BRBS dividend yield calculator – “Blue Ridge Bankshares Announces 0.1225 Cash Dividend”.

April 19, 2023

Dividends Yield

Blue Ridge Bankshares ($NYSEAM:BRBS) Inc. has announced on April 18 2023 the declaration of a 0.1225 cash dividend, per common share. This dividend is the same as the company’s annual dividend of 0.49 USD per share over the past three years, resulting in a combined dividend yield of 3.26%. If you are looking to invest in a dividend stock, BLUE RIDGE BANKSHARES may be a good option to consider.

The ex-dividend date for the dividend is April 17 2023 and those investors who purchase the stock prior to this date will be eligible to receive the dividend payout. BLUE RIDGE BANKSHARES has a history of consistent dividend payments and this recent announcement is an indication of their commitment to shareholders.

Market Price

This is the first dividend to be paid by Blue Ridge Bankshares this year, and investors are optimistic about the future of the company. The dividend will be distributed on August 18th and is payable to shareholders of record as of August 3rd. This cash dividend is seen as a sign of Blue Ridge Bankshares’ commitment to rewarding its shareholders.

It offers investors a way to earn a return on their investment while still maintaining ownership of the company’s stock. With the recent announcement of this dividend, investors are confident that Blue Ridge Bankshares will continue to perform well and reward its shareholders for their loyalty. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BRBS. More…

| Total Revenues | Net Income | Net Margin |

| – | 27.91 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BRBS. More…

| Operations | Investing | Financing |

| 93.93 | -628.18 | 480.98 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BRBS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.14k | 2.88k | – |

Key Ratios Snapshot

Some of the financial key ratios for BRBS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 37.1% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

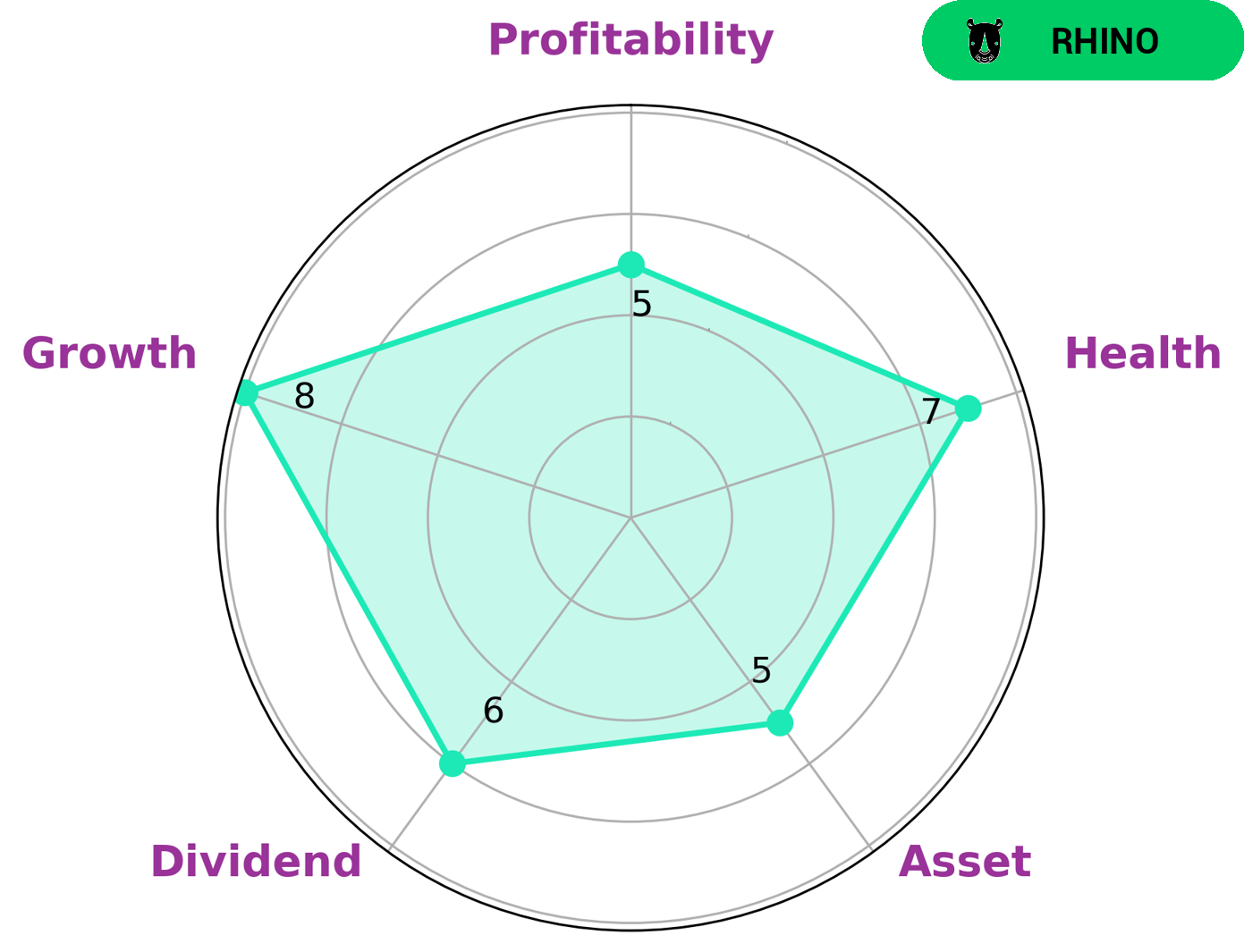

At GoodWhale, we recently performed an analysis of the wellbeing of BLUE RIDGE BANKSHARES. Our Star Chart revealed that BLUE RIDGE BANKSHARES has a high health score of 7/10. This score reflects the company’s ability to pay off debt and fund future operations with its cashflows and debt. Based on this assessment, we classified BLUE RIDGE BANKSHARES as a ‘rhino’ type of company. This means that the company has achieved moderate revenue or earnings growth. Investors who may be interested in the company are those who are looking for strong growth, with moderate profitability, assets, and dividend yields. BLUE RIDGE BANKSHARES is well-positioned, as it fits these criteria. More…

Peers

In the banking industry, competition is fierce. Different banks offer different products and services, and it can be difficult for consumers to know which bank is right for them. When choosing a bank, it is important to consider the fees, interest rates, and other factors that can affect your decision. The company has branches in Virginia, North Carolina, and South Carolina. Uwharrie Capital Corp is a regional bank that operates in North Carolina and Virginia. National Bank Holdings Corp is a national bank that offers a wide variety of banking products and services. Merchants & Marine Bancorp Inc is a regional bank that operates in Mississippi, Alabama, and Louisiana.

– Uwharrie Capital Corp ($OTCPK:UWHR)

Wharrie Capital Corp is a publicly traded company with a market capitalization of $45.4 million as of 2022. The company is engaged in the business of providing financing solutions to small and medium sized businesses in the United States. Wharrie Capital Corp is headquartered in Charlotte, North Carolina.

– National Bank Holdings Corp ($NYSE:NBHC)

As of 2022, National Bank Holdings Corporation had a market capitalization of $1.58 billion. The company is a bank holding company that operates through its subsidiaries, which provide banking and related financial services to retail, commercial, and corporate customers. It offers a range of deposit products and services, including checking and savings accounts, money market and certificates of deposit, and online and mobile banking. The company also provides lending products and services, such as consumer loans, mortgages, commercial loans, and lines of credit. In addition, it offers investment management, trust, and private banking services.

– Merchants & Marine Bancorp Inc ($OTCPK:MNMB)

Merchants & Marine Bancorp Inc is a bank holding company that operates through its subsidiary, Merchants Bank. The Bank offers a range of banking services to individuals and businesses in its market area, which includes southern Mississippi and central Alabama. As of December 31, 2016, the Bank operated 25 full-service banking offices and one loan production office.

Summary

Based on the dividend yield, BLUE RIDGE BANKSHARES appears to be a stable investment option. It has consistently paid out an annual dividend of 0.49 USD per share for the past three years, resulting in an overall yield of 3.26%. Investors seeking a consistent return may find this company attractive.

A further analysis should include the company’s financials, such as its cash flow, debt-equity ratio and earnings potential, to determine if investing in BLUE RIDGE BANKSHARES is a wise decision. As a potential investor, it is important to consider all aspects of a company before investing.

Recent Posts