Alerus Financial Co. (NASDAQ:ALRS) Experiences Uptick in Short Interest

April 4, 2023

Trending News ☀️

Investors should take note of a recent uptick in short interest for Alerus Financial ($NASDAQ:ALRS) Co. (NASDAQ:ALRS). Alerus Financial is a publicly traded bank holding company that provides financial services through two subsidiaries, Alerus Financial, N.A. and Alerus Securities, LLC. The company operates through three segments: Retail Banking, Corporate Banking, and Wealth Management and Mortgage.

They offer a variety of financial products and services to commercial and consumer customers, including deposit and loan products, as well as investment advisory services. Alerus Financial is headquartered in Grand Forks, North Dakota and serves customers throughout the United States.

Share Price

The stock opened at $16.1 and closed at the same price, marking a 0.2% increase from the prior closing price of 16.0. This increase in short interest suggests that more investors are anticipating a decrease in the value of ALERUS FINANCIAL‘s stock. However, the fact that the stock price closed at the same price as it opened indicates that the stock is still performing relatively well, despite the increase in short interest. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Alerus Financial. More…

| Total Revenues | Net Income | Net Margin |

| – | 39.59 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Alerus Financial. More…

| Operations | Investing | Financing |

| 102.97 | -292.62 | 5.59 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Alerus Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.78k | 3.42k | – |

Key Ratios Snapshot

Some of the financial key ratios for Alerus Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.9% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

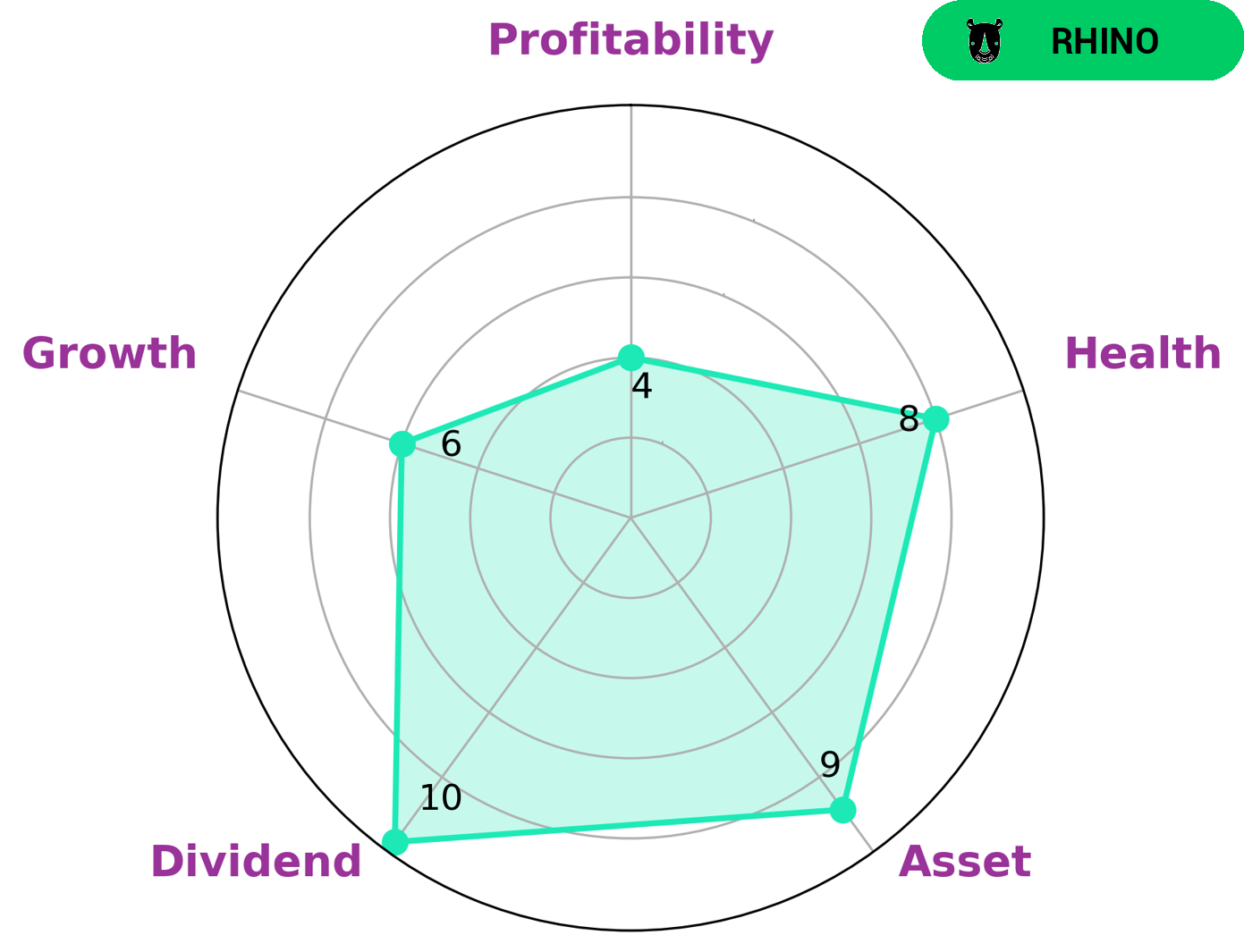

GoodWhale recently analyzed ALERUS FINANCIAL‘s wellbeing. Our analysis, using the Star Chart, showed that ALERUS FINANCIAL has a strong position in assets and dividends and is medium in growth and profitability. Due to this, we classified it as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. This could be attractive to investors looking for a company that has achieved moderate growth but is still stable in its finances. GoodWhale rated ALERUS FINANCIAL’s health score at 8/10 based on its cashflows and debt, demonstrating that it is capable of sustaining future operations in times of crisis. More…

Peers

The company operates through its subsidiaries, Alerus Bank and Alerus Mortgage. Alerus Financial competes with Juniata Valley Financial Corp, John Marshall Bancorp Inc, and Jd Bancshares Inc.

– Juniata Valley Financial Corp ($OTCPK:JUVF)

Juniata Valley Financial Corp is a financial holding company that operates through its subsidiary banks, which engage in a full range of banking activities. The Company’s subsidiary banks include The Juniata Valley Bank, N.A. and First National Bank of Mifflintown. As of December 31, 2016, the Company operated through 20 banking offices located in central Pennsylvania.

– John Marshall Bancorp Inc ($OTCPK:JDVB)

Jd Bancshares Inc is a bank holding company. As of 2022, its market cap is 94.72M. The company provides a full range of banking services to its customers, including deposits, loans, and investment services. It also offers a variety of other financial services, such as trust services, foreign exchange, and money transfer services.

Summary

Alerus Financial Co. (NASDAQ:ALRS) has seen a significant increase in short interest in the past month. This suggests investors are bearish on the stock in the short term, indicating that investors are expecting the stock price to fall in the short term. Given this increased short interest and the stock’s current valuation, investors should do their own research to evaluate the company’s fundamental prospects and make an informed decision regarding their investments.

Recent Posts