Dale McKim Appointed CFO, Treasurer of Chemung Financial

June 3, 2023

☀️Trending News

Chemung Financial ($NASDAQ:CHMG) Corporation has recently announced that Dale McKim has been appointed as their Chief Financial Officer and Treasurer. It offers a comprehensive suite of financial products and services to its customers, including commercial banking, consumer banking, wealth management, and mortgage banking solutions. Dale McKim has been appointed to the role of Chief Financial Officer and Treasurer with a wealth of experience in the financial sector. He will be responsible for overseeing the day-to-day financial operations of Chemung Financial, including financial planning, investments and analysis, risk management, and regulatory compliance.

In addition, he has extensive experience in the development and execution of strategic plans, budgeting and forecasting, credit administration, and process improvement. Chemung Financial is confident that McKim’s knowledge and expertise in financial operations will contribute significantly to the company’s growth and success in the years ahead. The company is excited to welcome McKim aboard and looks forward to tapping into his experience in finance.

Price History

On Friday, Chemung Financial made a major announcement, naming Dale McKim as their new Chief Financial Officer (CFO) and Treasurer. This news caused a surge in the stock price of the company, with an opening price of $36.1 and a closing price of $37.9 – a 6.3% increase from the previous day’s closing price of $35.7. McKim brings with him a wealth of experience in the financial services industry from his prior roles in banking, investments, and accounting. He is highly regarded as a key leader in these fields and is expected to make an immediate impact on the company’s financial performance.

Chemung Financial is confident that McKim will be able to help the company achieve its short-term and long-term goals, and has full confidence that his expertise in financial management and oversight will help the company remain successful in the future. With this new appointment, Chemung Financial is better positioned to ensure its continued growth and success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Chemung Financial. More…

| Total Revenues | Net Income | Net Margin |

| – | 29.19 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Chemung Financial. More…

| Operations | Investing | Financing |

| 35.05 | -252.62 | 246.46 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Chemung Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.65k | 2.48k | – |

Key Ratios Snapshot

Some of the financial key ratios for Chemung Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.8% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

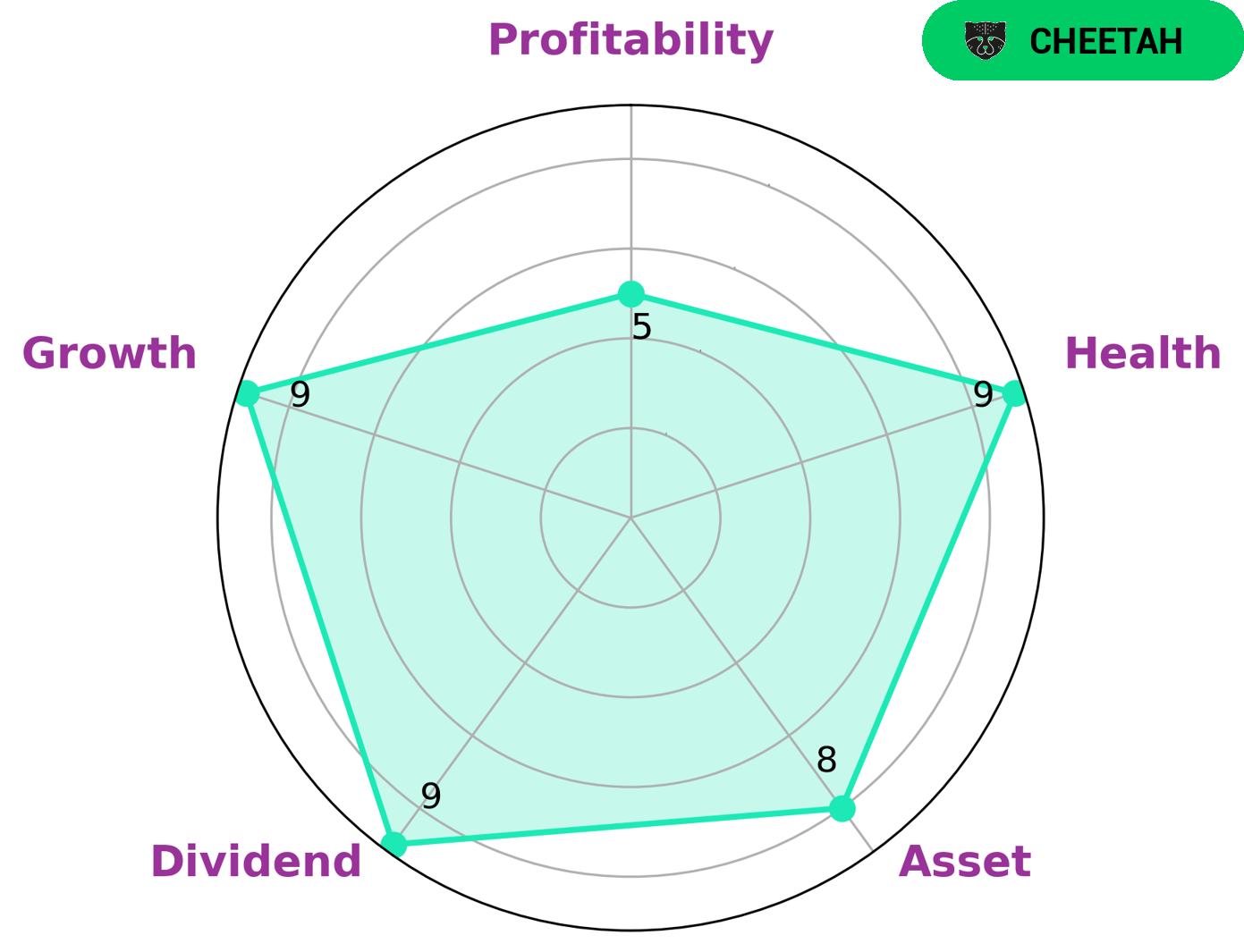

GoodWhale recently conducted an analysis of CHEMUNG FINANCIAL‘s wellbeing. Based on Star Chart, we concluded that CHEMUNG FINANCIAL has a high health score of 9/10, which suggests that this company is capable to pay off debt and fund future operations. CHEMUNG FINANCIAL is classified as ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This means that investors looking for fast growth may be interested in CHEMUNG FINANCIAL. Additionally, the company is strong in terms of growth, asset, dividend, and medium in profitability. Therefore, investors looking for companies with strong fundamentals and potential for growth may also be interested in investing in CHEMUNG FINANCIAL. More…

Peers

The company operates through its subsidiaries, Chemung Canal Trust Company and Chemung Valley Insurance Agency, Inc. It offers a range of deposit products, including checking and savings accounts, money market accounts, and certificates of deposit; and loan products, such as residential mortgages, home equity lines of credit, commercial real estate loans, construction loans, commercial and industrial loans, and consumer loans. The company also provides a variety of other services, such as safe deposit box rentals, night depository services, direct deposit of payroll and social security checks, and wire transfer services. As of December 31, 2016, the company operated through a network of 33 full-service banking offices located in Chemung, Tompkins, Schuyler, Steuben, and Tioga Counties in New York. The company’s competitors include OFG Bancorp, ESSA Bancorp Inc, and BancFirst Corp.

– OFG Bancorp ($NYSE:OFG)

The company has a market cap of 1.33B as of 2022. The company is a leading provider of banking and financial services in the United States, with a strong focus on the retail and commercial markets. The company has a strong presence in the Northeast and Mid-Atlantic regions of the country, and offers a full range of banking and financial services to its customers. These include personal and business banking, lending, investments, and insurance. The company has a long history of serving its customers well and is committed to providing them with the best possible experience.

– ESSA Bancorp Inc ($NASDAQ:ESSA)

The company’s market cap is $222.15 million as of 2022. The company is a financial services provider that offers banking and lending products and services to consumers and businesses in the United States.

– BancFirst Corp ($NASDAQ:BANF)

BancFirst Corp is a financial services holding company headquartered in Oklahoma City, Oklahoma. As of December 31, 2020, BancFirst Corp had $12.2 billion in assets, $8.7 billion in loans, and $9.6 billion in deposits. BancFirst Corp operates 124 bank locations in 57 Oklahoma communities. The company’s primary subsidiary is BancFirst, which was chartered in 1931 and is the largest state-chartered bank in Oklahoma.

Summary

Chemung Financial Corporation recently announced the appointment of Dale McKim as their new Chief Financial Officer (CFO) and Treasurer. This news resulted in a positive stock market reaction, as the stock price rose on the same day. Analysts consider this move a positive sign for investors, as Mr. McKim has extensive experience in the finance sector and a proven track record of successful financial management.

With his expertise, it is expected that he will be able to successfully manage the company’s financial operations and drive long-term profitability. Given the strong fundamentals of the company and the appointment of a new CFO, investors may find Chemung Financial to be an attractive long-term investment option.

Recent Posts