Brookline Bancorp dividend – Brookline Bancorp Declares 0.135 Cash Dividend

May 31, 2023

🌥️Dividends Yield

On May 26 2023, Brookline Bancorp ($NASDAQ:BRKL) Inc. announced the declaration of 0.135 Cash Dividend for its shareholders. If you are an investor interested in dividend stocks, Brookline Bancorp should definitely be on your list of consideration. The yearly dividend per share distributed over the past three years have been 0.53 USD, 0.52 USD, and 0.48 USD, resulting in dividend yields of 3.89%, 3.59% and 3.33%, respectively. Overall, the dividend yield from Brookline Bancorp averages out to 3.6%.

Investors should note that the ex-dividend date for this declared dividend is set for May 11 2023. As such, investors interested should consider buying the stock on or before this date to be eligible for the dividend payout.

Market Price

In response to the announcement, the stock opened at $8.5 and closed at $8.6, an increase of 2.1% from the prior closing price of $8.5. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Brookline Bancorp. More…

| Total Revenues | Net Income | Net Margin |

| – | 92.6 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Brookline Bancorp. More…

| Operations | Investing | Financing |

| 120.76 | -557.69 | 492.15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Brookline Bancorp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.52k | 10.36k | – |

Key Ratios Snapshot

Some of the financial key ratios for Brookline Bancorp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.0% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

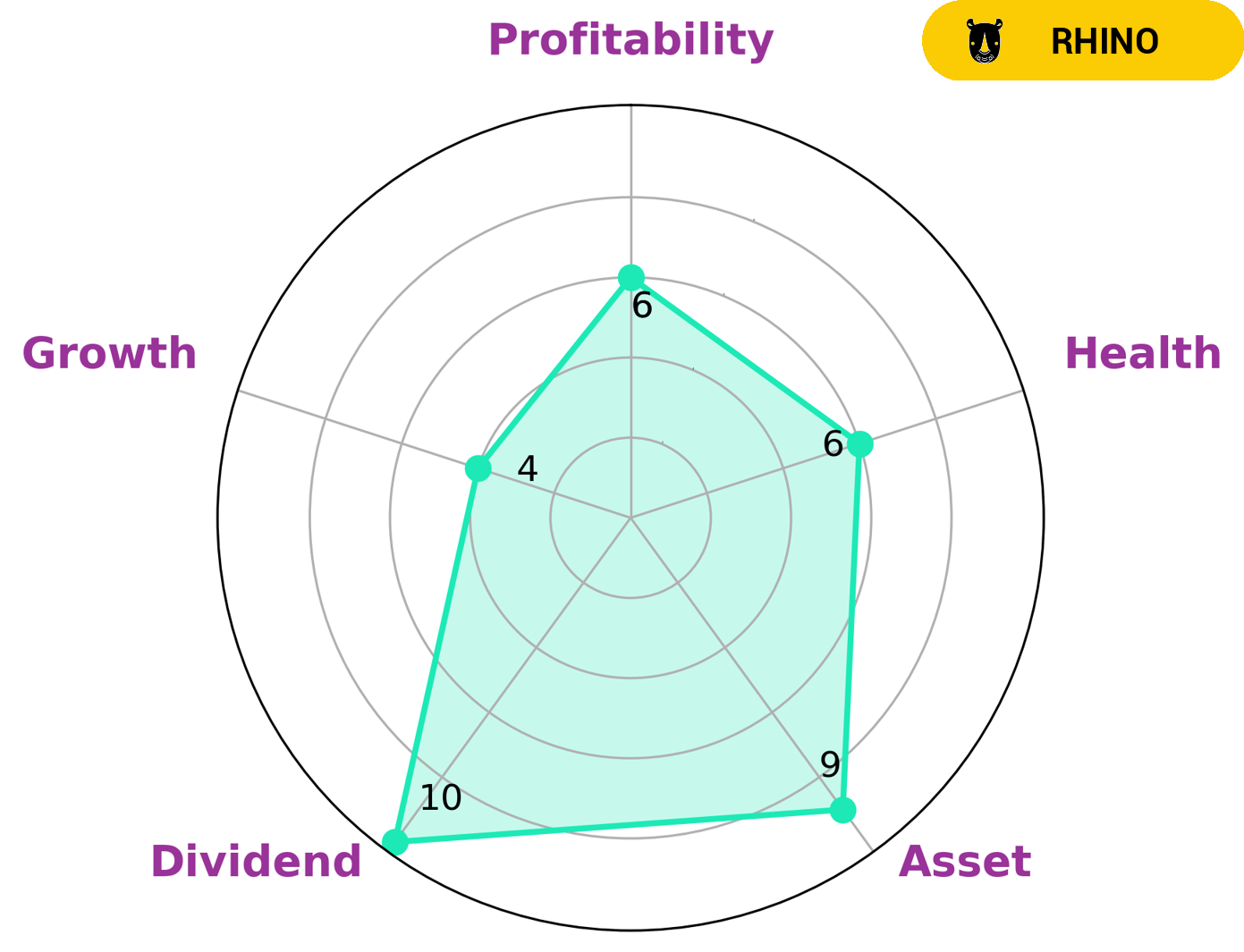

At GoodWhale, we analyze the financials of BROOKLINE BANCORP and have found that it is strong in asset, dividend, and medium in growth, profitability. We classify it as a ‘rhino’ type of company which has achieved moderate revenue or earnings growth. This type of company is likely to interest investors who are looking for a steady return on their investment. Furthermore, BROOKLINE BANCORP has an intermediate health score of 6/10 with regard to its cashflows and debt, indicating that it is likely to safely ride out any crisis without the risk of bankruptcy. More…

Peers

Brookline Bancorp Inc is one of the leading financial services companies in the United States, providing various banking and financial services to individuals and businesses alike. Along with Brookline Bancorp Inc, the competitive landscape in the banking sector is also comprised of Penns Woods Bancorp Inc, Eagle Financial Services Inc, and Southern Bancshares NC Inc. All four of these companies offer a variety of products and services to their customers to meet their needs.

– Penns Woods Bancorp Inc ($NASDAQ:PWOD)

Penns Woods Bancorp Inc is a financial holding company that operates through its subsidiaries, which provide commercial banking services and trust services in Pennsylvania. The company has a market cap of 189.74M as of 2022, which is the total value of all of its outstanding shares. The company’s market cap provides investors with an indication of the size of the company and its potential for growth. Penns Woods Bancorp Inc offers a range of products and services, including deposits, personal and business loans, commercial real estate loans, and wealth management services. The company also works to ensure that customers have access to competitive rates and access to a wide range of financial services.

– Eagle Financial Services Inc ($OTCPK:EFSI)

Eagle Financial Services Inc is a financial services holding company with a market cap of 127.71M as of 2022. The company provides a wide range of services, including investment banking, asset management, advisory services and insurance through its various subsidiaries. It is headquartered in Richmond, Virginia, and is traded on the Nasdaq stock exchange under the ticker symbol EFSI. Eagle Financial Services Inc has been providing financial services to clients since its inception in 1987, and it has grown to become one of the largest financial service companies in the region. Its mission is to provide the highest quality of financial services for clients, while ensuring the security and protection of their investments.

Summary

BROOKLINE BANCORP is an attractive dividend stock for investors. Over the past three years, it has offered an average dividend yield of 3.6%. The dividends per share have been distributed at 0.53 USD, 0.52 USD, and 0.48 USD, respectively.

It has provided steady returns for its shareholders and is a good addition to any portfolio of dividend stocks. Analyzing the stock’s performance and outlook will provide investors with a comprehensive understanding of the company’s future potential and returns.

Recent Posts