Brookline Bancorp stock dividend – BROOKLINE BANCORP Declares 0.135 Cash Dividend

February 6, 2023

Dividends Yield

Brookline Bancorp stock dividend – BROOKLINE BANCORP ($NASDAQ:BRKL) Inc. recently announced a 0.135 USD cash dividend on February 1, 2023. This dividend will be paid out on April 1, 2023 to shareholders of record as of the close of business on February 9, 2023. BROOKLINE BANCORP has been issuing a dividend of 0.52 USD per share for the past 3 years, yielding 3.59% annually. This makes it an attractive choice for investors looking for dividend stocks. BROOKLINE BANCORP is a publicly traded financial holding company with a diversified portfolio of banking and financial services businesses across the United States. The company has a long history of providing innovative banking and financial services to public and private sector customers, and it has consistently delivered high returns to its shareholders through excellent management and prudent capital allocation.

BROOKLINE BANCORP’s strong balance sheet and capital position make it well-positioned to continue delivering high returns to its shareholders. The company is well-positioned to benefit from a strengthening economy and higher consumer spending in the coming years. Its solid financial foundation is complemented by a strong management team and a commitment to delivering long-term value to its shareholders. The ex-dividend date for the dividend is February 9, 2023 which is just over two weeks away. Investors interested in dividend stocks should consider BROOKLINE BANCORP as a potential investment opportunity due to its competitive dividend yield of 3.59%. With its strong financial position, the company is well-positioned to continue to deliver value to its shareholders in the future.

Stock Price

On Wednesday, the stock opened at $13.1 and closed at $13.3, marking a 1.6% increase from its prior closing price of $13.1. Looking back at their performance, BROOKLINE BANCORP Inc. has seen a steady growth in their stock price over the past year. By providing a dividend, BROOKLINE BANCORP Inc. is giving investors a return on their investment in the form of a cash payout. This dividend payout is an indication of the company’s ability to generate value for their shareholders and is a sign of their strong financial position. The dividend payout is also beneficial for investors because it allows them to receive a steady stream of income without having to sell their shares.

This can help investors maintain their positions in the company and help them generate long-term returns on their investments. The dividend payout is a sign that the company is committed to rewarding its shareholders and is in a strong financial position to do so. It also provides investors with an additional source of income and allows investors to maintain their positions in the company while still earning returns on their investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Brookline Bancorp. More…

| Total Revenues | Net Income | Net Margin |

| – | 109.74 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Brookline Bancorp. More…

| Operations | Investing | Financing |

| 133.21 | 131.11 | -371.51 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Brookline Bancorp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.22k | 8.23k | – |

Key Ratios Snapshot

Some of the financial key ratios for Brookline Bancorp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.0% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

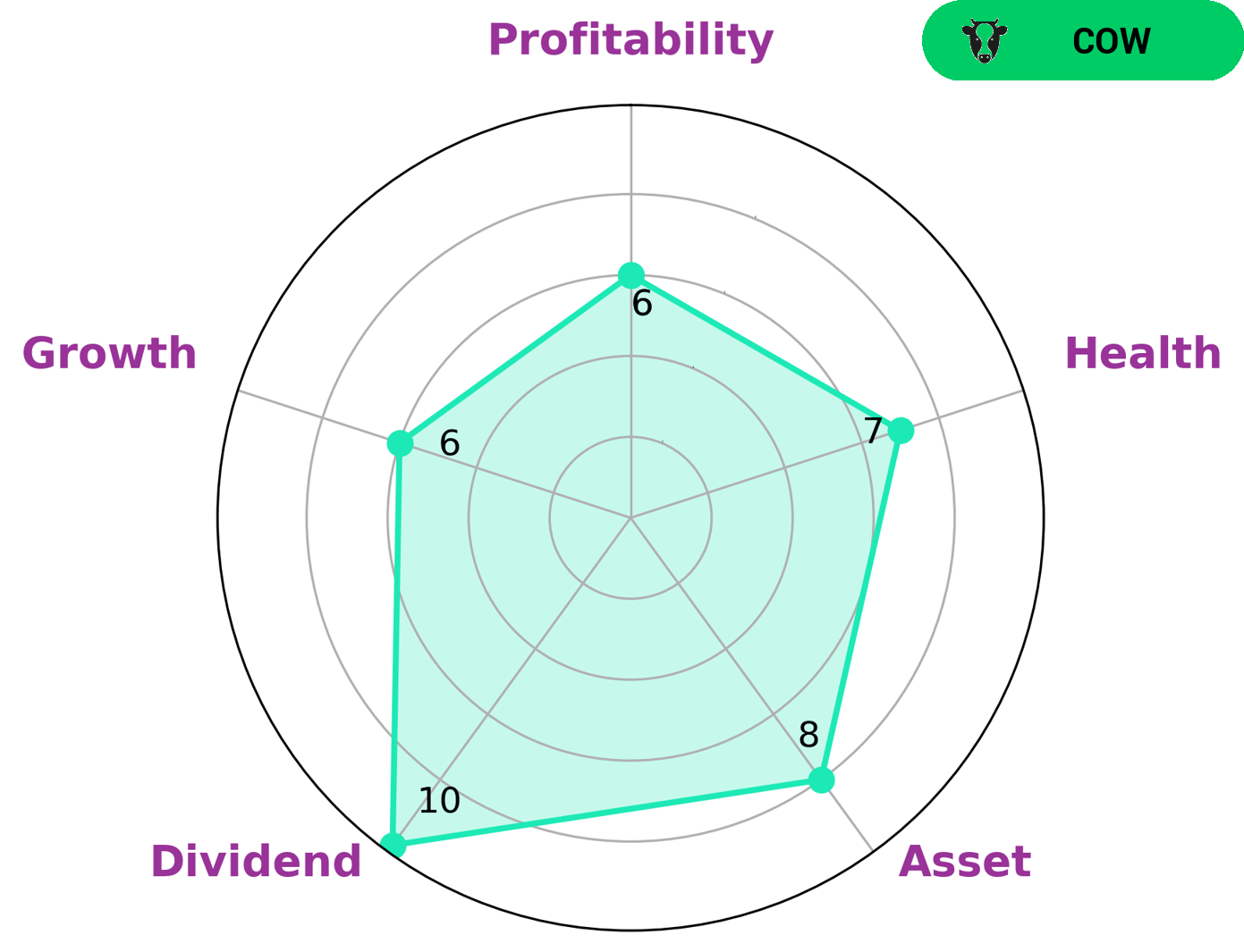

BROOKLINE BANCORP has been evaluated by GoodWhale and classified as a ‘cow’, a type of company that has a track record of paying out consistent and sustainable dividends. This makes BROOKLINE BANCORP an attractive investment opportunity for investors seeking steady income, such as retirees and those looking for a reliable portfolio addition. BROOKLINE BANCORP’s fundamentals are strong in asset, dividend, and medium in growth, profitability. It also has a high health score of 7/10 with regard to its cashflows and debt, indicating that it is capable of sustaining future operations even in times of crisis. Investors could also benefit from BROOKLINE BANCORP’s strong financials and consistent dividend by taking advantage of the potential for capital appreciation. The company’s strong balance sheet could also provide stability and financial flexibility for future investments and acquisitions. Overall, BROOKLINE BANCORP is an attractive investment opportunity for investors seeking a reliable and consistent dividend return as well as the potential for capital appreciation. Its strong balance sheet indicates the ability to weather any economic conditions in the future, making it a great choice for those looking for a secure long-term investment. More…

Peers

Brookline Bancorp Inc is one of the leading financial services companies in the United States, providing various banking and financial services to individuals and businesses alike. Along with Brookline Bancorp Inc, the competitive landscape in the banking sector is also comprised of Penns Woods Bancorp Inc, Eagle Financial Services Inc, and Southern Bancshares NC Inc. All four of these companies offer a variety of products and services to their customers to meet their needs.

– Penns Woods Bancorp Inc ($NASDAQ:PWOD)

Penns Woods Bancorp Inc is a financial holding company that operates through its subsidiaries, which provide commercial banking services and trust services in Pennsylvania. The company has a market cap of 189.74M as of 2022, which is the total value of all of its outstanding shares. The company’s market cap provides investors with an indication of the size of the company and its potential for growth. Penns Woods Bancorp Inc offers a range of products and services, including deposits, personal and business loans, commercial real estate loans, and wealth management services. The company also works to ensure that customers have access to competitive rates and access to a wide range of financial services.

– Eagle Financial Services Inc ($OTCPK:EFSI)

Eagle Financial Services Inc is a financial services holding company with a market cap of 127.71M as of 2022. The company provides a wide range of services, including investment banking, asset management, advisory services and insurance through its various subsidiaries. It is headquartered in Richmond, Virginia, and is traded on the Nasdaq stock exchange under the ticker symbol EFSI. Eagle Financial Services Inc has been providing financial services to clients since its inception in 1987, and it has grown to become one of the largest financial service companies in the region. Its mission is to provide the highest quality of financial services for clients, while ensuring the security and protection of their investments.

Summary

BROOKLINE BANCORP is an attractive investment opportunity for dividend investors. With a dividend yield of 3.59% per year, it offers a solid return that is well above the market average. The company has also consistently paid out a dividend of 0.52 USD per share over the past 3 years, which is a sign of financial stability and a reliable income stream for shareholders. The dividend is paid out quarterly and the next ex-dividend date is February 9, 2023. Investors looking to benefit from BROOKLINE BANCORP’s dividend should consider their long-term goals before investing. It is important to research the company’s financials, as well as its dividend history and future prospects, to ensure that it is a smart investment choice.

Additionally, investors should ensure that their portfolio is well diversified and that they understand the risks associated with investing in any single stock. By doing so, investors can maximize their returns and minimize their risk when investing in BROOKLINE BANCORP.

Recent Posts