Bank of Queensland’s Share Price Soars in 2023!

March 30, 2023

Trending News ☀️

Today, the Bank ($ASX:BOQ) of Queensland’s share price has skyrocketed to a level not seen in years. This remarkable rise has been attributed to a number of factors. Firstly, due to the bank’s diversified portfolio and risk management strategies, investors have been drawn to its stability and resilience. This has resulted in a drastic reduction in operational costs, allowing for greater earnings and returns for shareholders.

Additionally, the Bank of Queensland has taken a proactive stance in regards to corporate social responsibility, investing heavily in local communities and businesses. All these initiatives have seen a surge in investor confidence, resulting in a marked increase in its share price. It is no surprise then that analysts are predicting further gains in the coming months.

Share Price

On Monday, the Bank of Queensland‘s share price saw a dramatic increase, with the stock opening at AU$6.4 and closing at the same price. The surge was met with mostly positive media exposure, signalling optimism in the company’s future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BOQ. More…

| Total Revenues | Net Income | Net Margin |

| – | 423 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BOQ. More…

| Operations | Investing | Financing |

| -1.24k | -192 | 1.32k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BOQ. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 99.93k | 93.25k | – |

Key Ratios Snapshot

Some of the financial key ratios for BOQ are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.5% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

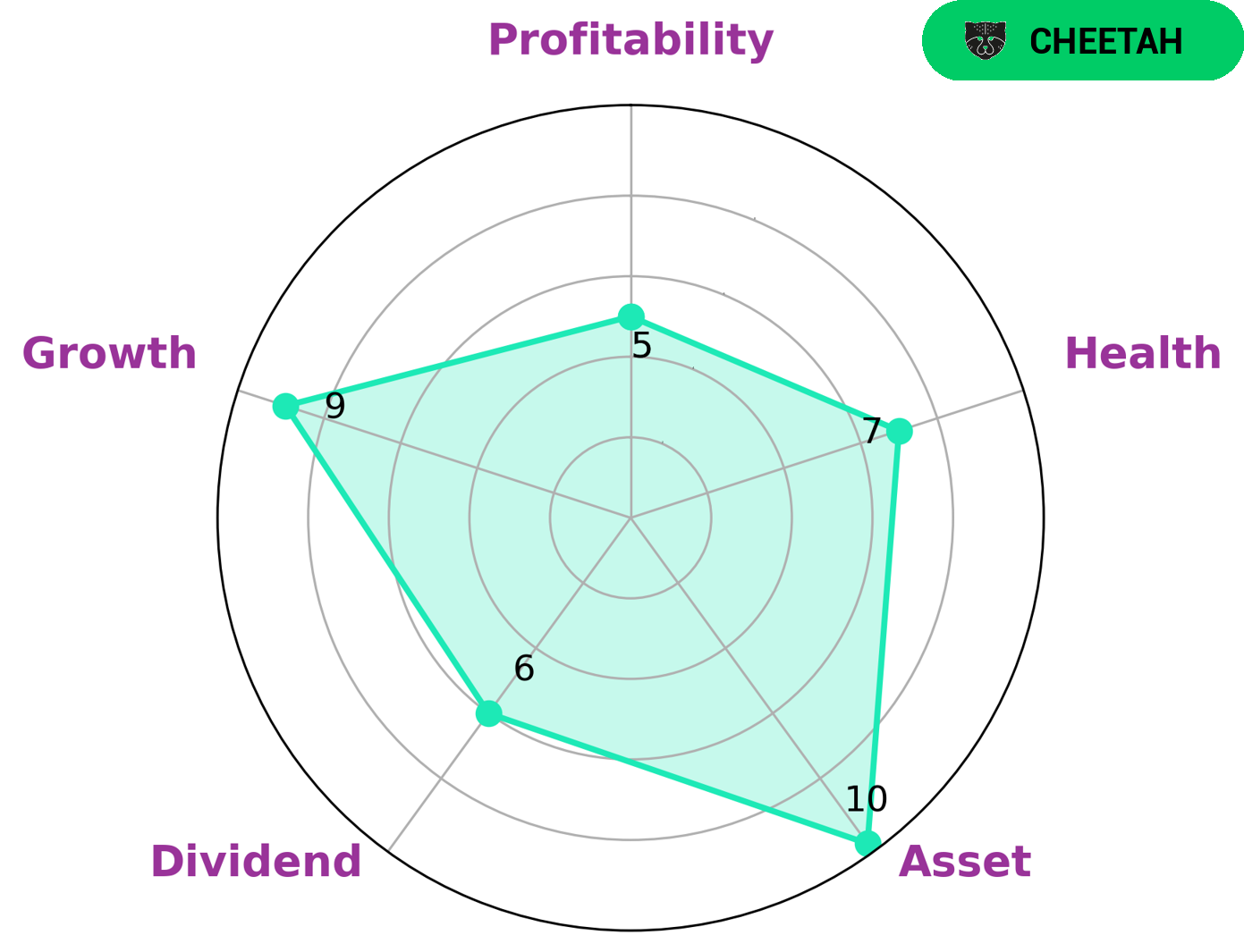

GoodWhale conducted an analysis of the economic wellbeing of BANK OF QUEENSLAND and found that they have a high health score of 7/10 in terms of cashflows and debt. This indicates that they are capable of paying off debt and funding future operations. Not only that, but BANK OF QUEENSLAND is also strong in growth and asset, and medium in profitability and dividend. Due to these results, GoodWhale classified BANK OF QUEENSLAND as a ‘cheetah’ type of company, which achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given the nature of this company, it is likely to be most attractive for the type of investors seeking high-growth opportunities, such as venture capital and private equity firms. These investors have the financial resources and risk tolerance to take on the risks associated with a company like BANK OF QUEENSLAND. However, it is also important to note that there are also other types of investors who may be interested in investing in BANK OF QUEENSLAND, such as those with a more conservative approach or those who want to diversify their portfolio. More…

Peers

The banking industry in Australia is fiercely competitive, with Bank of Queensland Ltd striving to maintain its market share against a range of competitors. These include Auswide Bank Ltd, Secure Trust Bank PLC, and Independent Bank Group Inc, all of whom are seeking to gain an advantage in the market by offering innovative products and services. As such, Bank of Queensland Ltd must remain agile and responsive to customer needs in order to remain competitive.

– Auswide Bank Ltd ($ASX:ABA)

Auswide Bank Ltd is a customer owned bank, offering banking, finance and insurance services to individuals, businesses and corporate customers. The company has a market cap of 270.02M as of 2023. Market capitalization (market cap) is the total market value of all of a company’s outstanding shares and is an important measure of a company’s size. Auswide Bank Ltd is a midsize bank with a market cap that places it in the mid-range of Australian banks in terms of size when compared to the larger four banks. It offers a range of services including home loans, personal loans, credit cards, savings accounts and transactional banking, as well as business banking, corporate banking and insurance products.

– Secure Trust Bank PLC ($LSE:STB)

Trust Bank PLC is a UK-based financial services company that provides a range of banking and financial services to customers in the UK. Its market capitalization as of 2023 is 142.43M, which indicates its size and market presence in the UK. The company’s services include retail banking, corporate banking, insurance, credit cards, mortgages, wealth management, and other services. Trust Bank PLC is committed to providing customers with secure, convenient, and reliable financial products and services. The company is well-known for its competitive interest rates and its strong customer service reputation.

– Independent Bank Group Inc ($NASDAQ:IBTX)

Independent Bank Group Inc., with a market cap of 2.4 billion as of 2023, is a financial holding company that provides community banking services in Texas, Oklahoma and Colorado. The company provides a range of banking services, including consumer and commercial loans, deposit accounts, treasury management services, and trust services. It also offers financial solutions to its customers through its subsidiaries. The company has a strong presence in the Dallas-Fort Worth metroplex and employs over 1,900 people. It has a solid customer base and a wide network of over 100 branches and offices located across the states of Texas, Oklahoma and Colorado.

Summary

Investing in Bank of Queensland (BOQ) could be a lucrative proposition for investors. Recent reports indicate that the company’s share price has soared in 2023, suggesting strong future growth potential. This is mainly attributed to its positive media exposure, which has been largely favorable since the start of the year. BOQ offers a range of financial products and services and has a wide network of branches throughout Australia. Over the past few years it has focused on improving its technology capabilities, which has helped to enhance customer experience, reduce costs, and improve operational efficiency. It has also made strategic investments in areas such as digital banking, payment solutions, and wealth management.

For investors looking to gain exposure to BOQ’s performance, there are a variety of options available. The company’s stock can be bought through a broker or online stock platform. Investors may also consider exchange-traded funds (ETFs) or mutual funds that invest in BOQ. Overall, BOQ could be a great way to diversify your portfolio and gain exposure to the Australian financial market. With its solid fundamentals and robust growth outlook, the company could be a good option for investors looking for long-term returns.

Recent Posts