Bok Financial stock dividend – BOK Financial Corp Declares 0.54 Cash Dividend

February 12, 2023

Dividends Yield

Bok Financial stock dividend – On February 4 2023, BOK ($BER:BJR) Financial Corp (BOKF) declared a 0.54 USD dividend per share for stockholders of record as of February 13 2023. This is the fourth consecutive year that BOK Financial has declared a dividend, with an annual dividend per share of 2.13 USD for the past three years. Between 2022 and 2023, the dividend yield was recorded at 2.22%, with an average dividend yield of 2.22%. This makes BOK Financial a viable option for investors looking to invest in stocks with a high dividend yield. BOK Financial is a U.S.-based financial services company offering consumer and commercial banking, trust and wealth management services, and other financial products. It has operations in 10 states, including Oklahoma and Texas, plus an extensive nationwide lending network.

The company is based in Tulsa, Oklahoma, but its stock is publicly traded on the New York Stock Exchange (NYSE: BOKF). BoK Financial‘s success has been driven by its ability to successfully manage its finances and operations. The company has experienced steady revenue growth over the past few years, and its balance sheet reflects a healthy net income and strong asset-liability management practices. Its strong financial performance has enabled the company to build its franchise and expand into new markets. Overall, BOK Financial is an attractive investment option for investors looking for a high dividend yield. The company’s strong financial performance and reliable dividend payments make it an ideal choice for investors seeking long-term gains. With the ex-dividend date set at February 13 2023, investors with an appetite for risk should consider investing in BOK Financial’s stocks.

Share Price

Following the announcement, BOK FINANCIAL stock opened at €96.0 and closed at €96.5, up by 0.5% from previous closing price of 96.0. The company’s management believes that the dividend declaration is in line with their strategy of returning excess capital to shareholders. They remain committed to a disciplined capital management strategy and will continue to assess the dividend policy on a regular basis in order to maximize shareholder value. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bok Financial. More…

| Total Revenues | Net Income | Net Margin |

| – | 520.27 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bok Financial. More…

| Operations | Investing | Financing |

| -3.69k | 2.6k | 2.75k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bok Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 47.79k | 43.1k | – |

Key Ratios Snapshot

Some of the financial key ratios for Bok Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.3% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

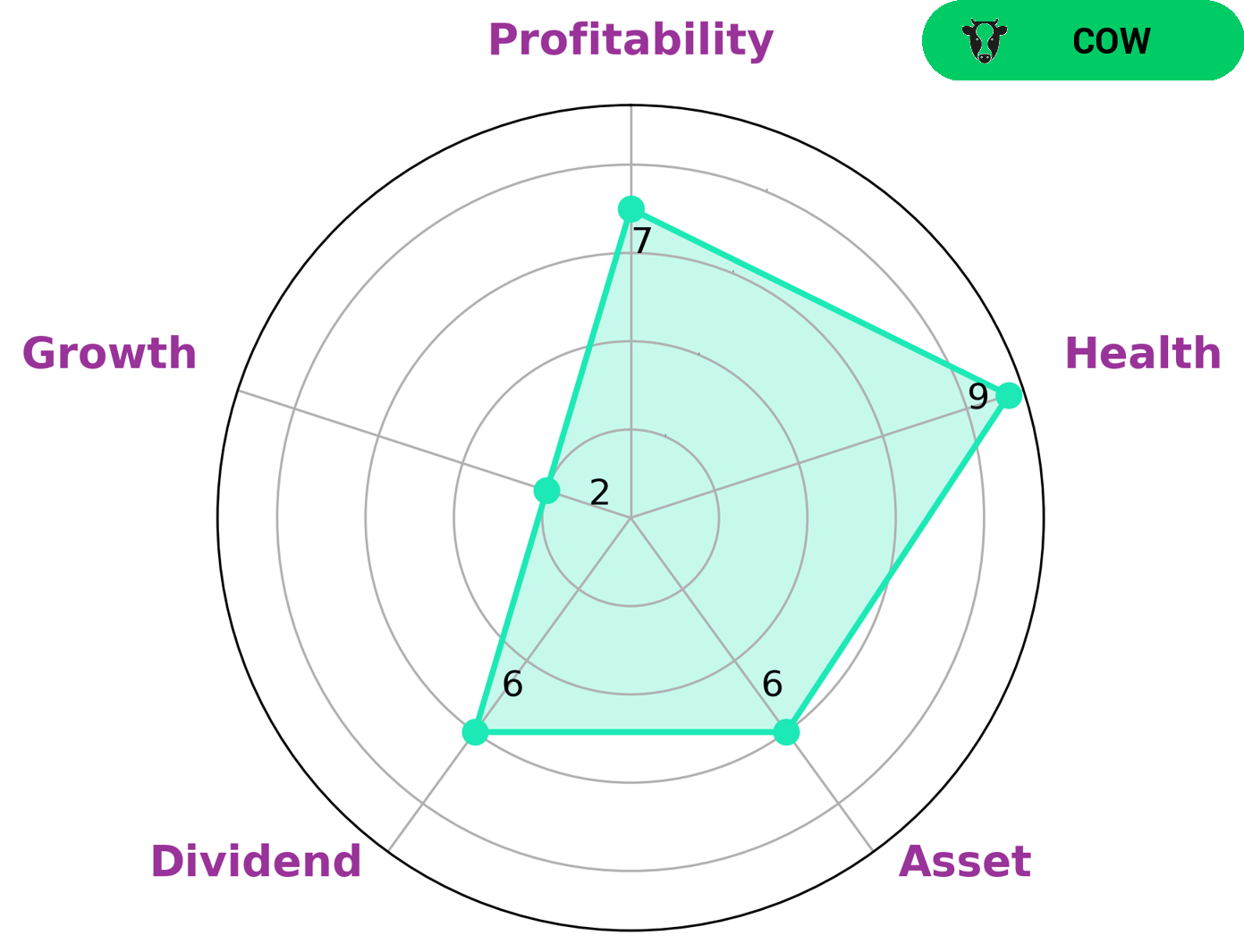

GoodWhale has conducted an analysis of BOK FINANCIAL‘s wellbeing. According to its Star Chart, BOK FINANCIAL has a high health score of 9/10, indicating its ability to fund future operations and pay off debt. Additionally, BOK FINANCIAL is strong in profitability, while its performance in terms of asset, dividend and growth are all judged to be medium. Therefore, it is classified as a ‘cow’, which is a type of company that has the track record of paying out consistent and sustainable dividends. Investors who are looking for reliable returns are likely to be interested in investing in BOK FINANCIAL. The company has a high health score and is capable of paying off debt and funding future operations. Moreover, its classification as a ‘cow’ indicates that it has a history of reliable dividend payouts. Furthermore, the company has a strong performance in terms of profitability and medium performance in terms of asset, dividend, and growth. This makes BOK FINANCIAL an attractive investment opportunity for investors who want steady returns and low risk. More…

Summary

Investing in BOK FINANCIAL is a great option for those looking to reap the benefits of a high dividend yield. The company has consistently declared an annual dividend per share of 2.13 USD for the past three years and currently has an average yield of 2.22%. It is important to note that the ex-dividend date for BOK FINANCIAL is February 13 2023. When evaluating the stock, investors should take into consideration its consistent track record of paying dividends, its current dividend yield, and its potential growth in future years.

Additionally, investors should also research and analyze the company’s financial statements to ensure its solvency and profitability.

Recent Posts