Wells Fargo Boosts Avantor’s Price Target to $28, Maintains Overweight Rating

February 9, 2023

Trending News ☀️

Wells Fargo ($NYSE:WFC), one of the largest financial institutions in the United States, has recently increased its price target for Avantor to $28, maintaining its Overweight Rating, up from the previous target of $25. Wells Fargo is one of the biggest banks in the United States and a leading provider of financial services to businesses, consumers, and government entities. Wells Fargo is well-known for its commitment to helping customers achieve their financial goals, through a variety of products and services. In addition to its banking services, Wells Fargo provides investment advice, retirement planning, and other financial services. The bank also offers credit cards and loans for individuals and businesses. Avantor is a leading global manufacturer and distributor of specialty chemicals and materials for research, development, and production applications. The company has established itself as a reliable supplier of high-quality products to customers in a wide range of industries.

Wells Fargo’s decision to increase Avantor’s price target indicates that the company believes in the long-term potential of the company and its products. This move could also be seen as a sign of confidence in the broader market and economic climate. As the economy continues to improve, investors may find Avantor’s stock to be an attractive option. Overall, Wells Fargo’s decision to increase Avantor’s price target to $28 is a positive move for the company and its shareholders. With its Overweight Rating, the bank is showing faith in Avantor’s ability to continue to provide high-quality products and services to its customers. Investors should keep an eye on Avantor’s stock in the coming weeks and months to see how it performs in light of this news.

Share Price

Wells Fargo has boosted Avantor’s price target to $28 and maintained an Overweight rating at the time of writing, despite the mostly negative media sentiment. On Wednesday, WELLS FARGO stock opened at $47.7 and closed at $48.2, up by 0.2% from last closing price of 48.1. This positive news from Wells Fargo has been seen as a potential indicator of growth for Avantor, and investors have been responding positively to the news. The Overweight rating given to Avantor by Wells Fargo is seen as a sign of confidence in the company’s future prospects. This is especially true in light of the current market conditions, which have been more volatile than usual and uncertain for many businesses.

The fact that Wells Fargo has chosen to boost Avantor’s price target at this time indicates that the company is confident in Avantor’s ability to perform, even in the current market climate. This news could be seen as a sign of optimism in the stock market and could ultimately lead to further gains for Avantor and other stocks alike. The Overweight rating given by Wells Fargo could also be seen as an endorsement of Avantor’s management team, as the company looks to continue to grow and make progress in the future. It is clear that Wells Fargo has confidence in Avantor and is willing to back their investment with a boost to the price target. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Wells Fargo. More…

| Total Revenues | Net Income | Net Margin |

| – | 12.07k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Wells Fargo. More…

| Operations | Investing | Financing |

| -11.53k | -7.62k | -11.24k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Wells Fargo. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.88M | 1.7M | – |

Key Ratios Snapshot

Some of the financial key ratios for Wells Fargo are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.6% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

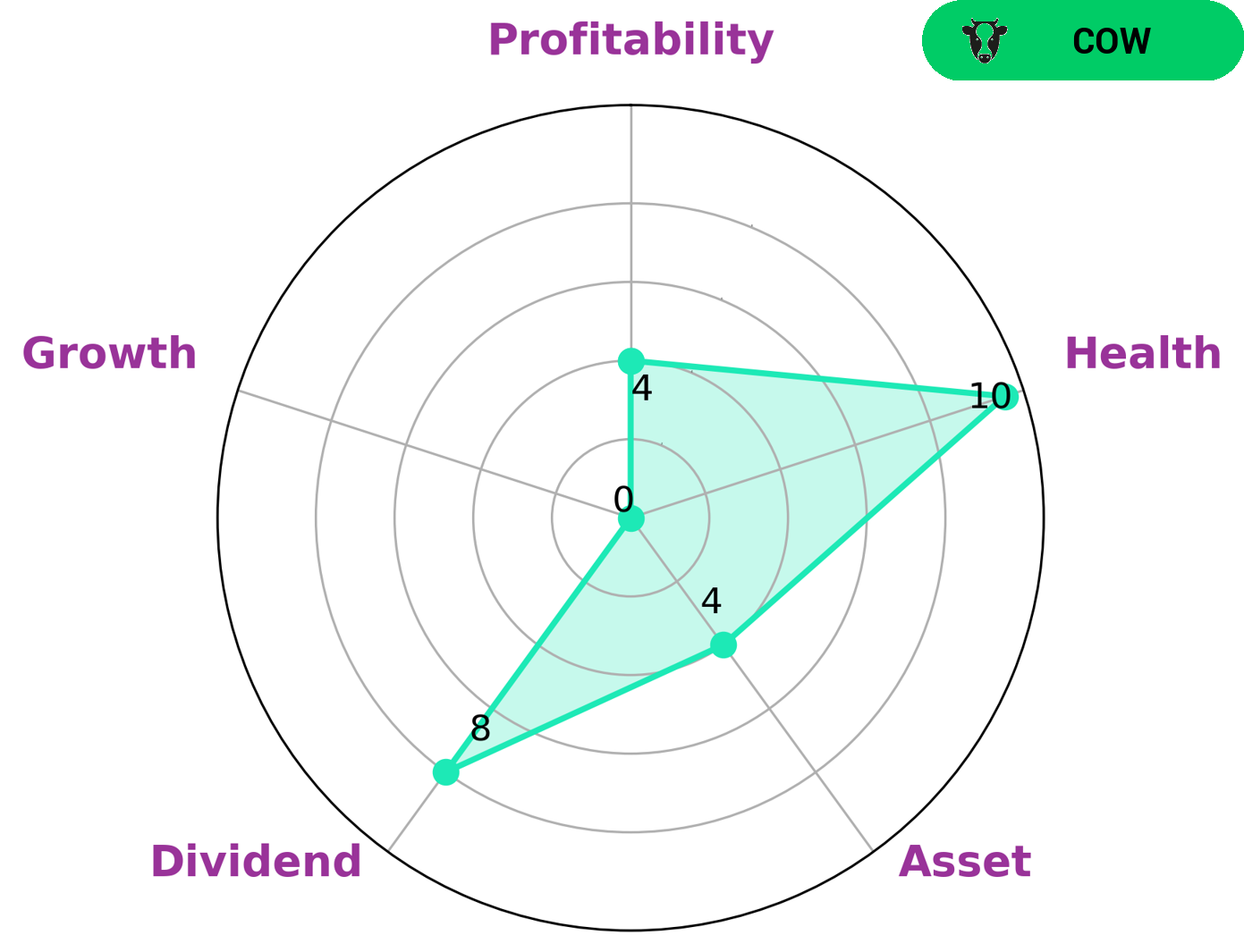

GoodWhale’s analysis of WELLS FARGO shows that the company has a strong dividend, medium profitability, asset and weak growth. Its classification as a ‘cow’ indicates that WELLS FARGO has a track record of paying out consistent and sustainable dividends to investors. The company’s high health score of 10/10 indicates that it has sufficient cashflows and debt to safely ride out any crisis or economic downturn without the risk of bankruptcy. As such, WELLS FARGO is suitable for conservative investors who are looking for regular income through dividends or retirees who are looking for reliable income streams. It is also attractive to investors who are looking for long term capital appreciation as it has a strong balance sheet and is able to pay out dividends even during times of economic downturn. Furthermore, it is attractive to those looking for value investments, as its stock price may be undervalued due to its weaker growth prospects. Overall, WELLS FARGO has many different qualities that make it attractive to different types of investors. Its strong balance sheet and high health score make it a safe investment, while its dividends and potential for capital appreciation make it an attractive choice for those looking for long-term investments. More…

Peers

JPMorgan Chase & Co, Bank of America Corp, Citigroup Inc are its main competitors.

– JPMorgan Chase & Co ($NYSE:JPM)

JPMorgan Chase & Co is a financial holding company. Through its subsidiaries, the firm provides investment banking, financial services. JPMorgan Chase & Co has a market cap of 369.23B as of 2022. The company has operations in more than 60 countries and serves more than 30 million customers globally.

– Bank of America Corp ($NYSE:BAC)

Bank of America Corp is an American multinational investment bank and financial services company with a market cap of 289.13B as of 2022. The company provides services such as investment banking, wealth management, and retail banking to clients all over the world. Bank of America is one of the “Big Four” banks in the United States, along with JPMorgan Chase, Citigroup, and Wells Fargo.

– Citigroup Inc ($NYSE:C)

Citigroup Inc. is an American multinational investment bank and financial services corporation with a market cap of 88.82B as of 2022. The company has operations in more than 160 countries and serves more than 200 million customers. Citigroup’s businesses include consumer banking, corporate banking, investment banking, and wealth management. The company was founded in 1812 and is headquartered in New York City.

Summary

Wells Fargo is a leading financial services company that has recently increased its price target for Avantor to $28 and maintained its Overweight rating. Investors should be aware that sentiment in the media is mostly negative, so they should conduct additional research before making an investment decision. Wells Fargo provides comprehensive insights on the markets and has an experienced team of analysts that provide valuable investing advice.

Recent Posts