1st Source Reports Lower-Than-Expected Earnings and Revenue

April 21, 2023

Trending News 🌥️

1st Source ($NASDAQ:SRCE) Corporation recently reported their quarterly earnings and revenue, with disappointing results. According to the report, the Earnings Per Share was just $1.25, which was short of the estimated figure by $0.02. Similarly, the revenue of $92.88M was lower than expected by $0.31M. 1st Source Corporation is a financial holding company that operates through its subsidiary, 1st Source Bank.

It provides banking services, including lending, deposit and investment products and services to individuals, businesses and other organizations. The company also offers trust and wealth management, insurance, and specialty finance services.

Stock Price

The company’s stock opened at $43.6 and closed at $43.4, a decline of 0.5% from the previous closing price of $43.6. The earnings results mark a sharp contrast to the previous quarter, when the company reported higher-than-expected earnings and revenue growth. The company attributed the decline in revenue to lower-than-anticipated consumer demand, which has been impacted by the current economic climate.

In addition, expenses associated with the restructuring of certain business operations also weighed on the results. Management is now focused on reviving consumer demand and optimizing costs to regain profitability. In light of this, the company is exploring cost-cutting measures and strategic investments in areas such as new product development, marketing and technology. The disappointing earnings report serves as a reminder that 1st Source needs to continue to pursue strategies to ensure long-term success. Investors will be keenly watching the company’s next few quarters to see if these measures will result in an improved performance and stock prices. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 1st Source. More…

| Total Revenues | Net Income | Net Margin |

| – | 119.51 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 1st Source. More…

| Operations | Investing | Financing |

| 175.53 | -784.87 | 206.95 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 1st Source. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.34k | 7.42k | – |

Key Ratios Snapshot

Some of the financial key ratios for 1st Source are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.0% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

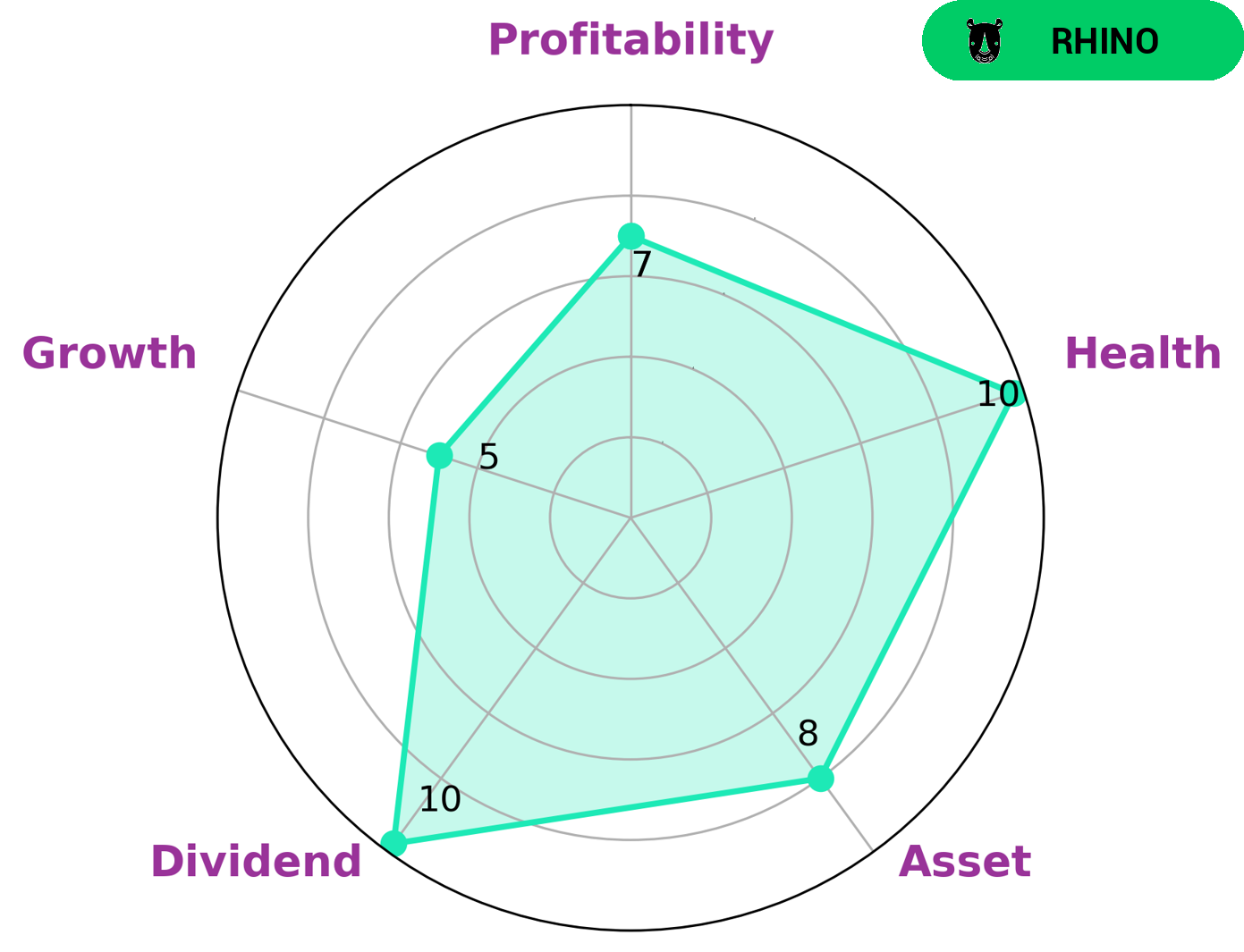

GoodWhale is tasked with analyzing the wellbeing of 1ST SOURCE. Based on Star Chart, 1ST SOURCE is classified as a ‘rhino’, indicating that it has achieved moderate revenue or earnings growth. As a result, investors who are looking for steadier, more consistent returns may be interested in this type of company. Additionally, 1ST SOURCE is strong in profitability, assets, and dividends and medium in growth. Moreover, 1ST SOURCE has a high health score of 10/10 considering its cash flows and debt, indicating that it is capable of paying off debt and funding future operations. More…

Peers

The company offers a wide range of products and services including banking, lending, investments, and insurance. 1st Source Corp competes with a number of other financial institutions in the United States, including Salisbury Bancorp Inc, Union Bank Of The Philippines Inc, East West Banking Corp.

– Salisbury Bancorp Inc ($NASDAQ:SAL)

Salisbury Bancorp Inc is a bank holding company based in the United States. The company was founded in 1892 and is headquartered in New York, New York. Salisbury Bancorp Inc operates through its subsidiary, Salisbury Bank and Trust Company. The company provides banking services to individuals and businesses in the United States. Salisbury Bank and Trust Company offers a range of deposit and loan products, as well as online and mobile banking services.

– Union Bank Of The Philippines Inc ($PSE:UBP)

Union Bank of the Philippines Inc has a market cap of 167.08B as of 2022. The company is a universal bank that provides a wide range of banking and other financial services to its retail, corporate, and institutional clients. Its products and services include deposit products, loans, credit cards, foreign exchange, treasury, and trust services. The bank has a network of over 900 branches and 2,600 ATMs nationwide.

– East West Banking Corp ($PSE:EW)

East West Banking Corporation is a Philippines-based bank. The Bank offers a range of personal and corporate banking services, which include deposits, loans, foreign exchange, treasury, credit cards, and other services. East West Banking Corporation has a nationwide network of over 500 branches and 1,800 ATMs.

Summary

1st Source Corporation has released its quarterly earnings report, missing analyst estimates for both EPS and revenue. Investors may want to consider the weaker-than-expected financial results as part of their overall analysis of the stock. The stock should be watched closely in the near future to determine if the underperformance is short-term or if 1st Source will need to adjust its strategy and outlook.

Recent Posts