if you are looking for a dividend stock to invest in, EAGLE BANCORP is a viable option.

Price History

On the same day, EAGLE BANCORP stock opened at $33.6 and closed at $33.4, down by 0.3% from previous closing price of 33.5. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Eagle Bancorp. More…

| Total Revenues | Net Income | Net Margin |

| – | 140.93 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Eagle Bancorp. More…

| Operations | Investing | Financing |

| 194.9 | -927.08 | -670.19 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Eagle Bancorp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.15k | 9.92k | – |

Key Ratios Snapshot

Some of the financial key ratios for Eagle Bancorp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.6% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

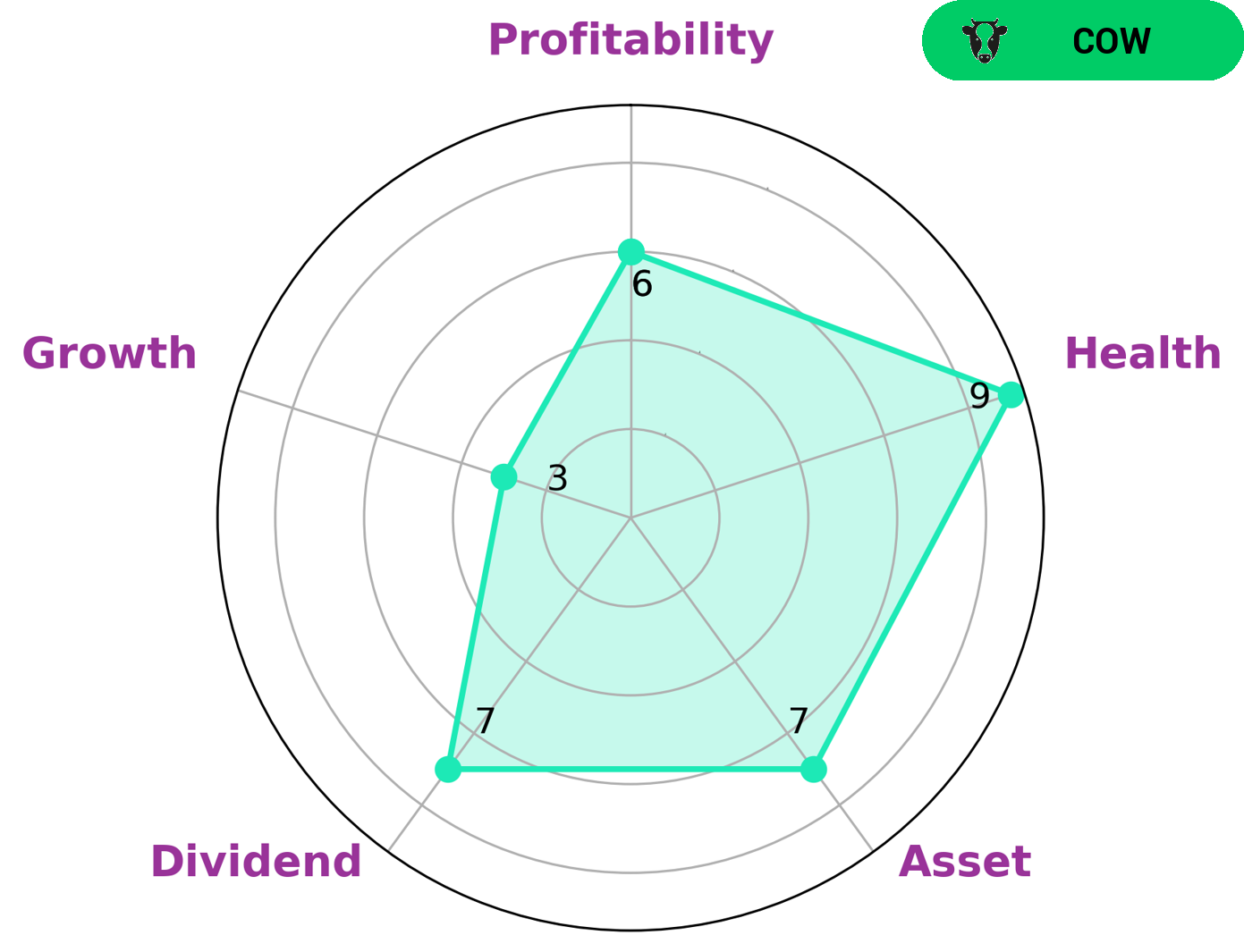

At GoodWhale, we have conducted an analysis on EAGLE BANCORP‘s wellbeing. After looking at the Star Chart, we have concluded that EAGLE BANCORP is classified as a ‘cow’, which means that the company has a track record of paying out stable and sustainable dividends. Investors who value these traits highly may find EAGLE BANCORP to be an attractive investment option. Furthermore, our analysis showed that EAGLE BANCORP has a high health score of 9/10, indicating that it has the resources to safely weather any crisis without the risk of bankruptcy. Additionally, it is strong in asset, dividend, and medium in profitability, while its weak point lies in growth. This overall assessment makes EAGLE BANCORP a strong candidate for investors looking for a reliable and sustainable dividend-paying stock. More…

Peers

Eagle Bancorp Inc is engaged in a fierce competition with its competitors Home BancShares Inc, Glacier Bancorp Inc and PacWest Bancorp in the banking sector. This competition has been intensifying as the companies vie for market share and strive to outdo each other in terms of customer service, product offerings, and other aspects of operations. The competition is a testament to the ever-changing banking landscape and the commitment of these companies to remain at the forefront of the industry.

– Home BancShares Inc ($NYSE:HOMB)

Home BancShares Inc has a market cap of 4.56B as of 2023, making it one of the largest financial holding companies in the United States. Home BancShares is headquartered in Conway, Arkansas and is the parent company of Centennial Bank. Centennial Bank operates over 100 branches in Arkansas, Florida, South Alabama, and New York City. Home BancShares provides retail banking services, mortgage banking services, consumer finance services and trust services to customers throughout the region. The company also offers commercial banking services, such as commercial and industrial loans, commercial real estate loans, and term loans. Home BancShares has demonstrated success in serving its customers and delivering strong returns for its shareholders over the years.

– Glacier Bancorp Inc ($NYSE:GBCI)

Glacier Bancorp Inc is a regional bank holding company based in Montana, with over $20 billion in assets as of 2023. The company provides banking services through its banking divisions in Montana, Idaho, Wyoming, Utah, Colorado, Arizona, and New Mexico. As of 2023, the company had a market capitalization of $5.4 billion. Glacier Bancorp Inc’s stock is traded on the NASDAQ Global Select Market under the symbol GBCI. The company has a strong presence in the region, offering commercial and consumer banking products and services to individuals, small businesses, and corporate customers. The company also provides treasury management services and wealth management services.

– PacWest Bancorp ($NASDAQ:PACW)

Pacific West Bancorp is a banking company headquartered in Los Angeles, California. As of 2023, the company has a market cap of 2.76 billion USD. The company focuses on providing banking services to small businesses and individuals in California, Arizona and Nevada. The company’s primary goal is to provide high-quality customer service and to maintain strong relationships with their customers. Pacific West Bancorp offers a wide array of products and services including loans, savings accounts, checking accounts, certificates of deposit, and other related services. The company also offers online banking services and mobile banking technologies. Pacific West Bancorp’s market cap reflects the company’s strength and stability in the banking industry.

Summary

Investing in EAGLE BANCORP has been a smart choice in the last few years, offering a consistent and attractive dividend of 2.15 USD per share. This has resulted in an average dividend yield of 3.22% since 2018, making it a reliable dividend payer and a strong investment choice. EAGLE BANCORP has also increased its dividend each year since 2018, further rewarding investors with greater returns. The company’s solid performance and financial strength suggest that it is well positioned for future growth, making it an attractive choice for long-term investors.

Recent Posts